Bioprosthetics Market Report Scope & Overview:

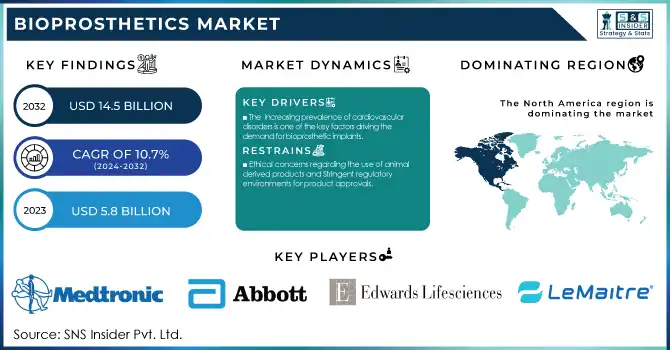

The Bioprosthetics Market Size was valued at USD 6.4 Billion in 2024 and is expected to reach USD 14.5 Billion by 2032, growing at a CAGR of 10.7% over the forecast period 2025-2032. This Report offers key insights into the growing demand for bioprosthetic implants driven by increasing incidences of cardiovascular and orthopedic conditions, as well as an aging population. The report includes regional device volumes, healthcare spending patterns and, regulatory compliance across major markets. It highlights advancements in materials and technology such as biocompatible devices and aimed at improving patient outcomes. Additionally, it examines adoption rates, market demand, and shifts in healthcare providers' preferences, providing a comprehensive overview of the bioprosthetics market and its future trajectory. The increased incidence rate of cardiovascular diseases, along with an aging population, is propelling the demand for bioprosthetic implants.

To get more information on Bioprosthetics Market - Request Free Sample Report

Key Bioprosthetics Market Trends:

-

Rising global burden of cardiovascular diseases increasing demand for heart valve bioprosthetics.

-

3D printing & regenerative medicine innovations enabling customized implants.

-

Growing preference for biocompatible & animal-derived implants over synthetic prosthetics in specific patient populations.

-

Expansion of orthopedic applications with bioprosthetic joints and scaffolds.

-

Increasing government funding in tissue engineering and regenerative medicine research.

-

Ethical and regulatory shifts influencing development of animal-free alternatives.

Bioprosthetics Market Drivers

-

The increasing prevalence of cardiovascular disorders is one of the key factors driving the demand for bioprosthetic implants.

The global burden of cardiovascular diseases (CVDs) is expected to increase dramatically during the period from 2025 to 2050. A 90.0% increase in cardiovascular prevalence is expected during this period, accompanied by a 73.4% increase in crude mortality and a 54.7% increase in crude disability-adjusted life years (DALYs). According to predictions, there will be 35.6 million cardiovascular deaths per year by 2050, compared to 20.5 million in 2025. Ischemic heart disease is expected to remain the leading cause of cardiovascular deaths, accounting for approximately 20 million deaths in 2050. It is anticipated that systolic blood pressure will be the leading cardiovascular risk factor responsible for 18.9 million deaths. These shocking statistics reflect the increasing demand for intervention, such as the use of bioprosthetic implants. For example, bioprosthetic valves appear to be effective at enhancing patient quality of life. In a recent study, an increase in quality of life was observed at 6 months and this was maintained at 1 year following bioprosthetic aortic valve replacement. Furthermore, the freedom from all-cause mortality at 1 year was 98.3% for patients under 60 years old receiving bioprosthetic aortic valve replacements.

Bioprosthetics Market Restrain

-

Ethical concerns regarding the use of animal-derived products and Stringent regulatory environments for product approvals.

The expansion of the market has been significantly restrained due to moral concerns regarding the usage of animal-derived products in bioprosthesis. Numerous patients, especially those with religious or moral dietary restrictions, request to know whether animal-derived products were used in their medical treatments. Rigorous regulatory frameworks for product approvals are another hurdle. Regulatory agencies are writing policies to advocate monitoring of potential animal welfare concerns in genetically engineered animals used in bioprosthetics. These laws and regulations seek to remedy ethical problems in the invasive nature of the techniques, high numbers of animals needed, unforeseen welfare issues, and moral bounds to genetic engineering.

Bioprosthetics Market Opportunities

-

Advancements in 3D printing technology for bioprosthetic development.

Advancements in 3D printing technology have revolutionized bioprosthetic development, offering unprecedented opportunities for personalized and efficient medical solutions. This technology enables the creation of intricate, patient-specific implants, prosthetics, and medical devices with high precision and customization. Studies performed in recent years have shown the potential of 3D-printed orthoses to enhance patient outcomes. A comparative study showed that patients have better quality of life while using 3D-printed orthoses when compared with conventional orthoses.

