Sensor Patch Market Size & Growth Trends:

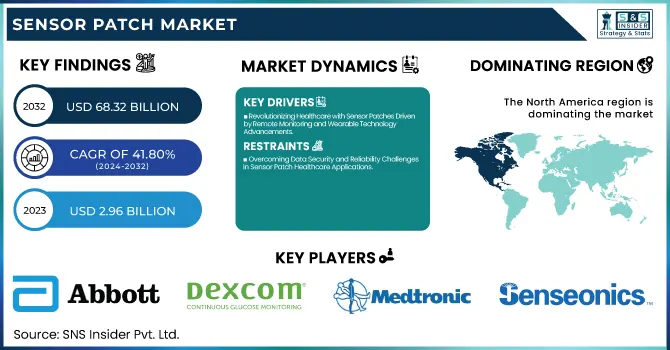

The Sensor Patch Market Size was valued at USD 2.96 billion in 2023 and is expected to reach USD 68.32 billion by 2032, growing at a CAGR of 41.80% over the forecast period 2024-2032. Advancements in performance, usability, and healthcare outcomes are some of the leading components driving the growth of the sensor patch market. Accuracy, comfort, and real-time monitoring capabilities enable the performance and usability metrics for an uninterrupted user experience. In healthcare, applications that measure biocompatibility, precision, and integration with clinical systems to improve patient care are prioritized.

To Get more information on Sensor Patch Market - Request Free Sample Report

Metrics for innovation and technology stress miniaturization, using flexible electronics and energy-efficient designs for greater application versatility. On the other hand, IoT and connectivity metrics allow for the transmission of data without issue, facilitate remote monitoring, and integrate with smart devices, which improves real-time health insights, as well as the evolution of telemedicine. A combination of such metrics is defining how sensor patches evolve and are adopted.

Sensor Patch Market Dynamics

Key Drivers:

-

Revolutionizing Healthcare with Sensor Patches Driven by Remote Monitoring and Wearable Technology Advancements

An increase in the need for remote patient monitoring and home healthcare solutions is a key factor fueling the efforts made toward this particular growth, especially when it concerns long-term illnesses such as diabetes, cardiovascular diseases, respiratory disorders, etc. Wearable technology for real-time health tracking is also a growing factor contributing to the enormous growth of this market as seen in recent years. The growing accuracy and adoption of sensor patches driven by advancements in sensor miniaturization, selective absorption in biocompatible materials, and wireless connection of wearable devices powered by the expansion of 5G networks are driving the demand for sensor patches in healthcare and fitness segments. The mounting prevalence of preventive healthcare is also expected to propel growth in the market, along with the rising geriatric population. Market growth can also be attributed to regulatory support for digital health innovations and increasing telemedicine investment.

Restrain:

-

Overcoming Data Security and Reliability Challenges in Sensor Patch Healthcare Applications

One major limitation is data privacy and security issues. Because sensor patches always monitor, accumulate, and send extremely sensitive health information from the environment, the data characteristics are vulnerable to data invasion and unauthorized access. Manufacturers must also ensure stringent alignment with healthcare data regulations like HIPAA and GDPR, meaning stronger encryption and security frameworks as they have to tackle compliance from multiple angles. Moreover, device reliability and accuracy issues are still a risk. Diagnostic and treatment results may be compromised by erroneous readings or sensor failures, restricting user trust and preventing widespread adoption in vital healthcare applications.

Opportunity:

-

Expanding Sensor Patch Market Driven by AI Integration Fitness Trends and Emerging Market Growth

The sensor patch market insights and opportunities are multiplying. Combining AI and data analytics with sensor patches can boost predictive healthcare and possible treatment strategies. The growing prevalence of remote work and fitness-focused lifestyles is boosting the popularity of non-invasive, easy-to-use monitoring technologies. Also, the growth potential available in developing markets in Asia-Pacific and Latin America should not be understated as both regions undergo rapid improvements to their healthcare infrastructure while witnessing an increase in disposable income. The application of sensor patches for sports performance tracking, stress monitoring, and drug delivery systems is expected to help expand market potential as sensor patches continue to evolve.

