Fluid Transfer System Market Report Scope & Overview:

Get More Information on Fluid Transfer System Market - Request Sample Report

The Fluid Transfer System Market Size was valued at USD 20.54 billion in 2023 and is expected to reach USD 35.22 billion by 2032, growing at a CAGR of 6.22% from 2024-2032.

The Fluid Transfer System Market will grow strongly as industries move increasingly towards efficient, sustainable, and high-performance systems. In terms of fluid transfer solutions, the growing adoption of electric cars and hybrid vehicles is opening new avenues for advanced fluid transfer solutions that will be required to cool the vehicle system, regulate the battery, and use transmission oil lines. Electric car sales nearly 14 million units in 2023, with 95% sold in China, Europe, and the United States. This is inducing a growing need for the transfer of fluids technologies that decrease emissions and enhance fuel efficiency. Since the manufacturers are investing in more light materials such as aluminum and high-performance polymers to place greater attention on them, further expansion in the market will be caused by these innovations.

The boom in industrial operations worldwide, especially in construction-related activities, along with associated mining and agricultural operations, will propel the demand for heavy-duty fluid transfer systems that can withstand aggressive operating conditions. Heavy-duty machinery carrying high-pressure fluid lines and automotive engine cooling systems that use advanced fluid circulation capabilities will continue to open up more avenues for the market. In line with the trend of the adoption of cleaner technologies within industries, fluid transfer systems will feature prominently in many of the integrating systems seen especially in respect to SCR and diesel particulate filters, DPF for emissions.

Looking to the future, the market accepts autonomous vehicles and energy-efficient machinery, fluid transfer systems will be crucial in the smooth operation of complex high-tech systems. The growing need for smart fluid management and advanced cooling solutions will lead to a need for even more reliable, compact, and cost-effective fluid transfer systems. With the strategies of alliances with other key players, innovation will be driven, and research and development will be invested in, with innovative solutions addressing the burgeoning trends related to electric mobility, autonomous vehicles, and industrial automation.

Fluid Transfer System Market Dynamics

Drivers

-

Rising Demand for Fluid Transfer Systems in the Automotive and Transportation Sectors

Automotive and transportation industries happen to be major boosters for fluid transfer systems market. Fluid transfer systems prove vital to the smooth functioning of vehicle sub-systems, like fuel, cooling, and braking. In this scenario, with more vehicles being produced globally, especially in emerging markets, the demand for fluid management solutions is quite high. Sales of electric vehicles are also on the rise, generating higher demand for custom fluid transfer systems for cooling and battery management. Improvement in fluid transfer technology has increased improved vehicle performance and safety, along with this growth. Industry innovation, which is evolving, will be comprised of innovative yet efficient fluid transfer solutions that will take center stage in filling industry demands during the forecast period.

-

Growth of Industrial Automation and Need for Efficient Fluid Control Driving Fluid Transfer Systems Market Expansion

Industrial automation, along with the increasing need for precise and accurate fluid control in the chemical, oil & gas, food & beverage, pharmaceuticals, and mining industries, shall be key drivers pushing fluid transfer systems into high gear. Fluid transfer solutions that include automation enhance production efficiency, minimize downtime, and add safety to working processes, causing demand for such solutions in a wide array of industries that now require fluid management to operate reliably and consistently. These systems are meant to meet the increasing demands of greater productivity and improved safety standards. Since industries continue to open their doors to automation, fluid transfer systems that will support advanced process controls will be important to optimize most of the operations. Demand for such systems is likely to increase in all sectors as automation technologies develop.

Restraints

-

Technical Challenges and System Complexity in Fluid Transfer Systems Pose Barriers to Market Growth

Fluid transfer systems are technically complex, particularly in highly automated or specialized industries, requiring skilled labor for installation, operation, and maintenance. Regions facing labor skill shortages struggle to support these advanced systems, limiting their market adoption. Additionally, implementing such systems often demands significant adjustments to existing infrastructure, leading to high time and cost investments. This complexity can slow down decision-making and adoption rates, particularly in industries or regions with limited resources for extensive technical support.

