Non-Grain Oriented Electrical Steel Market Report Scope & Overview:

Get E-PDF Sample Report on Non-Grain Oriented Electrical Steel Market - Request Sample Report

The Non-Grain Oriented Electrical Steel Market size was USD 17.91 billion in 2023 and is expected to Reach USD 27.92 billion by 2032 and grow at a CAGR of 5.06% over the forecast period of 2024-2032.

The Non-Grain Oriented Electrical Steel (NGOES) market is witnessing significant growth, driven by the increasing adoption of energy-efficient technologies across industries. This type of electrical steel, known for its superior magnetic properties in all directions, is widely utilized in motors, generators, and transformers. The demand is fueled by the rapid expansion of renewable energy systems, electric vehicles (EVs), and industrial automation, which require advanced electrical components to enhance performance and minimize energy losses.

One of the key trends shaping the market is the surging production and adoption of electric vehicles. NGOES plays a pivotal role in manufacturing efficient EV motors, as it enables better magnetic flux and operational efficiency. According to research, global EV sales have grown by over 40%, boosting demand for NGOES. Similarly, the integration of smart grids and the modernization of power distribution networks are driving increased usage of transformers, which rely heavily on NGOES for optimal performance. Another trend is the growing emphasis on sustainability and decarbonization. Governments and regulatory bodies worldwide are implementing strict energy efficiency standards, pushing manufacturers to adopt high-performance materials like NGOES. According to research energy-efficient transformers and motors could reduce global electricity consumption by 25% in industrial applications.

Additionally, advancements in production processes, such as continuous annealing and laser scribing, are improving the performance characteristics of NGOES, making it more suitable for high-frequency applications. The market is also witnessing investments in research and development to create innovative products with reduced core losses and enhanced durability. As industries increasingly prioritize energy optimization, the Non-Grain Oriented Electrical Steel market is expected to maintain a strong growth trajectory, playing a crucial role in the global energy transition.

Non-Grain Oriented Electrical Steel Market Dynamics

DRIVERS

- The non-grain-oriented electrical steel market is experiencing robust growth due to the rising demand for energy-efficient electrical appliances.

Governments and industries worldwide are prioritizing energy conservation, which has driven the adoption of motors and transformers designed to minimize energy losses. Non-grain-oriented electrical steel plays a critical role in these applications due to its superior magnetic properties, high permeability, and reduced core losses, making it a preferred material for manufacturing energy-efficient electrical equipment.

Increased adoption of renewable energy technologies further boosts demand, as generators in wind and solar power plants extensively utilize this material. According to research that wind energy capacity alone is expected to grow by nearly 60% by 2030, fueling demand for efficient electrical components. Additionally, the shift toward electric vehicles (EVs) has created new avenues, with EV motors requiring advanced electrical steel for optimal performance. According to research that over 55% of global EV motors use non-grain-oriented electrical steel. Emerging trends such as improved rolling technologies and eco-friendly coatings are enhancing the performance of this material while addressing environmental concerns. As energy efficiency becomes a global priority, the non-grain-oriented electrical steel market is poised for substantial growth in the coming years.

RESTRAINT

- Volatility in raw material prices, particularly for iron ore and alloying elements like silicon and manganese, poses a significant challenge for the non-grain-oriented electrical steel market.

Raw materials form the core inputs in the production process, and any fluctuation in their prices directly affects manufacturing costs. For instance, the price of iron ore has experienced frequent spikes, with rates increasing by over 40% at times due to supply chain disruptions, geopolitical tensions, or increased global demand. Similarly, the cost of silicon and manganese, crucial for enhancing the magnetic properties of electrical steel, often varies due to limited mining operations and export restrictions from key producing countries like China and Brazil.

These price fluctuations impact manufacturers’ profit margins, especially for small to medium-sized enterprises that may lack the capacity to absorb sudden cost hikes. Additionally, such unpredictability can disrupt the supply chain, forcing manufacturers to seek alternative suppliers or delay production. In the long run, sustained raw material price volatility may also lead to higher end-product costs, ultimately affecting the affordability of energy-efficient motors, transformers, and other electrical equipment. Addressing this issue requires strategic procurement planning and fostering collaboration between raw material suppliers and steel manufacturers to ensure cost stability.

