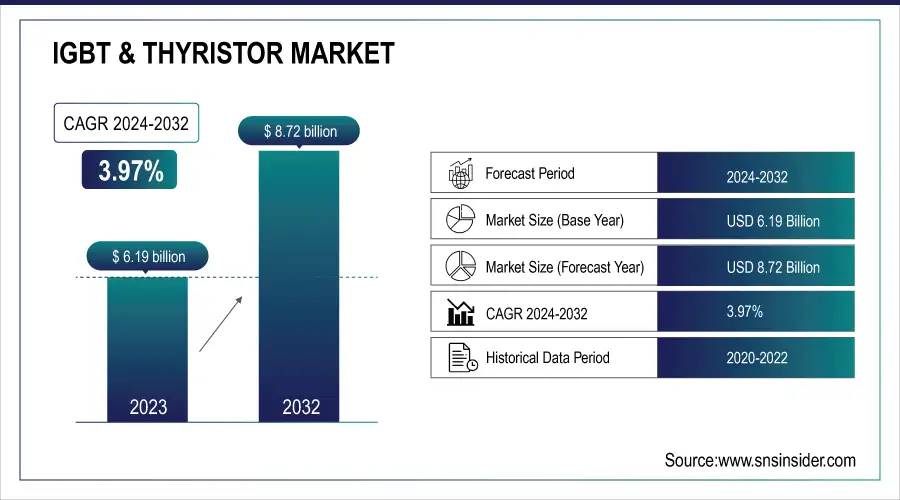

IGBT & Thyristor Market Size & Growth:

The IGBT & Thyristor Market Size was valued at USD 6.19 billion in 2023 and is expected to reach USD 8.72 billion by 2032 and grow at a CAGR of 3.97% over the forecast period 2024-2032.

It is fueled by growing need for high-efficiency power electronics in e.g., electric vehicles (EV), renewable energy systems, and industrial automation. IGBTs and thyristors are central to achieving high-efficiency energy conversion and switching in power electronics. Advances in technology, coupled with a worldwide trend toward clean energy and electrification, are further bolstering market growth. Yet, there could be barriers like high initial investments and sophisticated production processes preventing adoption. Asia-Pacific is still an important growth region because of robust manufacturing and energy infrastructure growth.

To Get more information on IGBT & Thyristor Market - Request Free Sample Report

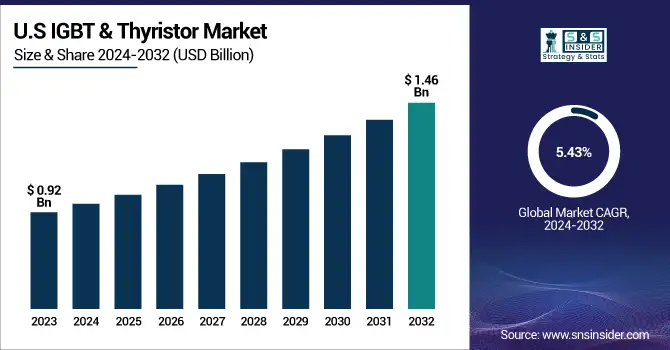

The U.S. IGBT & Thyristor Market size was USD 0.92 billion in 2023 and is expected to reach USD 1.46 billion by 2032, growing at a CAGR of 5.43% over the forecast period of 2024–2032.

This growth is fueled by increasing use of advanced power electronics in industries like electric vehicles, renewable energy, and industrial automation. IGBTs and thyristors play an essential role in effective energy management and high-speed switching devices. The U.S. industry is aided by significant investments in clean energy infrastructure and continuous innovation in semiconductor technologies.

In addition, increasing need for energy-efficient products in consumer electronics and utilities also contributes to market growth. Nevertheless, high production costs and supply chain complexities could act as restraints for market growth.

IGBT & Thyristor Market Dynamics:

Key Drivers:

-

Rising Integration of IGBT and Thyristor Components in Renewable Energy and Electric Vehicle Applications Boosts the IGBT & Thyristor Market Growth.

Growing global pressure to adopt green energy and clean transportation is largely propelling the market for IGBT and thyristor devices. These semiconductors are pivotal to high-efficiency power conversion and control, hence their pivotal position in solar inverters, wind turbines, and electric vehicle powertrains. With the pressure on decarbonization from governments and industries, demand for efficient, energy-saving devices surges. The growth of electric mobility and renewable energy installations is generating consistent demand, particularly in developed and emerging markets. This is likely to continue driving market expansion during the forecast period with power electronics playing a crucial role in shifting towards green energy solutions.

