Multimedia ICs Market Size & Trends:

The Multimedia ICs Market Size was valued at USD 54.45 billion in 2024 and is expected to reach USD 117.88 billion by 2032 and grow at a CAGR of 10.25% over the forecast period 2025-2032.

To Get More Information On Multimedia ICs Market - Request Free Sample Report

The global Multimedia ICs Market is experiencing significant growth due to increased use of Centres in automotive electronics, consumer products and mobile products. Growing need for smart features like HD video, immersive audio, and real-time connectivity encourages the use of advanced multimedia ICs. Ongoing advancements in IoT,5G, and AI-based solutions are also driving the acceleration of IC performance and power efficiency. Moreover, the market is rapidly progressing in terms of product design and architecture due to rising investments in major industries and growing demand for miniaturized and multifunctional semiconductors.

According to research, as of 2024, over 50% of the global population is covered by 5G networks, accelerating demand for ICs that can support multimedia streaming and low-latency applications.

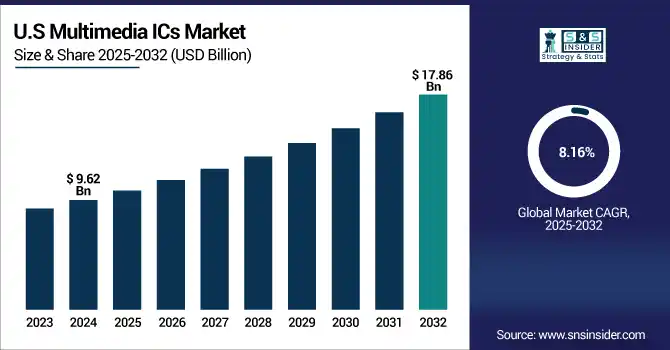

The U.S. Multimedia ICs Market size was USD 9.62 billion in 2024 and is expected to reach USD 17.86 billion by 2032, growing at a CAGR of 8.16% over the forecast period of 2025–2032.

The US multimedia ics market growth is driven by increasing demand for high-performance ICs in infotainment systems, connected vehicles, and the next-generation consumer electronics. Furthermore, with rapid 5G, AI and multimedia application developments, local innovation and product development are being encouraged. Strong presence of key players along with a favorable tech landscape is further catapulting this surge in demand across various end-user sectors, including automotive and the smart home domain.

Multimedia ICs Market Dynamics

Key Drivers:

-

High demand for connected devices and multimedia-rich applications across industries is significantly accelerating the adoption of multimedia ICs globally.

With increased use of smartphones, smart TVs, IoT devices and automobile infotainment systems, demand has increased for multimedia ICs with audio, video and imaging capability. This ever growing reliance on quality content processing and real-time data transfer requires unified multimedia solutions. The ICs support real-time encoding/decoding, improved graphics and better power savings. Such functions would be essential for next-gen applications in consumer electronics, AR/VR and autonomous driving, broadband multimedia ICs have now become an essential segment in today's electronics, in-turn driving the global market demand forward.

According to research, Over 80% of televisions shipped globally in 2024 were smart TVs, each equipped with multimedia ICs supporting 4K/HDR video and internet connectivity.

Restrain:

-

Fluctuations in raw material availability and global semiconductor supply chain constraints impact multimedia IC production.

Access to semiconductor material such as silicon wafer, rare earth and advanced lithographic equipment is key factor for multimedia IC industry. Interruptions can occur in the supply chain to the world—geopolitical realities, export regulations, natural disasters, all of which causes either shortages in material or a rise in costs. These problems slow time-to-market, drive up cost-of-operations and narrow margins for manufacturers. These challenges are further exacerbated by the growing need across sectors which is adding additional strain to already stretched global semiconductor ecosystems.

Opportunities:

-

Expansion of automotive infotainment and ADAS systems presents vast opportunities for multimedia IC integration and innovation.

With the increase of intelligent and connected vehicles, the demand for multimedia ICs to simultaneously support audio, video, navigation, and real-time communication is increasing. ADAS, in-car entertainment, heads-up displays and other systems all need ICs that can handle data from a number of sensors and cameras simultaneously. The trend of autonomous driving and electric vehicles will drive the integrated multimedia chip development. An automotive-grade IC investment now, focusing on the relationships with OEMs, and they will be in a favored position toward capitalizing on this growing opportunity.

