Gastric Cancer Diagnostics Market Scope & Overview

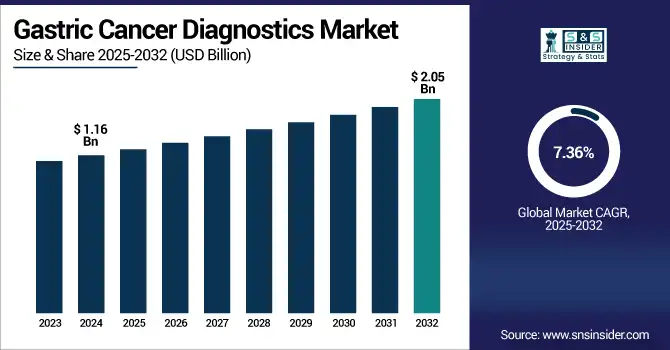

The Gastric Cancer Diagnostics Market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 2.05 billion by 2032, growing at a CAGR of 7.36% over the forecast period of 2025-2032.

Rapid regulatory approvals are adding momentum to the catalyst, and expedited access to cutting-edge diagnostic tools, such as liquid biopsies, AI-based imaging, and molecular diagnostics is adding fuel to the gastric cancer diagnostics market growth. The FDA and EMA are simplifying pathways for approval of non-invasive and precision diagnostics, leading to wider global adoption. New and emerging market trends include the increasing incidence rate of gastric cancer, growing demand for early diagnosis, digital pathology adoption, and reimbursement.

For instance, on 4 June 2024, Guardant Health introduces the new Guardant360 TissueNext test with nearly 500 biomarkers to identify more treatment options for patients with advanced cancer.

To Get more information on Gastric cancer diagnostics market - Request Free Sample Report

The U.S. Gastric Cancer Diagnostics Market was valued at USD 408.34 million in 2024 and is expected to reach USD 707.13 million by 2032, growing at a CAGR of 7.12% over 2025-2032.

High healthcare spending in the country, which allows investment for the deployment of advanced technologies such as AI imaging, molecular diagnostics, and liquid biopsy, is the main reason behind the strong presence of the U.S. in the gastric cancer diagnostics industry. Spending over USD 5 trillion each year, the U.S. has strong R&D, solid healthcare infrastructure, broad insurance coverage, and access to cutting-edge medical devices. This culture of early discovery, inventiveness, and high-present diagnostic use will continue to support the nation’s lead in the global gastric cancer diagnostics market.

For instance, in December 2024, the NIH allocated USD 130 million to fund research in AI and molecular diagnostics, advancing early detection tools for cancers, including gastric cancer.

Gastric Cancer Diagnostics Market Dynamics

Drivers:

-

Rise in Gastric Cancer Incidence, Driving the Gastric Cancer Diagnostics Market Growth

The increasing incidence of gastric cancer is contributing to the growth of the gastric cancer diagnostics market share globally. Increased patient burden of patients calls for early and exact diagnosis, raising demand for endoscopy, imaging, and biomarker-driven tests. Additionally, many other factors, including H. pylori infection, bad diet, and obesity, are contributing to the number of cases. The strength of an experienced clinical team and our technologies is not only driving robust growth and momentum of the global gastric cancer diagnostics market share, but they are also paving the way for expanded screening programs, increased healthcare investment, and R&D in non-invasive diagnostics.

For instance, in February 2025, Japan’s gastric cancer screening rate rose to 58%, driven by AI-assisted endoscopy and nationwide awareness programs, boosting diagnostic demand significantly.

Restraints:

-

Minimal User Adaptability, Restraining the Gastric Cancer Diagnostics Market

Limited healthcare infrastructure is a key factor that is restricting the gastric cancer testing market share, particularly in low-income and rural areas. Lack of diagnostic facilities, poorly trained personnel, and imbalances between the urban-rural divide prevent early and correct diagnosis. Low screening rate, out-of-pocket expenditure, and late detection also impede utilization. Moreover, inadequate funding is constraining infrastructure build-out, collectively delaying the uptake of diagnostic procedures, and constraining the overall gastric cancer diagnostics market growth.

