Green and Bio Polyols Market Size Analysis

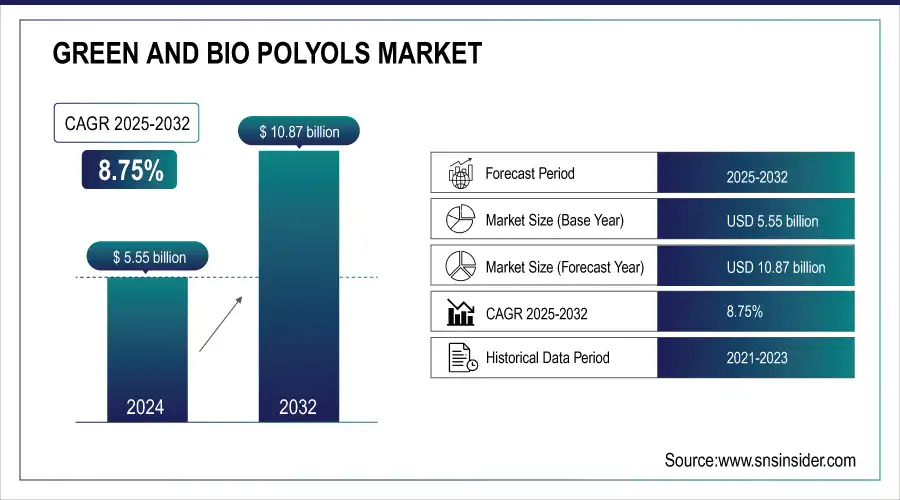

The Green and Bio Polyols Market size was valued at USD 5.55 billion in 2024 and is expected to reach USD 10.87 billion by 2032 and grow at a CAGR of 8.75% over the forecast period 2025-2032.

Get More Information on Green and Bio Polyols Market - Request Sample Report

This report delivers a comprehensive statistical analysis of the green and bio polyols market, covering production capacity and utilization trends by country and type. It examines regional feedstock pricing dynamics for key raw materials, providing insight into cost competitiveness. The report evaluates the impact of regulatory frameworks and government incentives on market growth and innovation. Environmental metrics such as emissions data, waste management practices, and sustainability initiatives are also analyzed to underscore the market’s ecological footprint. Finally, it reviews trends in R&D and adoption rates, offering a clear picture of the market’s evolving landscape.

Key Green and Bio Polyols Market Trends

-

Rising demand for sustainable and eco-friendly materials.

-

Expanding applications in polyurethane foams, coatings, and adhesives.

-

Advancements in feedstock utilization (natural oils, waste resources).

-

Supportive government regulations and incentives for bio-based chemicals.

-

Growing adoption in the automotive and construction industries.

-

Increased R&D in high-performance and durable bio polyols.

-

Strategic collaborations and capacity expansion by key players.

Green and Bio Polyols Market Growth Drivers

-

Increasing use in automotive, furniture, and construction industries drives the market growth.

Rising consumption of green and bio polyols in the automotive, furniture, and construction sectors considerably drives the growth of the green and bio polyols market. In the automotive industry, bio polyols are used to manufacture lightweight and wear-resistant components which enhance fuel efficiency and reduce emissions. Apart from this, the application of this product in adhesives and coatings helps the furniture industry by improving product quality and providing an environmentally friendly manufacturing process. The use of green polyols in insulation materials and sealants in construction reduces the environmental footprint of buildings by promoting energy efficiency. The cross-industry application of the invention highlights the strong growth of the market and the transitioned demand for greener, sustainable materials.

Green and Bio Polyols Market Restraints

-

High production costs associated with these polyols market may hamper the market growth.

The high production cost associated with green and bio polyols can act as a considerable deterrent in hampering market growth owing to its inability to be cost competitive as compared to petroleum-based alternatives. These high costs are attributable to the intricate production routes and the requirement for specialized renewable feedstocks, which are typically more expensive. Especially in price-sensitive industries, this price difference may dissuade manufacturers from adopting green polyols, perhaps restricting large-scale market penetration. This cost step also may slow the development of larger scale mills and postpone getting on an economy of scale cost decline path. In the end, these cost challenges will need to be tackled by technological innovations and enabling policies to allow sustainable polyols to realize their full potential in the market.

