Thermal Insulation Material Market Analysis & Overview:

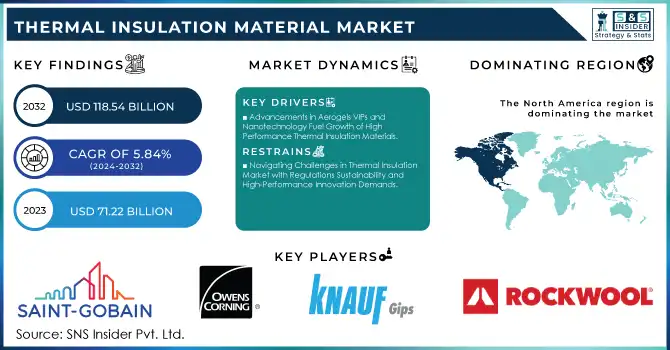

The Thermal Insulation Material Market Size was valued at USD 75.88 billion in 2024 and is expected to reach USD 118.70 billion by 2032, growing at a CAGR of 5.84% over the forecast period 2025-2032. The global thermal insulation material market is growing due to rising demand for energy efficiency and sustainability. Government regulations, climate change concerns, and stricter energy codes in North America, Europe, and Asia-Pacific are driving adoption of fiberglass, stone wool, and plastic foam in buildings. Green building trends and smart construction methods further fuel demand by reducing heating and cooling energy use. Residential construction initiatives, such as India’s "Housing for All by 2022" and 6% annual growth in Southeast Asia, also boost demand. Additionally, over 30% of new European buildings in 2023 used green insulation materials.

Get Sample Copy of Thermal Insulation Material Market - Request Sample Report

Key Thermal Insulation Material Market Trends

-

Increasing use of sustainable insulation materials is driving demand for eco-friendly building solutions globally.

-

Nanotechnology integration enhances thermal efficiency while reducing thickness in advanced insulation products.

-

Energy-efficient building construction boosts demand for high-performance thermal insulation materials worldwide.

-

Industrial sectors like oil, gas, and power plants increase demand for insulation solutions.

-

Lightweight, flexible insulation materials gain popularity in automotive and aerospace applications.

-

Fire-resistant, high-temperature insulation materials improve safety across construction and industrial sectors.

-

Cost-effective composite insulation materials attract emerging markets and small-scale industrial adoption.

-

Smart insulation systems with digital monitoring optimize energy efficiency and operational performance.

Thermal Insulation Material Market Drivers

-

Advancements in Aerogels VIPs and Nanotechnology Fuel Growth of High-Performance Thermal Insulation Materials

Aerogels, vacuum insulation panels (VIPs), and phase change materials are emerging as superior alternatives to traditional insulation like fiberglass and stone wool, offering lower thermal conductivity, reduced thickness, and lightweight properties. These materials are ideal for space-limited applications in modern construction, automotive, and aerospace sectors. Aerogels, ultra-lightweight and highly insulating, are increasingly adopted across industries, while nanotechnology-based insulations provide enhanced thermal resistance, water repellence, and fire safety. Innovations such as self-healing and recyclable insulation align with sustainability and circular economy goals. VIPs are 5–10× more efficient than conventional materials, with composite foam–VIP boards achieving R-values over 25. Aerogels’ thermal conductivity as low as 0.013 W/m·K enables significant volume and weight savings, contributing to reduced construction energy use, which accounts for around 40% of U.S. energy consumption.

-

Rising Demand for Thermal Insulation Materials Driven by Infrastructure Growth and Sustainability Initiatives Worldwide

Rising infrastructure investments in emerging economies like China, India, and Southeast Asia are fueling strong demand for thermal insulation materials. Growth in residential, commercial, and industrial facilities, coupled with stricter energy efficiency codes, is driving the need for cost-effective, high-performance insulation. Government initiatives such as China’s green building redesign, India’s Smart Cities Mission, and the U.S. Department of Energy’s home renovations further boost market demand. Europe’s Renovation Wave aims to renovate 35 million buildings by 2030, targeting a 60% energy reduction, highlighting sustained opportunities. Additionally, the rise of modular and prefabricated construction accelerates adoption of pre-insulated panels. Rapid urbanization in Southeast Asia, along with infrastructure development and energy conservation mandates, continues to propel the thermal insulation material market globally, ensuring persistent growth across regions.

