Hydrogen Gas Sensor Market Size & Trends:

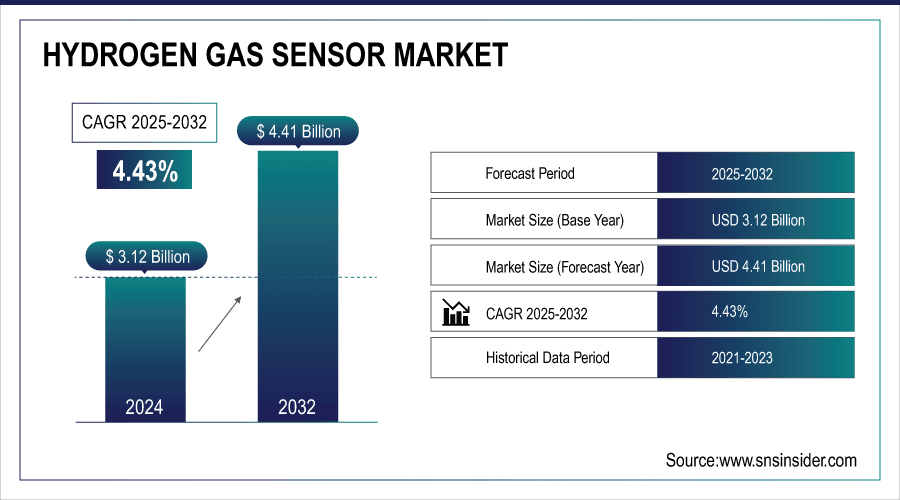

The Hydrogen Gas Sensor Market size was valued at USD 3.12 Billion in 2024 and is projected to reach USD 4.41Billion by 2032, growing at a CAGR of 4.43% during 2025-2032.

To Get More Information On Hydrogen Gas Sensor Market - Request Free Sample Report

The hydrogen gas sensor market is expanding rapidly on account of the increasing requirement for safety in hydrogen production, storage, and utilization in different industry verticals. As hydrogen is the cornerstone of the world’s transition to clean power, there’s a growing demand for dependable detection technologies. Key sectors, such as automotive, industrial manufacturing, aerospace, and energy are adopting hydrogen sensors to prevent leaks and ensure operating safety. Tight environmental and safety legislation is also pushing market uptake. These have already enabled enhancement of sensitivity, productivity, and IOT system integration and further broadened the application fields. Increasing investment toward hydrogen infrastructure along with the introduction of energy-efficient systems will drive the overall market size.

China invested over 300 billion yuan (USD42B) in green hydrogen during the first nine months of 2023. This surge is driving advancements in hydrogen fuel applications and expanding nationwide infrastructure.

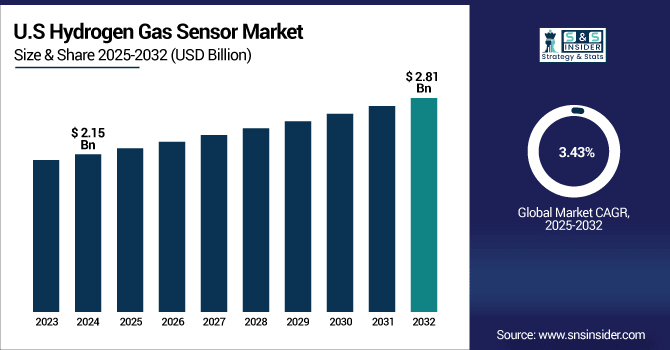

The U.S Hydrogen Gas Sensor Market size was valued at USD 2.15 Billion in 2024 and is projected to reach USD 2.81Billion by 2032, growing at a CAGR of 3.43% during 2025-2032. The growth is influenced by Emerging safety regulations, the growing hydrogen infrastructure, and increasing adoption in fuel cell vehicles and industrial applications. hydrogen gas sensor market growth is also being driven by ongoing technological advancements that lead to enhanced accuracy and durability of sensors and allow for real-time monitoring as the world seeks cleaner and more sustainable energy.

Hydrogen Gas Sensor Market Dynamics:

Drivers:

-

Advances in Ultra-Sensitive Hydrogen Sensors Boost Market Growth by Enhancing Safety and Efficiency

The hydrogen gas sensor market is rapidly expanding due to advancements in ultra-sensitive, fast-responding, and low-power sensor technologies. The next-generation sensors can help detect leaks instantly at room temperature, overcoming the limitations of the previous sensors that are slow and energy-intensive. Rising deployment of hydrogen in the transportation, manufacturing and power generation industries is boosting the demand for robust safety mechanisms. Polymer sensors advance additionally contribute to better accuracy of detection, particularly in complex gas environments and a wider range of industrial applications. Ascending safety concerns associated with hydrogen's flammable nature, combined with more stringent regulations and rapid technological advancements will drive global market growth. This expansion is in line with the global transition to a sustainable hydrogen economy, by enabling safer hydrogen production, storage and utilization in different sectors.

