Hybrid Printing Market Size & Overview:

Get E-PDF Sample Report on Hybrid Printing Market - Request Sample Report

The Hybrid Printing Market Size was valued at USD 5.18 Billion in 2023 and is expected to grow to USD 15.81 Billion by 2032 and grow at a CAGR of 13.20% over the forecast period of 2024-2032.

The hybrid printing market is experiencing significant growth, particularly within the packaging and labeling industries, thanks to its ability to combine traditional methods like flexographic and offset printing with cutting-edge digital technologies. This integration allows businesses to efficiently manage short print runs, customize products, and incorporate variable data, which are crucial in modern supply chains. The demand for customizable packaging, such as RFID tags and smart labels, has further driven the adoption of hybrid printing, offering unmatched flexibility and operational efficiency. Additionally, hybrid printing aligns with sustainability trends by utilizing eco-friendly inks and minimizing material waste, making it an attractive solution for environmentally conscious businesses in the packaging sector. Companies like Domino Printing emphasize the importance of innovation and sustainability in hybrid systems to meet the growing needs of e-commerce and consumer goods markets. Hybrid printing is poised to dominate the label and packaging market, supported by advancements in inks, substrates, and automation. These innovations enhance production efficiency, merging the speed of traditional methods with the versatility of digital solutions. Furthermore, with brands increasingly prioritizing product differentiation through advanced packaging, hybrid printing is well-positioned for exponential growth. In 2024, the U.S. print advertising market is projected to reach USD 44.17 billion, underscoring the ongoing significance of print media despite the shift toward digital. On the security front, 67% of organizations reported experiencing printer-related security incidents in 2024, a notable increase from 61% in the prior year. Small and mid-market businesses were hit hardest, with 74% facing data loss incidents linked to printer vulnerabilities. The top security concerns include unmanaged, employee-owned printers (33%) and risks tied to office printing environments (29%), highlighting the need for organizations to prioritize printer security as part of their broader vulnerability management strategy.

Hybrid Printing Market Dynamics

Drivers

-

Driving Growth in Hybrid Printing with the Rising Demand for Customization and Personalization in Packaging and Labels

The rising demand for customization and personalization is a key driver in the growth of the hybrid printing market, especially in sectors like packaging, labels, and marketing materials. As consumers increasingly seek unique and tailored products, businesses are turning to hybrid printing to meet these evolving needs. Hybrid printing combines traditional methods, such as flexography and offset, with digital technologies, offering a solution for short-run, high-quality, and customized production. This innovation enables brands to create personalized packaging, labels, and promotional materials that boost customer engagement and satisfaction. In industries like e-commerce and retail, product personalization is shown to enhance customer loyalty and brand appeal, as highlighted in a Forbes article. The emergence of print-on-demand platforms has further fueled this demand, allowing consumers to design bespoke products, packaging, and marketing materials. As the trend toward personalization grows, hybrid printing plays a critical role in enabling businesses to offer customized solutions. Variable data printing, discussed in the FabSoft article, enables companies to tailor products and marketing materials, driving more targeted customer engagement. Hybrid printing is also transforming narrow web label production, providing industries with the customization and flexibility needed for unique packaging solutions. Additionally, sustainability has become a driving force, with hybrid printing offering eco-friendly ink options and minimizing waste, appealing to both businesses and consumers who prioritize environmental responsibility. As mass customization and hyper-personalization continue to rise, hybrid printing is becoming a vital tool for businesses, providing the necessary flexibility, efficiency, and sustainability to meet the growing demand for personalized products.

Restraints

-

A key restraint in the hybrid printing market is the limited availability of materials, which restricts production flexibility and increases costs.

