Metallic Telecoms Cable Market Size Analysis:

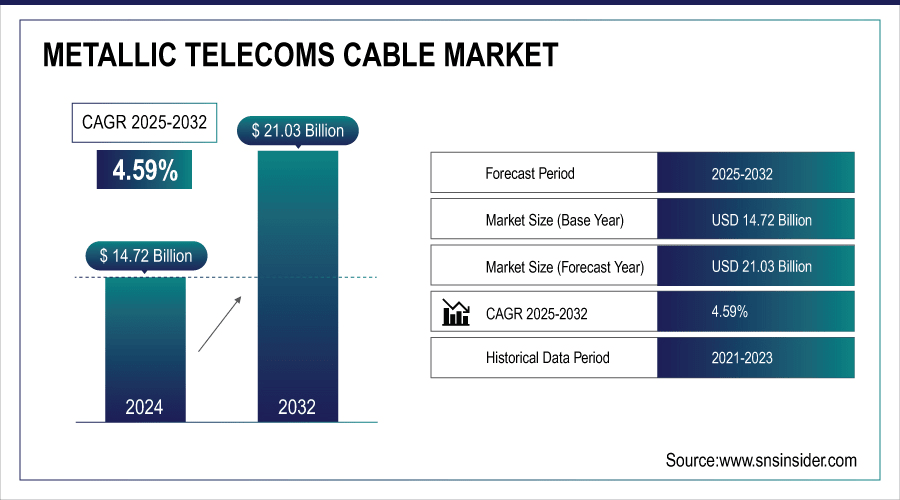

The Metallic Telecoms Cable Market size was valued at USD 14.72 billion in 2024 and is expected to reach USD 21.03 billion by 2032, growing at a CAGR of 4.59% over the forecast period of 2025-2032.

The metallic telecoms cable market trends are being driven by growing demand for broadband applications and a need for reliable wired communications, which will remain largely on copper-based telecommunication infrastructure, and the cost-effective transmission of vast amounts of data over long distances, particularly in developing parts of the world where fibre deployment is still challenging or more expensive than microwave transmission.

To Get More Information On Metallic Telecoms Cable Market - Request Free Sample Report

The metallic telecoms cable market growth is primarily driven by investments in 5G and hybrid deployments, along with demand for durable cabling under harsh environmental conditions and non-interceptable connections in mission-critical and/or safety-critical applications. Upgrade of the installed base will further drive growth along with modernization of legacy infrastructure, scale-up of smart grid, and industrial automation networks, and continuing upgrades in defense communication. Moreover, metallic cables are still preferred in areas with difficult landscapes, especially since they are more durable and have minimal maintenance costs, thus economical in the long run.

-

In 2024, Vietnam initiated its first commercial 5G network, deploying over 6,500 sites, with plans for further expansion in early 2025. This rollout emphasizes the need for reliable and durable cabling solutions, particularly in challenging terrains.

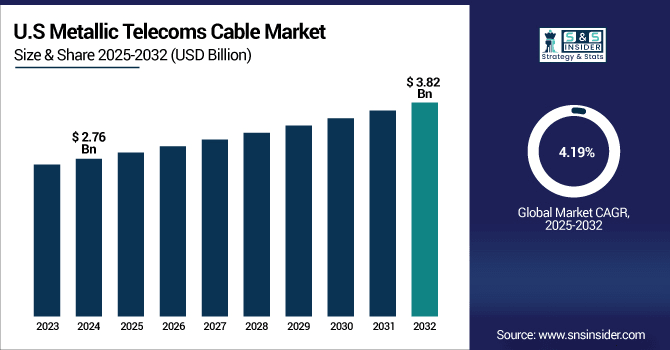

The U.S. Metallic Telecoms Cable Market size is estimated to be valued at USD 2.76 billion in 2024 and is projected to grow at a CAGR of 4.19%, reaching USD 3.82 billion by 2032. The demand for the U.S. metallic telecoms cable is driven primarily by rural broadband expansion projects, government infrastructure upgrades, and the continued reliance on legacy systems that utilize copper for voice and data communications.

Metallic Telecoms Cable Market Dynamics:

Key Drivers:

-

Robust Metallic Cables Powering Affordable, Reliable Telecom Connectivity in Challenging and Legacy Network Environments

Continuing demand for low-cost and reliable telecoms communication infrastructure, especially in regions where economic conditions render fibre-optic deployments less feasible, is a major factor driving the global demand for metallic telecoms cable. For last-mile connectivity, rural communication networks, and legacy system support, metallic cables, particularly copper-based ones, provide strong signal transmission over small distances for voice and data. This is made convenient by their robustness and easy maintenance in various environments.

-

In 2024, BT Group secured EURO 105 million from recycling surplus copper cables as it transitions to full-fiber broadband. The company recovered 3,300 tonnes of copper in the year ending March 2024, and estimates that up to 200,000 tonnes could be recovered through the 2030s.