The technology has potential applications across many areas of medicine. For example, 3D-printed microporous scaffolds have been used to build bioprosthetic ovaries, which might one day be a possible option in reproductive medicine. In orthopedics, silver ion-coated 3D-printed implants were within the scale capable of decreasing local infection rates, and hydroxyapatite surface coatings accelerate osseointegration. In addition, this technology enables rapid prototyping and production, thereby shortening the time between a diagnosis and implantation considerably. This efficiency together with the freedom of design capabilities, and even the ability to use new types of biomaterials are driving innovation in prosthetics and orthopedic technology. As the technology continues to evolve, it promises to further enhance patient-specific treatments and improve overall healthcare outcomes.

Bioprosthetics Market Challenges

-

Intense competition from synthetic alternatives in the prosthetics market.

The bioprosthetics market faces significant challenges due to intense competition from synthetic alternatives. Such prosthetics can often be more cost-effective, have predictable quality, and be more durable. Recent technological advancements have further intensified this competition. Innovations in materials science and engineering have led to the development of synthetic prosthetics that aim to match or surpass the biocompatibility of bioprosthetics while offering improved durability and reduced need for replacement surgeries. For example, the incorporation of non-biodegradable scaffolds in hybrid tissue-engineered prostheses has enhanced durability and resistance properties over traditional bioprosthetic materials. In response, the manufacturers of bioprosthetics are seeking improved performance and durability from their offerings. There is ongoing investment into development of bioprosthetic materials to better withstand wear, and improving tissue engineering approaches.

Bioprosthetics Market Segment Highlights:

By Product Type: Allografts held 68% share in 2024, driven by availability, stability, and low manufacturing costs; Xenografts are the fastest growing segment, fueled by porcine-based implants and ongoing clinical trials.

By Application: Cardiovascular applications dominated with 81% market share in 2024, supported by growing demand for heart valve replacements; Orthopedic and reconstructive applications are gaining traction, boosted by 3D-printed bone and joint implants.

Bioprosthetics Market Segmentation Analysis

By product

The allograft segment dominated the market and held around 68% share in 2023. The supremacy of allografts can be assigned to the multiple benefits offered by them like long-term stability, convenience of raw material availability, greater survival rate, lower manufacturing cost, and simple implantation process. This has rendered allografts the most popular of available bioprosthetics. The growth of the allograft segment is also boosted due to its application in creating customized 3D-printed implants and tissue repair applications. Also, the development of allograft technologies has heavily been influenced by national readiness for regenerative medicine research funding. The allograft segment has also indirectly benefited from some large research funded in some locations like NIH (National Institutes of Health) in the U.S. for tissue engineering and regenerative medicine. The xenograft segment is growing with the fastest CAGR over the forecast period. Rapid expansion in the particularly porcine-based devices, driven by continuing trials focused on enhancement of effectiveness and minimization of side effects associated with these implants.

By application

In 2023, the cardiovascular segment accounted for the largest revenue share of 81.0% of the market. The large market share is mainly owing to high prevalence of cardiovascular diseases worldwide and rising demand for heart valve replacement. Cardiovascular diseases are the number one cause of death globally, taking an estimated 17.9 million lives every year (World Health Organization (WHO). This shocking statistic demonstrates the urgent need for more cardiovascular treatments, such as bioprosthetic heart valves. This dominance of cardiovascular segment is further augmented by the increasing preference for bioprosthetic heart valves over mechanical valves in older patients owing to their lower thromboembolism risk as well as lesser long-term anticoagulation therapy requirement. Government initiatives to promote heart health awareness have also boosted the segment. Similarly, the U.S. Department of Health and Human Services's Million Hearts initiative, which began in 2012 and aims to prevent 1 million heart attacks and strokes by 2027, has an indirect impact on the bioprosthetics market, as it increases the demand for advanced cardiovascular treatment

Bioprosthetics Market Regional Analysis:

North America Bioprosthetics Market Insights

North America led the market with 38% revenue share in 2024, primarily due to the high prevalence of cardiovascular diseases and a mature healthcare infrastructure. The U.S. remains the largest contributor, with cardiovascular disease claiming a life every 33 seconds according to the CDC, creating significant demand for bioprosthetic heart valves. Favorable reimbursement policies, research investments, and the presence of key biopharma companies strengthen the region’s leadership. Canada also contributes steadily, supported by government initiatives to enhance cardiac care and orthopedic treatment accessibility. Over the forecast period, North America is expected to maintain dominance, although growth rates will stabilize as the market matures.

Europe Bioprosthetics Market Insights

Europe accounted for roughly 29% share in 2024, making it the second-largest regional market. Demand is fueled by aging populations in Germany, Italy, and the U.K., coupled with high adoption of advanced cardiovascular interventions. Germany leads the European market due to its strong medical device manufacturing sector and ongoing government investment in regenerative medicine. The European Medicines Agency’s strict regulations ensure product quality, while rising patient preference for biocompatible implants supports stable growth. Western Europe remains at the forefront, while Eastern Europe shows potential through modernization of healthcare systems.