Hybrid printing combines traditional and digital printing technologies, requiring specific substrates, inks, and materials that may not be as readily available or as cost-effective as those used in conventional printing methods. This scarcity can drive up production expenses, particularly for small to medium-sized businesses that rely on affordable solutions. Hybrid printing systems often require specialized inks and substrates designed to function effectively with both digital and traditional processes. These materials, essential for achieving high-quality and customizable results, tend to be more expensive than those used in standard printing. The limited availability of these materials can be especially problematic in industries where short-run, customized orders are in high demand, as material shortages may lead to delays or disruptions in production. Additionally, the integration of hybrid materials in sectors like packaging, labeling, and biosensing applications presents both opportunities and challenges due to these material-related limitations. Advancements in hybrid printing for applications such as microfluidic devices and 3D printing optics highlight the ongoing need for material innovation and research. The high cost and limited supply of suitable materials can hinder the scalability of hybrid printing in some industries, slowing its adoption across a broader market. To address this issue, companies must invest in material research and establish strategic partnerships to secure a reliable supply of compatible, cost-effective substrates and inks. This will help maintain the competitiveness of hybrid printing solutions, ensuring they can meet the growing demand for customized, high-quality products.

Hybrid Printing Market Segment Outlook

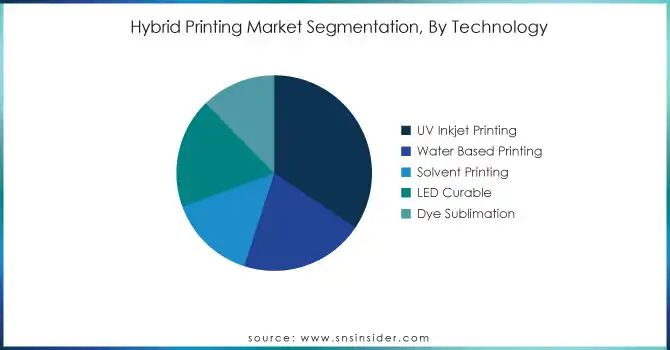

By Technology

In 2023, the UV Inkjet Printing segment holds a leading share of approximately 35% in the hybrid printing market, thanks to its ability to deliver high-quality and versatile printing solutions. UV inkjet printing utilizes ultraviolet light to instantly cure the ink as it is applied, enabling quick drying on a wide range of substrates, including non-porous materials. This technology is well-suited for both small and large print runs, making it a preferred choice for industries that require customization and short-run production, such as packaging and labeling. UV inkjet printing offers vibrant colors, precise details, and excellent durability, especially on materials like plastics, glass, and metal. Its eco-friendly characteristics, with low solvent emissions, align with the growing demand for sustainable solutions. As businesses seek more flexible, high-quality, and environmentally-conscious printing options, UV inkjet printing continues to drive growth and adoption in the hybrid printing market.

By Application

The Label Printing segment dominates the hybrid printing market, accounting for approximately 40% in 2023. This dominance is driven by the growing demand for customized, high-quality labels across various industries, including food and beverage, pharmaceuticals, cosmetics, and consumer goods. Hybrid printing technologies, which combine traditional and digital printing methods, enable label manufacturers to produce short-run, on-demand, and personalized labels with high precision and vibrant colors. The ability to handle variable data, such as barcodes, QR codes, and product information, makes hybrid printing ideal for label printing. Additionally, the flexibility of hybrid systems allows for efficient production of both simple and complex labels, meeting the needs of diverse packaging requirements. The increasing trend toward product differentiation and branding further fuels the growth of this segment in the hybrid printing market.

