Lease Management Market Report Scope & Overview:

Lease Management Market was valued at USD 5.31 Billion in 2024 and is projected to reach USD 8.44 Billion by 2032, growing at a 6.00% CAGR (2025–2032).

Get more information on Lease Management Market - Request Sample Report

The lease management sector is rapidly expanding due to the lease management systems' capacity to track a company's performance regularly with access to real-time data. Tenant applications and screening, maintenance, administration and tracking, marketing and advertising, online payments, contract management, financial management, and other benefits are just a few of the benefits that come with lease management. For instance, enhancements to the lease accelerator's lease lifecycle automation platform were announced. The company hopes to achieve automation in lease management operations and assist users in focusing on important business tasks with the new enhancements. In addition, the upgrades are designed to provide testing, connectivity, and advanced account and technical support.

The adoption of cloud-based lease management systems is steadily on the rise due to the need for scalable and flexible solutions by organizations that can be used in managing their lease portfolios. These cloud-based systems allow organizations to reach data from multiple locations for seamless collaboration between teams inside and outside the office. In particular, the Software as a Service (SaaS) model has gained popularity due to its value proposition of lower initial investments, and regular updates without much IT burden. This model gives businesses the flexibility to scale their lease management implementation based on requirements, adapting easily to changing needs from leasing market changes, without the limitations of traditional software solutions.

Moreover, the security features that are built into cloud systems make data less vulnerable, providing organizations with greater confidence in how they manage sensitive lease information. In any case, moving to a cloud-based lease management solution is more than cost savings for the organization particularly for companies operating in an increasingly complex leasing landscape.

Market Size and Forecast:

-

Market Size in 2024 USD 5.31 Billion

-

Market Size by 2032 USD 8.44 Billion

-

CAGR of 6.00% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Lease Management Market Trends:

-

Growing global smart building projects are driving increased demand for lease management solutions.

-

Adoption of cloud-based lease management software enables remote access, collaboration, and operational efficiency.

-

Regulatory standards like IFRS 16 and ASC 842 are pushing organizations to implement robust lease management systems.

-

Integration of big data analytics allows organizations to analyze lease performance, identify trends, and make data-driven decisions.

-

Rising real estate demand and portfolio complexity create new opportunities for SaaS-based lease management solutions.

Lease Management Market Growth Drivers:

Increasing requirements to manage leases efficiently is one of the prime factors contributing toward the growing demand for software as a service lease management solution and the steady growth of the managed services market. In the wake of growing complexity around lease portfolios and regulatory obligations, organizations need a smoother way to manage their leases. The scale of the real estate and rental sector is immense, contributing roughly USD 2.9 trillion to the U.S. economy as per the latest figures released by the U.S. Bureau of Economic Analysis in 2022, illustrating why lease management solution is so coveted in this industry. In addition, the National Association of Realtors polled commercial real estate professionals and found that about 70% believe implementing technology solutions, especially SaaS, is critical for improving operational efficiency and compliance. Despite the demands for effective lease management systems, and despite new lease accounting standards such as IFRS 16 and ASC 842 pushing organizations to begin recognizing their lease liabilities on balance sheets the urgency has only increased over time.

Lease Management Market Restraints:

Lack of awareness of organizations about the benefits and features provided by lease management systems is one of the crucial factors restricting the adoption of these solutions. Still, a lot of these businesses particularly the smaller ones or those within traditional industries that have less experience utilizing technology for efficiency and compliance may not recognize how optimizing lease management could streamline operations, save costs, and ensure they meet regulatory requirements. Moreover, companies might lose opportunities to create efficiencies in the lease process, prevent over- and underutilization of assets, and help identify when company risk might be increased via a lease agreement without enough knowledge surrounding available technologies or effects. This is why the solution needs to be widely recognized and taught for it to become more widespread and yield effective productivity from this technology.

Lease Management Market Opportunities:

The shift towards new technologies, particularly around cloud computing and big data analytics, creates major opportunities for lease management solutions. Modern organizations can access lease management software remotely through the cloud, enabling instant collaboration and data sharing across various locations. Such flexibility allows businesses to manage lease processes better, portfolios more efficiently, and save on the operational costs associated with older, on-premise systems. Moreover, big data analytics has been integrated into the lease management systems which allows organizations to comprehensively analyze their leasing activities. Analyzing big data helps companies find trends, measure lease performances, and make data-driven decisions to improve their negotiation processes and get the best terms on their leases. This not only adds to efficiency but also enables organizations with the necessary tools and flexibility required to adjust to emerging market conditions, and regulatory requirements, ensuring a competitive advantage thought to be difficult in the lease management arena.

