HPV Testing And Pap Test Market Size Analysis

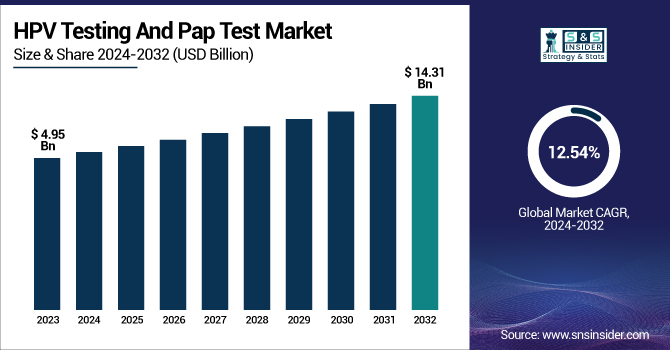

The HPV Testing and Pap Test Market was valued at USD 4.95 billion in 2023 and is projected to reach USD 14.31 billion by 2032, driven by a 12.54% CAGR from 2024 to 2032.

This report brings into focus the growing incidence and prevalence of cervical cancer and HPV, which are stimulating demand for screening and early detection solutions. Trends in the usage of Pap testing and HPV testing by regions have been studied with a focus on the influence of awareness drives, government policies, and healthcare facilities.

To Get more information on HPV Testing and Pap Test Market - Request Free Sample Report

It also delves into the progress of technology in terms of automation and molecular diagnostics to enhance precision and efficiency in screening. The report also examines spending on HPV and Pap testing in healthcare, segmented by government, commercial, private, and out-of-pocket spending, highlighting regional differences and investment patterns in preventive care.

HPV Testing And Pap Test Market Dynamics

Drivers

-

The growing prevalence of human papillomavirus (HPV) infections and cervical cancer is a significant driver for the HPV testing and Pap test market.

As per the World Health Organization (WHO), HPV is accountable for almost 99% of cervical cancer, so early detection is imperative for prevention and treatment. Growing awareness campaigns by organizations like the American Cancer Society (ACS) and Gavi, the Vaccine Alliance have increased screening rates, further fueling market demand. In addition, technological advances in diagnostic products, including molecular HPV testing and liquid-based cytology (LBC), have enhanced accuracy and reliability, fueling adoption. The transition from Pap smears to HPV primary screening, supported by recommendations from organizations such as the U.S. Preventive Services Task Force (USPSTF), has also boosted market growth. In addition, the growth in government-sponsored screening programs, insurance for HPV testing, and investment in healthcare facilities have contributed significantly towards the increase in access to cervical cancer screening services. Demand for self-sampling HPV tests has risen as they are convenient, especially in low-resource settings as well as among people who are apprehensive about going to healthcare centers, further driving the market.

Restraints

-

Despite the increasing adoption of HPV testing and Pap tests, high test costs and limited accessibility in low-income populations remain major restraints.

Most developing nations do not have organized screening programs, and out-of-pocket costs discourage patients from undergoing regular testing. Moreover, uneven healthcare infrastructure poses an equally important obstacle, especially in rural and underserved areas, where advanced diagnostic centers are not easily accessible. False-positive and false-negative outcomes in HPV and Pap testing also present challenges, inducing unnecessary follow-up, distress, and possible overtreatment. Compliance problems, especially in countries where cultural stigma and poor awareness of HPV-related ailments continue to prevail, are limiting market expansion. Some healthcare providers' and patients' resistance to shifting from Pap to HPV DNA testing also slows down market expansion. Additionally, strict regulatory clearance and reimbursement issues can slow the acceptance of new screening technologies, limiting market expansion. In other instances, insurance constraints bar people from having access to routine HPV tests, with more added costs.

Opportunities

-

The growing adoption of self-sampling HPV tests and point-of-care diagnostics presents significant opportunities for market expansion.

