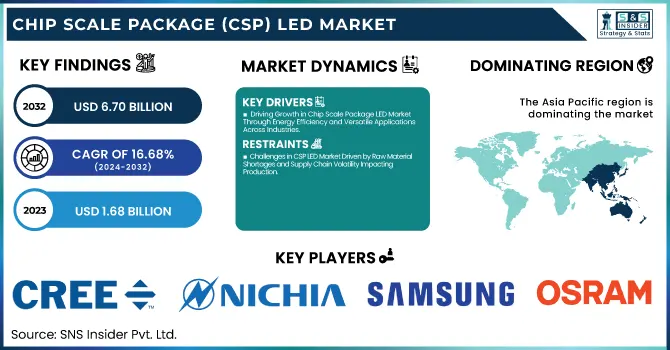

Chip Scale Package (CSP) LED Market Size & Growth Trends:

The Chip Scale Package (CSP) LED Market was valued at USD 1.68 billion in 2023 and is expected to reach USD 6.70 billion by 2032, growing at a CAGR of 16.68% over the forecast period 2024-2032. Integration with innovative technologies is driving market growth, resulting in more efficient and versatile solutions and providing necessary features for the growing popularity of Chip Scale Package (CSP) LED applications. Because of their small size, high performance, and robustness, CSP LEDs see higher adoption in outdoor and industrial lighting applications.

To Get more information on Chip Scale Package (CSP) LED Market - Request Free Sample Report

Moreover, the compact size and low power consumption of CSP LEDs are also proving useful in consumer electronics. Apart from this, these LEDs are also energy savers and they support sustainable development by enhancing environmentally friendly initiatives in various sectors. As adoption continues to grow in the U.S., the Chip Scale Package (CSP) LED Market is expanding due to its small size, high efficiency, and versatility for quality of light, as compared to competing products. CSP LEDs are increasingly being adopted in applications such as smart lighting, but also in automotive lighting and consumer electronics. The U.S. gains from advancements in lighting technology and the increasing focus on energy-efficient products.

The U.S. Chip Scale Package (CSP) LED Market is estimated to be USD 0.34 Billion in 2023 and is projected to grow at a CAGR of 17.03%. The U.S. Chip Scale Package (CSP) LEDs market will benefit from increasing advancements in smart technologies leading to high adoption of energy-efficient outdoor and industrial lighting, consumer electronic applications, and a greater emphasis on sustainability and energy savings.

CSP LED Market Dynamics

Key Drivers:

-

Driving Growth in Chip Scale Package LED Market Through Energy Efficiency and Versatile Applications Across Industries

The main driver of the Chip Scale Package (CSP) LED market is the increasing demand for energy-efficient lighting solutions in a wide range of industries. Multi-facets of advantages such as small in size, high light output, and reduced energy are expected to make CSP LEDs a versatile solution for end-use application items including backlighting, automotive lighting, and general lighting. As the world is transforming towards energy-saving technologies, a large part of governments and industries are investing in LED lighting solutions to save energy and carbon footprints. The rising deployment of CSP LEDs in consumer electronics, automotive, and outdoor lighting applications is also expected to drive the market, especially in countries such as North America and Asia Pacific.

Restrain:

-

Challenges in CSP LED Market Driven by Raw Material Shortages and Supply Chain Volatility Impacting Production

A big drawback is the shortage of raw materials needed to produce high-performance LEDs. Another issue is that CSP LEDs depend on certain materials such as gallium and phosphors, the prices or supply chains of which are susceptible to volatility. These disruptions can affect how long production takes, resulting in delays in fulfilling short-term market demand, especially in fast-moving sectors (like automotive and consumer electronics) requiring rapid manufacturing processes. A relatively large amount of these materials may sometimes be required from other industries, which brings about a time lag in their capacity and may slow down the acceptance of CSP LED due to high lead times.

Opportunity:

-

Emerging Opportunities for CSP LEDs in Automotive Smart Lighting and Electric Vehicles Driving Market Growth

CSP LEDs are also an emerging opportunity in the automotive segment with better performance in headlamps, tail lights, and other vehicle lighting systems. The driver of high-power LED with CSP characteristics is expected to be a growing market, especially as cars shift towards Electric Vehicles (EVs), which require advanced lighting systems for both vision and stylistics. Furthermore, advancements in IoT and smart lighting can provide the CSP LED with fresh opportunities, especially in residential and commercial spaces like smart homes and smart buildings. These opportunities are projected to propel remarkable market growth from 2024-2032, as the need for energy-efficient and sustainable lighting solutions continues to rise.

Challenges:

-

Technical Challenges in CSP LED Performance and Consistency Impeding Mass Adoption in Automotive and Industrial Applications

The ongoing complexity of the technology and the desire to continually improve the way that the items are designed. CSP LEDs are small in size and energy efficient, but delivering performance in terms of light output, thermal management, and life is a technical challenge. Although manufacturers are continuously extending LED technology, achieving consistent output quality while fulfilling the stringent performance requirements in automotive and industrial applications could be a major challenge. Furthermore, the absence of uniformity in various marketplaces might result in incompatibility, which could further impede the mass adoption and deployment of this technology.

Chip Scale Package (CSP) LED Industry Segments Analysis

By Application

In 2023, the backlighting Unit (BLU) segment led the market with 37.8% market share. This dominance is mainly due to the large-scale application of CSP LEDs in display technologies such as TV sets, smartphones, and monitors. CSP LEDs are compact, high-end, and energy-efficient, which makes them ideal for various backlit BLU applications of electronic devices. Additionally, the increasing consumer appetite for premium displays also confirms the BLU segment's strong position.