Lease Management Market Segment Analysis:

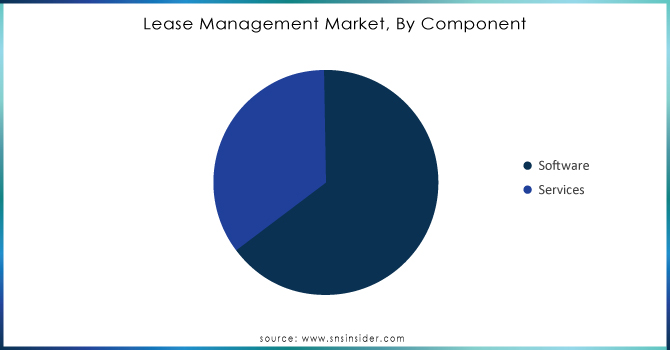

By Component

The software segment held the largest market share of over 68% as of 2024. This is mainly because they are turning towards technology to automate and optimize their lease management functions. Lease management software has become a growing area of value with organizations wanting to automate repetitive tasks like tracking lease agreements, monitoring compliance, and generating reports. It not only minimizes human errors but also helps businesses in better organization of their lease portfolios and swift adaptation to changing market conditions. Moreover, the increasing preference for these solutions for lease management over on-premise solutions is driving the growth of this segment as software applications adopted in cloud environments are easy to use and can be accessed from anywhere thus providing flexibility and scalability. Moreover, the inclusion of some advanced features like data analytics and integration with existing enterprise systems bolsters the functionality of lease management software making it a required product by organizations.

Need any customization research on Lease Management Market - Enquire Now

By Deployment

The cloud segment held the largest market share around 62% in 2024. Cloud lease management solutions provide organizations the flexibility to scale up or down based on current business requirements without the hassle of significant hardware investments or maintenance efforts. That flexibility is essential for any business that functions in a real estate environment where business or employee needs evolve quickly. Moreover, cloud solutions provide accessibility of all lease management tools and data from anywhere you are, allowing collaboration for the teams anywhere or as remote/hybrid work becomes more commonplace. Subscription pricing models common to cloud services help decrease upfront costs and lower the financial risk of investing in software solutions.

By Application

The commercial segment held the largest market share around 39% in 2024. The dependence on leased spaces – offices, retail outlets, and even industrial plants has grown significantly among the businesses to function and scale, requiring a robust lease management solution. Commercial leases come with special terms that demand careful monitoring of regulatory and financial obligations. They also have several obstacles in holding multiple lease contracts throughout different locations which boosts the requirement for centralized lease management solutions. Real estate operates to reduce cost and improve operational efficiency, growth in this segment is being driven by the growing importance of optimizing real estate portfolio. In addition, the rise of flexible workspace solutions such as co-working spaces and short-term leases is expected to positively impact the commercial segment, since companies are searching for novel ways to efficiently control their leasing strategies.

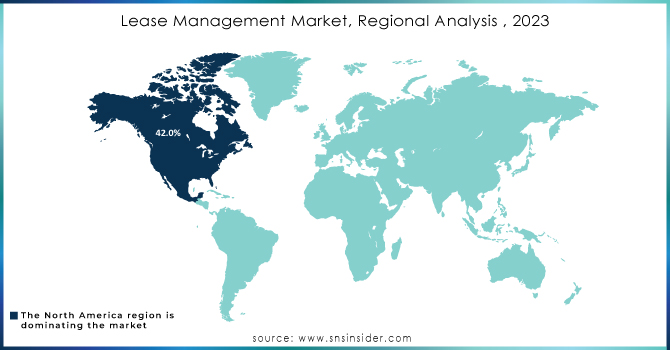

Lease Management Market Regional Analysis:

North America Lease Management Market Insights

North America accounted for the largest revenue share around 42.0% in 2024 and it is expected to maintain its lead over the forecast period. It can be attributed to the early adoption of lease management technologies in the region. The lease management market in North America is quite developed due to the presence of many large enterprises, a robust real estate sector, and a strong emphasis on efficient business operations. Major countries like the United States and Canada contribute significantly to this market. In North America, lease management software and services are widely adopted across various industries such as real estate, retail, healthcare, and manufacturing.

