Octyl Alcohol Market Report Scope & Overview:

Get E-PDF Sample Report on Octyl Alcohol Market - Request Sample Report

The Octyl Alcohol Market Size was valued at USD 6.6 Billion in 2023 and is expected to reach USD 8.4 Billion by 2032 and grow at a CAGR of 2.7% over the forecast period 2024-2032.

The octyl alcohol market has experienced steady growth due to its versatile applications across multiple industries. It finds extensive use in the production of plasticizers, Industrial lubricants, flavors & fragrances, and pharmaceuticals. The increasing demand for these products, coupled with the expanding chemical industry, has propelled the growth of the octyl alcohol market.

One of the major trends in the octyl alcohol market is the increasing demand for bio-based octyl alcohol. With growing environmental concerns and the need for sustainable solutions, the market is witnessing a shift towards bio-based alternatives. This trend is expected to drive the growth of the octyl alcohol market in the coming years. Another significant trend is the rising demand for octyl alcohol in the pharmaceutical industry. Octyl alcohol is widely used as an intermediate in the production of pharmaceuticals, including drugs, ointments, and creams.

The expanding pharmaceutical sector, coupled with the increasing prevalence of chronic diseases, is expected to fuel the demand for octyl alcohol in the coming years. As of 2021, Europe has imposed strict regulatory standards through the Medical Devices Regulation (MDR) developed by European Union that requires coatings protecting, specifically for use with medical devices to be biocompatible and long-lasting. Similar kinds of regulatory changes and growing usage of coated device in minimally invasive surgeries in turn fuel Octyl Alcohol market.

Chemical intermediates are the fastest growing segment in the Octyl Alcohol Market as it finds extensive application in manufacturing plasticizers, lubricants, and coatings which are essential for automotive, construction, and packaging sectors. The chemicals are in big demand as industrialization and urbanization of countries like China and India race ahead. In 2023, for example, the construction sector is reported to have grown by 5.5% according to the National Bureau of Statistics of China in response, coatings and lubricants saw increased use.

Moreover, the Ministry of Commerce and Industry (MCI) in India touts 10% annual gains for the nation's automotive industry, a large consumer of plasticizers and lubricants. This is a driving growth aspect for octyl alcohol market as increase in the octyl alcohol supply and consumption has been observed to cater requirements of these two industries which are combining to propel the overall CAGR of octyl alcohol.

The advent of technological innovations in the chemical synthesis and production techniques is playing a pivotal role in improving octyl alcohol yield on as well as aiding in scalability thereby fostering the market expansion. Catalytic processes and the use of biotechnological methods have boosted yields and reduced energy input into manufacturing. In the process, these innovations help producers in meeting this increasing demand more sustainably and help them lower their production costs.

Market Dynamics

Drivers

-

Rising awareness among consumers regarding personal grooming and hygiene drive the market growth.

Growing awareness among consumers about personal grooming and hygiene is the prominent factor influencing the demand for Octyl Alcohol, especially in personal care and cosmetics. The rise in disposable incomes, urbanization, and changing lifestyle patterns have prompted more individuals to purchase skincare, haircare or hygiene products. Particularly pronounced is this trend among emerging nations in the Asia-Pacific and Latin American areas. This generated an increase in consumer spending on personal grooming goods due to a 4.8% rise in the per capita income of middle-income countries, according to the World Bank.

Augmenting the market growth is the increasing interest to health and wellness that has surged demand for skin care products with safe and efficacious ingredients such as octyl alcohol, used in emollients, surfactants and moisturizers. In 2023, Advanced Polymer Coatings developed a new range of anti-corrosive and biocompatible coatings for use in orthopedic implants. These coatings are designed to increase the longevity and safety of implants, particularly in joint replacements, which are in high demand due to the rising incidence of osteoporosis and arthritis.

Moreover, in 2023, BASF SE introduced bio-based octyl alcohol as part of its initiative to meet the growing demand for sustainable personal care ingredients, enhancing its portfolio for cosmetics and skincare markets.

These developments, alongside government statistics, such as the Indian Ministry of Chemicals and Fertilizers projecting an around 12% growth in the country’s cosmetics and personal care industry in 2023, underscore the increasing role of octyl alcohol in meeting consumer demands for grooming and hygiene products.

Restrain

-

Availability of substitutes such as decyl alcohol and cetyl alcohol hamper the market growth.

Octyl alcohol, a versatile chemical compound, finds extensive applications in various industries. However, the presence of substitutes like decyl alcohol and cetyl alcohol limits the growth potential of the octyl alcohol market. These alternative compounds possess similar properties and functionalities, making them viable options for many applications. The availability of substitutes creates a competitive environment within the market, as customers have more choices to meet their specific needs. This increased competition can lead to a decrease in demand for octyl alcohol, as customers may opt for readily available substitutes instead. Furthermore, the availability of substitutes can also impact the pricing dynamics of the octyl alcohol market. With multiple options to choose from, customers can negotiate better deals and potentially drive down the prices of octyl alcohol. This can further hinder the market's growth and profitability.

Market segmentation

By Application

The 2-Ethylhexanol segment dominated the octyl alcohol market with a revenue share of more than 90% in 2023. This growth is due to its extensive use in various industries. It serves as a crucial component in the production of plasticized PVC for automobiles, acts as a solvent for surface coatings and inks, acts as a precursor for manufacturing plasticizers like dioctyl phthalate (DOP), and serves as a raw material for producing acrylate esters, which are essential in the manufacturing of emulsion paints and surface coatings.