Restraints:

-

Fiber Optics Rise Threatens Metallic Cable Market as Operators Shift to High Speed Future Networks

The metallic telecoms cable industry is under heavy pressure due to the fast development and commercialization of fiber optics technology. Fiber optics provide greater bandwidth, transmission distances, and immunity to electromagnetic interference, and are therefore the preferred technology for all new telecom infrastructure projects. The case for metallic cables in urban, developed, and high-demand areas where fibre can be economically and technically viable is likely to weaken as telecom operators prioritize future-proof networks.

Opportunities:

-

Emerging Markets and Smart Technologies Drive New Growth Opportunities for Metallic Telecom Cable Solutions

The global market is becoming an opportunity for telecom modernization in developing countries, where many governments and private operators have invested to improve the reach and availability of the network. Another way metallic telecom cables can flourish is from the growth of smart cities, IoT applications in industrial sectors, and the continued growth of defense and security communication systems. The expanding automotive communication and infotainment market further provides niche applications, particularly for hybrid and alloy-based cable technologies optimized for performance at cost.

-

India’s government invested over USD 9 billion in expanding telecom infrastructure in rural areas by 2024, aiming to connect over 214,000 villages through the BharatNet project, leveraging existing copper and hybrid cable systems for last-mile connectivity.

Challenges:

-

Harsh Conditions Signal Loss and Regulations Challenge Metallic Telecom Cable Manufacturers Globally in Cost-Effective Innovation

The use of metallic telecoms cable can be challenging due to the harsh environmental conditions where they are used, inability to maintain signals over a distance, corrosion, and mechanical wear. Additionally, with the need to be innovative but at the same time cost-effective, manufacturers also face the challenges of supply chain disruption and adherence to varying international safety and sustainability standards.

Metallic Telecoms Cable Market Segmentation Analysis:

By Type

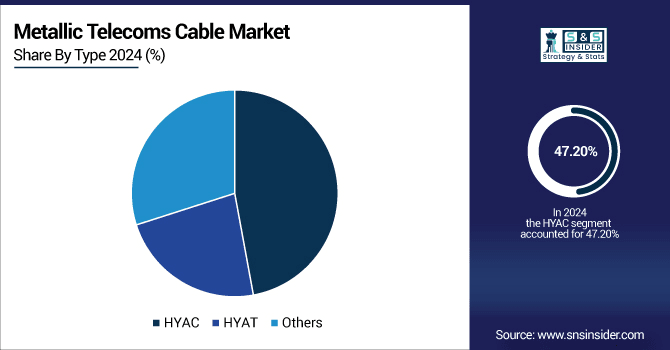

HYAC (Hybrid Aluminum Conductor) led the metallic telecoms cable market share in 2024, accounting for around 47.2% of the market. The share is driven by the beneficial balance of light weight, corrosion resistance, and high electrical conductivity of HYAC, making it a useful solution for various telecom applications due to its suitability for various harsh operating conditions. The high reliability of performance with low maintenance overhead cost has made it the preferred option for several urban and rural deployments.

HYAT (Hybrid Aluminum Titanium) cables are anticipated to experience the fastest growth in the market. HYAT’s superior strength, enhanced durability, and resistance to extreme temperatures and mechanical stress make it ideal for emerging telecom infrastructure projects, including 5G networks, smart grids, and industrial automation. As operators seek cables that combine performance with cost-effectiveness for demanding applications, HYAT’s advanced material properties are driving increased adoption, positioning it as a key growth segment in the metallic telecoms cable market from 2025 to 2032.

By Application

The communication segment held the majority share of the metallic telecoms cable market in 2024 at an estimated 53.6% of the market share. Meanwhile, this dominance is fueled by the continued global roll-out of telecommunication networks, with 4G and 5G upgrades requiring metallic cables for effective signal transfer and last-mile connectivity. Metallic cables are used for communication networks, especially in challenging rural and urban environments, due to their robustness, durability, and low maintenance.

The automotive segment is expected to register the fastest growth over 2025-2032. The expansion is supported by the high incorporation of connected vehicles, cutting-edge infotainment systems, and increased implementation of IoT technologies in automobiles. Due to their higher performance, flexibility, and cost efficiency, hybrid and alloy-based metallic cables are becoming particularly popular in automotive applications. With the growing markets of electric and autonomous vehicles, the increasing requirement for automotive communication and infotainment systems will be met by metallic cables specifically designed for this purpose, further boosting this specific segment.

By Material

Copper accounted for a sizeable 64.7% of the metallic telecoms cable market in 2024. Telecom cables are used globally, and copper is widely used because of its unique properties such as good electrical conductivity, durable, and reliable. Copper can transmit signals over long distances with little loss and resist mechanical stress and corrosion, making it the spine of telecom infrastructure as well as the backbone of comms and industrial applications.

