Military Laser Systems Market Size & Trends:

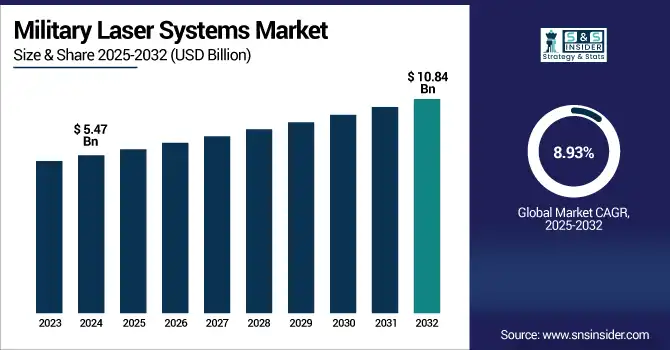

The Military Laser Systems Market size was valued at USD 5.47 Billion in 2024 and is projected to reach USD 10.84 Billion by 2032, growing at a CAGR of 8.93% during 2025-2032. The military laser systems market is experiencing robust growth, driven by rising demand for precision strike capabilities, enhanced threat detection, and next-generation directed energy weapons. are driving the growth in military laser systems market. They also provide speed-of-light engagement, low operational costs and minimal collateral damage–ideal for dealing with drones, missiles or asymmetric threats. Laser technology is becoming more and more integrated into the land, naval and airborne platforms of international defense ministries and agencies to enhance response time, as well as for sheer lethality. Solid-State and Fiber Laser Technologies Are Accelerating Deployments With Improvements in Beam Control, Thermal Management, and Power Efficiency. Moreover, increasing investments in autonomous targeting, AI enabled fire-control systems and mobile laser units is accelerating market proliferation in both developed and emerging defense economies.

To Get more information on Military Laser Systems Market - Request Free Sample Report

BAE Systems has demonstrated laser-guided rockets fired from the ground or air to hit emerging and fast-moving ground targets, such as enemy vehicles or mobile missile launchers on land or in the air. Held at the U.S. Army's Dugway Proving Ground in Utah, the demonstrations displayed precision strike capabilities.

The U.S Military Laser Systems market size was valued at USD 1.64 Billion in 2024 and is projected to reach USD 2.68 Billion by 2032, growing at a CAGR of 6.30% during 2025-2032, aided by vulnerabilities due to unmanned aerial systems (UAS), and increasing demand for cost-effective and scalable defense solutions. The increasing investments in directed energy weapons for short-range air defense and tactical applications are driving the growth across branches that is helping to spur rapid technological innovation and operational deployment.

The Military Laser Systems market trends include the rapid deployment of solid-state and fiber laser technologies owing to their miniature dimensions, optimum performance ratio and cost effectivity. Artificial intelligence is used in armed forces for a variety of purposes including, real-time target identification, automatic threat elimination and energy optimization. The advent of portable and vehicle-mounted laser platforms has been driven by growing requirement for counter-drone systems, short-range air Defence systems. Hybrid defense architectures are also making a major headway combining laser weapons with radar and optical sensors to offer integrated layered and precise aerial / missile threat responses across combat landscapes.

Military Laser Systems Market Dynamics:

Drivers:

-

Proliferation of Low-Cost Drones Driving Integration of Laser-Based Air Defense Systems

The rising deployment of inexpensive and easily accessible drones has significantly increased the vulnerability of defense infrastructure, prompting armed forces to explore advanced countermeasures. The shifting threat environment has accelerated the progress in the area of military laser systems, specifically for close-in air defense. The recent live-fire trials showcased that directed energy weapons used in conjunction with kinetic systems enables drone swarm suppression with even greater precision and effect, all at a much lower total cost. Both the real-time response rate of laser-based systems and reduced cleansing in war are highly valued, which is why lasers should be considered a strategic investment opportunity. The increasing focus on multiple layer air defense has raised worldwide procurement of high-energy laser programs for military modernization and combat readiness.

On June 27, 2025, the U.S. Army Testing Direct Energy Weapons Integrated with Kinetic Systems directed at LAD Using the Right Layered Approach For Air Defense The demonstration highlighted the adaptability of laser-based systems to counter airborne threats against which limited range defense capabilities can be invaluable.

Restraints:

-

Power Supply, Weather, and Integration Restraints Limit Deployment of Military Laser Systems

Despite their promise, military laser systems face significant restraints limiting large-scale adoption. This flexibility is limited as operations especially remotely or on the go are supported by power supply, making extremely high-energy requirements. Furthermore, the laser is highly sensitive to weather such as dust, fog and rain that limits their combat efficiency in operational scenarios. That precision beam control requires complex technology to remain accurate also makes AR devices expensive and technically difficult to produce. In addition, being integrated in the current military platforms requires significant and expensive infrastructural updates also logistical and budgetary issues. Still, these technical and environmental challenges are holding back wider deployment of directed energy weapon across different armed forces.