Green and Bio Polyols Market Opportunities

-

Rising global demand for sustainable and renewable materials creating an opportunity for the market.

The Opportunities pointer of the green and bio-polyols market looks at the increasing penetration of sustainable and renewable products for feedstock across the globe. With the gradual transition of industries towards an eco-friendly approach, bio polyols gain the potential demand to replace conventional materials, especially in the automotive, construction, and furniture industries. Continuous improvements in production technologies and processes optimizations enable cost reductions and better performance, arguably a positive feedback loop for increased adoption. Moreover, by way of beneficial governmental policies and strategic industry collaborations, there are opportunities to expand market growth and penetrate new regional markets. This interplay provides a strong foundation for a long-term growth and innovation platform.

Green and Bio Polyols Market Challenges

-

Limited availability of raw materials required for the production major challenges for Green and Bio Polyols market.

One of the major challenges faced by the green and bio-polyols market is the unavailability of raw materials required for production. The bio-based polyols are mainly produced from renewable feedstocks such as vegetable oils and various agricultural by-products which are provided by seasonal variation and regional supply limitation. Fluctuating weather conditions and competition for agricultural land leads to variability in crop yields which in turn results in an inconsistent supply and heightened raw material prices. This shortage is not only a factor in the limitation of scaling production but also a risk to being able to hold the competitive price versus traditional materials. With the growing demand for sustainable products, a key challenge for industry stakeholders is maintaining reliability and price accessibility for these essential feedstocks.

Green and Bio Polyols Market Segment Analysis

-

By Raw Material

The Green and Bio Polyols Market was dominated by Natural Oils and Their Derivatives with a revenue share of over 55% in 2024. The abundance design & sustainability of Natural oils such as soybean, rapeseed, and palm oil-based oils are easily available as well as, renewable and replenished in the relatively short period. Also, Other natural oils have characteristics that are ideal for different uses. Castor oil, for instance, has high thermal stability, and soy oil has good flexural resistance. Furthermore, it should be noted that natural oils are less well-known but comparatively inexpensive relative to alternative raw materials based on sucrose and glycerin.

-

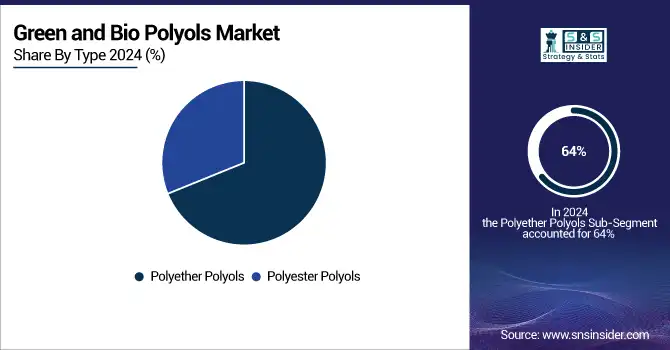

By Type

The polyether polyols held the largest market share around 64% in 2024. As it has extensive software and higher overall performance characteristics. Due to their versatility, they are commonly used in the manufacture of products, such as polyurethane foams, coatings, adhesives, and sealants, which are further used in various industries, including automotive, construction, and furniture. These properties contribute to the increases in production efficiency and constant performance of the end product while still maintaining low viscosity, high chemical stability, and high processing ease. Due to these factors, and because of competitive pricing and compatibility with a wide range of isocyanates, polyether polyols are an essential ingredient in producing high-performing materials, and solidifying a leading market share.

