Industrial Evaporators Market Report Scope & Overview:

Get E-PDF Sample Report on Industrial Evaporators Market - Request Sample Report

The Industrial Evaporators Market size was valued at USD 20.4 billion in 2023, and is expected to reach USD 32.6 billion by 2032, and grow at a CAGR of 5.4% over the forecast period 2024-2032.

The Industrial Evaporators market is significantly driven by the growing demand for energy-efficient solutions, especially in industries like food and beverages, chemicals, and pharmaceuticals. Key factors such as rising concerns about water conservation and waste management are prompting the use of advanced evaporation technologies. Recent technological innovations, such as the development of forced circulation and falling film evaporators, are creating new opportunities for companies to expand their product portfolios. For instance, developments in multi-effect evaporators (MEEs) that use less energy have made them more attractive for use in energy-intensive sectors, where efficiency is a priority.

Several recent developments further showcase how companies are leveraging innovations to cater to market demand. For example, in May 2023, a leading global provider of industrial evaporator systems introduced a new, advanced evaporator model aimed at improving energy efficiency and minimizing operational costs. This new product is designed to enhance the distillation process in the food and beverage industry, addressing the increasing consumer demand for sustainable production practices. By utilizing state-of-the-art components and processes, the evaporator ensures higher heat recovery rates and reduced environmental impact. Such innovations reflect the ongoing push within the industry to align with sustainability goals and meet regulatory requirements. This continuous focus on energy-efficient technologies ensures the continued expansion of the Industrial Evaporators market in the coming years.

Industrial Evaporators Market Dynamics:

Drivers:

-

Increasing Demand for Energy-Efficient Industrial Processes is Boosting the Adoption of Advanced Evaporator Technologies

The push for energy efficiency is a significant driving force in the Industrial Evaporators market. As industries face rising energy costs and tighter regulations on emissions, the need for energy-efficient solutions is more critical than ever. Advanced evaporator technologies, such as multi-effect evaporators (MEEs) and forced circulation systems, provide effective means to achieve lower energy consumption while maintaining high operational efficiency. These technologies allow companies to optimize their production processes, reduce utility bills, and enhance their sustainability credentials. As manufacturers across various sectors recognize the long-term savings associated with these advanced systems, they are increasingly integrating them into their operations. This trend is particularly evident in industries like food processing, where energy costs significantly impact profitability. The adoption of innovative evaporation technologies not only meets regulatory demands but also addresses consumer preferences for sustainable practices, further reinforcing market growth.

-

Environmental Regulations and Sustainability Initiatives Are Encouraging the Use of Green Evaporation Systems

-

Rising Demand for Wastewater Treatment Solutions is Driving the Growth of Industrial Evaporators in Environmental Applications

The increasing awareness of environmental issues and regulatory pressures are driving the demand for effective wastewater treatment solutions, thereby expanding the market for industrial evaporators. Industries generating large volumes of wastewater, such as textiles, chemicals, and food processing, are seeking efficient technologies to concentrate and treat effluents. Industrial evaporators are crucial in these processes, allowing for the recovery of valuable water resources while minimizing waste disposal costs. By implementing evaporation systems, companies can enhance their sustainability efforts, reducing their reliance on freshwater sources and ensuring compliance with environmental regulations. The trend toward zero-liquid discharge (ZLD) systems, which aim to minimize waste generation, further highlights the growing importance of industrial evaporators in wastewater management. As industries increasingly recognize the financial and environmental benefits of adopting advanced evaporation technologies for wastewater treatment, the Industrial Evaporators market is poised for significant growth.

Restraint:

-

High Initial Investment Costs of Advanced Evaporators May Hinder Adoption in Smaller Industries

High initial investment costs for advanced industrial evaporators hinder adoption, especially for small and medium-sized enterprises (SMEs). These systems require substantial capital for installation and maintenance, which may deter smaller companies due to tight profit margins. Despite long-term energy savings, the upfront financial burden remains significant. Financing options, incentives, or subsidies could support SMEs in adopting these technologies and realizing their benefits, enabling wider market penetration and addressing the financial barrier that limits their growth across industry sectors.