Opportunities:

-

Integration of Realistic Training Technologies Fuels Growth Opportunities in Military Laser Systems Market

The Military Laser Systems market is poised for growth as defense forces increasingly prioritize the integration of high-precision, simulation-based training systems. The increasing needs for laser-based solutions that allow for training on lifelike engagement scenarios, without the use of live ammunition, allowing to both increase safety stay ready to retain that competitive edge. They can include 360° hit detection, GPS enabled tracking, and data analytics for performance analysis which makes them indispensable in the overall modern military training ecosystem. With the global armed forces increasingly movign towards digitalized and immersive training environments, substantial procurement of advanced laser-based systems is anticipated across tactical, operational and combat training sequences.

In, 22 July 2025 – The British Army is expanding its use of Bagira Systems’ Roundless Tactical Engagement Simulation (RTES), aiming to enhance live training with geolocation-enabled, laser-based rifle simulators. The RTES system, already deployed in key training centers, integrates real-time tracking and 360° hit detection for improved exercise realism.

Challenges:

-

System Complexity and Tactical Limitations Pose Challenges to Military Laser Systems Market Expansion

The Military Laser Systems market faces key challenges stemming from technological complexity and operational constraints. These systems need to have very accurate beam control, intensive cooling systems and require sophisticated energy management that make them hard for them to be miniaturized or fit into mobile platforms. Targeting being the keyword, laser efficacy is directly proportional to battlefield conditions with dust, fog, and rain affecting targeting accuracy making things even worse. Moreover, the integration of laser systems into existing tactical doctrines and training paradigms is still a challenge as one attempts to balance power requirements, ranges restrictions and real-time decision-making. In addition to the need to keep costs, low, lengthy testing cycles and a lack of unified requirements across different militaries slow down deployment and adoption even further.

Military Laser Systems Market Segmentation Outlook:

By Output Power

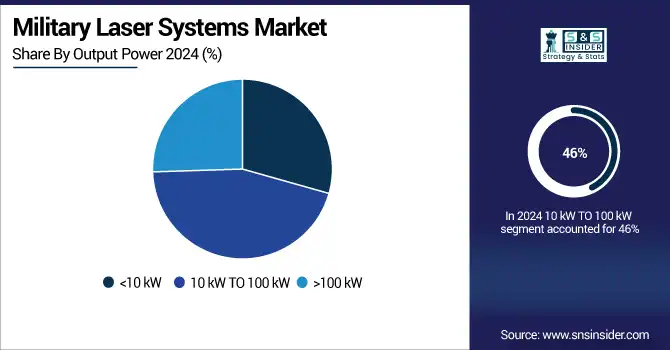

In 2024, the 10 kW TO 100 kW segment accounted for approximately 46% of the Military Laser Systems market share, owing to increasing installation of miniaturized, man-portable laser weapons for ground and naval support. Hinting at potential operators in modern combat zones, the systems offer a competitive mix of cost and capability for counter-drone missions, short-range air defense.

The >100 kW segment is expected to experience the fastest growth in Military Laser Systems market over 2025-2032 with a CAGR of 15.20%, driven by the rising need for ultra-high energy weapon systems designed to counter advanced threats like cruise missiles, aircraft, and hypersonic systems. These systems are proving of increasing interest for strategic applications, especially in naval and fixed-base air defense deployments.

By Platform

In 2024, the Airborne segment accounted for approximately 34% of the Military Laser Systems market share, driven by rising adoption of high-energy lasers on fighter jets, UAVs, and other aerial platforms for precise targeting, counter-drone operations, and threat neutralization. Advancements in lightweight laser modules and power optimization have further enabled integration into next-gen airborne defense systems.

The Space segment is expected to experience the fastest growth in Military Laser Systems market over 2025-2032 with a CAGR of 11.86%, due to escalating investments in space-based directed energy weapons for satellite defense, anti-missile applications, and space asset protection. Increased geopolitical tensions and Developments in Laser Communications & Power Systems to Drive Market Growth are the growth Trend geological reasons behind the rapid expansion of this market segment.

By Technology

In 2024, the Solid-state Laser segment accounted for approximately 34% of the Military Laser Systems market share, due to its quality beam, and compact design consumes less power. Thanks to their high operational reliability and compatibility with mobile and airborne platforms, these lasers are in high demand for tactical applications such as target illumination, rangefinding, and counter-UAS missions.

The Free-electron Laser segment is expected to experience the fastest growth in Military Laser Systems market over 2025-2032 with a CAGR of 13.04%, as it allows for flexible wavelength and high power scalability. This is perfect for sophisticated missile defence as well as long-range threat elimination which is pushing up defence spending in the area of experimental and next-generation directed energy systems.