According to research, Modern vehicles use over 10 to 20 sensors and 5–10 cameras on average, each feeding data to processors for simultaneous multimedia and safety operations.

Challenges:

-

Intensifying global competition and IP protection issues create strategic and operational barriers for multimedia IC vendors.

The market is highly competitive, with established players and emerging startups vying for technological leadership. The world's firms need to both innovate ceaselessly and safeguard their intellectual capital. But there is widespread cross-border IP theft and patent infringement, particularly in places where enforcement is weak. And it leads to lots of lawsuits, brand erosion and lost revenue. Moreover, the race to market with new features can be so fast that there is little opportunity to monetise the development investment, at least for smaller companies that do not have an arsenal of IP or an innovation factory.

Multimedia ICs Market Segment Analysis:

By Type

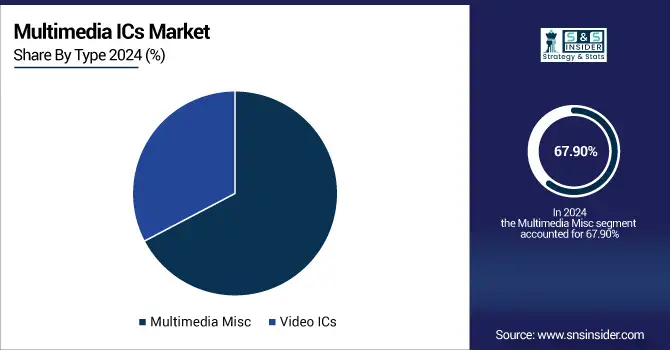

Multimedia Misc segment dominated the Multimedia ICs Market with the highest revenue share of about 67.90% in 2024, because of its wide applications of signal processing, timing and system interfacing among different instruments. These ICs enable key capabilities in smart appliances, industrial automation, and embedded systems. Analog Devices, for example, has taken advantage of this trend with a broad line of general-purpose mixed-signal ICs specifically designed for multimedia applications. Their versatility and application-readiness make them mandatory in many applications, and will place strong demand on consumer electronics and industrial electronics through the forecast period.

Video ICs segment is expected to grow at the fastest CAGR of about 11.38% from 2025–2032, due mainly to the increasing penetration of high definition video content in smartphones, surveillance and home entertainment devices. This growing market of 4K & 8K Displays, online streaming and AR/VR Applications further fuel the demand for next generation Video Processing Solutions. MediaTek continues innovation in this area with proprietary video ICs for mobiles and smart TVs that are energy-efficient, high performance solutions for video decoding and are designed for more sophisticated multimedia experiences.

By Application

Consumer Electronics segment dominated the highest Multimedia ICs Market Share of about 32.11% in 2024, due to increased adoption of infotainment, digital instrument cluster and telematics in recent automotive. The transition of vehicles to connected platforms has boosted buyer requirements for ICs that offer smooth multimedia experience solutions. Texas Instruments has been a significant enabler in this space with automotive-quality multimedia ICs for in-vehicle entertainment and display systems. These chips are designed for reliable, real-time performance for automotive environments, and they help the segment to continue to lead.

Automotive segment is expected to grow at the fastest CAGR of about 11.68% from 2025–2032, as development of electric and self-driving vehicles ramps up around the world. Smart Cockpit, ADAS, and the immersive driving experience are leading the demand for high performance Multimedia ICs. Automotive electronics player NXP is working on its scalable multimedia IC platforms that are designed to provide real-time video, voice control and driver assist capabilities. The emphasis on connected mobility solutions corresponds to increasing industry demand and establishes the segment as the fastest growing application area.

By Channel Type

1-16 Channel segment dominated the Multimedia ICs Market with the highest revenue share of about 40.63% in 2024, high performance/cost and easy interfacial compatibility with commodity electronics. These channels are commonly used in consumer devices, home automation devices, and media players. Among these companies is Infineon Technologies, which provides innovative IC solutions for space-saving, reliable multimedia output. Their energy-efficient, scalable products are increasingly used in everyday devices, guaranteeing the continuation of its market leadership.