KAUST researchers have developed a highly sensitive hydrogen sensor capable of detecting hydrogen and hydrogen-containing gases in 0.8 seconds with 10,000 times signal enhancement. This ultralow-cost, power-efficient device is functioning at room temperature, exhibiting significantly enhanced sensitivity as compared to commercial sensors, which will contribute to hydrogen safety.

Restraints:

-

Improving Humidity and Temperature Resistance to Reduce Sensor Errors and Extend Lifespan

Hydrogen gas sensors must maintain reliable performance despite varying environmental conditions such as humidity and temperature changes, which can negatively impact their accuracy and stability. Research is focused on the development of novel materials and extended sensor designs that are insensitive to the influence of humidity and temperature changes. This provides reliable and accurate hydrogen detection even in the toughest environments such as industrial sites, outdoor distribution, or transportation systems. Without these enhancements, the sensors could potentially have false alarms, be inaccurate or degrade more quickly. Improving the humidity/temperature resistance not only eliminates these problems, but also enhances the service life of the sensor, and it is the key to secure the safety, stability and reliability of hydrogen leak detection in practical application.

Opportunities:

-

Increased Hydrogen Usage Drives Demand for Advanced Leak Detection Sensors to Enhance Safety

Rising hydrogen adoption in sectors like energy, transportation, and industrial manufacturing is driving strong demand for reliable gas sensors. Since hydrogen is flammable and odorless, detecting low concentration of hydrogen leak is an important safety concern and gift of advanced sensor. Advancements minimizing the maintenance requirements and able to work in hostile conditions are also fueling market demand. Rising government norms & industry regulations for safety along with the requirement to adopt hydrogen leakage detection technology will further complement the business landscape. The growth in the hydrogen fuel cell vehicle market, as well as increased utilization of hydrogen in heavy machinery and power generation, provides continued opportunities for sensor makers. Increased sensor robustness and the ability to monitor in real time will have a tangible impact on safe operation, cutting down on accidents and on downtime, and will lead to an increase in the global market.

Honeywell is expanding its gas detection line with the newly-enhanced Honeywell BW Ultra, a five-gas detector from Honeywell’s BW™ GasAlert MicroClip series. This maintenance free sensor does not require manual calibration for its 10 year lifetime, making it ideal for safety in hydrogen fuelled industries.

Challenges:

-

Environmental Variations Cause Performance Challenges in Hydrogen Gas Sensors

Hydrogen gas sensors must maintain accuracy and reliability despite fluctuating environmental conditions such as humidity, temperature, and industrial pollutants. These fluctuations can lead to sensor drift, error measurement or less sensitivity, proving detrimental for safety and operational effectiveness. Hydrogen gas sensors are operating in severe industrial environment conditions where contaminants and mechanical stress contribute to the performance degradation. To guarantee stability in the environment, material ruggedization and advanced sensor designs enabling in-situ corrections against moisture and temperature shifts are necessary. Without such enhancements, sensors are likely to require too much calibration and have a shortened lifespan, leading to costly down time and the need for maintenance. Addressing environmental skeleton, which is vital for realizing reliable hydrogen leak detection in a variety of practical scenarios and thus ensures the safe and successful integration of hydrogen technologies in various industries.

Hydrogen Gas Sensor Market Segmentation Outlook:

By Technology

The Electrochemical segment held a dominant hydrogen gas sensor Market share of around 60% in 2024. This domination is justified by the sensor’s high sensitivity, precision, and low cost, as they are suitable for industrial safety premiums. Their capability to offer accurate, on-line detection of hydrogen leaks ensures a broad field of use in different applications. High performance and low-cost of electrochemical sensors are attracting them increasing attentions in the global market.

The Metal Oxide Semiconductor segment is expected to experience the fastest growth in the hydrogen gas sensor Market over 2025-2032 with a CAGR of 6.32%. This expansion is driven by the reliability, low cost and high performance of the sensors in harsh environments. Rising demand from automotive as well as industrial sector will also help the metal oxide semiconductor hydrogen sensors market to grow globally.