-

By Application

PU flexible foam is the dominating segment in the market, due to considerable application of PU flexible foam in the end-use industries wherein the industry requires comfort, durability, and durability of the product. It is extensively employed in applications like automotive seating, furniture, and bedding, primarily for its excellent cushioning properties, light weight and energy absorption characteristics. Additionally, the use of green and bio-based polyols in its manufacture not only fits within sustainability aspirations but also increases the performance of the product. Increased cost efficiency and improved consistency driven by advances in manufacturing techniques have also helped to solidify the position of topside in the market.

-

By End-use Industry

Furniture and Bedding held the largest market share around 32% in 2024. It is because of consumer preference is shifting towards sustainable and eco-friendly products for the home, the Furniture and Bedding segment dominates the market. With the backing of environmentally-friendly consumers, manufacturers are utilizing green and bio-based polyols in the production of polyurethane foams to create comfy and resilient furniture and bedding. Product innovations in this sector are constant, and, if the production efficiencies are improved in this order, the pricing generally remains competitive, although the performance is enhanced. Along with that, the increasing inclination towards green living and rising awareness about the sustainable materials has also contributed towards the demand for these products, thus strengthening the leading position of the Furniture & Bedding segment in the market.

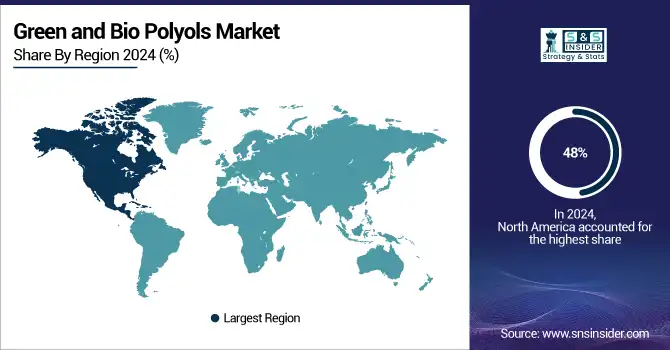

Green and Bio Polyols Market Regional Analysis

North America Green and Bio Polyols Market Insights

North America led the largest market share around 48% in 2024. It is owing to high demand from end-use industries, technological advancements and government initiatives. Consumer inclination towards the adoption of sustainable materials in automotive, construction and furniture industries along with regulations against the use of synthetic materials, has spurred the demand for bio-based polyols in the region. Also, North America has world-class manufacturing capabilities and R&D, making it more adaptable to development in energy used in production of bio polyols. Market growth is also stimulated by government incentives, such as tax credits offered for the utilization of renewable materials. Therefore, these factors all boost the green and bio polyols market in North America.

Get Customized Report as per your Business Requirement - Request For Customized Report

Europe Green and Bio Polyols Market Insights

Europe held a significant market share owing to strict environmental regulations, strong government incentives, and strong consumer demand for green products. The proactive policy frameworks existent in the region incentivized various industries to adopt sustainable practices and boost investment in research and development of cleaner solutions. In addition, the saturated chemical sector with a well-established supply chain network in Europe simplifies the one-step integration of bio-based materials, providing a competitive advantage in sustainable industrial production.

Asia Pacific Green and Bio Polyols Market Insights

APAC is the largest demand generator for green and bio polyols by 2024, driven by the growth of industries coupled with increasing urbanization and their need for sustainable materials in construction, automotive, furniture industries, and consumer goods. Nations such as China, India, and Japan are leading, as they are majorly spending on bio-based polyols in order to decrease dependency on petrochemical-based products. So is a growing middle class across the region and more stringent regulations on carbon emissions. Despite the influx of R&D and government promotions towards bio-based industries, the Asia Pacific continues to be the dominant regional market, and its market is expanding at the fastest pace.