Opportunity:

-

Growing Adoption of Multi-Effect Evaporators in Food and Beverage Industry Presents Market Growth Potential

-

The Expanding Pharmaceutical Industry Provides a Lucrative Market for Specialized Evaporation Solutions

As the pharmaceutical industry continues to grow, the demand for specialized evaporation solutions is increasing. This sector requires high-performance evaporators for various applications, including the concentration of active pharmaceutical ingredients (APIs) and solvent removal during drug manufacturing. Industrial evaporators play a crucial role in ensuring the quality and efficacy of pharmaceutical products while adhering to stringent regulatory standards. As pharmaceutical companies invest in advanced technologies to enhance production efficiency and maintain product integrity, the market for specialized evaporation solutions is set to expand. The growing emphasis on biopharmaceuticals and complex formulations further underscores the need for innovative evaporator designs capable of meeting the specific requirements of this rapidly evolving industry.

Challenge:

-

Difficulty in Scaling Up Evaporation Systems for Larger Operations in Diverse Industrial Applications

Scaling industrial evaporators for large-scale applications like petrochemicals and power generation is challenging due to the need for customizable systems that can handle high volumes and varying conditions. These systems must be efficient, reliable, and cost-effective while maintaining environmental standards. The complexity of designing and operating such systems requires continuous innovation to meet the demands of large industries, making it a significant hurdle for manufacturers in the market.

Enhancing Supply Chain Efficiency in Industrial Evaporators Market

| Insight | Description |

|---|---|

| Supplier Diversification | Companies are increasingly diversifying suppliers to mitigate risks associated with reliance on a single source for raw materials. |

| Lead Time Reduction | Streamlining logistics and improving communication with suppliers to reduce lead times is becoming a priority for manufacturers. |

| Sustainability in Sourcing | There is a growing emphasis on sourcing materials sustainably, driven by regulatory requirements and consumer preferences for eco-friendly products. |

| Regional Sourcing Strategies | Businesses are adopting regional sourcing to reduce transportation costs and improve supply chain resilience, especially post-pandemic. |

| Technology Integration | The adoption of advanced technologies, such as IoT and blockchain, is enhancing transparency and efficiency in the supply chain. |

Efficient supply chain management is crucial for the Industrial Evaporators Market, as companies seek to minimize risks and improve operational effectiveness. Diversifying suppliers reduces dependency on single sources, while reducing lead times ensures the timely availability of materials. The shift towards sustainable sourcing reflects growing regulatory and consumer demands for eco-friendly practices. Furthermore, regional sourcing strategies enhance resilience and reduce transportation costs, particularly relevant in a post-pandemic landscape. Finally, integrating advanced technologies like IoT and blockchain improves transparency and efficiency throughout the supply chain.

Industrial Evaporators Market Segments

By Type

Falling Film Evaporators dominated the Industrial Evaporators market in 2023, holding a substantial 40% share. These evaporators are highly favored due to their ability to handle heat-sensitive fluids and perform efficiently at lower temperatures. The process involves liquid flowing downward along the surface of heated tubes, promoting fast evaporation. This technology is widely used in industries like food & beverage, pharmaceuticals, and chemicals, where rapid evaporation without compromising product quality is essential. The compact design and high evaporation efficiency make it ideal for continuous operations, making it a top choice for high-throughput evaporation processes. The adoption of falling film evaporators is further driven by their ability to conserve energy while handling large volumes of liquid. The growing demand for energy-efficient and sustainable evaporation technologies, combined with the versatility of falling film evaporators, cements their leading position in the industrial evaporators market.