Challenges:

-

Addressing Sensor Patch Challenges in Integration Flexibility and Healthcare Professional Awareness

A further major challenge is the compatibility of sensor patches with available medical systems and devices. Full integration with EHR and telemedicine platforms requires considerable tailoring, which can delay uptake. In addition, the lack of knowledge and training of healthcare professionals about sensor patch applications may limit their use. For sensitive skin types, making sure that the extended uses do not cause major irritation is also a challenge. Since the human body constantly moves and bends, patch design will need to change to improve flexibility and endurance but these technical and integration issues need to be solved for widespread use over the entire healthcare and fitness market.

Sensor Patch Market Segment Analysis

By Product Type

Blood glucose sensor patches accounted for a 33.6% market share in 2023 and are expected to grow at the highest CAGR during the forecast period from 2024 to 2032. The growing burden of diabetes and the high adoption of continuous glucose monitoring (CGM) systems are the key drivers of this dominance. These patches are a painless and effective way of achieving ongoing glucose tracking, so you don't have to prick your finger constantly every 10 minutes. The increased demand has also been driven by significant advancements in biosensor technology, increased accuracy of devices, and higher connectivity with smartphones. Also, the increasing trend of remote patient monitoring, and home healthcare is accelerating the adoption of trends. Moreover, collaboration among healthcare providers and tech companies is also speeding up innovation in this area. The increasing global diabetic population, along with better awareness regarding diabetes management, is anticipated to stimulate the need for blood glucose sensor patches, thereby contributing to the market growth over the estimated period.

By Application

Monitoring sensor patches dominated the market with a 44.8% share in 2023, due to their increase in demand that finds a wider application in chronic disease management, post-surgical care, and fitness monitoring. Such patches allow tracking of health metrics, including real-time monitoring of heart arrhythmias, blood pressure, and temperature. Several factors continue to support the increasing adoption of monitoring patches with the home healthcare industry continually on the rise, along with the demand for remote patient monitoring.

Diagnostics sensor patches are projected to grow at the fastest CAGR from 2024 to 2032. Growth of this market is driven by technological advancements in diagnostics, which allow physicians to detect life-threatening ailments including cardiovascular diseases, infections, and metabolic disorders at an early stage. The market for non-invasive testing is estimated to observe robust growth owing to growing investments in digital health innovations along with greater demand for non-invasive diagnostic tools.

By Wearable Type

Wristwear sensor patches held the largest revenue share of 45.6% in 2023, which is mainly due to the growth of demand for smartwatches and fitness trackers. Worn on the wrist or other body parts, these smart gadgets are capable of tracking heart rate, blood oxygen, and activity in real-time features that made them popular among fitness enthusiasts and people with various chronic conditions. Wristwear patches have gained a major part of the market due to their convenience, comfort, and ergonomics.

From 2024 to 2032, bodywear sensor patches will have the fastest-growing CAGR. The growing demand for advanced medical patches for continuous health monitoring, drug delivery, and post-operative care is contributing to this growth. An increasing number of flexible and skin-friendly designs of patches combined with a growing focus on remote patient monitoring will drive the proliferation of bodywear sensor patches in the health care market.

By End-user

In 2023, the healthcare sensor patches segment led with a 69.3% market share, due to the growing use in chronic disease management, post-surgical monitoring, and care of elderly persons. These patches serve as the foundation for monitoring crucial criteria, such as vital signs, even medication compliance, or real-time data collection for health, increasing patient care. Furthermore, the rising incidence of diabetes, cardiovascular diseases, and respiratory disorders coupled with increasing healthcare costs have further complemented the demand for healthcare sensor patches in clinical and home care environments.

The Fitness & Sports segment is expected to grow at the fastest CAGR from 2024 to 2032. The global wellness device market is witnessing impressive growth indebted to the growing propensity towards health-conscious living and surging application of wearable technologies for performance tracking, recovery monitoring, and injury prevention. This segment is further aided by innovations in non-invasive sensor technologies.