Restraints:

-

High Initial Costs and Complex Manufacturing Processes Restrain the Adoption of IGBT and Thyristor Components in Cost-Sensitive Applications.

Despite increasing uses, IGBT and thyristor devices tend to resist price-sensitive markets because of the high cost of manufacturing. Such semiconductors need complex fabrication technologies and costly raw materials, which also drive their higher prices. Also, the high degree of precision required in design and integration contributes to higher costs, especially for small- and mid-sized producers or applications that have tight budgets. This financial barrier will retard adoption in some sectors, like low-cost consumer electronics or small industrial applications. Consequently, though the market is ready for expansion, heavy initial investment hurdles and production technological issues are important impediments to wider rollout.

Opportunities:

-

Increasing Deployment of Smart Grid Infrastructure and Industrial Automation Presents Lucrative Opportunities for IGBT & Thyristor Market Expansion

The speedy modernization of energy infrastructure using smart grids and the development of Industry 4.0 are creating significant opportunities for the IGBT & thyristor market. These devices are critical to providing efficient power distribution, voltage regulation, and system reliability in sophisticated, automated systems. With utilities and industries becoming increasingly reliant on digital control systems and automation, there is growing demand for reliable power electronics with the ability to deal with high voltages and switching frequencies. Government initiatives toward grid modernization, particularly in advanced regions, add to this potential. Further, increased investment in industrial IoT and energy-efficient manufacturing provides new opportunities for integrating IGBT and thyristors.

Challenges:

-

Fluctuations in Raw Material Supply Chains and Geopolitical Tensions Pose a Major Challenge to IGBT & Thyristor Market Stability.

The IGBT & thyristor industry is susceptible to interruption in the worldwide supply chain of essential raw materials like silicon, gallium, and other rare earth metals. Geopolitical tensions, trade barriers, and pandemic-driven supply disruptions have underscored the vulnerability of semiconductor manufacturing and supply chains. Interruptions in these supply chains can result in price fluctuations, manufacturing delays, and supply shortfalls, impeding manufacturers' capacity to capitalize on increasing demand.

Furthermore, the geographic concentration of semiconductor production in certain areas heightens the risk. Maintaining supply chain resilience and having access to stable sources of materials are key challenges that need to be overcome in order to support long-term market expansion.

IGBT & Thyristor Market Segments Analysis:

By Application

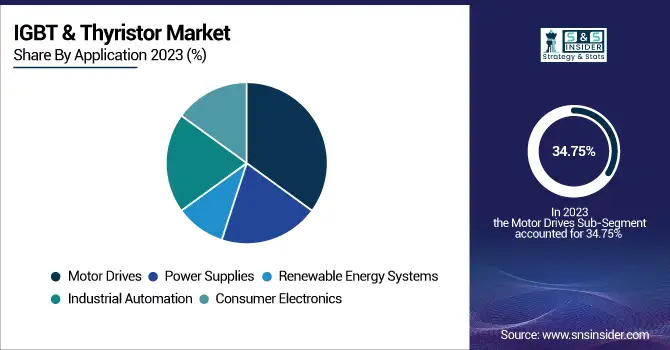

In 2023, Motor Drives segment had the highest revenue share of 34.75% in the IGBT & Thyristor Market due to increased industrial motor control and automation demand. IGBTs and thyristors play a crucial role in facilitating effective, high-speed switching in variable frequency drives and servo motors. Infineon Technologies and Mitsubishi Electric have introduced sophisticated IGBT modules for industrial motor drives, focusing on energy saving and minimized size. For instance, Infineon's TRENCHSTOP™ IGBT7 modules enhance motor control performance and minimize power losses. With industries focusing on productivity and efficiency, the demand for high-performance and rugged motor drive solutions increases the uptake of power semiconductors, making this segment the leader in the world market.

The Renewable Energy Systems segment is expected to advance at the Fastest CAGR of 5.95% between 2024–2032, driven by increasing worldwide investments in clean energy. IGBT and thyristor devices play a crucial role in power inverters used in solar and wind applications to facilitate efficient DC-AC conversion and grid connectivity. Top industry players such as ABB and Hitachi Energy have introduced new solutions focused on this space. ABB’s new IGBT-based inverter technologies enhance grid stability and energy harvesting in solar farms. Similarly, Hitachi’s high-voltage thyristor modules support next-gen wind energy systems. As nations push for net-zero targets, the integration of advanced semiconductors into renewable infrastructure accelerates, directly boosting demand and shaping the future growth of the IGBT & Thyristor Market.