By End Use

In 2024, the Navigation, Guidance, & Control segment accounted for approximately 25% of the Military Laser Systems market share, due to increase demand for precision strike capabilities and real-time target acquisition. Laser-based guidance delivers better accuracy, reduces the risk of collateral damage and enables advanced weapons systems which are critical for modernized, efficient battlefield operations across the air, ground and naval forces.

The Directed Energy Weapons segment is expected to experience the fastest growth in Military Laser Systems market over 2025-2032 with a CAGR of 15.23%, driven by increasing drone and hypersonic threats. These systems provide a speed-of-light target engagement capability, reduced cost per shot and scalable lethality, which is driving demand for high-energy laser capabilities as part of next-generation air and missile defense.

Military Laser Systems Market Regional Analysis:

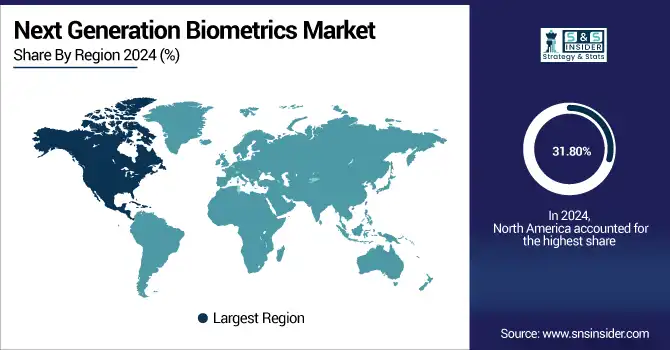

In 2024 North America dominated the Military Laser Systems market and accounted for 44% of revenue share, fueled by high defense budgets and quick procurement of directed energy systems due to sustained military modernization programs. Spearheaded by the active US Department of Defense investments in high-energy laser weapons for missile defense, drone neutralization, and tactical battlefield superiority has notably reinforced the regional market position.

Asia-Pacific is expected to witness the fastest growth in the Military Laser Systems Market over 2025-2032, with a projected CAGR of 10.63%, which can be attributed to rising geopolitical tensions along both borders and maritime routes, increased military expenditures of China and India on defense-related budget together with focus moving towards the homeland development as well indigenous laser weaponization for air defense system or naval modernizations programs among other proactive measures that are also imperative but at regional level though.

In 2024, Europe emerged as a promising region in the Military Laser Systems Market, supported by collaborative defense initiatives, increased investment in laser-based air and missile defense systems, and rising demand for energy-efficient, precision-guided technologies. Programs like the European Defence Fund and NATO-led R&D projects have further boosted regional development and integration of laser systems across land, air, and naval platforms.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Military Laser Systems market, as a result of robust defense modernization programs, persistent border security concerns, and now more significantly replacing aging technology focusing on precision-targeting. These strategic alliances with international defense giants and growing investment in counter-drone & directed energy programs are encouraging the utilization of laser based military solutions in so far developing regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Military Laser Systems Companies are:

The Key Players in Military Laser Systems market are Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, Elbit Systems Ltd., BAE Systems plc, Boeing Company, Rheinmetall AG, Leonardo S.p.A., MBDA, L3Harris Technologies, Inc., FLIR Systems Inc., Textron Inc., Saab AB, Kratos Defense & Security Solutions, Inc., Hanwha Aerospace, Israel Aerospace Industries (IAI), General Atomics, Dynetics, Inc., and Directed Energy Solutions, LLC and Others.

Recent Developments:

-

In April 2025, Northrop Grumman has successfully demonstrated a secure laser communication system for its Tranche 1 Transport Layer prototype constellation, validating encrypted, high-speed connectivity for proliferated LEO military missions.

| Report Attributes | Details |

| Market Size in 2024 | USD 5.47 Billion |

| Market Size by 2032 | USD 10.84 Billion |

| CAGR | CAGR of 8.93% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Output Power(<10 kW, 10 kW TO 100 kW, >100 kW) • Platform(Space, Naval, Airborne and Land) • Technology(Solid-state Laser , Fiber Laser , Semiconductor Laser , Gas Laser , Liquid Laser and Free-electron Laser) • End Use(Target Designation and Ranging , Navigation, Guidance, & Control , Defensive Countermeasures , Communication System and Directed Energy Weapons) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Military Laser Systems market Companies are Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, Elbit Systems Ltd., BAE Systems plc, Boeing Company, Rheinmetall AG, Leonardo S.p.A., MBDA, L3Harris Technologies, Inc., FLIR Systems Inc., Textron Inc., Saab AB, Kratos Defense & Security Solutions, Inc., Hanwha Aerospace, Israel Aerospace Industries (IAI), General Atomics, Dynetics, Inc., and Directed Energy Solutions, LLC and Others. |