Self-sampling devices, including QIAGEN's careHPV and Roche's cobas HPV Test, have become increasingly popular because they can enhance screening rates, especially in low-resource and hard-to-reach locations. Telemedicine and home-based diagnostic technologies are also increasingly boosting demand for HPV testing beyond conventional healthcare facilities. Furthermore, rising investments in AI-based cervical cancer diagnosis and next-generation sequencing (NGS) technologies will augment the efficacy and precision of screening tests. Increased partnerships among public health institutions and diagnostic firms are driving the introduction of affordable screening solutions, increasing access to HPV and Pap tests. As personalized medicine gains momentum, there is an escalating need for HPV genotyping tests that offer precise risk stratification to enable doctors to customize patient treatment plans. Additionally, the marriage of machine learning and digital cytology in Pap testing is transforming early detection, providing tremendous market growth opportunities for players.

Challenges

-

low screening compliance rates, particularly in developing regions where cultural barriers, lack of awareness, and fear of stigma prevent women from undergoing routine cervical cancer screening.

Even with advances in diagnostic technology, inappropriate turnaround times for test results in certain clinical settings affect timely decision-making and patient outcomes. Furthermore, shortage of healthcare providers coupled with insufficient cytology and HPV testing procedure training introduces inefficiency bottlenecks in screening. Making new HPV testing technologies widely available and affordable, e.g., molecular point-of-care tests, continues to be a challenge owing to large upfront capital requirements and limited reimbursement in many nations. The development of competing cervical cancer prevention methods, like HPV vaccination campaigns, can potentially decrease the frequency of screening demand in the future, influencing market forces. Finally, managing data privacy issues relating to online screening platforms and at-home tests becomes increasingly important as patient data protection laws become stricter.

HPV Testing And Pap Test Market Segmentation Analysis

By Type

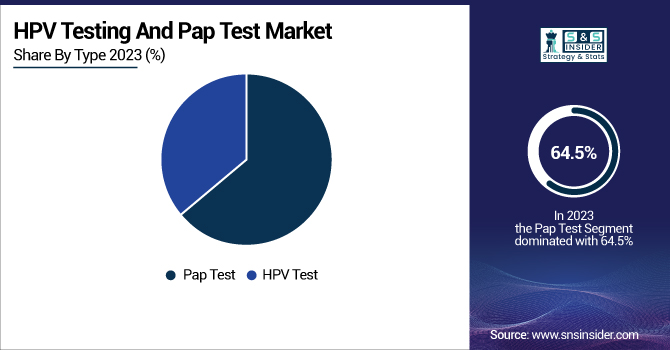

The Pap test segment led the HPV testing and Pap test market in 2023 with a revenue share of 64.5%. Its dominance is largely due to its long-standing status as the default screening method for identifying precancerous and cancerous cervical cell signs. Extensive use within national screening programs, powerful recommendations from healthcare organizations, as well as high awareness among medical practitioners, have further enhanced its dominance. Moreover, the Pap test has been a standard test for decades, and thus it is more accessible and accepted by patients and clinicians. Nevertheless, the HPV testing segment is anticipated to register the highest growth over the forecast period because of its greater sensitivity in identifying high-risk HPV strains that cause cervical cancer. In contrast to the Pap test, HPV testing is capable of detecting infections prior to cellular abnormalities, allowing early intervention. Increased recognition of the role of HPV in cervical cancer, growing use of co-testing (Pap + HPV), and advancements in molecular diagnostics are driving its swift growth. Moreover, various regulatory bodies and medical societies now endorse HPV testing as a first-line screening tool, further enhancing its use. The shift to HPV-based screening programs and the growing incidence of HPV infections globally are major drivers of its rapid market growth.

By Application

Screening for cervical cancer maintained the highest revenue share of 78.5% in 2023 as the leading driver of the HPV testing and Pap test market. The strong market share is mainly attributed to the rising global incidence of cervical cancer, which continues to be a major public health issue, especially in low- and middle-income countries. Government programs and mass screening projects have played a significant role in encouraging systematic cervical cancer screening, enhancing test uptake, and advancing early diagnosis. Initiatives by many public and private bodies aimed at improving screening access through free or subsidized testing have also helped propel the share of this segment. The increasing inclination towards early diagnosis and preventive care has also supported the need for routine check-ups. The cervical cancer screening market is also expected to increase at the highest rate, with the ongoing development of national screening programs, improved diagnostic technologies, and the expanding use of HPV DNA testing. The launch of self-sampling HPV tests is also expected to drive this segment's growth as they enhance access and promote screening program participation. Increasing awareness drives focused on promoting the need for cervical cancer prevention and screening adherence are also driving market growth.

