IoT Microcontroller Market Key Insights:

To Get More Information on IoT Microcontroller Market - Request Sample Report

The IoT Microcontroller Market Size was valued at USD 5.4 Billion in 2023 and is expected to reach USD 17.5 Billion by 2032, growing at a CAGR of 14% over the forecast period 2024-2032.

The global IoT microcontroller (MCU) market is being driven by the rapid expansion of IoT applications across diverse sectors, including consumer electronics, industrial automation, healthcare, and smart homes. Government initiatives worldwide are encouraging digital transformation, which is propelling the demand for IoT devices. For instance, in 2023, the U.S. government allocated $2 billion in federal funding towards initiatives supporting smart cities and industrial IoT projects, fostering the adoption of IoT solutions across public infrastructure and manufacturing. In the EU, the European Commission set aside approximately €1.5 billion to fund technology projects under the Horizon Europe program, further encouraging industrial automation and IoT integration.

Additionally, India has been strengthening its “Digital India” campaign, with incentives designed to increase the penetration of IoT technologies across urban and rural settings. According to government forecasts, global IoT device installations are expected to surpass 75 billion by 2025, demonstrating the scale of connected devices requiring efficient and low-power microcontrollers. This accelerated adoption has created a significant market for MCUs designed for IoT applications, as they play a central role in managing and processing data within IoT devices, particularly given the requirement for real-time data handling. The rise in connected devices in sectors like manufacturing, smart homes, and public administration is expected to sustain strong demand for IoT MCUs over the coming years.

Wearables are smart devices worn as accessories, implanted in the body, or integrated into clothing. Advances in sensor miniaturization and technologies like Artificial Intelligence, Machine Learning, and Big Data enable wearables to connect with IoT systems. The rising issue of obesity is encouraging people to use wearables to track fitness progress. The growing popularity of fitness wearables, especially among millennials, is expected to drive market growth for IoT microcontrollers. Major companies such as Apple and Google are heavily investing in wearable technology, introducing innovative products that offer enhanced features and comfort for users. Factors like in-store marketing, small sensors, wearable payment options, and smartwatch-user interaction are boosting wearable adoption.

Market Dynamics

Drivers

-

Expanding smart home trends and connected devices like appliances and security systems drive IoT microcontroller demand, particularly in consumer-heavy regions such as Asia-Pacific.

-

Increased industrial automation and machine-to-machine communication in smart factories demand IoT microcontrollers, supported by initiatives like “Make in India” and “Made in China”.

-

Rising adoption of IoT for wearable health devices and remote patient monitoring bolsters demand in the healthcare sector, essential for elderly and chronic care.

The expansion of smart home and consumer electronics is one of the key factors driving the IoT microcontroller market. IoT microcontrollers are used in a variety of devices including smart thermostats, lights, and security cameras that are being commercially deployed as part of the larger trend of increasing digitalization of the home. The increasing installed base of connected devices around the world and the consumer demand for convenience, energy savings, and security One clear example is the increased popularity of app-based smart lighting systems, which enable the remote adjustment of lighting, scheduling, and the changing of brightness according to the ambient light. With consumers increasingly embracing such conveniences, the demand for microcontrollers to deliver that connectivity and functionality has exploded. Moreover, the rise of digital lifestyles and tech-driven home solutions in fast-growing economies especially in China, India, and the United States are providing an ideal environment for the growth of IoT during the forecast period. The IoT-based home automation systems market is expected to grow significantly in the Asia-Pacific region, due to the high consumer electronics production and urbanization rates. The fast-paced digital shift in this region coupled with government plans boosting smart city projects will continue to drive demand for IoT microcontrollers for smart home applications positively.

Restraints

-

With increasing IoT integration, cybersecurity remains a top challenge, requiring advanced encryption and tamper-resistant designs, raising development complexity and costs.

-

The global semiconductor shortage and trade disruptions create supply-demand imbalances, affecting microcontroller availability and market growth.

A major restraint for the IoT microcontroller Market is the rising concern regarding cybersecurity. Since IoT devices are increasingly being used in sectors such as healthcare, manufacturing, and consumer electronics, they are becoming prime targets for cybercriminals as well. As IoT security risks increase, so does the complexity of IoT systems themselves, making it much more difficult to protect such devices from threats like unauthorized access, data breaches, and malware. IoT devices have microcontrollers that should include advanced security features such as secure boot, encryption, and tamper-resistant design. This is good but adds development complexity and cost attributed to security measures. For example, in sectors like healthcare and industrial automation, where sensitive data is constantly exchanged, the need for robust security is critical. The inability to implement or maintain these security features effectively can expose IoT devices to vulnerabilities, potentially undermining the market's growth.

Key Segment Analysis

By Product

In 2023, the 32-bit microcontroller segment accounted for the largest market share, capturing 46%. 32-bit MCUs have been gaining popularity as of late due to their increased processing capability and readiness to handle complex IoT applications, especially in sectors such as industrial automation and automotive and smart home devices, where high performance, real-time data processing, and sophisticated control capabilities are crucial. In this regard, government-centered projects focusing on smart infrastructure and automation, like Japan's Society 5.0 initiative, highlight the ability of 32-bit MCUs to build a smarter version of a system able to manage larger chunks of data and more advanced processing needs than their 8-bit and 16-bit equivalents. In addition to their relentless low cost and improved energy efficiency compared to the past, 32-bit MCUs can also dominate the share in 2023 for many IoT applications, which is driving the adoption of 32-bit MCUs to irradiate a greater part of the whole MCU market. Accompanying their widespread adoption are government-backed research and development incentives, mostly in North America and Asia-Pacific, to prompt manufacturers to embrace new semiconductor technology.