Latin America, Middle East & Africa (MEA) Green and Bio Polyols Market Insights

On the other hand, the Latin America and Middle East & Africa (MEA) construction aggregates markets will witness moderate growth, as the construction aggregates market is growing due to growing infrastructure development, growing automotive industry, and preference for eco-friendly construction material. In the LATAM, Brazil and Mexico are anticipated to witness significant contributions driven by the government efforts to adopt sustainable materials and the rising adoption of carbon reduction. As of now, green and bio polyols are being used in construction and industrial applications in MEA. Countries including KSA, UAE, South Africa are using this product to achieve the economic diversification and sustainability aim of the region. Both LATAM and MEA are fast-growing regions with increasing consumer demand for green alternatives and backed by various governments to excel market to its fullest potential.

Competitive Landscape for Green and Bio Polyols Market

Lanxess AG

Lanxess AG is a leading specialty chemicals company with a strong focus on sustainable material solutions across diverse industrial sectors.

-

In 2023, Lanxess rolled out improvements to its bio polyol formulations, emphasizing both environmental sustainability and enhanced material performance. These upgrades were designed to address the rising demand for eco-friendly and high-performance polyols in multiple industrial applications.

Cargill, Inc.

Cargill is a global agribusiness and food processing leader, increasingly investing in sustainable chemicals and materials.

-

In 2023, Cargill partnered with leading research institutions to advance bio polyol formulations. The collaboration aimed to leverage innovative R&D to improve sustainability and performance in polyurethane applications, reinforcing its commitment to greener industrial solutions.

Green and Bio Polyols Market Key Players

-

BASF SE (EcoPolyol 365, BioPolyol 720)

-

Biobased Technologies LLC (GreenRenew Polyol, BioSustain Polyol)

-

E.I. Du Pont De Nemours & Co. (DuPont BioBlend, DuPont EcoFoam Polyol)

-

Bayer AG (Bayer BioActive Polyol, Bayer GreenTech Polyol)

-

Emery Oleochemicals (Emery BioPolyol, Emery EcoFoam)

-

Jayant Agro Organics Pvt., Ltd. (Jayant BioPolyol, Jayant GreenRenew)

-

Cargill, Inc. (Cargill BioFoam, Cargill EcoBlend)

-

Koch Industries (Koch GreenPolyol, Koch BioSustain)

-

DOW Chemical Company (Dow EcoPolyol, Dow BioFlex Polyol)

-

Mitsui Chemicals (Mitsui BioPolyol, Mitsui EcoBlend)

-

Global Bio-Chem Technology Group (Global BioRenew, Global GreenPolyol)

-

Huntsman Corporation (Huntsman BioPolyol, Huntsman EcoFlex)

-

Covestro (Covestro EcoPolyol, Covestro BioFoam)

-

Hexion Inc. (Hexion GreenPolyol, Hexion BioBlend)

-

Solvay S.A. (Solvay BioPolyol, Solvay EcoFoam)

-

Wanhua Chemical Group (Wanhua GreenPolyol, Wanhua BioFlex)

-

Clariant AG (Clariant EcoPolyol, Clariant BioRenew)

-

Lanxess AG (Lanxess BioPolyol, Lanxess EcoBlend)

-

Celanese Corporation (Celanese GreenPolyol, Celanese BioFoam)

-

Indorama Ventures (Indorama BioPolyol, Indorama EcoFlex)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.55 Billion |

| Market Size by 2032 | US$ 10.87 Billion |

| CAGR | CAGR of 8.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Natural Oils and their Derivatives, Sucrose, Glycerin, Carbon Dioxide) • By Type (Polyether Polyols, Polyester Polyols) • By Application (PU Flexible Foam, CASE, PU Rigid Foam) • By End-use Industry (Furniture and Bedding, Construction, Automotive, Packaging, Carpet Backing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Biobased Technologies LLC, E.I. Du Pont De Nemours & Co., Bayer AG, Emery Oleochemicals, Jayant Agro Organics Pvt., Ltd., Cargill, Inc., Koch Industries, DOW Chemical Company, Mitsui Chemicals, Global Bio-Chem Technology Group, Huntsman Corporation, Covestro, Hexion Inc., Solvay S.A., Wanhua Chemical Group, Clariant AG, Lanxess AG, Celanese Corporation, Indorama Ventures |