Industrial Foam Market Report Scope & Overview:

Get E-PDF Sample Report on Industrial Foam Market - Request Sample Report

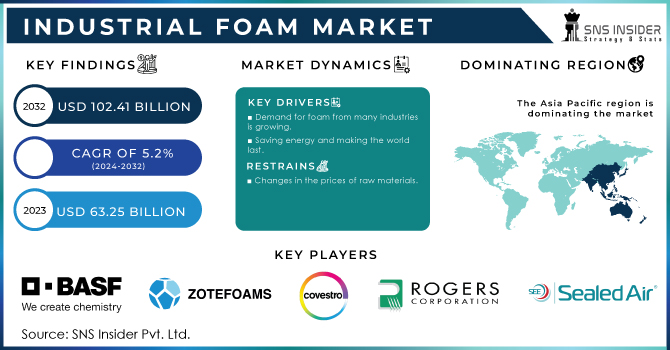

The Industrial Foam Market Size was valued at USD 63.25 billion in 2023 and is expected to reach USD 102.41 billion by 2032 and grow at a CAGR of 5.50% over the forecast period 2024-2032.

Industrial foams are widely used for seating, interior components, vibration and noise reduction in the car sector. The growing trend of lightweight and fuel-efficient car designs, along with increased vehicle production, is driving increased demand for industrial foams.

Moreover, strict laws and rising environmental consciousness drive the market for recyclable and environmentally friendly foam products. Producers are putting more effort into creating foams that are environmentally friendly and bio-based in order to comply with regulations and satisfy consumer demands.

For instance, the EU has adopted a comprehensive Circular Economy Action Plan aimed at promoting sustainable product design and waste reduction. This includes targets for recycling and reducing the environmental impact of materials like industrial foams.

Furthermore, bio-based foams are made from biodegradable plastics that BASF created, such as Ecoflex and Ecovio. These materials can be composted in an industrial setting and are made to comply with strict environmental laws.

Additionally, the main factor driving this trend is the growing usage of industrial foams in key end-use sectors like electronics, construction, automotive, and packaging. Foams are used in these industries for stress absorption, sealing, cushioning, and insulation.

Industrial Foam Market Dynamics:

Drivers

-

Rising demand for Bio-based polyols drive the market growth.

The rising demand for bio-based polyols can be attributed to their environmental advantages and compliance with strict sustainability standards, which are propelling the market's expansion. These polyols provide a more environmentally friendly option than conventional petroleum-based polyols since they are made from renewable resources including vegetable oils and other natural feedstocks. The need to meet customer demand for eco-friendly products, minimize carbon footprints, and comply with regulatory criteria is driving the shift towards bio-based polyols.

Several companies are leading this change. For example, under its cardyon trademark, Covestro has created a line of bio-based polyols that use CO2 as a raw material, greatly lowering the dependency on fossil fuels. In a similar vein, BASF has reduced greenhouse gas emissions with the launch of Lupranol Balance, a line of polyols derived from renewable raw resources. The Dow Chemical Company's RenuvaTM technology, which recycles leftover polyurethane foam into new polyols and supports a circular economy, is another example of its dedication to sustainability. The industrial foam market is experiencing significant expansion due to bio-based polyols, which offer performance benefits such increased durability and versatility, in addition to improving the environmental profile of products.

Restrain

-

Fluctuation of raw material prices may hamper the market growth.

Growth in the market is severely hampered by fluctuations in raw material prices, especially in the industrial foam sector. The price of raw materials, which include polyurethane, polystyrene, and other petroleum-based goods, varies according to market demand, geopolitical conditions, and the availability of crude oil. Manufacturers must pay more for production when the price of these raw materials rises, which may result in higher final product prices. Manufacturers find it difficult to maintain profit margins as a result of this price fluctuation, which may lead to a decrease in investment in novel ideas and technologies.

Industrial Foam Market Segmentation:

By Foam Type

By Foam Type, the rigid foam segment dominated the industrial foam market with the highest revenue share of more than 68.23% in 2023. Because of its superior thermal insulation qualities, rigid foam is frequently utilized in the building and insulation sectors. It is a crucial component of energy-efficient structures, appearing in flooring, roofing, and wall insulation. It offers effective thermal barriers and is also utilized in appliances and refrigeration systems. Moreover, it has critical applications in energy-efficient construction, infrastructure development, and durable structural components. Its market growth is propelled by stringent energy regulations, the push for sustainable building practices, and ongoing technological advancements.