By Type

The IGBT segment commanded the highest revenue share of 49.72% in 2023, a testament to its extensive adoption across applications like electric vehicles, motor drives, and renewable energy systems. IGBTs are highly efficient and have fast switching times, which makes them vital for contemporary power electronics. Leading players like ON Semiconductor and STMicroelectronics have introduced advanced IGBT modules that are optimized for better thermal performance and lower switching losses. For example, ST's STPOWER IGBT series is specifically designed for industrial and EV applications, providing superior energy efficiency. While worldwide energy requirements increase and electrification widens, IGBTs persist in reigning supreme because of their conduciveness and performance, propping their top spot within the overall development and technological advancement of the IGBT & Thyristor Market.

The Thyristor Systems segment is likely to develop at the Fastest CAGR of 5.98% during the period from 2024 to 2032, owing to demand in high-power and high-voltage applications. Thyristors play a key role in AC power control, industrial heating, and HVDC transmission. General Electric and Siemens have developed advanced thyristor modules optimized for energy grids and heavy industrial applications. Siemens' recent thyristor-based HVDC solutions enhance long-distance power transmission with minimal losses. With power infrastructure getting upgraded and efficient energy control demand increasing, thyristor systems are taking center stage, particularly in the big grid and industrial installations. This robust growth path highlights their growing significance in the changing IGBT & Thyristor Market landscape.

By End Use

The Industrial segment held the highest IGBT & Thyristor Market share of 40.09% in 2023, thanks to the immense use of automation and motor control systems in manufacturing and processing industries. IGBTs and thyristors play a key role in the accurate and efficient control of industrial equipment like drives, invertors, and power control systems. Companies like Mitsubishi Electric and Fuji Electric have launched enhanced industrial-grade IGBT modules to improve energy efficiency and thermal management. For example, Fuji’s X Series IGBT modules offer optimized performance in heavy-duty industrial applications. As industries prioritize productivity and sustainability, the demand for reliable power semiconductors is rising, solidifying the industrial sector’s leading role in the IGBT & Thyristor Market.

The Automotive Systems segment will advance at the Fastest CAGR of 5.50% during the period from 2024 to 2032, driven by the widespread transition to electric mobility and sophisticated vehicle electronics. IGBTs are extensively deployed in electric vehicle drivetrains, battery management systems, and charging stations owing to their high switching efficiency and power density. Market leaders like Infineon Technologies and ROHM Semiconductor have launched next-generation automotive-grade IGBTs for EVs and hybrids. Infineon's EDT2 IGBT technology provides reduced conduction losses and enhanced efficiency for EV inverters. With the world's automotive sector adopting electrification, the adoption of IGBT & thyristor solutions gains momentum, playing a key role in the market's long-term growth and innovation.

By Technology

The SiC segment dominated the IGBT & Thyristor Market in 2023 with a resounding 59.37% revenue share, owing to its higher efficiency, thermal conductivity, and switching performance compared to conventional silicon-based devices. SiC technology is now more commonly deployed in electric vehicles, industrial power supplies, and renewable energy solutions. Wolfspeed and STMicroelectronics have introduced sophisticated SiC modules that promote system reliability and energy efficiency. Wolfspeed's latest 650V SiC MOSFETs address fast-charging EV infrastructure and industrial drive applications, with lower energy losses. With increasing demand for high-performance, energy-efficient solutions across industries, SiC-based IGBT and thyristor solutions are gaining ground as the technology of choice, solidifying their supremacy in the transformation of the power semiconductor environment.

The GaN Systems segment is expected to grow at the Fastest CAGR of 5.35% during 2024–2032, driven by its capability to provide high-speed switching, miniaturized size, and efficiency in low-to-medium voltage applications. Gallium Nitride (GaN) technology is making inroads into consumer electronics, automotive, and power supply systems owing to its performance benefits. Firms such as GaN Systems and Infineon have introduced new GaN transistors and power modules for high-efficiency chargers and EV converters. For example, GaN Systems released 650V GaN transistors that are intended for compact, energy-efficient power conversion. With the growing demand for lightweight, high-efficiency components, GaN technology is driving innovation and adoption, which will have a huge impact on the future growth of the IGBT & Thyristor Market.

