Mercaptan Market Report Scope & Overview:

Get More Information on Mercaptan Market - Request Sample Report

The Mercaptan Market size was valued at USD 1.9 Billion in 2023. It is expected to grow to USD 3.0 Billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

Rising demand for mercaptans, especially ethyl mercaptan owing to their usage as odorants in natural gas and LPG to detect leakages boosts the market growth. Natural gas is colorless and odorless, so we add mercaptans to create an easily identifiable scent for safety as a quick indication of gas leaks in residential areas. As natural gas is increasingly being adopted as a lower-carbon alternative to coal and oil, mercaptan-based odorants have become highly sought after. Other potential factors contributing to the growth of this market segment are regulations such as the requirement of government bodies to be added to these gas distribution systems because it increases safety norms by adding odorants that result in complementing natural gas odorization demand for mercaptans.

Government regulations and policies have played a significant role in the growing demand for mercaptans in natural gas odorization. For instance, in the United States, the Pipeline and Hazardous Materials Safety Administration (PHMSA) under the U.S. Department of Transportation mandates the odorization of natural gas as per 49 CFR § 192.625, requiring all gas to have a distinct and recognizable odor at concentrations of 1/5th of the lower explosive limit to detect leaks effectively.

Moreover, mercaptans are important intermediates of chemical synthesis and essential for yielding pharmaceuticals, flavors, and rubber additives. Due to their particular properties, they are helpful for the synthesis of complex compounds in these industries. Increased healthcare demand and R&D spending are boosting the mercaptan-based intermediates market, particularly within the pharmaceutical industry. Increasing demand for specialty chemicals in the manufacturing of flavoring agents, agrochemicals, and rubber processing further propels the growth of the specialty chemical market. As mercaptans are versatile reagents to produce specialty compounds available in the market, their increasing adoption in chemical manufacturing is significantly driven by growth in end-use industries such as pharmaceuticals and rubber manufacturing.

Government data and industry statistics highlight the growing demand for mercaptans in chemical manufacturing, particularly in the pharmaceutical and specialty chemicals sectors. According to the European Chemical Industry Council (Cefic), the European pharmaceutical sector saw a 4.4% increase in production in 2022, driven by rising healthcare needs and investments in drug manufacturing.

Drivers

-

Mercaptan-based pesticides and fungicide intermediate sales are increasing as a result of the expanding agrochemicals market

The growth of the global agrochemical market is driving the increasing demand for mercaptan-based pesticides and fungicide intermediates. Methyl mercaptan is an essential intermediate in the synthesis of numerous agrochemicals utilized as crop protectants from various pests and diseases. The increasing demand for food products caused by a surge in human population, and the growing necessity to increase crop productivity are driving up pesticide & fungicide consumption, which in turn boosts mercaptan-based compound consumption. Moreover, the popularity of modern farming methods and the transition towards more effective and eco-friendly approaches to crop protection are expected to open new avenues for innovative agrochemical formulations.

The Food and Agriculture Organization (FAO) reported that more than 4.1 million tonnes of pesticides were used around the globe in 2021, showing continuous growth over previous years driven by increasing interest in enhancing crop productivity. Moreover, rapid investment by India and China in their agricultural sectors is fuelling demand for products like herbicides and fungicides which, in turn, is expected to drive the market growth. Moreover, increasing farmer awareness regarding the concept of precision farming is further expected to support market growth for mercaptans used as agrochemical intermediates over the projected period.

Restraint

-

Growing environmental and health concerns may hamper the market growth.

The mercaptan market is primarily restrained by the growing environmental and health concerns. While mercaptans are important as intermediates and odorants, their potency gives them a very strong, unpleasant smell even at low concentrations. Mercaptans when exposed at high levels can cause headaches, nausea, and respiratory irritation. Secondly, the production and disposal of mercaptans requires the use of dangerous substances which raises environmental issues related to potential soil and water contamination. Governments and environmental agencies are increasingly enacting strict laws for the use and handling of chemicals such as mercaptans to reduce health and environmental hazards. Inevitably, regulatory agencies like the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) provide rules for allowable emissions by hazardous chemicals including mercaptans. Consequently, industries are being driven to explore safer substitutes and processes for the production which would hamper the potential market growth of mercaptans.

Market segmentation

By Type

Methyl Mercaptan held the largest market share around 34% in 2023. Its main application is the production of methionine, an essential amino acid that acts as a dietary supplement for animal feed to promote livestock growth and health. The increasing global population, coupled with rising disposable incomes and changing eating patterns, has resulted in increased meat and poultry consumption or demand for methionine further driving the market growth opportunity for methyl mercaptan. Furthermore, methyl mercaptan is one of the essential intermediates used in agriculture for the manufacture of pesticides and herbicides. Due to its wide range of industrial applications, it is a leading choice for manufacturers in the petrochemical, pharmaceutical, and flavor industries. Large-scale production, along with the ongoing improvements in manufacturing technologies that have made it more cost-effective, makes this material hard to counter its dominant position. The demand for methyl mercaptan is constantly growing due to the rising focus on agricultural productivity and increasing animal husbandry which are anticipated to foster its largest market share amid the mercaptan market.