Non-Grain Oriented Electrical Steel Market Segmentation

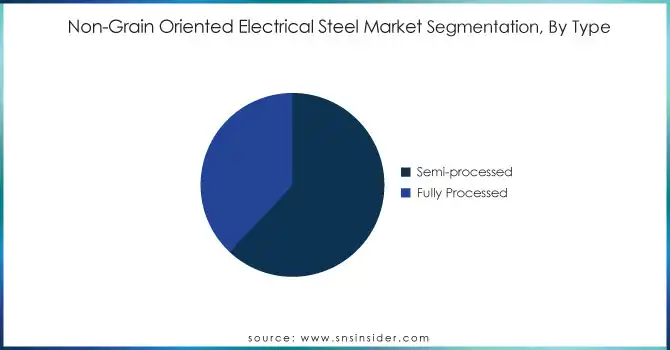

By Type

The semi-processed segment dominated with the market share over 62% in 2023, due to its extensive use in a wide range of applications, particularly in electrical transformers, motors, and other electrical equipment. Semi-processed NGO steel offers a favorable balance of cost and performance, making it a preferred choice for industries requiring efficient magnetic properties at a relatively lower cost compared to fully processed steel. This steel type is particularly suitable for large-scale applications, such as power transformers and industrial motors, where cost efficiency is crucial, but performance is still important. The demand for semi-processed NGO steel is also driven by its versatility in manufacturing electrical cores that operate in a range of electromagnetic environments.

By Application

The Power Generation segment dominated with the market share over 42% in 2023, due to the material's superior magnetic properties and efficiency in reducing power loss. NGO electrical steel is essential in the production of transformers, generators, and other power generation equipment, as it enhances energy efficiency and minimizes losses during the conversion and transmission of electrical power. The steel's high magnetic permeability allows it to handle alternating currents effectively, which is crucial for power generation applications where maintaining energy efficiency is paramount. Its use in transformers helps in reducing the size and weight of the equipment while improving its performance.

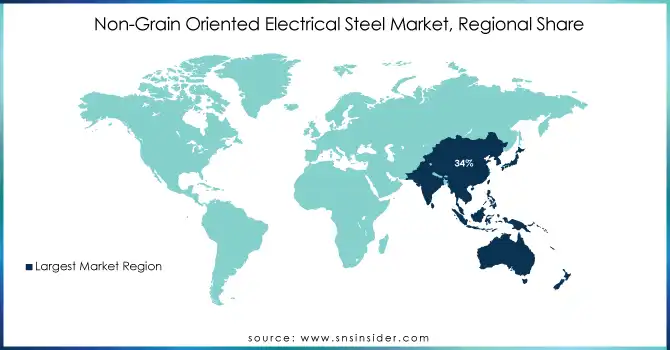

Non-Grain Oriented Electrical Steel Market Regional Analysis

Asia-Pacific region dominated with the market share over 34% in 2023, due to the presence of key manufacturing hubs in countries like China, Japan, and South Korea. These nations have a robust industrial base, making them major producers and consumers of electrical steel. China, in particular, is the largest producer, driven by its extensive manufacturing infrastructure and demand across various sectors, including automotive, energy, and construction. The automotive industry's growth, especially with the rise of electric vehicles, and the expansion of renewable energy infrastructure further boost demand for electrical steel in the region. Additionally, advancements in manufacturing technologies and a focus on energy-efficient solutions contribute to the region's leadership in the global market.

North America is the fastest-growing region in the Non-Grain Oriented Electrical Steel Market, primarily fueled by the increasing demand for high-efficiency transformers, electric motors, and electrical equipment. As industries across the region emphasize energy efficiency and sustainability, non-grain oriented electrical steel has become essential for manufacturing advanced electrical components. The growing focus on renewable energy, such as wind and solar power, drives the demand for efficient transformers and power distribution equipment, which rely on this material. Additionally, the surge in electric vehicle production further boosts the need for high-performance electrical motors, where non-grain-oriented steel is a key material due to its superior magnetic properties.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Non-Grain Oriented Electrical Steel Market

- Tata Steel (Non-grain oriented electrical steel, High permeability grades)