IGBT & Thyristor Market Regional Analysis:

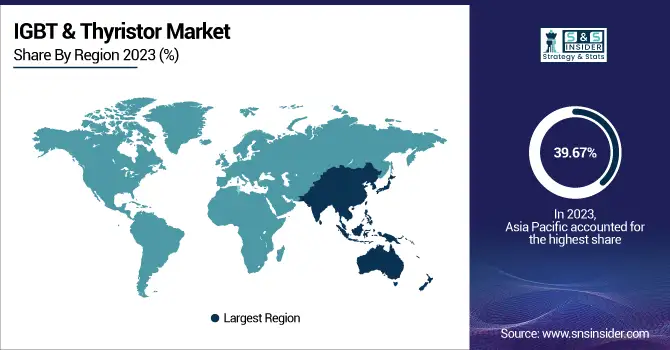

In 2023, the Asia Pacific region accounted for the IGBT & Thyristor Market with a leading revenue share of 39.67% due to strong industrialization, extensive use of electric vehicles, and high growth in renewable energy infrastructure. China, Japan, and South Korea are leading countries for electronics and semiconductor production, with the government actively promoting clean energy and EVs. Major players like Toshiba and Mitsubishi Electric are still investing in product development, such as high-end IGBT modules for motor drives and solar inverters. For example, Toshiba introduced a new range of IGBT modules designed for industrial equipment. With growing demand for energy-efficient technology in various industries, Asia Pacific is still a key growth driver for the world IGBT & Thyristor Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North America region is expected to record the Fastest CAGR of 6.17% over the 2024–2032 forecast period, led by growing investments in electric mobility, smart grid technologies, and industrial automation. The U.S. is a key contributor, with significant emphasis on domestic semiconductor manufacturing and energy efficiency requirements. Firms like Texas Instruments and General Electric are driving IGBT and thyristor technology in EV charging, renewable energy equipment, and intelligent power infrastructure. GE's recent achievement of developing high-performance thyristor modules for grid-level energy management is a prime example. As the region speeds up the shift toward electrification and digital infrastructure, demand for sophisticated power semiconductors is anticipated to grow, underpinning robust market growth.

Key Players:

-

Semikron International – (SKiiP 4 Intelligent Power Module, SEMITRANS 10 IGBTModule)

-

Fuji Electric – (X-Series IGBT Module, PIM (Power Integrated Module)

-

STMicroelectronics – (STGWA40H65DFB IGBT, STTH Series Thyristor)

-

Texas Instruments – (UCC21750 IGBT Driver, TPS6H000-Q1 Smart High-Side Switch)

-

Rohm Semiconductor – (RGTV60TS65DGTC IGBT, BTB16-600BW Thyristor)

-

ON Semiconductor (onsemi) – (FGA25N120ANTD IGBT, MAC15A6G Triac Thyristor)

-

Mitsubishi Electric – (CM600DY-24NF IGBT Module, PM75RLA060 Power Module)

-

Nidec Corporation – (TM-Series IGBT Inverter Modules, Power Management Modules)

-

Infineon Technologies – (IKW75N65ES5 IGBT, T1635H Thyristor)

-

NXP Semiconductors – (GD3160 Gate Driver IC (for IGBT/SiC), BTA16 Triac Thyristor)

Recent Development:

-

December 2024, Mitsubishi Electric Shipment of samples for the S1-Series High Voltage Insulated Gate Bipolar Transistor (HVIGBT) module, targeting large industrial equipment.

-

February 2025, NXP Semiconductors Introduction of gate driver ICs and smart high-side switches for IGBT-based power stages.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.19 Billion |

| Market Size by 2032 | USD 8.85 Billion |

| CAGR | CAGR of 4.14 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application ( Motor Drives, Power Supplies, Renewable Energy Systems, Industrial Automation, Consumer Electronics) •By Type ( IGBT, Thyristor, Integrated Modules, Power Modules) •By End Use –( Automotive, Industrial, Energy Power, Consumer Electronics) •By Technology ( Silicon-Based, SiC, GaN ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Semikron International, Fuji Electric, ST Microelectronics, Texas Instruments, Rohm Semiconductor, ON Semiconductor, Mitsubishi Electric, Nidec Corporation, Infineon Technologies, NXP Semiconductors. |