By Product

The consumables segment dominated the HPV test and Pap test market with 67.8% revenue in 2023 due to the intense demand for test kits, reagents, sample collection devices, and other disposable materials required to perform HPV and Pap tests. The need to repeat the tests guarantees a steady demand for consumables, hence making them the most important revenue-generating segment. Hospitals, laboratories, and clinics are purchasing these materials routinely, thereby further augmenting their market share. Besides, growth has also come into the segment in the form of new consumable developments like LBC test kits and molecular assay reagents with high precision, but services would be the one that will register the fastest growth in the coming years as reliance on third-party diagnostic service providers continues to increase. Numerous healthcare centers are outsourcing their testing requirements to specialized labs that provide high-throughput, automated testing solutions. Telehealth-enabled diagnostic services and direct-to-consumer (DTC) testing are also becoming popular, as they are convenient, decrease wait times, and increase access to screening. The increasing trend towards laboratory automation, artificial intelligence (AI)-enabled diagnostic products, and personalized screening programs will also drive the need for services and make it the fastest-growing category in the HPV and Pap test market.

By Technology

The other technologies segment, comprising colposcopy and cystoscopy, was the market leader with a 49.5% revenue share in 2023. These diagnostic tests are important follow-up modalities for assessing abnormal Pap or HPV test results. Colposcopy, in particular, is popularly utilized for extensive cervical examinations to enable clinicians to identify precancerous changes that need additional intervention. The wide prevalence of abnormal cytological results, coupled with the need for further diagnostic testing, has maintained the market for these technologies. Moreover, technological advances in colposcopic imaging and AI-facilitated visual interpretation have enhanced accuracy, supporting their overall acceptance. Nevertheless, the PCR segment will experience the most significant growth as it offers higher sensitivity, specificity, and low viral load detection. PCR-based HPV testing is becoming increasingly popular as a first-line screening test, as it allows for early identification of high-risk HPV types even before cellular changes develop. The growing trend towards molecular diagnostic methods, the development of PCR assays, and the increased use of automated PCR platforms are driving this segment's high growth rate. With healthcare professionals prioritizing accuracy tests and effectiveness in screening for cervical cancer, the technology of PCR is likely to witness substantial growth in the market in the forthcoming years.

By End-use

Hospitals and clinics were the leaders in the market in 2023, representing a 45.6% share of the revenue. Cervical cancer screening is taken as a principal place in healthcare centers, hence making HPV and Pap testing available on a widespread basis. Medical facilities and centers of hospitals take advantage of solid infrastructures, high-end testing equipment, and trained medical officers, thus taking the lead to undertake routine, follow-up testing, and similar other procedures. Government-sponsored public health programs and insurance for hospital-based screening have also bolstered their market presence. Moreover, the availability of multidisciplinary teams within hospitals enables extensive patient management, such as diagnosis, follow-up, and treatment. Nonetheless, the others segment is anticipated to register the highest growth, owing to the growing usage of home-based HPV testing kits, expanding research and development efforts, and the launch of point-of-care diagnostic solutions. Self-sampling HPV tests are becoming increasingly popular because of their convenience, reach to underserved populations, and potential to enhance screening adherence. In addition, technological advancements like AI-based mobile diagnostic devices and telehealth-enabled consultations are facilitating the accessibility of HPV and Pap testing beyond traditional clinical environments. With patient preference moving towards decentralized and personalized screening, the others segment is likely to witness major growth in the coming years.