- Nucor Corporation (Electrical steel, Cold-rolled non-oriented steel)

- Nippon Steel Corporation (Grain-oriented and non-grain-oriented electrical steel)

- ThyssenKrupp Steel Europe (Electrical steel, Grain-oriented steel)

- Arcelor Mittal (non-grain oriented electrical steel, High-efficiency electrical steel)

- NLMK (Cold-rolled electrical steel, non-grain-oriented steel)

- POSCO (Cold-rolled electrical steel, High-performance non-grain-oriented steel)

- Shougang Group (Electrical steel, non-grain-oriented steel)

- Benxi Steel Group Co Ltd (Non-grain oriented electrical steel, Electrical steel for transformers)

- Baosteel Group Co (Grain-oriented electrical steel, Cold-rolled electrical steel)

- JFE Steel Corporation (Non-grain oriented electrical steel, High-silicon steel)

- Hyundai Steel (Electrical steel, non-grain-oriented steel)

- Severstal (Cold-rolled electrical steel, non-grain-oriented steel)

- AK Steel (Electrical steel, non-grain-oriented silicon steel)

- Voestalpine AG (Cold-rolled non-grain oriented electrical steel)

- United States Steel Corporation (Non-grain oriented electrical steel, Electrical steel for transformers)

- Shougang Jingtang United Iron & Steel Co., Ltd. (Electrical steel, non-grain-oriented steel)

- China Steel Corporation (Electrical steel, High-efficiency non-grain-oriented steel)

- Outokumpu (Electrical steel, non-grain oriented high permeability steel)

- Essar Steel (Electrical steel, High-silicon non-grain-oriented steel)

Suppliers for (wide range of electrical steel products, including NGO and CRGO (Grain-Oriented) steel, of Non-Grain Oriented Electrical Steel Market

- ArcelorMittal

- Nippon Steel Corporation

- JFE Steel Corporation

- POSCO

- United States Steel Corporation (U.S. Steel)

- Baosteel Group Corporation

- Hyundai Steel

- Steel Authority of India Limited (SAIL)

- ThyssenKrupp Steel Europe AG

- Cleveland-Cliffs (formerly AK Steel)

RECENT DEVELOPMENT

In March 2024: ThyssenKrupp Steel has commissioned a new slitting line at its Motta Visconti plant in Italy. This investment aims to enhance production capacity for high-efficiency electrical steel, crucial for the automotive industry, and will enable a doubling of output, with improved cutting precision for thin electrical steel and sensitive coatings.

In January 2024: POSCO finalized the construction of its new electrical steel plant in Gawangyang. The facility is designed to produce high-efficiency, eco-friendly non-grain oriented electrical steel sheets, marking the company’s entry into the green product sector as it strives to achieve net-zero carbon emissions by 2050.

In March 2023: ArcelorMittal S.A. made an investment of USD 317.90 million to build an electrical steel production plant at the Mardyck site in northern France. This investment aims to enhance production capacity and optimize revenue generation.

| Report Attributes | Details |

| Market Size in 2023 | USD 17.91 billion |

| Market Size by 2032 | USD 27.92 billion |

| CAGR | CAGR of 5.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By thickness (0.35 mm, 0.5 mm, 0.65 mm, and other) • By Type (Semi Processed and Fully Processed) • By Application (Household appliance, AC Motor, Power Generation, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Steel, Nucor Corporation, Nippon Steel Corporation, ThyssenKrupp Steel Europe, ArcelorMittal, NLMK, POSCO, Shougang Group, Benxi Steel Group Co Ltd, Baosteel Group Co., JFE Steel Corporation, Hyundai Steel, Severstal, AK Steel, Voestalpine AG, United States Steel Corporation, Shougang Jingtang United Iron & Steel Co., Ltd., China Steel Corporation, Outokumpu, Essar Steel. |

| Key Drivers | • The non-grain-oriented electrical steel market is driven by rising demand for energy-efficient appliances, renewable energy adoption, and the growing EV industry, supported by advancements in production technologies. |

| RESTRAINTS | • Fluctuations in raw material prices, especially for iron ore, silicon, and manganese, lead to increased manufacturing costs, reduced profit margins, and disrupted supply chains in the non-grain-oriented electrical steel market. |