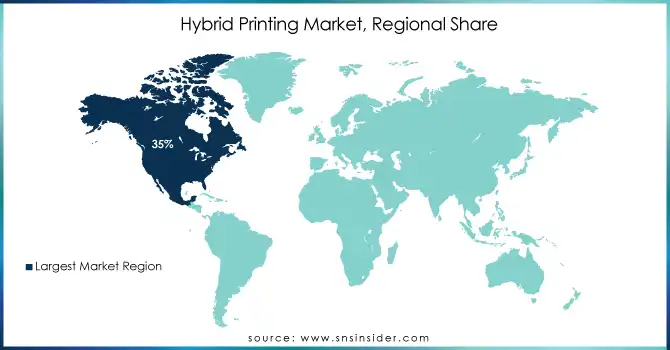

Hybrid Printing Market Regional Analysis

In 2023, North America dominates the hybrid printing market with a share of around 35%, driven by substantial growth in key markets such as the U.S. and Canada. The region's leadership is fueled by its advanced manufacturing infrastructure, high-tech research, and rapid adoption of innovative printing technologies. The U.S., in particular, leads the charge due to its thriving e-commerce sector, where personalized and customized packaging, labels, and marketing materials are in high demand. The country’s strong focus on sustainability and environmental concerns has further boosted the adoption of eco-friendly hybrid printing solutions. Additionally, North America's robust supply chain for printing materials, inks, and substrates supports the growth of the hybrid printing market. With ongoing advancements in technology and significant investments in digital and hybrid solutions, the region remains at the forefront of the global market. The presence of key industry players and a high level of technological innovation solidifies North America's dominance, as it continues to cater to industries seeking high quality, versatile, and sustainable printing solutions.

Asia-Pacific is projected to be the fastest-growing region in the hybrid printing market from 2024 to 2032, driven by rapid industrialization, technological advancements, and increasing demand for customized packaging and labels. Key countries like China, Japan, India, and South Korea are at the forefront of this growth. China, as the world's manufacturing hub, is seeing substantial investments in advanced printing technologies, catering to its large consumer base and growing e-commerce sector. India’s expanding retail and packaging industries are also contributing to the surge in demand for hybrid printing solutions, particularly in short-run and personalized print jobs. Japan, with its focus on technological innovation and sustainability, continues to lead in advanced printing solutions, aligning with global eco-friendly trends. The region’s emphasis on cost-effective production, efficient supply chains, and a growing appetite for custom products are making it a hotspot for hybrid printing adoption. Furthermore, Asia-Pacific's large-scale manufacturing sector, combined with increased urbanization and the rise of digital printing technologies, positions it as a leader in the global market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

KEY PLAYERS

Some of the Major Players in Hybrid Printing Market along with their product:

-

Adelco Screen Process Ltd. (Hybrid Screen Printing Systems)

-

Bobst (Mastercut and Hybrid Flexo Printing Systems)

-

ColorJet Group (Hybrid UV Printers)

-

Domino Printing Sciences PLC. (N730i Digital Label Press)

-

EFI (Electronics for Imaging, Inc.) (EFI VUTEk Hybrid Printers)

-

Durst Group (Rho Series Hybrid Printers)

-

HP Inc. (HP Latex Hybrid Printers)

-

Konica Minolta Inc. (AccurioJet KM-1e UV Inkjet Press)

-

Xerox Corporation (Iridesse Hybrid Digital Press)

-

Roland DG Corporation (VersaUV LEC Series Hybrid Printers)

-

Canon Inc. (Colorado Series UV Gel Hybrid Printers)

-

Mimaki Engineering Co., Ltd. (JFX200 Series Hybrid Printers)

-

Ricoh Company, Ltd. (Pro TF6250 Hybrid Printers)

-

Screen Holdings Co., Ltd. (Truepress Jet520 Series)

-

FUJIFILM Holdings Corporation (Acuity Ultra Hybrid LED Printers)

-

Epson (SureColor SC-F Series Hybrid Printers)

-

Kornit Digital Ltd. (Presto MAX Hybrid Printers for Textiles)

-

Heidelberg Druckmaschinen AG (Versafire Hybrid Printing Solutions)

-

MS Printing Solutions (JP4 Evolution Hybrid Printers)

List of key suppliers for hybrid printing raw materials and components, categorized by the types of materials and components they provide:

1. Ink Suppliers

-

Sun Chemical Corporation – UV-curable and water-based inks.

-

Flint Group – Solvent-based, water-based, and LED-curable inks.

-

Siegwerk Druckfarben AG & Co. KGaA – Eco-friendly printing inks.

-

Huber Group – Offset and digital inks for hybrid printing.

-

Marabu GmbH & Co. KG – Digital and screen-printing inks.

2. Substrate Suppliers

-

Avery Dennison Corporation – Self-adhesive label materials.

-

UPM Raflatac – Films and paper materials for labels and packaging.

-

Mondi Group – Flexible and sustainable packaging substrates.