During 2025-2032, aluminum is expected to be the fastest-growing segment of the global market. The lighter weight, lower cost, and reasonable conductivity of aluminum cables provide substantial benefits that have put this configuration in greater demand among telecom operators seeking to decrease installation and maintenance costs. Furthermore, the development of high-strength aluminum alloy technology enhances performance and durability, allowing aluminum cables to fulfill more stringent telecom specifications.

Metallic Telecoms Cable Market Regional Outlook:

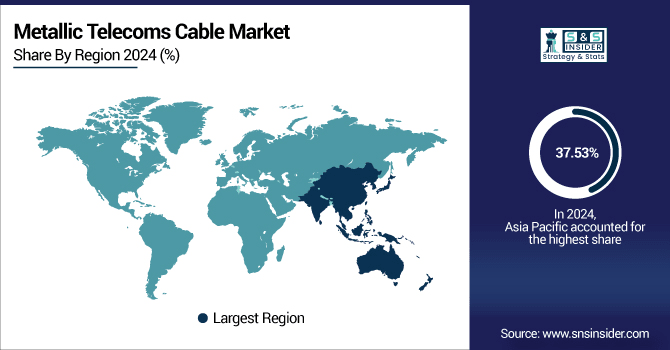

The metallic telecoms cable market was led by Asia Pacific, capturing 37.53% in 2024. Furthermore, Asia Pacific will also witness the fastest growth over 2025-2032. This expansion is fueled by fast urbanization, an improving telecom framework, and growing investments in next-generation communication technologies in the region. This is accelerating the market development for trusted and durable cabling solutions to buttress 5G deployments, smart city initiatives, and industrial automation. Moreover, the rugged and varied landscapes of the area require strong metallic cables, able to endure harsh climatic conditions, while still providing reliable functionality. The increasing adoption of connected devices and Internet of Things (IoT) applications is creating cyberspace for advanced cabling systems.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific metallic telecoms cable market was led by China and was largely fueled by significant 5G network deployments, the growth of smart cities and heavy investments in telecom infrastructure upgrading inericular and rural areas.

North America's metallic telecoms cable market is primarily characterized due continuous investments to upgrade telecom infrastructure and expansion of 5G networks. Demand for rugged and high-performance metal cables is driven by extensive industrial automation, smart grid implementations, and stringent defense communication needs in the region. Tough climatic conditions in some regions, paired with a demand for reliable and low-maintenance cable solutions, make these robust. Also, the presence of a comprehensive telecommunication ecosystem in North America supports legacy network modernization, which is also likely to promote metallic cable over fiber optics for certain applications driven by low-cost and resilience requirements.

The U.S. held the highest share in North America metallic telecoms cable market due to rapid 5G infrastructure expansion, growing smart grid and stable demand for reliable & durable cabling in industrial and defense sectors by production of telecoms cables at low cost.

In Europe, upgrades of legacy telecom infrastructure and the growing deployment of 5G networks throughout the region support the metallic telecoms cable market. Market growth is further aided by investments in industrial automation and smart grids, and secure defense communication systems. This Region focuses on durable, aesthetically pleasing, and high-quality cabling solutions that can survive a broad environmental range. Furthermore, stringent regulatory requirements on safety and sustainability drive shovel-ready technologies in cable material and design, further consolidating the stable demand for metallic telecom cables in Europe for both urban and rural applications.

The German market led Europe in metallic telecoms cable due to robust 5G network expansion, continued demand for industrial automation, investments in smart grid, and a continued need for secure and reliable communications infrastructure.

Growth in Latin America and the Middle East & Africa (MEA) metallic telecoms cable markets is supported by the continual development and modernization of telecom infrastructure. Market growth is also driven by investments in existing networks and 5G networks, along with increased demand for effective communication in rural and difficult geographic conditions. The demand for durable metallic cables is also bolstered by the expansion of smart city projects, industrial automation, and defense and communication requirements.

Key Players:

Some of the major metallic telecoms cable companies are Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System, General Cable, Belden Inc., Furukawa Electric, YOFC, Southwire, and Hengtong Group and others.

Recent Developments:

-

In July 2024, Prysmian Group set a new industry record by successfully installing a 500 kV HVDC submarine cable at a depth of 2,150 meters during the Tyrrhenian Link project.

-

In April 2025, Nexans announced that its Jeumont plant in France will produce low-voltage cables incorporating 10% recycled aluminum content. These cables will be manufactured using low-carbon aluminum produced with a decarbonized energy mix.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.72 Billion |

| Market Size by 2032 | USD 21.03 Billion |

| CAGR | CAGR of 4.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (HYAC, HYAT, and Others) • By Application (Communication, Automotive, National Defense, and Others) • By End User (Copper, Aluminum, and Alloy-based Cables) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System, General Cable, Belden Inc., Furukawa Electric, YOFC, Southwire, and Hengtong Group. |