By Construction Type

Shell & Tube Evaporators dominated the Industrial Evaporators market in 2023, holding a revenue of 60% market share. This type of evaporator is widely used across industries requiring robust and reliable heat exchange systems, such as petrochemical, power generation, and refrigeration sectors. Shell & tube evaporators consist of a series of tubes enclosed within a shell, with fluids passing through the tubes while heating or cooling. This design allows for efficient heat transfer and is particularly effective in high-pressure environments. Their ability to handle large flow rates, high temperatures, and high pressures makes them ideal for large-scale industrial processes. Additionally, their ease of maintenance and long operational life have made shell & tube evaporators the preferred choice in industries that require continuous, high-efficiency operations. Given their ability to manage high-capacity applications, the market share for shell & tube evaporators continues to rise, particularly in sectors where heat transfer is critical for operational success.

By Capacity

Medium Capacity Evaporators dominated the Industrial Evaporators market in 2023, accounting for 45% market share. These evaporators strike a balance between cost and performance, making them a popular choice for mid-sized operations. Industries like food & beverage, chemical processing, and pharmaceuticals rely on medium-capacity evaporators for processes such as concentration, solvent recovery, and drying. The adaptability of medium-capacity evaporators allows them to meet the needs of a diverse range of applications without the high capital and maintenance costs associated with larger systems. Additionally, their ability to perform efficiently in continuous or batch processes has made them the go-to solution for companies requiring reliable and scalable evaporation technologies. The flexibility, coupled with the reduced energy consumption compared to large-capacity systems, positions medium-capacity evaporators as a cost-effective solution in numerous industrial sectors, fueling their continued dominance in the market.

By End-Use Industry

The Chemical & Petrochemical sector dominated the industrial evaporators market in 2023, with a significant 30% share. Evaporators are integral in the chemical and petrochemical industries for applications such as concentrating chemicals, recycling solvents, and separating valuable by-products during refining processes. These industries require highly efficient and reliable evaporation technologies due to the large volumes of material that need to be processed and the high-value products involved. Evaporators, especially those designed for high-pressure and high-temperature conditions, are essential for improving the efficiency and sustainability of these processes. The growing focus on energy efficiency and sustainability within the chemical and petrochemical sectors has further driven the demand for advanced evaporation technologies. Moreover, as the sector continues to scale up production, the need for continuous and high-capacity evaporators is expected to increase, ensuring that this segment remains dominant in the market for the foreseeable future.

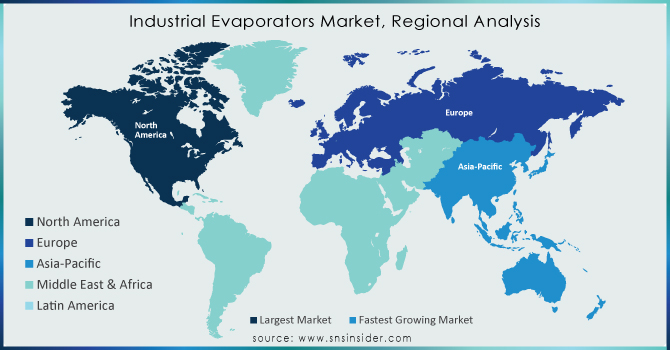

Industrial Evaporators Market Regional Analysis

North America dominated the industrial evaporators market in 2023 with a 35% market share. The region's leadership stems from its advanced industrial base and the extensive use of evaporators across key sectors like food & beverage, pharmaceuticals, and chemicals. The United States, the largest contributor, benefits from its highly developed infrastructure and ongoing investment in energy-efficient evaporation technologies. For instance, U.S.-based chemical companies widely use falling film and forced circulation evaporators for high-precision applications. Canada is also a significant player, driven by its robust food processing industry, particularly in the dairy and beverage sectors, where evaporators are indispensable for product concentration and pasteurization. Moreover, the presence of leading manufacturers and the increasing adoption of sustainable technologies across industries bolster North America's dominance in the market.