Fluid Transfer System Market Segmentation Overview

By Type

In 2023, Hoses held the largest market share for Fluid Transfer Systems market due to its wide usage across applications in industries such as automobile, oil & gas, and construction, wherein the hose possession duration is considerably high and fluid flow needs flexibility. They are versatile, handling fluids of different types, which makes them highly utilized in heavy-duty applications that create high revenues.

Tubing is projected to increase with the highest CAGR of 7.28% over the forecast period of 2024 to 2032 due to stronger demand in healthcare and pharmaceutical, as well as burgeoning food & beverage sectors. Tubing gives precision combined with exactitude of compliance with tight hygiene standards, which are crucially in-demand areas such as healthcare and pharmaceutical and growing; hence another high growth area.

By System

Vehicle Fluid Transfer Systems are dominant in the Fluid Transfer Systems Market with a revenue share of 57% primarily because these systems are an important part of all automotive applications, such as the transfer of fuel, cooling, air conditioning, and transfer of brake fluid. The increased demand for passenger and commercial vehicles around the globe, particularly from developing countries, necessitates efficient fluid systems that guarantee high standards of safety and performance.

This is expected to record the highest CAGR of 6.92% between 2024 and 2032, with developments around electric and hybrid vehicles opening further markets for specialized fluid transfer systems, especially battery cooling and thermal management. Increasing pressure from consumers for better fuel efficiency and reliability puts additional pressure on vehicle manufacturers to achieve improved performance for their vehicles.

By On-Highway Vehicle

Passenger and light Commercial vehicles are 59% revenue share for the Fluid Transfer Systems Market. Automotive sectors are in demand for fluid systems of cooling, fuel management, and braking require passenger and light commercial vehicles at high rates. These are produced and adopted on an enormously large scale in the global market and rapidly growing markets.

Passenger and light Commercial vehicles is expected to increase at the highest CAGR of 6.62% in the period from 2024 to 2032, with an increasing demand for advanced fluid transfer solutions in battery cooling and thermal management amidst a rising electric vehicle market. The shift in consumer preferences towards fuel-efficient and electric vehicles is further driving growth in this segment by manufacturers of reliable, high-performance fluid transfer systems.

By Material

Rubber dominated the Fluid Transfer Systems Market, with a revenue share of 34% in 2023, driven by its strength, elasticity, and exceptional wear and chemical resistance that enable the use of rubber in extreme applications across diverse sectors such as automotive, oil & gas, and industrial manufacturing. Its mass application in hoses and tubing for different fluid handling requirements ensured the retention of leadership by rubber.

Nylon is expected to grow at the fastest cagr of 9% in the forecast period 2024-2032 because of its lightweight, high strength, and superior resistance to pressure and temperature. These factors make nylon a preferred material in such innovative designs and performance upgrades in the automotive and aerospace industries due to growing requirements for advanced and efficient fluid transfer systems.

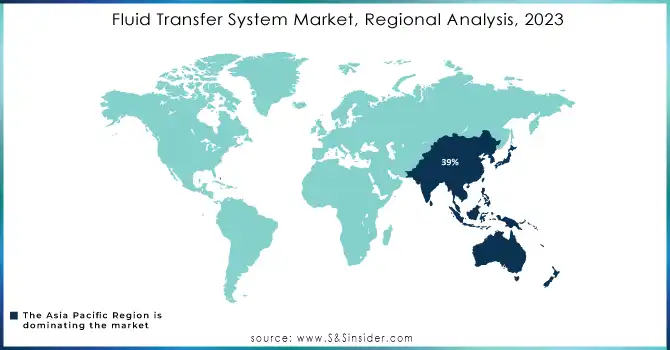

Fluid Transfer System Market Regional Analysis

The Asia Pacific region dominated the Fluid Transfer Systems Market, having the largest revenue in 2023 at 39%, mainly due to the well-established automotive manufacturing industry and an incredible level of industrialization and infrastructure development. Mass passenger and commercial vehicle production along with the oil & gas, chemical, and food processing industries further boosted the demand for fluid transfer systems. Ongoing urbanization, industrial expansion, and the adoption of advanced technologies in fluid management systems are expected to drive growth at the highest CAGR of 7.30% during the period 2024-2032. Countries like China and India, where electric vehicles have seen tremendous growth, also fuel growth that is specifically supported by the need for advanced fluid transfer solutions for cooling the battery as well as other applications.