Thermal Insulation Material Market Restraints

-

Navigating Challenges in Thermal Insulation Market with Regulations Sustainability and High-Performance Innovation Demands

Tighter energy efficiency regulations are pushing manufacturers to seek products that comply with countries with shift-quality-compliance, which is added to the time-to-market and compliance costs. Moreover, while insulation products should be sustainable materials, sustainable raw materials available for the production of insulation products are very limited, and factors such as the lack of infrastructure for recycling ecosystem make it difficult to manufacture the insulation products. Low thermal conductivity alone does not guarantee high performance insulation, and this trend also presents technical challenges in relation to many emerging applications, for example the upcoming electric vehicles (EVs) and advanced HVAC systems. As a result, imperatives for innovation to ensure products are safe and environmentally friendly along with top thermal performance is being placed on manufacturers to increase the cycle of product advancement with longevity.

Thermal Insulation Material Market Opportunities

-

Expansion in Renewable Energy Sector Boosting Demand for Advanced Thermal Insulation Materials Globally

The growing adoption of renewable energy technologies, such as solar thermal plants, wind turbines, and concentrated solar power systems, is creating significant opportunities for thermal insulation materials. Efficient insulation is critical in these applications to minimize energy losses, enhance system efficiency, and improve overall performance. For instance, high-temperature insulation is required in solar thermal power plants to retain heat, while lightweight and flexible insulation is essential for wind turbine components to reduce weight and improve durability. As governments and private companies continue investing in renewable energy infrastructure to meet carbon neutrality and sustainability targets, the demand for advanced thermal insulation materials is expected to rise substantially. Manufacturers focusing on high-performance, durable, and eco-friendly insulation solutions can capitalize on this growing market segment.

-

Rising Demand in Cold Chain and Refrigeration Systems Driving Innovative Thermal Insulation Solutions

The rapid growth of cold chain logistics, food storage, and refrigeration systems presents a lucrative opportunity for thermal insulation materials. Efficient insulation in cold storage warehouses, refrigerated trucks, and shipping containers is essential to maintain temperature-sensitive products, including pharmaceuticals, perishable foods, and vaccines. Innovations in vacuum insulation panels, aerogels, and phase change materials can provide superior thermal resistance while reducing material thickness and weight, improving storage efficiency and energy savings. The increasing globalization of food trade and the growing pharmaceutical sector, especially in vaccine distribution, are driving investments in energy-efficient and high-performance insulation solutions. Companies that develop tailored insulation products for cold chain applications can gain a competitive edge and meet the rising demand for sustainable and cost-effective temperature management.

Thermal Insulation Material Market Segment Highlights

By Material Type

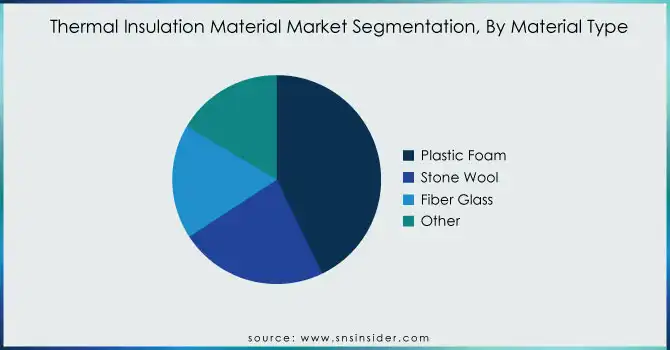

In 2024, plastic foam held over 42% of the thermal insulation material market and is expected to grow fastest through 2032. Its light weight, high thermal and moisture resistance, and cost-effectiveness drive widespread use. Common types like EPS, XPS, reclaimed polystyrene, and PU foam are applied in construction, HVAC, automotive, and industrial sectors. EPS and XPS improve wall, roof, and floor insulation to meet energy codes, while PU foam enhances HVAC efficiency and EV battery thermal management. Stricter building energy standards and the rise of energy-efficient construction and EV adoption further accelerate demand for plastic foam insulation and pre-insulated panels.

By Temperature Range

The 1°C–100°C temperature range dominated the thermal insulation market with 47% share in 2024, as moderate-temperature insulation maintains indoor climate, reduces energy consumption, and optimizes building and industrial operations. It is widely used in buildings, HVAC systems, pipelines, and storage tanks, with fiberglass, stone wool, and plastic foam offering cost-effective and easy-to-install solutions. The −160°C to −50°C range is expected to grow fastest through 2032 due to rising demand for cryogenic insulation in LNG, oil & gas, chemicals, and healthcare. Materials like aerogels, vacuum panels, and advanced foams minimize heat transfer, supporting cold chain logistics and ultra-low temperature applications.