By Resin Type

Polyurethane type held the largest market share of more than 38% in 2023. Because of its many uses and adaptable qualities, polyurethane foam is the most popular kind of industrial foam in the market. Since polyurethane foam is widely utilized in both rigid and flexible forms, it is quite versatile and may be used in a wide range of sectors, including packaging, furniture, automobiles, and construction. Rigid polyurethane foam is highly valued in the construction industry due to its exceptional thermal insulation and energy efficiency, which are essential for building panels, roofing, and insulation. This is in line with the global environmental rules and the increasing need for energy-efficient structures. Flexible PU foam is crucial for interior components, seating, and cushioning in the car industry, as it enhances comfort and safety.

By End-Use Industry

The building & construction segment dominated the end-use industry segment with around 31.23% share of the market revenue in 2023. The industrial foam market is dominated by the building and construction industry because of the industry's significant demand for high-performance insulation products. This dominance is a result of the vital demand for energy-efficient solutions in commercial, industrial, and residential buildings, which lowers the amount of energy used for heating and cooling. The utilization of recyclable and environmentally friendly foams is fueled by the increasing emphasis on sustainable construction practices and strict energy efficiency rules and requirements. In contrast to other end-use sectors including HVAC, industrial pipe insulation, aerospace, maritime, and industrial cold storage, the size and scope of the building and construction

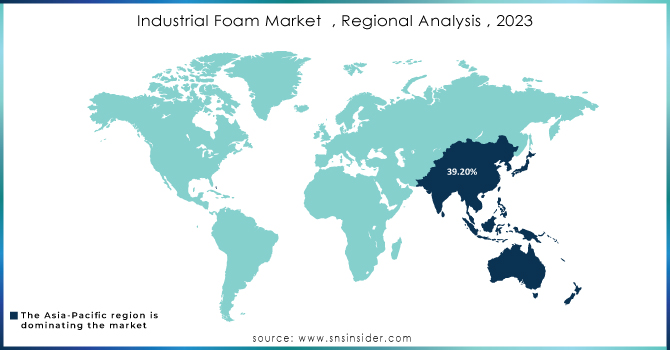

Industrial Foam Market Regional Analysis:

The Asia-Pacific region is expected to have the largest revenue share of around 39.20% in 2023. This is due to a confluence of factors including rapid urbanization, industrial expansion, and increasing infrastructure development. As countries in this region continue to industrialize and urbanize, there is a substantial demand for building materials, including industrial foams, to support new residential, commercial, and industrial construction projects. Moreover, key players focused on the expansion of the market in this region. For instance, Nitto Denko, expanded its production capacity in China. The company invested in a new manufacturing facility to meet the growing demand for its high-performance foam products used in automotive, electronics, and construction applications.

North America is the fastest-growing market due to its established market presence is supported by a robust supply chain, technological advancements, and innovation in foam products, including improvements in performance and environmental sustainability. Additionally, the region's stringent regulations and standards for quality and safety contribute to the dominance of North American companies in the global industrial foam market.

Key Players:

Zotefoams Plc., BASF SE,Covestro AG, Rogers Corporation, Recticel NV/SA, Sealed Air Corporation, Bayer Material Science, The Woodbridge Group, Ube Industries, Ltd, The Dow Chemical Company, Huntsman International LLC, Wanhua Chemical Group Co., Ltd., and Others.

Recent Development:

-

In 2024, BASF to meet the growing demand in the building and construction industry, BASF announced a major investment in its European production facilities to increase the capacity for its polyurethane foam and polystyrene foam products.

-

In 2023, Armacell launched Armaflex Pro, a new range of flexible insulation foams with improved thermal resistance and ease of installation. The product is targeted at the HVAC and building insulation markets.

-

In 2023 Kingspan Group, Kingspan invested in research and development to advance its line of high-performance insulation foams. The company is focusing on enhancing the thermal efficiency and environmental sustainability of its products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 63.25 Billion |

| Market Size by 2032 | US$ 102.41 Billion |

| CAGR | CAGR of 5.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Foam Type (Flexible, Rigid) • By End-use Industry (Building & Construction, HVAC, Industrial pipe insulation, Marine, Aerospace, Industrial cold storage, Others) • By Type (Polyurethane, Polystyrene, Polyolefin, Phenolic, PET, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Zotefoams Plc., BASF SE,Covestro AG, Rogers Corporation, Recticel NV/SA, Sealed Air Corporation, Bayer Material Science, The Woodbridge Group, Ube Industries, Ltd, The Dow Chemical Company, Huntsman International LLC, Wanhua Chemical Group Co., Ltd. |

| Drivers | • Rising demand for Bio-based polyols drive the market growth. |

| Restraints | • Fluctuation of raw material prices may hamper the market growth. |