By Application

The industrial automation segment held the largest share of 34% revenue share of the IoT microcontroller market in 2023. This growth has been attributed to an increase in IoT-based devices used in manufacturing and production environments for real-time data monitoring and analysis for effective functioning. Government regulations promoting better energy efficiency and sustainability in production also contribute to industrial automation. For example, the directives related to energy efficiency from the European Union made manufacturers potentiate automation systems based on IoT MCUs.

On the other hand, the smart home segment is anticipated to grow at a remarkable CAGR over the forecast period owing to the growing consumer inclination for home automation along with improved security solutions. This segment is also driven by government support in regions like North America which are offering tax rebates on energy-efficient smart home appliances. With homes becoming increasingly connected to the Internet of Things (IoT), which requires sophisticated management of numerous devices on a single platform, an IoT MCU addresses interoperability, energy efficiency, and user control over the home environment.

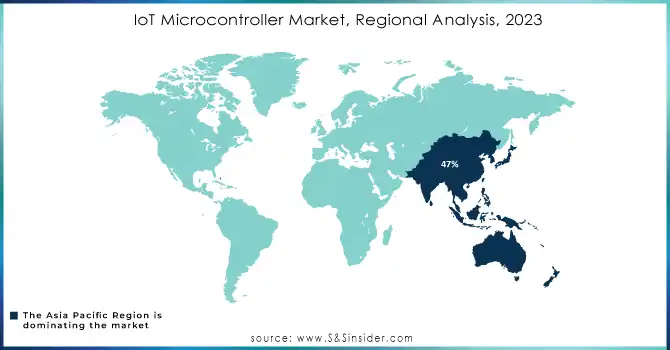

Regional Insights

In 2023, the Asia Pacific led the IoT microcontroller market with the largest share of 47% in the market. This dominance is simply due to the swift adoption of IoT technologies across a wide range of sectors, particularly manufacturing, automotive, and consumer electronics. The high rate of growth in the manufacturing sector of the region owing to the expansion of smart cities and industrial automation has increased the deployment of IoT microcontrollers across the region. Key players include China, Japan, and South Korea whose government initiatives on advanced technologies drive the development of IoT systems, including China’s "Made in China 2025" program and Japan’s aims for a Society 5.0. Moreover, due to the huge demand for consumer electronics and wearable devices in countries like India, the IoT microcontroller market has broadened. Increasing adoption of connected devices to support real-time data processing, along with the anticipated roll-out of 5G networks across several countries in Asia Pacific, is expected to drive the demand for microcontroller units that support IoT applications.

The growth in Europe is likely to be high with a significant CAGR during the forecast period. Europe is expected to be one of the fastest-growing regions due to increasing investments in smart infrastructure, industrial automation, and IoT-enabled healthcare solutions across the region. Government-supported initiatives across European countries such as Germany, the UK, and France that focus on digitalization and green technologies, which are usually IoT-based, are also contributing significantly to the segment growth. That coupled with the EU to accelerate IoT technology development for all industries through its Horizon Europe program for innovation and technology development. In addition, regulations related to energy saving, sustainability, and data privacy are forcing enterprises and industries to implement advanced IOT systems and influencing microcontroller growth. The emphasis on the advancement of technology and supportive regulations are the key factors making Europe one of the dominant growth regions in the IoT microcontroller market during the forecast period.

Do You Need any Customization Research on IoT Microcontroller Market - Inquire Now

Recent Developments

-

In June 2023, Arduino launched the UNO R4 board, the next generation of its popular UNO series. This upgraded version marks a shift from the previous 8-bit technology, offering improved performance and greater flexibility, enabling makers and enthusiasts to expand the capabilities of their projects.

Key Players

Key Service Providers/Manufacturers in the IoT Microcontroller Market:

-

Intel Corporation (Intel® Quark™, Intel® Atom™)

-

NXP Semiconductors (LPC800, i.MX RT)

-

STMicroelectronics (STM32, STSPIN)

-

Microchip Technology (PIC32, SAM D)

-

Qualcomm (Snapdragon Wear 4100, QCC5100)

-

Texas Instruments (MSP430, Tiva C)

-

Infineon Technologies (XMC1000, AURIX)

-

Analog Devices (ADuC, Blackfin)

-

Renesas Electronics (RX, RL78)

-

Arm Holdings (Cortex-M, Mbed)

Key Users of IoT Microcontrollers:

-

Apple Inc.

-

Google LLC

-

Samsung Electronics

-

Fitbit

-

Garmin Ltd.

-

Bosch

-

Honeywell International

-

General Electric

-

Ford Motor Company

-

Caterpillar Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.4 Billion |

| Market Size by 2032 | USD 17.5 Billion |

| CAGR | CAGR of 14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (8 Bit, 16 Bit, 32 Bit) • By Application (Industrial Automation, Smart Homes, Consumer Electronics {Smartphones, Wearables, Others}, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intel Corporation, NXP Semiconductors, STMicroelectronics, Microchip Technology, Qualcomm, Texas Instruments, Infineon Technologies, Analog Devices, Renesas Electronics, Arm Holdings |

| Key Drivers | • Expanding smart home trends and connected devices like appliances and security systems drive IoT microcontroller demand, particularly in consumer-heavy regions such as Asia-Pacific. • Increased industrial automation and machine-to-machine communication in smart factories demand IoT microcontrollers, supported by initiatives like “Make in India” and “Made in China”. |

| Restraints | • With increasing IoT integration, cybersecurity remains a top challenge, requiring advanced encryption and tamper-resistant designs, raising development complexity and costs. |