-

Arjo Solutions – Printable papers for high-security applications.

-

Nippon Paper Industries Co., Ltd. – Specialty and coated papers.

3. Printhead and Component Suppliers

-

Xaar PLC – Industrial inkjet printheads.

-

Seiko Instruments Inc. – High-performance printheads for hybrid printers.

-

Fujifilm Dimatix, Inc. – Precision inkjet printheads.

-

Konica Minolta, Inc. – Piezoelectric printheads.

-

Ricoh Company, Ltd. – Thermal and piezo printhead technologies.

4. UV Lamp and Curing Equipment Suppliers

-

Phoseon Technology – LED curing systems for hybrid printing.

-

GEW (EC) Limited – UV curing solutions.

-

Heraeus Noblelight GmbH – UV curing lamps.

-

Nordson Corporation – UV curing systems for flexible printing lines.

-

American Ultraviolet – UV LED curing systems.

5. Adhesive and Coating Material Suppliers

-

Henkel AG & Co. KGaA – Adhesives for flexible packaging and labels.

-

Dow Chemical Company – Coatings for improved adhesion and durability.

-

Ashland Inc. – Water-based and UV-curable coatings.

-

BASF SE – Functional coatings for hybrid printing applications.

-

3M – Adhesive tapes and printable coatings.

6. Printer Spare Part and Component Suppliers

-

Trelleborg AB – Printing blankets for hybrid printers.

-

Ceramicx – Heating elements for hybrid printing systems.

-

igus GmbH – Motion components like cables and chains.

-

SKF Group – Bearings and components for high-speed printing systems.

-

Festo Corporation – Automation components for hybrid printers.

7. Software and Electronics Suppliers

-

Global Graphics PLC – Software for hybrid printing workflows.

-

Esko – Prepress software for packaging and label printing.

-

Onyx Graphics, Inc. – RIP software solutions for hybrid printers.

-

ColorLogic GmbH – Color management software.

-

Electrolube – Conductive coatings for hybrid printer electronics.

RECENT DEVELOPMENT

-

On November 2024, Adelco has launched its upgraded UV DTF printing technology, providing faster production, lower costs, and improved precision for custom prints on various substrates. This system is ideal for fashion, promotional, and industrial products.

-

On July 2024, Fokina, a leading German printing company, has experienced significant business growth after investing in Fujifilm's Acuity Ultra Hybrid LED printer. The investment, marking Fujifilm's first sale of the printer in Germany, has enhanced Fokina's capabilities, allowing for faster turnaround times and more diverse jobs, while also reducing energy costs.

-

On October 2024, Canon Europe launches the SELPHY QX20, an upgraded portable photo printer that offers enhanced versatility with support for 2:3 and square paper sizes. Featuring improved design, built-in Wi-Fi, and dye sublimation technology, the QX20 enables users to print high-quality, smudge-free photos on-the-go, making it an ideal tool for creative projects and memory-making.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.18 Billion |

| Market Size by 2032 | USD 15.18 Billion |

| CAGR | CAGR of 13.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (UV Inkjet Printing, Water Based Printing, Solvent Printing, LED Curable, Dye Sublimation) • By Application (Label Printing, Packaging Printing, Commercial Printing, Others) • By End-use Industry(Healthcare, Food and Beverage, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adelco Screen Process Ltd.,Bobst, ColorJet Group, Domino Printing Sciences PLC., EFI (Electronics for Imaging, Inc.), Durst Group, HP Inc., Konica Minolta Inc., Xerox Corporation, Roland DG Corporation, Canon Inc., Mimaki Engineering Co., Ltd., Ricoh Company, Ltd., Screen Holdings Co., Ltd., FUJIFILM Holdings Corporation, Epson, Kornit Digital Ltd., Heidelberg Druckmaschinen AG, and MS Printing Solutions are key players in the hybrid printing market. |

| Key Drivers | • Driving Growth in Hybrid Printing with the Rising Demand for Customization and Personalization in Packaging and Labels. |

| Restraints | • A key restraint in the hybrid printing market is the limited availability of materials, which restricts production flexibility and increases costs. |