Asia Pacific Bioprosthetics Market Insights

Asia Pacific is the fastest-growing region, holding 23% market share in 2024 but projected to expand rapidly through 2032. China, India, and Japan drive growth, supported by rising healthcare investments, urbanization, and increasing awareness of advanced treatment options. China’s Healthy China 2030 initiative and India’s rising healthcare expenditures foster adoption of bioprosthetic implants. Japan contributes significantly with its advanced research in regenerative medicine and strong geriatric patient base. Asia Pacific is likely to close the gap with Europe during the forecast period, driven by affordability, local manufacturing, and expanding hospital infrastructure.

Latin America Bioprosthetics Market Insights

Latin America captured around 7% share in 2024, with Brazil and Mexico as the largest contributors. The region is experiencing growing demand for cardiovascular interventions and orthopedic bioprosthetics. However, access to advanced devices remains uneven due to disparities in healthcare infrastructure. Government-backed healthcare reforms and local partnerships with multinational firms are improving availability. The trend toward localized manufacturing is expected to lower costs and increase adoption in urban areas.

Middle East & Africa (MEA) Bioprosthetics Market Insights

MEA accounted for 5% share in 2024, but holds long-term potential. Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are investing in advanced cardiovascular care centers, creating demand for bioprosthetic valves and orthopedic implants. South Africa shows growing adoption due to increasing orthopedic procedures. However, much of Sub-Saharan Africa faces affordability and access challenges. As healthcare infrastructure strengthens, MEA is expected to grow steadily, albeit at a slower pace compared to Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape for Bioprosthetics Market:

Edwards Lifesciences Corporation

A global leader in bioprosthetic heart valves and transcatheter heart valve technologies, with a focus on improving patient survival and recovery outcomes.

-

In April 2024, Edwards expanded its U.S. production facility to increase supply of bovine pericardial heart valves, supporting rising demand for cardiovascular treatments.

Medtronic plc

A key player in cardiovascular implants, offering bioprosthetic valves and advanced tissue-engineered products.

-

In June 2024, Medtronic launched its next-generation porcine-based aortic valve in Europe, designed to reduce complications and extend implant durability.

Abbott Laboratories

Provides a wide range of cardiovascular devices, including bioprosthetic heart valves and structural heart innovations.

-

In February 2024, Abbott announced clinical trial success of its new tissue-based mitral valve replacement system, aiming for FDA approval in 2025.

CryoLife, Inc. (Artivion, Inc.)

Specializes in bioprosthetic valves, vascular grafts, and cardiac tissue processing.

-

In July 2024, CryoLife rebranded as Artivion and invested in R&D for xenograft-based implants to improve long-term performance.

LivaNova PLC

A provider of tissue-engineered implants and cardiovascular solutions with a focus on minimally invasive technologies.

-

In October 2023, LivaNova opened a new European innovation hub to accelerate the development of regenerative tissue technologies for bioprosthetics.

Key Players in the Bioprosthetics Market

-

Abbott Laboratories

-

CryoLife, Inc. (Artivion, Inc.)

-

LivaNova PLC

-

Boston Scientific Corporation

-

Zimmer Biomet Holdings, Inc.

-

Johnson & Johnson (DePuy Synthes)

-

Terumo Corporation

-

JenaValve Technology, Inc.

-

LeMaitre Vascular, Inc.

-

Hancock Jaffe Laboratories, Inc.

-

St. Jude Medical (Abbott subsidiary)

-

Aortech International plc

-

Colibri Heart Valve LLC

-

SynCardia Systems, LLC

-

Braile Biomedica

-

Meril Life Sciences Pvt. Ltd.

-

BioIntegral Surgical, Inc.

-

Corcym S.r.l

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.4 Billion |

| Market Size by 2032 | USD 14.5 Billion |

| CAGR | CAGR of 10.7% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Allograft, Xenograft) • By Application (Cardiovascular, Plastic surgery & wound healing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Edwards Lifesciences Corporation, Medtronic plc, Abbott Laboratories, CryoLife, Inc. (Artivion, Inc.), LivaNova PLC, Boston Scientific Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), Terumo Corporation, JenaValve Technology, Inc., LeMaitre Vascular, Inc., Hancock Jaffe Laboratories, Inc., St. Jude Medical (Abbott subsidiary), Aortech International plc, Colibri Heart Valve LLC, SynCardia Systems, LLC, Braile Biomedica, Meril Life Sciences Pvt. Ltd., BioIntegral Surgical, Inc., Corcym S.r.l. |