Paper Pigments Market Report Scope & Overview:

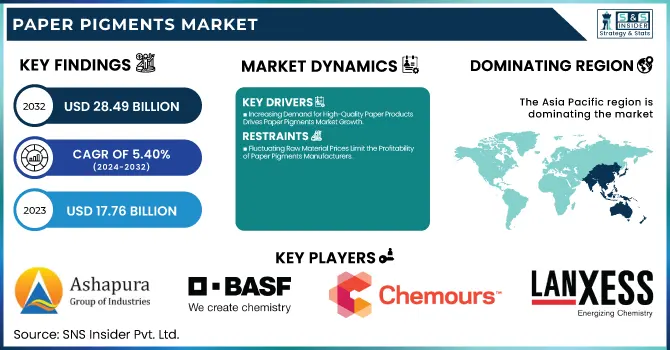

The Paper Pigments Market Size was valued at USD 17.76 Billion in 2023 and is expected to reach USD 28.49 Billion by 2032, growing at a CAGR of 5.40% over the forecast period of 2024-2032.

To Get more information on Paper Pigments Market - Request Free Sample Report

The Paper Pigments Market is transforming based on the dominant factors that drive its evolution. Supply Chain and Distribution Insights present the flow of raw materials, showing the roles played by main actors. Price Trends and Cost Analysis identify how the cost of materials influences general pricing strategies. The Impact of Trade Policies and Tariffs shows how policies shape market access and competition. Technological Advancements and Innovation are enabling the creation of sustainable, high-performance pigments. Production Utilization Rates and Capacities further disclose how effective producers can sustain growing demand. Such information, compiled in our report, gives an in-depth analysis of the market's pattern.

Paper Pigments Market Dynamics

Drivers

-

Increasing Demand for High-Quality Paper Products Drives Paper Pigments Market Growth

Growth of Paper Pigments Market is primarily driven by the rising consumption of high-quality paper products including printing, packaging and publishing. Among them, the increase in the use of coated papers that require high - grade pigments to match with the intended surface texture and decorative quality is growing. This need is even higher with the packaging industry where aesthetics, printability, and durability of the product are crucial. Industries aspire to deliver high-quality products to consumers, paving the way for high-performance pigments to improve the paper properties like brightness, smoothness, and opacity. Consequently, manufacturers are focusing more on supplying high-performance pigments that drive growing demand for premium paper products.

Restraints

-

Fluctuating Raw Material Prices Limit the Profitability of Paper Pigments Manufacturers

Increasing raw material price fluctuation continues to remain a challenge for the Paper Pigments Market. The costs of basic raw materials, including titanium dioxide, calcium carbonate, and kaolin, can fluctuate sharply because of things like geopolitical instability, the supply chain breakdowns, and changes in global demand. This volatility in price causes challenges for manufacturers to keep stable prices and margins. Prolonged high prices of raw materials can also exasperate high prices of products, stunting overall demand and competitiveness. In addition, the dependence on these ores gives high exposure for manufacturers to the risks of shortages or import/export restrictions, which also affect profitability and production capacity.

Opportunities

-

Growing Popularity of Digital Printing Opens New Avenues for Paper Pigments Market Growth

The increasing demand for digital printing, especially in advertisement, packaging, and publishing, encourages the Paper Pigments Market. Digital printing is a process of elective results, so it needs paper with high quality, good printability, and excellent opacity and color retention. With the constant development in digital printing technology, the requirement for high level pigments that can produce sharp, rich colors at an economical price, is also growing. Owing to this trend, innovative paper pigments which are specifically designed for digital printing process are anticipated to boost in demand. Manufacturers focused on digital-ready pigments and design products achieving optimal performance in digital printing applications can expect to earn dominant standard share over the forecast period.

Challenge

-

Raw Material Scarcity and Supply Chain Disruptions Impact Paper Pigments Production

The Paper Pigments Market is facing challenges such as a shortage of raw materials and disruption in supply chain. Titanium dioxide, kaolin, and calcium carbonate, which are all vital elements in the pigment industry, are mined from certain areas, which exposes the supply chain to various risks such as natural disasters, geopolitical issues, or trade restrictions. Limited availability of these raw materials may result in increased production costs and delays in manufacturing, ultimately impacting market supply. Due to these disruptions, the industry will have to adjust and diversify its supply strategy, offering them new funds, alternative raw materials, and developing supply chain strategies better designed to withstand these challenges.

Paper Pigments Market Segmental Analysis

By Source

In 2023, Natural pigments dominated the Paper Pigments Market which constituted about 54.4% of the total market share. The shift towards natural pigments is attributed to increased environmental consciousness and regulatory backing for sustainability. Agencies like the Environmental Protection Agency stress the need for green materials, which has made manufacturers turn toward natural solutions. As an example, carbon footprint reduction and recyclability improvement projects have driven demand for natural pigments from renewable resources. In line with this trend, companies, such as Omya and Imerys, have expanded their portfolios of natural pigments, showing their commitment to sustainability and playing a significant role in maintaining their leadership position in the market.

By Type

In 2023, titanium dioxide segment dominated the Paper Pigments Market, holding a market share of 36.7% in terms of revenue. The paper has been widely used for various applications especially for producing coated papers and packing because of its high opacity, brightness and durability. Titanium dioxide is a widely adopted product by manufacturers for its high performance for the aesthetic value it adds to the quality of the various printed products. Its predominance was further cemented by the recognition of its importance to meeting desired paper qualities by groups including the American Coatings Association. Moreover, the top producers, such as Chemours, have enhanced their production technologies to improve cost-effectiveness of titanium dioxide and cater to the surging applications.