For instance, in May 2025, the WHO reported that over 70% of cancer deaths in low-income countries are due to limited diagnostic access, highlighting major infrastructure gaps in gastric cancer detection and care.

Segmentation Analysis of the Gastric Cancer Diagnostics Market

By Product

Reagents & Consumables were the dominant and also the fastest growing segment in the Gastric Cancer Diagnostics Market analysis, with a market share of 61.30% share in 2024, as they are used regularly in all of the key procedures, including biopsy, PCR, IHC, and liquid biopsy, among others. Their low cost, ease to incorporation into existing diagnostic platforms, and the fact that they are required for every test conducted maintains steady demand along with the hospital and lab stream. With increasing testing globally, in particular for early diagnosis, the reagent segment is expected to be a significant driver of revenues in the diagnostics market.

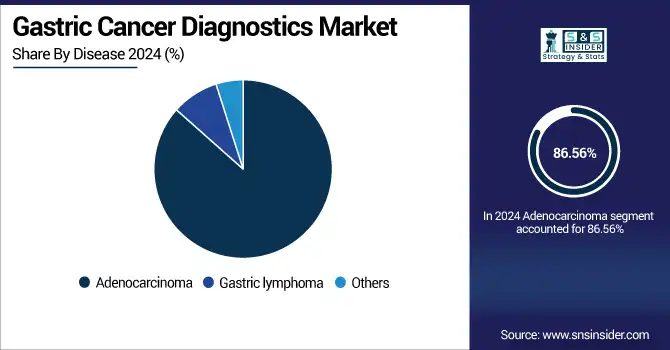

By Disease

In 2024, the Adenocarcinoma segment was the dominant and fastest-growing one in the gastric cancer diagnostics market analysis. It holds an 86.56% market share and a CAGR of 7.53%. High global incidence of this disease, especially in East Asia, has generated continuous demand for advanced testing, such as endoscopy, biopsy, HER2, and MSI testing. Growing awareness, increasing number of screening programs, and increasing risk factors, including H. pylori infection and unhealthy diet, have led to increased demand for diagnosis, which in turn adds substantial revenue to the gastric cancer diagnostics market share globally.

By End-User

Hospitals were the dominant segment in the gastric cancer diagnostics market, 64.32%, owing to their sophisticated diagnostic facilities including endoscopy units, pathology labs, and imaging sections. The increasing need for early diagnosis, the existence of experienced medical personnel, and a higher number of patients being admitted for cancer screening are factors that have supported this development. All of these factors together are driving the market for gastric cancer diagnostics, as the hospitals are also the largest source of diagnostic volume and technology adoption.

Diagnostic Laboratories are emerging as the fastest-growing segment in the gastric cancer diagnostics market trend, as they can process high numbers of tests effectively and precisely. They provide specialised services, including PCR, NGS, and biomarker analysis for accurate stomach cancer diagnosis. Rising need for early diagnosis, hospital outsourcing, and lab automation are some of the factors driving the market. These are the factors that necessitate overall depigmentation market growth. Thus, diagnostic labs are essential parts of the diagnosis system.

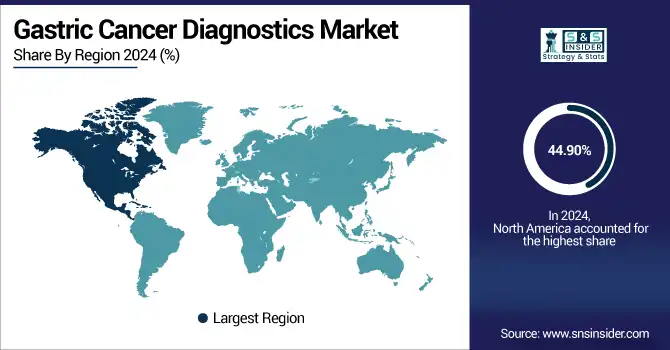

Regional Insights: Gastric Cancer Diagnostics Industry Outlook

In 2024, the North American region dominated the gastric cancer diagnostics industry and accounted for 44.90% of the overall revenue share, based on its developed healthcare system, high cost of healthcare, and high use of top-of-the-line diagnostic technology. It has strong regulatory support, good insurance coverage, and access to AI-based imaging, molecular diagnostics, and liquid biopsy tools. The U.S. especially takes the lead when it comes to innovation and clinical studies, with the support of heavyweights and academic institutions. Growing awareness, early screening initiatives, and reimbursement for second-line testing promote the use of diagnostics.