Asia Pacific Lease Management Market Insights

Asia Pacific is anticipated to register the highest over the forecast period. Factors such as the growing industrialization and the increasing number of smart city projects are further fueling the demand for smart buildings in the region. This is expected to boost the market growth in this region. The Asia Pacific region has been experiencing rapid economic growth and urbanization, which has led to increased demand for real estate and commercial spaces. This growth has also driven the adoption of lease management solutions to streamline leasing processes and manage property portfolios efficiently. Countries like China, Japan, India, Australia, and Singapore are key players in the Asia-Pacific lease management market.

Europe Lease Management Market Insights

Europe’s lease management market is growing due to increasing adoption of cloud-based solutions, regulatory compliance requirements, and rising real estate investments. Organizations are leveraging advanced software and analytics to efficiently manage complex lease portfolios, optimize operational workflows, and ensure compliance with standards like IFRS 16 and ASC 842, driving market expansion across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Lease Management Market Insights

The LATAM and MEA lease management market is expanding as businesses adopt cloud-based solutions and big data analytics to manage growing lease portfolios efficiently. Rising real estate development, regulatory requirements, and increasing demand for operational efficiency are driving organizations to implement SaaS lease management systems, creating significant growth opportunities in these emerging regions.

Lease Management Market Key Players:

-

Accruent (Lucernex)

-

CoStar Realty Information, Inc. (CoStar Suite)

-

IBM Corporation (IBM TRIRIGA)

-

Lease Accelerator (Lease Accelerator Software)

-

MRI Software, LLC (MRI Lease Management)

-

Odessa (Odessa Lease Management)

-

Oracle (Oracle Lease and Finance Management)

-

SAP (SAP Real Estate Management)

-

RealPage, Inc. (RealPage Lease Management)

-

Yardi Systems Inc. (Yardi Voyager)

-

Nakisa Inc. (Nakisa Lease Administration)

-

Cin7 (Cin7 Inventory Management)

-

LeaseQuery (LeaseQuery Lease Accounting Software)

-

eLease (eLease Lease Management Software)

-

Asset Panda (Asset Panda Lease Management)

-

WiredScore (WiredScore Certification Platform)

-

Mapletree (Mapletree Lease Management System)

-

ProLease (ProLease Software)

-

NetSuit (NetSuite ERP)

-

FAS Solutions (FAS Lease Accounting Software)

Competitive Landscape for Lease Management Market:

Colliers International is a leading global real estate services firm offering comprehensive lease management solutions. The company helps organizations optimize lease portfolios, ensure regulatory compliance, and improve operational efficiency through advanced software, analytics, and advisory services. Its expertise supports effective decision-making in managing commercial and corporate real estate leases.

-

In July 2023, Colliers International, a global real estate services firm, announced that it had acquired the lease management business of Cresa, a competitor. The acquisition will add Cresa's lease management portfolio of over 100 million square feet to Colliers' existing portfolio of over 200 million square feet.

RealPage, Inc. is a prominent provider of lease management solutions, offering cloud-based software and analytics to streamline lease administration, optimize real estate portfolios, and ensure regulatory compliance. Its platforms enable organizations to efficiently manage commercial and residential properties, improve operational workflows, and make data-driven decisions, driving efficiency and value in the lease management market.

-

In August 2023, RealPage, a leading provider of software and data analytics to the real estate industry, announced that it had acquired Yardi Voyager, a lease management platform. The acquisition will expand RealPage's lease management capabilities and help its customers to more effectively manage their properties.

| Report Attributes | Details |

| Market Size in 2024 | USD 5.31 Billion |

| Market Size by 2032 | USD 8.44 Billion |

| CAGR | CAGR of 6.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment Mode (On-Premise, Cloud) • By Enterprise Size (Large Enterprise, Small and Medium-Sized Enterprise) • By End-Use Industry (Retail, Education, Government, Manufacturing, Others) • By Application (Industrial, Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accruent, CoStar Realty Information, Inc., IBM Corporation, Lease Accelerator, MRI Software, LLC, Odessa, Oracle, SAP, RealPage, Inc., Yardi Systems Inc. and Nakisa Inc. |