By Application

Animal Feed held the largest market share around 38% in 2023. The mercaptan market is characterized by the largest animal feed segment in terms of market share as a result of growing meat and dairy consumption around the world. Methyl mercaptan, as one of the main precursors for methionine import, is an important method to improve the quality of animal feed. Methionine is an important amino acid, and it is one of the most vital nutrients for livestock growth, reproduction, and health. As the world population is expected to exceed almost 10 billion people by the middle of this century, there will be an enormous focus on serving high-quality sources of protein, especially from animals then this underlines the necessity for effective feed additives. Moreover, the movement towards more intensive livestock farming practices has increased feed requirements and the need for additives that can support rapid weight gain while efficiently converting feed.

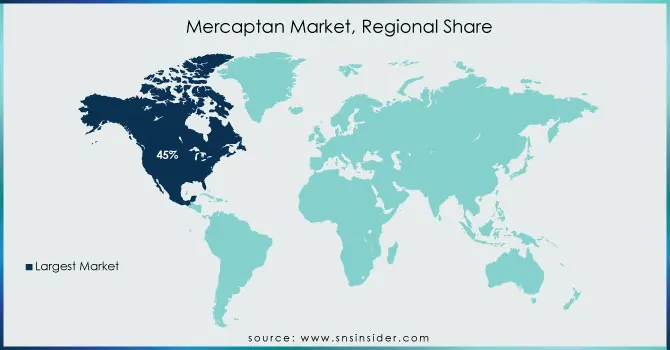

Regional Analysis

North America region held the largest market share around 45% in 2023. This is owing to the convenient industrial infrastructures coupled with widespread agricultural farms and stringent regulations on safety which help to endorse the usage of mercaptans for natural gas odorization. The US is a huge mercaptans consumer, largely thanks to the natural gas industry, which uses ethyl mercaptan as an odorant for leak detection. North America has a well-established livestock sector, which is another factor driving demand growth for methyl mercaptan here, primarily through methionine in animal feed. The total U.S. meat production was about 108.5 billion pounds in 2021, data reported by the United States Department of Agriculture (USDA) show part of a generally upward trend for agriculture over the years. Growing meat production is directly attributed to increasing demand for high-quality animal feed, thus driving the mercaptans market. The presence of leading chemical manufacturers, as well as an increase in production technologies, further supports the regional dominance over the mercaptan market that makes North America a significant region for mercaptan production and consumption.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Key Manufacturers

-

ARKEMA (Methanethiol)

-

Chevron Phillips Chemical Company LLC (Scentinel T-50)

-

Evonik Industries AG (Vulkanox)

-

TORAY FINE CHEMICALS CO., LTD. (Methyl Mercaptan)

-

Jiande Xingfeng Chemical Co., Ltd. (Ethyl Mercaptan)

-

Huntsman International LLC (TERT-Dodecyl Mercaptan)

-

Chevron Oronite Company LLC (OLOA 22000)

-

Phillips 66 Company (Mercaptan Scavengers)

-

BASF SE (2-Mercaptoethanol)

-

Sumitomo Chemical Co., Ltd. (Propyl Mercaptan)

-

Solvay S.A. (Sodium Mercaptobenzothiazole)

-

SHANGHAI BOC SCIENCES (Thioglycolic Acid)

-

Tianjin Zhongxin Chemtech Co., Ltd. (N-Butyl Mercaptan)

-

Zhejiang NHU Special Materials Co., Ltd. (Tert-Butyl Mercaptan)

-

Wuhan Grand Hoyo Co., Ltd. (Thiourea Dioxide)

-

Shandong Lianmeng Chemical Group Co., Ltd. (Thioglycolic Acid)

-

Akzo Nobel N.V. (Mercaptobenzothiazole)

-

Bruno Bock Chemische Fabrik GmbH & Co. KG (2-Mercaptobenzothiazole)

-

Global Calcium PVT LTD (Mercaptopropionic Acid)

-

Merck KGaA (2-Mercaptoethanol)

Recent Development:

-

In 2023, BASF announced the expansion of its production capacity for specialty chemicals, including mercaptans, at its Ludwigshafen site to meet the growing demand in the agricultural sector.

-

In 2023, Merck Arkema unveiled its latest innovation in mercaptan chemistry, focusing on developing biodegradable mercaptans for the agrochemical market, highlighting its commitment to sustainability.

-

In 2023, Evonik launched a new line of high-performance mercaptans designed for use in specialty chemical applications, emphasizing sustainability and reduced environmental impact.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.9 Billion |

| Market Size by 2032 | US$ 3.00 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Methyl Mercaptan, Ethyl Mercaptan, Propyl Mercaptan, Butyl Mercaptan, Octyl Mercaptan, Dodecyl Mercaptan, Others) • By Application (Pesticides, Jet Fuels and Plastics, Natural Gas, Food and Nutrition, , Animal Feed, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ARKEMA, Chevron Phillips Chemical Company LLC., Evonik, TORAY FINE CHEMICALS CO., LTD., Jiande Xingfeng Chemical Co., Ltd., Huntsman International LLC., other players |

| DRIVERS | • Mercaptan-based pesticides and fungicide intermediate sales are increasing as a result of the expanding agrochemicals market. |

| Restraints | • Growing Environmental and Health Concerns |