By Application

In 2023, the coated paper segment dominated the Paper Pigments Market was which held a market share of 59.1%. Coated paper continues to dominate as it provides superior print quality, which is critical in advertising, packaging, and publishing application. Demand for quality printed products has increased as companies try to raise brand awareness and engage consumers. Coated paper plays a critical role to address the market demands, as per industry reports from the Printing Industries of America. Moreover, manufacturers like BASF, and Sibelco have also produced high-performance-enhancing coatings to optimize performance of paper, thus increasing the demand for coated paper in several industries.

By End-User

In 2023, the packaging segment dominated the Paper Pigments Market with the maximum market share of 40.2% and is attributed to the growing demand for paper-based packaging material by various end-use industries. This demand has been propelled by the shift towards sustainable packaging solutions, as consumers and regulators seek to reduce plastic waste. The increased adoption of paper-based packaging has been greatly supported by government initiatives encouraging the use of recyclable and biodegradable materials. The Sustainable Packaging Coalition and other similar organizations have spoken out in favor of a move to paper packaging to help align with environmental goals. Innovations have emerged like paper pigments that provides a power pack to the segment growth and the Stora Enso are one of the global players who is collaborated with innovative packaging solution.

Paper Pigments Market Regional Outlook

Asia Pacific region in dominated the Paper Pigments Market in 2023, with a market share of 45.3%. The region's rapid pace of industrialization, strong paper and packaging industries, and the growing demand for sustainable materials to drive this dominance. There are countries such as China and India that lead the way in producing paper that serves both domestic consumption and exports. Due to the country being the largest consumer of all paper pigments, while also benefitting from large-scale manufacturing and government incentives for the paper and packaging sectors, in the years leading up to 2030 Chinese growth stays strong. For example, China's stringent environmental regulations are driving the use of green paper colorants, which is expected to spur the growth of the market. In India, the growth of disposable income and the middle class is leading to the demand for high-end paper and packaging. Asia Pacific holds the dominant share of the Paper Pigments Market due to the region's extensive manufacturing base and increasing environmental awareness.

On the other hand, North America emerged as the fastest growing region in Paper Pigments Market in the forecast period. The region's swift development is driven by the increasing demand for premium coated paper and packaging solutions. Industries are increasingly required to adopt eco-friendly materials in use, for example, from the Green New Deal in the United States, paper pigments. Furthermore, the change from digital printing to sustainable packaging solutions in nations such as Canada is fuelling market growth. The advancement of paper pigments that meet consumers' demand for sustainability and performance is heavily focused on investments by leading companies in North America, including BASF and Minerals Technologies. These trends will contribute to the growth of the Paper Pigments Market, as the region works to ramp up its sustainability initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Ashapura Group (Kaolin, Calcined Kaolin)

-

BASF (Titanium Dioxide, Kaolin)

-

Chemours (Ti-Pure Titanium Dioxide)

-

Huber (Hubercarb WELLCARB, Minex)

-

Imerys (Kaolin, Ground Calcium Carbonate (GCC))

-

KaMin LLC / CADAM (KaMin Kaolin, CADAM Kaolin)

-

Kemira Oyj (Paper Chemicals, Coating Pigments)

-

LANXESS (Bayferrox, Hombitex)

-

Minerals Technologies Inc. (Precipitated Calcium Carbonate (PCC), Dolomitic Lime)

-

Mississippi Lime Company (Calcium Carbonate, Quicklime)

-

Omya (OmyaCal Calcium Carbonate, OmyaHydro Coating Fillers)

-

Sudarshan Chemical Industries Ltd. (Color Pigments, Organic Pigments)

-

Thiele Kaolin Company (Thiele Kaolin, Thiele Pigments)

-

Tronox Holdings plc (Tiona Titanium Dioxide, TiO2)

-

Venator Materials PLC (Huntsman Titanium Dioxide, Venator Pigments)

-

Aditya Birla Chemicals (Titanium Dioxide, Calcium Carbonate)

-

ECKART GmbH (Metallic Pigments, Special Effect Pigments)

-

Ferro Corporation (Inorganic Pigments, Organic Pigments)

-

J.M. Huber Corporation (HuberCal Calcium Carbonate, Minex)

-

WTi Pigments (White Pigments, Specialty Coatings Pigments)

Recent Highlights

-

October 2024: Sudarshan Chemical Industries acquired Heubach Group, the second biggest pigment company in the world, headquartered in Germany. Sudarshan had announced acquisition of the European business of speciality pigment firm for a consideration of $ 58 million.

-

March 2024: Vipul Organics was awarded a ₹7.15 crore contract by Tamil Nadu Newsprint and Papers Limited for the supply of pigment dyes. This contract highlighted Vipul Organics' dedication to catering to the growing market for superior pigment dyes within the paper sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.76 Billion |

| Market Size by 2032 | USD 28.49 Billion |

| CAGR | CAGR of 5.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Synthetic, Natural) •By Type (Titanium Dioxide, Calcium Carbonate [Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC)], Kaolin, Others) •By Application (Uncoated paper, Coated paper) •By End-User (Printing & Writing, Packaging, Newsprint, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF, Omya, Imerys, Minerals Technologies Inc., Chemours, Huber, Kemira Oyj, Thiele Kaolin Company, LANXESS, Ashapura Group and other key players |