HPV Testing And Pap Test Market Regional Insights

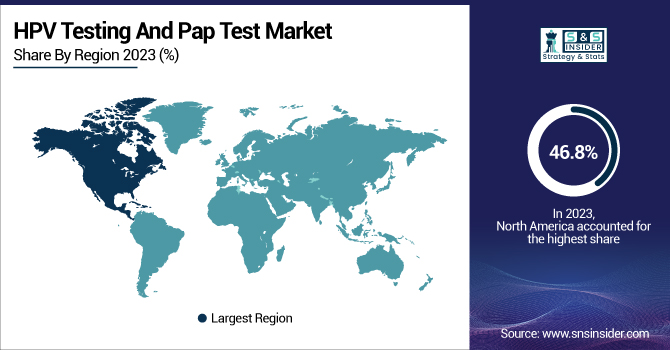

North America was the leading region in the HPV testing and Pap test market in 2023, and it held the highest revenue share of 46.8%. It is mainly due to the presence of strong healthcare infrastructure, high prevalence of cervical cancer screening programs, and high government initiative for preventive healthcare programs. The ready availability of sophisticated diagnostic technology, coupled with positive reimbursement practices, has greatly supported the large-scale adoption of HPV and Pap testing throughout the region. Further supporting the region's leadership has been the availability of leading market players, ongoing research and development efforts, and rising FDA approvals for novel testing technologies. The area also enjoys high rates of participation in routine screening programs, with bodies like the American Cancer Society (ACS) and the Centers for Disease Control and Prevention (CDC) actively encouraging routine HPV and Pap testing.

Nevertheless, Asia Pacific will be the most rapidly growing market in the forecast period. It is driven by heightened awareness regarding prevention of cervical cancer, rising healthcare spending, and growing government-initiated screening programs in China, India, and Japan. Increased availability of cost-effective diagnostic solutions, better healthcare infrastructure, and the escalating prevalence of HPV infection are further driving the growth in demand for HPV and Pap tests in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the HPV Testing and PAP Test Industry

-

Abbott Molecular: m2000 RealTime System, Abbott RealTime High Risk HPV

-

QIAGEN: digene HC2 HPV DNA Test, digene HC2 Sample Conversion Kit, careHPV Test

-

Becton, Dickinson and Company (BD): BD SurePath, BD Onclarity HPV Assay, BD Viper LT System, BD Totalys MultiProcessor, BD Totalys SlidePrep

-

Quest Diagnostics Incorporated: Cervical Cancer TERC Test, HPV mRNA Genotype Test, HPV mRNA Test

-

Hologic, Inc.: ThinPrep Pap Test, ThinPrep Cervista HPV Test, Aptima HPV Assay, Aptima HPV 16 18/45 Genotype Assay, Panther System

-

F. Hoffmann-La Roche Ltd: cobas HPV Test, CINtec PLUS Cytology

-

Femasys Inc.: FemCerv

-

Arbor Vita Corporation: OncoE6 Cervical Test

-

NURX Inc.: Home HPV Screening Test

-

Seegene Inc.: Anyplex II HPV28 Detection

-

Thermo Fisher Scientific Inc.: Invitrogen HPV Genotyping Kit

-

bioMérieux: NucliSENS EasyQ HPV

-

Mylab Discovery Solutions Pvt. Ltd.: PathoDetect HPV Detection Test

Recent Developments in the HPV Testing And Pap Test Market

In Feb 2025, Ontario announced the replacement of the Pap test with HPV testing as the primary cervical cancer screening tool, effective Monday. This shift aims to enhance detection accuracy and reduce cervical cancer deaths, as HPV tests are more reliable and require less frequent screening.

In May 2024, the FDA approved self-collection for HPV testing in healthcare settings, expanding access to cervical cancer screening. This approval allows individuals to collect their own vaginal samples using a swab or brush in locations like clinics, pharmacies, and mobile units, catering to those unable or unwilling to undergo a pelvic exam.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.95 billion |

| Market Size by 2032 | USD 14.31 billion |

| CAGR | CAGR of 12.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Pap Test, HPV Test] By Application [Cervical Cancer Screening, Vaginal Cancer Screening] • By Product [Instruments, Consumables, Services] By Technology [PCR, Immunodiagnostics, Other Technologies] • By End-use [Hospitals & Clinics, Laboratories, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Molecular, QIAGEN, Becton, Dickinson and Company (BD), Quest Diagnostics Incorporated, Hologic, Inc., F. Hoffmann-La Roche Ltd, Femasys Inc., Arbor Vita Corporation, NURX Inc., Seegene Inc., Thermo Fisher Scientific Inc., bioMérieux, and Mylab Discovery Solutions Pvt. Ltd. |