Gastric Cancer Diagnostics industry in Europe is expected to have a large share of the market, owing to well-developed healthcare systems, government support for cancer screening programs, and high awareness to diagnose early. Many countries, including Germany, France, and the U.K., have introduced national screening programs matched with reimbursement incentives for the use of endoscopy, biopsy, and molecular testing. The area also boasts a prominent group of diagnostic companies and research institutions that are helping spur innovation. The increasing prevalence of gastric cancer due to the elderly population, increasing incidence of gastric cancer across Europe, also contributes to the leading share of the European gastric cancer diagnostics market trend.

The Asia Pacific region is projected to grow with the fastest CAGR of 8.00% over the forecast period in the gastric cancer diagnostics in industry, owing to the high gastric cancer prevalence in the region, especially in countries, such as China, Japan, and South Korea, which have a high percentage of the global cases. National population screening programs and early detection programs are being implemented by governments more and more. Increasing healthcare awareness, infrastructure development, and penetration of advanced diagnostic techniques such as endoscopy and biomarker tests are other demand drivers. Moreover, the growth of healthcare access in emerging markets combined with rising R&D investments, is also driving the Gastric Cancer Diagnostics market growth in the Asia Pacific region.

The Middle East & Africa have a relatively smaller yet growing percentage in the gastric cancer diagnostics market share, led by increasing awareness, incidence-induced further awareness, and gradual enhancement of healthcare infrastructure. Cities in countries, such as the UAE, Saudi Arabia, and South Africa are shifting toward advanced diagnostics, including endoscopy and histopathology. But headwinds, such as lack of access in rural areas, expensive out-of-pocket costs, and lack of trained professionals are still holding the larger market’s growth back. However, existing government efforts and foreign alliances will lead to enhanced diagnostic capacity, facilitating the regions’ participation in the gastric cancer diagnostics market growth.

A moderate share of Latin America in the gastric cancer diagnostics industry is expected to show growing opportunities with an increase in the number of patients with gastric cancer in the region and improving healthcare infrastructure. Countries including Brazil, Mexico, and Argentina are funding cancer screening programmes and increasing access to diagnostics, such as endoscopy, imaging, and biopsy. But obstacles, such as uneven access to health care, particularly in rural areas, and inadequate reimbursement systems, hinder its adoption. Nevertheless, greater public awareness and aid from international health agencies are fueling the gastric cancer diagnostics market in Latin America, making it a growing region with significant potential ahead.

Get Customized Report as per Your Business Requirement - Enquiry Now

Leading Companies in the Gastric Cancer Diagnostics Market

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc.

-

Siemens Healthineers AG

-

Agilent Technologies, Inc.

-

GE HealthCare Technologies Inc.

-

QIAGEN N.V.

-

Bio-Rad Laboratories, Inc.

-

Canon Medical Systems Corporation and other players

Recent Developments in Gastric Cancer Diagnostics

-

On 31 Jan 2025, Roche receives FDA approval for the first companion diagnostic to identify patients with HER2-ultralow metastatic breast cancer eligible for ENHERTU.

-

In March 2025, Siemens Healthineers launched an AI-powered upgrade to its syngo.via oncology software, improving CT/MRI-based detection and analysis of gastric tumors, enhancing diagnostic accuracy and workflow efficiency.

-

In January 2025, Agilent Technologies received CE-IVD approval for its Dako HER2 Complete Solution, enabling accurate and standardized HER2 testing in gastric cancer across clinical labs in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.16 billion |

| Market Size by 2032 | USD 2.05 billion |

| CAGR | CAGR of 7.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents & Consumables, Instruments) • By Disease (Adenocarcinoma, Gastric lymphoma, Others) • By End-User (Hospitals, Diagnostic Laboratories, Diagnostic Imaging) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd., Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers AG, Illumina, Inc., Agilent Technologies, Inc., GE HealthCare Technologies Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc.,Canon Medical Systems Corporation and other players. |