Sensor Patch Market Regional Landscape

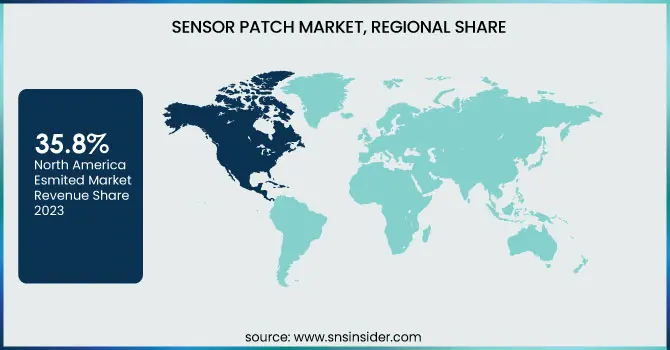

North America was the largest market for sensor patches in 2023, accounting for 35.8% of the global revenue. The presence of developed healthcare infrastructure, the growing prevalence of chronic diseases, and increasing awareness towards preventive healthcare are some of the factors boosting the North American sensor patch market over the forecast period. The innovation of sensor patch technologies has proliferated in the region, owing to the presence of players such as Abbott Laboratories, Dexcom Inc., and Medtronic. To take one example, Abbott has seen such success in the U.S. with its post-wear FreeStyle Libre sensor patch for continuous glucose monitoring that it completely upended diabetes care. Further, the collaborations of healthcare providers with tech giants like Apple and Fitbit have also contributed to the accessibility of sensor patches and their market penetration through consumer health products.

Asia-Pacific sustains the highest CAGR from 2024 to 2032, due to improving healthcare investments alongside increased chronic disease cases and rising awareness concerning wearable health devices. Medtrum, Ypsomed, and other similar companies are innovating with sensor patches in countries like China, India, and Japan for glucose monitoring and fitness activities. This rapid growth in the Asia-Pacific region is primarily due to the growing adoption of digital health technologies and government initiatives to promote telemedicine.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Sensor Patch Market are:

-

Abbott Laboratories (FreeStyle Libre)

-

Dexcom, Inc. (G6 CGM System)

-

Medtronic plc (Guardian Sensor 3)

-

Senseonics Holdings, Inc. (Eversense CGM)

-

Smith & Nephew plc (PICO 7)

-

VitalConnect, Inc. (VitalPatch)

-

iRhythm Technologies, Inc. (Zio Patch)

-

Leaf Healthcare, Inc. (Leaf Patient Monitoring System)

-

Gentag, Inc. (NFC Skin Patches)

-

Blue Spark Technologies, Inc. (TempTraq)

-

VivaLNK, Inc. (Fever Scout)

-

Proteus Digital Health, Inc. (Ingestible Sensor Patch)

-

Masimo Corporation (Radius PPG)

-

Nemaura Medical, Inc. (SugarBEAT)

-

GlucoTrack, Inc. (GlucoTrack DF-F).

Recent Trends

-

In January 2024, Abbott's latest FreeStyle Libre 2 Plus CGM sensor now integrates with Tandem's t:slim X2 insulin pump, enhancing automated insulin delivery for improved diabetes management.

-

In June 2024, Abbott and Dexcom launched the first over-the-counter CGMs, expanding access to real-time glucose monitoring for people with diabetes and prediabetes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.96 Billion |

| Market Size by 2032 | USD 68.32 Billion |

| CAGR | CAGR of 41.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Temperature Sensor Patch, Blood Glucose Sensor Patch, Blood Pressure/Flow Sensor Patch, Heart Rate Sensor Patch, ECG Sensor Patch, Blood Oxygen Sensor Patch, Others) • By Application (Monitoring, Diagnostics, Medical Therapeutics) • By Wearable Type (Wristwear, Footwear, Neckwear, Bodywear) • By End-user (Field mapping, Crop scouting and monitoring, Soil monitoring, Yield mapping and monitoring, Variable rate application, Weather tracking and forecasting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Dexcom Inc., Medtronic plc, Senseonics Holdings Inc., Smith & Nephew plc, VitalConnect Inc., iRhythm Technologies Inc., Leaf Healthcare Inc., Gentag Inc., Blue Spark Technologies Inc., VivaLNK Inc., Proteus Digital Health Inc., Masimo Corporation, Nemaura Medical Inc., GlucoTrack Inc. |