By End Use

In 2024, the construction sector led the thermal insulation market with 41% share, driven by energy-efficient buildings, green construction, and mandatory energy codes in North America, Europe, and Asia-Pacific. Materials like plastic foam, fiberglass, and stone wool enhance indoor comfort while reducing heating and cooling energy use. The rise of modular and prefabricated construction, including pre-insulated panels, further boosts demand. The automotive segment is projected to grow fastest through 2032, fueled by electric vehicle production and advanced thermal management needs. Insulation materials like polyurethane foams, aerogels, and specialty composites optimize EV battery performance, cabin comfort, and overall vehicle efficiency.

Thermal Insulation Material Market Regional Analysis

North America Thermal Insulation Material Market Insights

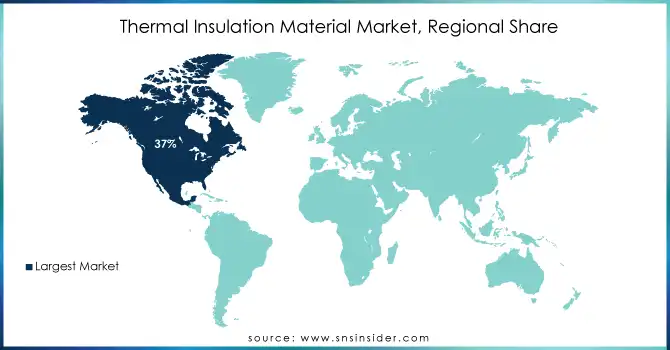

In 2024, North America dominated the market with market share of 37% due to focus on construction strength energy conservation and sustainability derivatives allowing to have a higher share of the market. This domination contributes to a significant example of increased energy use over the years of energy-efficient buildings and green building standards in the United States and Canada as a result of incremental and stricter energy codes. What they have done in California with the Title 24 Building Energy Efficiency Standards is a perfect example of this, which has required high-performance insulation in residential and commercial structures to minimize energy consumption. In North America, the LEED (Leadership in Energy and Environmental Design) green certification incentivizes the use of the newest insulation methods to achieve energy savings for new buildings. Moreover, growing inclination towards smart homes, and net-zero homes coupled with increasing investment in building energy-efficient homes in Toronto, and San Francisco are further propelling the use of high-performance insulation materials such as spray foam, rigid foam boards, and fiberglass.

U.S. Thermal Insulation Material Market Insights

The U.S. leads the North America thermal insulation materials market which is driven by rising demand for energy-efficient buildings, stringent energy codes, and expanding construction and industrial activities. Materials like fiberglass, stone wool, and plastic foam dominate due to their cost-effectiveness and ease of installation. Growing adoption of advanced insulation solutions in electric vehicles, HVAC systems, and cold chain applications further fuels market growth. Government initiatives supporting green construction and energy conservation, along with increasing investments in modular and prefabricated buildings, are expected to sustain strong demand through the forecast period.

Asia Pacific Thermal Insulation Material Market Insights

The Asia Pacific is the fastest-growing region in terms of CAGR during 2025-2032, due to urbanization, industrialization, and a growing emphasis on energy efficiency in nations such as China, India, and Japan. The proliferation of Smart Cities and Sustainable Infrastructure Development in China For instance, green building practices and energy-saving construction in the municipal district of Shenzhen are delivering development for thermal insulation materials. This is driving strong demand for energy-efficient building insulation products like extrusion form polystyrene, and rock wool in alignment with China's 13th Five-Year Plan for Ecological and Environmental Protection. The infrastructure development in India owing to government initiatives such as Housing for All and Smart Cities Mission has created a significant market for insulation materials to enhance energy efficiency and thermal comfort in residential and commercial construction. Apart from this, the commitment of Japan to disaster-resilient construction and eco-friendly urban planning has further spurred the use of high-tech insulation solutions in new construction as well as renovation projects.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Competitive Landscape for Thermal Insulation Material Market

Saint-Gobain is a French multinational company founded in 1665, headquartered in Courbevoie, France. It specializes in construction materials, high-performance solutions, and sustainable building products. In the thermal insulation market, Saint-Gobain offers glass wool, rock wool, and rigid foam insulation for residential, commercial, and industrial applications. These products enhance energy efficiency, reduce thermal losses, and contribute to green building initiatives globally. The company also invests in R&D to develop innovative, eco-friendly insulation solutions that comply with evolving energy codes and sustainability standards.