Above 64 Channel segment is expected to grow at the fastest CAGR of about 11.37% from 2025–2032, driven by high data rate demands in enterprise class multimedia applications and intelligent devices. Application Examples Surveillance systems, Medical imaging, and Advanced automotive sensor networks. Multimedia ic companies such as ON Semiconductor are developing scalable multi-channel ICs that can accommodate multiple input/output streams at the same time. Such products are instrumental in supporting real-time decision-making and visual analytics in complex systems, which has helped drive the segment’s high-end growth rate.

Multimedia ICs Market Regional Insights:

North America dominated the Multimedia ICs Market with the highest revenue share of about 33.80% in 2024, driven by strong consumer demand, early tech adoption, and strong R&D. This dominance is underpinned by the presence of many of the world leading semiconductor companies and the burgeoning automotive and smart device sectors. The area also boasts a high-per-capita device usage rate, and government initiatives are conducive to advanced electronics and chip manufacturing, which in turn enhance the leadership of the market.

-

The U.S. dominates the North American Multimedia ICs Market due to strong R & D practices, semiconductor device manufacturers having technological edge and an established consumer electronics market, in addition to early adoption of smart automotive, mobile and home automation in various domains.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific segment is expected to grow at the fastest CAGR of about 11.30% from 2025–2032, powered by surging electronics manufacturing centers, digital transformation and the rising demands of the middle class for smart devices. Semiconductor innovation and self-reliance are also regional government priorities. Moreover, availability of skilled labor as well as ability to achieve cost-effective production in the region has made Asia Pacific the fastest advancing and most dynamic region in the world in terms of end-use industry wherein multimedia IC is implemented.

-

China dominates the Asia Pacific Multimedia ICs Market due to high production of electronics, government support for industry growth, increasing consumer demand for smartphones, and presence of key domestic tech companies in the country supporting both innovation and mass production of multimedia ICs.

Europe holds a significant position in the Multimedia ICs Market due to the high concentration of automotive electronics and the demand for smart consumer devices in the region, and growing industrial automation. Germany and France lead the process of adopting multimedia ICs in connected cars and smart systems. Favorable regulatory landscape and rising investments toward semiconductor R&D augment the industry growth in the region.

-

Germany dominates the European Multimedia ICs Market due to its advanced automotive industry, industrial, and smart technology contributing significantly to the advancements in the multimedia ICs. Emergence of infotainment systems and embedded electronics in vehicles drive the demand for multimedia ICs in the country.

The Middle East & Africa and Latin America Multimedia ICs Market is also experiencing a growth owing to the increasing need of smart devices, digitalization, and automobile progressions. UAE and Saudi Arabia top regional tech usage, with Brazil and Argentina showing strong promise due to growing electronics production and rising consumer demand for connected devices.

Multimedia ICs Companies are:

Major Key Players in Multimedia ICs Market are Qualcomm Incorporated, MediaTek Inc., Texas Instruments Inc., NVIDIA Corporation, Analog Devices, Inc. (ADI), Broadcom Inc., Samsung Electronics Co., Ltd., STMicroelectronics N.V., NXP Semiconductors N.V., Renesas Electronics Corporation and others.

Recent Development:

-

In March 2025, Samsung’s internal 4K/165 Hz TV SoCs enabled top-tier TVs, sharing leadership with MediaTek in leading-edge refresh-rate TV markets.

-

In November 2024, Broadcom’s BCM7216 high-definition video-broadcasting SoC reasserted its multimedia strength, with acquisition enhancing networking and video-processing capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 54.45 Billion |

| Market Size by 2032 | USD 117.88 Billion |

| CAGR | CAGR of 10.25% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multimedia Misc, Video ICs) • By Application (Consumer Electronics, Medical, Industrial, Automotive, Aerospace, Others) • By Channel Type (1-16 Channel, 16-32 Channel, 32-64 Channel, Above 64 Channel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Qualcomm Incorporated, MediaTek Inc., Texas Instruments Inc., NVIDIA Corporation, Analog Devices, Inc. (ADI), Broadcom Inc., Samsung Electronics Co., Ltd., STMicroelectronics N.V., NXP Semiconductors N.V., Renesas Electronics Corporation. |