Within the 2-Ethylhexanol segment, plasticizers accounted for the largest sub-segment in terms of revenue, comprising approximately 56% of the market share. This surge in demand is attributed to the increasing need for flexible and durable plastics across a wide range of industries, including automotive, construction, and packaging. Plasticizers play a vital role in enhancing the flexibility, durability, and processability of polymers. Moreover, the rising concerns regarding health and the environment have led to a growing demand for bio-based and non-phthalate plasticizers, further fueling the demand for plasticizers.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

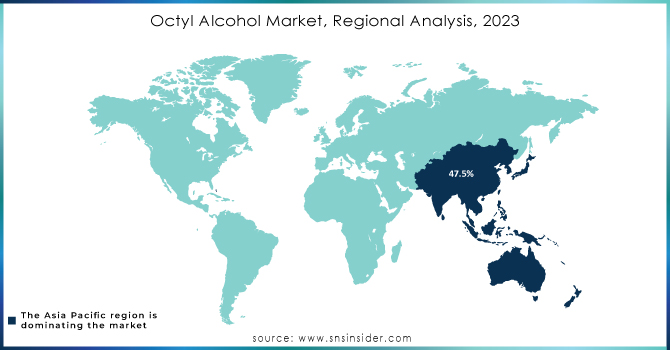

Asia Pacific dominated the Octyl Alcohol Market with the highest revenue share of about 47.5% in 2023. This remarkable growth is attributed to the rapid advancements witnessed in the cosmetics, cleaning chemicals, and pharmaceutical industries within the region. Notably, China's beauty and personal care industry experienced a significant surge in sales, reaching a staggering USD 70 billion in 2023. The remarkable progress of end-use industries in China, India, and Japan is expected to fuel the demand for octyl alcohol throughout the forecast period. India, in particular, has witnessed a surge in demand for cosmetics and personal care products, driven by increasing consumer awareness, urbanization, and evolving lifestyles. Meanwhile, Japan stands as a significant contributor to the market within the region, boasting a well-established cosmetics industry renowned for its innovation and high-quality offerings. The demand for octyl alcohol in Japan is primarily driven by the need for ingredients used in cosmetics and personal care products.

The rapid growth of these sectors in Asia Pacific has consequently driven the demand for octyl alcohol, leading to its market dominance. The rising disposable incomes and changing lifestyles of the region's population have resulted in an increased demand for personal care and cosmetic products. Octyl alcohol, with its properties as an emollient and solvent, is widely used in the formulation of skincare and haircare products. The growing consumer preference for such products has significantly contributed to the region's dominance in the octyl alcohol market.

North America is expected to grow with a significant CAGR of about 3.1% in the Octyl Alcohol Market during the forecast period of 2024-2031. The anticipated growth in the North American Octyl Alcohol Market is attributed to the region's robust industrial sector, coupled with the increasing demand for consumer goods, which is expected to drive the market's expansion. As industries continue to flourish, the need for octyl alcohol as a raw material or additive will rise correspondingly. Furthermore, the growing awareness among consumers regarding personal care and hygiene products is contributing to the surge in demand for octyl alcohol-based cosmetics and toiletries. Moreover, the pharmaceutical industry's continuous advancements and the development of innovative drug formulations are fueling the demand for octyl alcohol. Its applications in drug delivery systems, as well as its use as a solvent in pharmaceutical manufacturing processes, are driving its market growth.

Key Players

-

BASF SE (Isooctanol)

-

Sasol Limited (Alfol 810)

-

The Andhra Petrochemicals Limited

-

Arkema Group (Octyl Acrylate)

-

KLK OLEO

-

Axxence Aromatic GmbH

-

Liaoning Huaxing Group Chemical

-

Eastman Chemical Company (2-Ethylhexanol)

-

Dow Chemical Company (Octylphenol)

-

ExxonMobil Chemical Company (Exxal 8)

-

LG Chem (Octanol)

-

Mitsubishi Chemical Corporation (Octyl Acetate)

-

Evonik Industries AG (C8 Alcohol)

-

Perstorp Group (2-Ethylhexanoic Acid)

-

Oxea GmbH (2-Ethylhexanol)

-

Shandong Longda Chemical Co., Ltd. (N-Octanol)

-

Penta Manufacturing Company (Octyl Methoxycinnamate)

Recent Development:

-

In Sept 2023, BASF made an exciting announcement regarding the expansion of its bio-based monomers portfolio. They introduced a proprietary process for producing 2-octyl Acrylate (2-OA), showcasing their unwavering dedication to innovation for a sustainable future. This new product boasts an impressive 73% 14C-traceable bio-based content, aligning with the standards set by ISO 16620.

-

In March 2023, companies like Andhra Petrochemicals Ltd and Bharat Petroleum Corporation Limited raised the prices of 2-ethylhexanol in India. This surge in prices can be attributed to the rising costs of raw materials, as well as the robust demand for the product in the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.6 Bn |

| Market Size by 2032 | US$ 8.4 Bn |

| CAGR | CAGR of 2.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (1-Octanol, 2-Octanol, and 2-Ethylhexanol) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SABIC, BASF, Sasol, The Andhra Petrochemicals Limited, Ecogreen Oleochemicals, KLK OLEO, Arkema, Axxence Aromatic GmbH, Liaoning Huaxing Group Chemical, BharatPetroleum |

| Key Drivers | • Growing demand for octyl alcohol from various end-use industries • Rising awareness among consumers regarding personal grooming and hygiene drive the market growth. |

| Market Restraints | • Availability of substitutes such as decyl alcohol and cetyl alcohol hamper the market growth. |