On the other hand, Asia-Pacific emerged as the fastest-growing region in the industrial evaporators market in 2023, with an estimated CAGR of 7.5%. The rapid industrialization and urbanization in countries like China and India are driving the demand for evaporators in sectors such as chemicals, power generation, and food processing. China leads the regional growth, leveraging its expansive chemical manufacturing and energy sectors. For example, the deployment of mechanical vapor recompression systems is increasing in Chinese petrochemical plants to enhance efficiency. India follows with significant adoption in the food & beverage industry, particularly for dairy and beverage production, where medium-capacity evaporators are used for concentration processes. Additionally, Southeast Asian nations like Thailand and Vietnam are experiencing growth due to their expanding food export markets, supported by government incentives for modernizing industrial infrastructure. These factors collectively establish Asia-Pacific as the fastest-growing region, driven by rising industrial demands and technological advancements.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Belmar Technologies Ltd. (Evaporator System, Heat Exchanger)

-

Colmac Coil Manufacturing, Inc. (Colmac Evaporator, Stainless Steel Evaporators)

-

Coilmaster Corporation (Coilmaster Evaporator, Direct Expansion Evaporators)

-

De Dietrich Process Systems (Thin Film Evaporator, Forced Circulation Evaporator)

-

GEA Group AG (GEA Evaporator, GEA Rotatube Evaporator)

-

JEOL Ltd. (Rotary Evaporator, Thin Film Evaporator)

-

Saltworks Technologies Inc. (Saltworks Evaporator, Advanced Evaporation System)

-

SPX Flow Inc. (APV Evaporators, SPX Flow Falling Film Evaporator)

-

Sumitomo Heavy Industries, Ltd. (Falling Film Evaporator, Forced Circulation Evaporator)

-

SUEZ Water Technologies & Solutions (EcoClear Evaporator, Evaporator System)

-

Veolia Water Technologies (VSEP Evaporator, Vacuum Evaporator)

-

Alfa Laval (Alfa Laval Plate Evaporator, Alfa Laval Evaporation Systems)

-

Andritz AG (Andritz Evaporator, Evaporator System)

-

Krones AG (Krones Evaporator, Krones Forced Circulation Evaporator)

-

Mitsubishi Heavy Industries, Ltd. (MHI Falling Film Evaporator, MHI Forced Circulation Evaporator)

-

Pentair PLC (Pentair Evaporator, Evaporator System)

-

The Dow Chemical Company (Dow FilmTec Evaporator, Dow Industrial Evaporators)

-

Scherzer GmbH (Scherzer Evaporator, Thin Film Evaporator)

-

ThermoEnergy Corporation (ThermoEnergy Evaporator, Evaporation Technology)

-

Xylem Inc. (Xylem Evaporator, Xylem Industrial Evaporators)

Recent Developments

-

March 2023: Colmac Coil Manufacturing introduced three configurations for A+P Insulated Penthouse Air Coolers (evaporators), enhancing flexibility with insulated base, pitched base, and dual coil options.

-

April 2023: Artisan Industries launched ROTOTHERM MINI, a lab-scale evaporator/dryer utilizing thin-film separation technology for continuous evaporation and drying of heat-sensitive materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 20.4 Billion |

| Market Size by 2032 | US$ 32.6 Billion |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Falling Film Evaporators, Rising Film Evaporators, Forced Circulation Evaporators, Agitated Thin Film Evaporators, Mechanical Vapor Recompression, Others) •By Construction Type (Shell & Tube Evaporators, Plate Evaporators) •By Capacity (Small Capacity Evaporators, Medium Capacity Evaporators, Large Capacity Evaporators) •By End-Use Industry (Pharmaceutical, Chemical & Petrochemical, Electronics & Semiconductor, Pulp & Paper, Food & beverage, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sumitomo Heavy Industries, Ltd., Veolia Water Technologies, Saltworks Technologies Inc., JEOL Ltd., Colmac Coil Manufacturing, Inc., GEA Group AG, De Dietrich Process Systems, Coilmaster Corporation, SPX Flow Inc., Belmar Technologies Ltd., SUEZ Water Technologies & Solutions and other key players |

| Key Drivers | •Environmental Regulations and Sustainability Initiatives Are Encouraging the Use of Green Evaporation Systems •Rising Demand for Wastewater Treatment Solutions is Driving the Growth of Industrial Evaporators in Environmental Applications |

| RESTRAINTS | •High Initial Investment Costs of Advanced Evaporators May Hinder Adoption in Smaller Industries |