By Portability

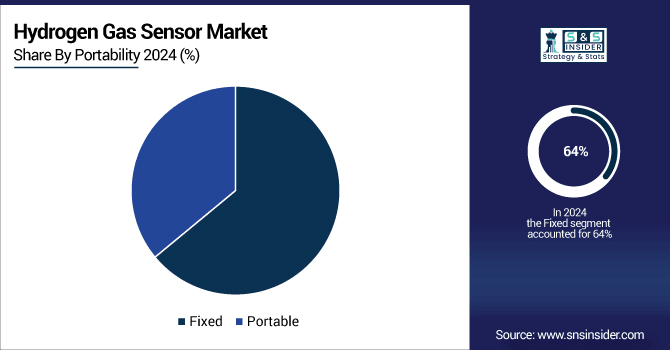

The Fixed segment held a dominant hydrogen gas sensor market share of around 64% in 2024, driven by its critical role in industrial safety and continuous monitoring applications. Growing industrial automation and stringent safety regulations are increasing the demand for fixed sensors, which provide reliable, real-time leak detection in factories, power plants, and refineries, ensuring worker safety and preventing costly accidents.

The Portable segment is expected to experience the fastest growth in the hydrogen gas sensor market over 2025-2032 with a CAGR of 6.88%, the demand for the portable hydrogen gas sensor is growing significantly as the need for the flexible safety solutions that can be taken on the move increases. Rising need in the fields of transportation, emergency response and field inspections drives growth; portable sensors allow fast, accurate hydrogen leak detection in various applications where fixed sensors are not practical.

By Application

The Oil and Gas segment held a dominant hydrogen gas sensor Market share of around 32% in 2024. Motivated by the industry’s urgent emphasis on safety and leak protection. Hydrogen is an ever-growing clean energy option at oil and gas facilities, and so the call for accurate and reliable leak detection has become more urgent. Stringent regulations and the increased risk factor of hydrogen-associated accidents are forcing the need for novel hydrogen sensors for transportation sector to rise.

The Automotive segment is projected to witness the fastest growth in the hydrogen gas sensor market from 2025 to 2032, due to the growing use of hydrogen fuel cell vehicles. Higher government emissions regulation and growth of clean energy transportation drives the demand for high-quality hydrogen leak detection systems, for safety and sensor development in a fast moving market.

Hydrogen Gas Sensor Market Regional Analysis:

In 2024, the Asia Pacific dominated the hydrogen gas sensor market and accounted for 44% of revenue share. This expansion occurs as high-speed industrialization, rising application of hydrogen-based fuel technologies, and aggressive govt. support for clean energy continue to develop. Rising manufacturing and energy production in the area is underpinning demand for state-of-the-art hydrogen sensors to maintain safety and regulatory compliance in various applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China leads the Asia Pacific hydrogen gas sensor market, driven by massive investments in hydrogen infrastructure, government support for clean energy, and rapid growth in fuel cell vehicle production boosting sensor demand.

North America is projected to register the fastest CAGR of 6.06% during 2025-2032, driven by rising adoption of hydrogen fuel cells in transportation and industrial applications, favourable government incentives towards renewable energy sources, and rising investments in hydrogen infrastructure. Increasing safety standards and development of hydrogen gas sensors also contribute to growth of the market in the region.

The U.S. leads the hydrogen gas sensor market, due to substantial government funding, expanding hydrogen infrastructure, rising adoption of fuel cell vehicles, and stringent safety regulations promoting advanced leak detection technologies.

In 2024, Europe emerged as a promising region in the hydrogen gas sensor market, driven by strong government initiatives supporting green hydrogen, increasing investments in renewable energy projects, stringent safety regulations, and growing adoption of hydrogen fuel cells in transportation and industrial sectors, fueling demand for advanced sensing technologies.

LATAM and MEA is experiencing steady growth in the hydrogen gas sensor market, owing to growing investments in renewable energy, expanding industrial hydrogen applications, and rising attention to safety regulations, leading to requirements for trustworthy and effective hydrogen leak detection solutions in these economies.

Key Players:

The hydrogen gas sensor market companies are Honeywell, Siemens, Toshiba, Membrapor, Figaro, Nissha FIS, City Technology, Aeroqual, Makel Engineering, NTM Sensors, and Others.

Recent Developments:

-

In 7 Feb 2025, Membrapor launched the H2/VA-1000 hydrogen sensor, offering the lowest CO cross-sensitivity and guaranteed selectivity for one year. This sensor reduces costs with a replaceable filter, ideal for leak detection, emission monitoring, and medical applications.

-

In March 13, 2024, Toshiba received an order from Tanaka Kikinzoku for a 500 kW H2Rex™ hydrogen fuel cell system, one of Japan’s largest, to power its Shonan Plant.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.12 Billion |

| Market Size by 2032 | USD 4.41 Billion |

| CAGR | CAGR of 4.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Electrochemical, Metal Oxide Semiconductor, Catalytic and Others) • By Portability (Fixed and Portable) • By Application (Automotive, Oil and Gas, Healthcare, Aerospace and Defense and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The hydrogen gas sensor market companies are Honeywell, Siemens, Toshiba, Membrapor, Figaro, Nissha FIS, City Technology, Aeroqual, Makel Engineering, NTM Sensors and Others. |