Between 2024 and 2032, the automotive lighting sector is poised to record the fastest compound annual Growth Rate (CAGR) within this market. Due to the push for electric vehicles (EVs) and the need for state-of-the-art, energy-efficient high-performance lighting systems, the demand for advanced vehicle lighting has increased, such as headlamps, tail lights, and ambient lighting. CSP LEDs are set to only gain in importance as the automotive industry changes with the times and vehicle lighting technologies improve.

By Power Range

Low to Medium power range has held the largest share of the Chip Scale Package (LED) market in 2023 with 69.6% of the market size. Low to medium-power CSP LEDs, which are widely used in general lighting, BLUs, and consumer electronics applications, account for most of this dominance. These LEDs are the most economical and energy-efficient thus widely chosen by many industries. They possess smaller sizes and can deliver enough brightness for most purposes which leads to their growing dominance in the market.

High power Range is projected to witness the highest Compound Annual Growth Rate (CAGR) during the forecast period. The increasing demand for high performance LEDs for automotive lighting, industrial lighting and high-intensity displays from industries, necessitates High-power CSP LEDs. Technologies to improve heat dissipation and performance will enable the high-power segment to deliver significant growth as more demanding applications emerge.

By End Use

The biggest share of the Chip Scale Package (CSP) LED market in 2023 was held by the Residential segment with a 43.5% share. This dominance has mainly been due to the increasing demand for sustainable and cost-effective lighting solutions in homes, leading to the accelerated adoption of energy-efficient lighting solutions. Packing compact size, high efficiency, and long life, CSP LEDs fit well with home applications, including general lighting, smart home, and decorative lighting.

The Industrial segment is predicted to have the highest CAGR between 2024-2032. CSP LED is majorly used for healthcare and is used for many industrial applications such as factory lighting, warehouses, outdoor signs, and others owing to their excellent energy efficiency, performance, and durability in harsh environments. The industrial sector will witness significant growth on the back of increasing adoption of cost-efficient and energy-efficient lighting solutions in the commercial building sector which will further fuel the growth of the CSP LED market.

Chip Scale Package LED Market Regional Overview

Asia Pacific held a majority share of 32.2% in the Chip Scale Package (CSP) LED market in 2023. The region's strong manufacturing base, technological advancements, and high demand for CSP LEDs in consumer electronics, automotive, and industrial applications are contributing to the dominance. Some of these countries that are widely regarded as the most significant contributors to this market are China, Japan, and South Korea, where great companies such as Samsung Electronics and LG Electronics use these CSP LEDs in their products. Moreover, the penetration of LED technology in urban infrastructure and transportation such as street lighting and advertisement billboards – has fueled the Asia Pacific to dominate the market, particularly in China.

It is estimated that the region having the highest Compound Annual Growth Rate (CAGR) from 2024-2032, will be North America. The sector is expected to grow due to the rising investments in energy-efficient technologies, especially in the automotive and smart lighting sectors. CSP LEDs for first- and second-generation automotive lighting systems are being rapidly adopted in the United States, as General Motors and others are employing these devices in their lighted vehicles (including Tesla). There is also increasing demand for smart lighting solutions, both in commercial and residential spaces, with both Signify and Acuity Brands, offering energy-efficient lighting systems in the North American region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Chip Scale Package (CSP) LED Market are:

-

Cree, Inc. (XLamp XP-G3 LED)

-

Nichia Corporation (NFSW757A)

-

Samsung Electronics (LM301B)

-

Osram Opto Semiconductors (Oslon SSL)

-

Lumileds (LUXEON 3030 2D)

-

Epistar Corporation (CSP LED Series)

-

LG Innotek (LPX Series)

-

Everlight Electronics Co., Ltd. (CSP-0504)

-

Seoul Semiconductor (WICOP)

-

Harvatek Corporation (CSP-LED-0402)

-

Samsung LED (LM301H)

-

VeroLight, Inc. (Vero CXP CSP LED)

-

Kingsun Optoelectronic (KSL-CSP)

-

San'an Optoelectronics (CSP-SMD LED)

-

Bridgelux (Vero 18 CSP LED)

Recent Trends

-

In February 2025, Cree LED launched the XLamp XP-L Photo Red S Line LEDs, enhancing horticulture lighting with improved efficiency and durability. These LEDs offer up to 35% fewer components for the same performance, reducing costs and increasing lifespan in harsh environments.

-

In January 2024, Nichia launched the NFSWL11A-D6 chip-scale white LED, offering soft, low-glare lighting with horizontal distribution. This innovation enables thinner, lighter fixtures while maintaining high brightness and uniformity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.68 Billion |

| Market Size by 2032 | USD 6.70 Billion |

| CAGR | CAGR of 16.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Backlighting Unit (BLU), General Lighting, Automotive Lighting, Flash Lighting, Others) • By Power Range (Low to Medium, High) • By End Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cree, Inc., Nichia Corporation, Samsung Electronics, Osram Opto Semiconductors, Lumileds, Epistar Corporation, LG Innotek, Everlight Electronics Co., Ltd., Seoul Semiconductor, Harvatek Corporation, Samsung LED, VeroLight, Inc., Kingsun Optoelectronic, San'an Optoelectronics, Bridgelux. |