Need Any Customization Research On Fluid Transfer System Market - Inquiry Now

Latest News-

-

Hutchinson is innovating for the electric vehicle market in 2024 by introducing a new elastomer compound designed to seal CO2 heat pumps. This advancement supports thermal management in EVs, where R744 refrigerant requires specialized materials.

-

Kongsberg Automotive secured a EUR 105 million contract in 2024 to supply fluid transfer assemblies for heavy-duty truck engines. These components will aid in meeting EU emissions standards, with production starting in 2026.

Key Players in Fluid Transfer System Market

-

Cooper Standard (Fuel and Brake Lines, HVAC Hoses)

-

AKWEL (Fuel Lines, Engine Cooling Hoses)

-

Gates Corporation (Automotive Belts and Hoses, Hydraulic Hoses)

-

Tristone Flowtech Holding SAS (Cooling Hoses, Fuel Lines)

-

Lander Automotive LTD (Fuel Delivery Systems, Oil Coolers)

-

ContiTech AG (Automotive Hoses, Air Conditioning Systems)

-

Kongsberg Automotive (Fuel and Brake Lines, HVAC Systems)

-

Hutchinson SA (Fuel and Hydraulic Hoses, Air Management Systems)

-

Castello Italia SpA (Fuel Lines, Engine Cooling Systems)

-

TI Fluid Systems (Fuel Systems, Brake Fluid Systems)

-

Parker Hannifin Corporation (Hydraulic Hoses, Fluid Conveyance Systems)

-

Saint-Gobain Performance Plastics (Fluid Transfer Tubing, Hydraulic Hose)

-

Eaton Corporation (Hydraulic Fluid Systems, Fuel and Emissions Systems)

-

Dana Incorporated (Powertrain Fluid Lines, Engine Cooling Hoses)

-

Flextech Industries (Flexible Hoses, Engine Cooling Systems)

-

Amtek Inc. (Brake Fluid Lines, Fuel Delivery Systems)

-

Roechling Automotive (Air Intake Systems, Fuel Lines)

-

Sogefi Group (Fuel Lines, Engine Cooling Hoses)

-

VOSS Automotive GmbH (Fuel and Brake Line Systems, Hydraulic Hoses)

-

Air Water Inc. (Fluid Transfer Hoses, Industrial Fluid Systems)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.54 Billion |

| Market Size by 2032 | USD 35.22 Billion |

| CAGR | CAGR of 6.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Vehicle Fluid Transfer Systems, Emissions and Exhaust Fluid Transfer Systems, Cooling and Transmission Fluid Systems) • By Type (Hoses, Tubing) • By Material (Nylon, Aluminum, Steel, Rubber, Others) • By On-Highway Vehicle (Passenger & Light Commercial Vehicles, Heavy-duty Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cooper Standard, AKWEL, Gates Corporation, Tristone Flowtech Holding SAS, Lander Automotive LTD, ContiTech AG, Kongsberg Automotive, Hutchinson SA, Castello Italia SpA, TI Fluid Systems, Parker Hannifin Corporation, Saint-Gobain Performance Plastics, Eaton Corporation, Dana Incorporated, Flextech Industries, Amtek Inc., Roechling Automotive, Sogefi Group, VOSS Automotive GmbH, Air Water Inc. |

| Key Drivers | • Rising Demand for Fluid Transfer Systems in the Automotive and Transportation Sectors • Growth of Industrial Automation and Need for Efficient Fluid Control Driving Fluid Transfer Systems Market Expansion |

| RESTRAINTS | • Technical Challenges and System Complexity in Fluid Transfer Systems Pose Barriers to Market Growth |