-

In September 2024, Saint-Gobain launched low-density aerogel insulation panels in Europe, providing superior thermal performance and reduced thickness for space-constrained construction applications.

Owens Corning is a U.S.-based company founded in 1938, headquartered in Toledo, Ohio. It offers insulation, roofing, and composite solutions, with thermal insulation products including fiberglass batts, blown-in insulation, and foam boards for residential, commercial, and industrial use. Owens Corning focuses on energy efficiency, indoor comfort, and sustainable building materials. The company emphasizes lightweight, high-performance insulation solutions to meet evolving building energy codes, environmental standards, and modern construction demands across global markets.

-

In January 2024, Owens Corning introduced high-R-value spray foam for commercial buildings in the U.S., enhancing energy efficiency and performance in HVAC and structural applications.

Rockwool International A/S is a Denmark-based company founded in 1937, headquartered in Hedehusene, Denmark. It specializes in stone wool insulation solutions for building, industrial, and technical applications. Rockwool’s thermal insulation products include batts, slabs, and loose-fill materials that provide fire resistance, acoustic performance, and energy efficiency. The company focuses on sustainable, high-performance insulation solutions that support green building standards, reduce energy consumption, and enhance indoor comfort. It invests in R&D to develop innovative insulation technologies suitable for residential, commercial, and industrial sectors globally.

-

In November 2024, Rockwool launched a high-performance stone wool facade board in Europe, improving thermal resistance and fire safety in modern constructions.

Thermal Insulation Material Market Companies

-

Saint-Gobain (Isover Glass Wool, Isover Acoustic Insulation)

-

Owens Corning (Fiberglas Insulation, Thermafiber Mineral Wool)

-

Knauf Insulation (Glass Mineral Wool, Rock Mineral Wool)

-

Rockwool International A/S (Comfortbatt, Safe’n’Sound)

-

BASF SE (Elastospray LWP, Elastospray Closed-cell Foam)

-

Johns Manville (Formaldehyde-free Fiberglass Insulation, Mineral Wool Insulation)

-

Kingspan Group (Kooltherm, Therma)

-

DuPont (Styrofoam XPS, Thermax Sheathing Insulation)

-

GAF Materials Corporation (EnergyGuard SPF, DeckShield Spray Foam)

-

Huntsman International LLC (SprayFoam Polyurethane Insulation, Puren Foam Panels)

-

Armacell International (Armaflex Elastomeric Foam, ArmaGel Aerogel)

-

Recticel (Eurothane PIR Foam, Recticel Insulation Boards)

-

Aspen Aerogels (Cryogel Z, Pyrogel XT-E)

-

Celotex (GA4000 PIR Board, XR4000 PIR Board)

-

CertainTeed (InsulSafe Cellulose, CertaSpray Foam)

-

USG Corporation (Sheetrock Acoustic Insulation, USG GlasRoc Board)

-

Firestone Building Products (Spray Polyurethane Foam, ISO 95+ Insulation Board)

-

Atlas Roofing Corporation (EnergyShield Polyiso Board, Ecolite Foam Board)

-

Cabot Corporation (Aerogel Insulation Blankets, Cabot ThermaGel)

-

Dow Inc. (STYROFOAM XPS, FOAMULAR Extruded Polystyrene)

Some of the Raw Material Suppliers for Thermal Insulation Material companies:

-

BASF SE

-

Huntsman International LLC

-

Dupont

-

ExxonMobil Chemical

-

Covestro AG

-

3M

-

SABIC

-

Celanese Corporation

-

Momentive Performance Materials

-

Owens Corning

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 75.38 Billion |

| Market Size by 2032 | USD 118.70 Billion |

| CAGR | CAGR of 5.84% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Plastic Foam, Stone Wool, Fiber Glass, Other) |

| • By Temperature Range ((−160⁰C to −50⁰C), (− 49⁰C to 0⁰C), (1⁰C to 100⁰C), (1⁰C to 650⁰C)) | |

| • By End Use (Construction, Automotive, HVAC, Industrial, Others) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Saint-Gobain, Owens Corning, Knauf Insulation, Rockwool International A/S, BASF SE, Johns Manville, Kingspan Group, DuPont, GAF Materials Corporation, Huntsman International LLC, Armacell International, Recticel, Aspen Aerogels, Celotex, CertainTeed, USG Corporation, Firestone Building Products, Atlas Roofing Corporation, Cabot Corporation, and Dow Inc. |