POLYMER NANOCOMPOSITES MARKET KEY INSIGHTS:

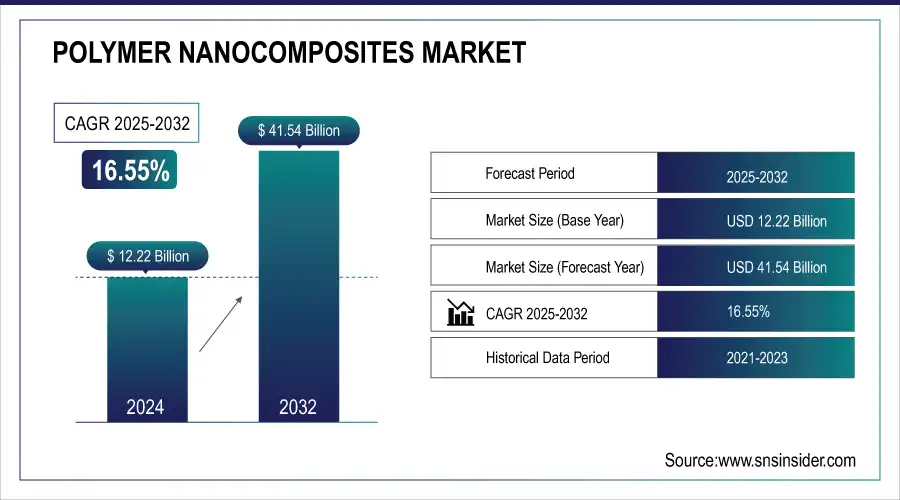

Polymer Nanocomposites Market was valued at USD 12.22 Billion in 2024 and is expected to reach USD 41.54 Billion by 2032 at a CAGR of 16.55% from 2025-2032.

The polymer nanocomposites market is experiencing significant growth, fueled by rising demand across industries such as automotive, aerospace, electronics, packaging, and energy. These advanced materials incorporate nanoparticles into polymer matrices, delivering enhanced mechanical, thermal, and electrical properties suitable for a wide range of applications. Governments worldwide are actively supporting the development of polymer nanocomposites, recognizing their potential in next-generation technologies. Japan’s Society 5.0 initiative and Integrated Innovation Strategy 2022 prioritize their use in flexible electronics and high-capacity batteries. Similarly, China’s Made in China 2025 initiative focuses on nanotechnology to achieve 70% domestic content in core materials, promoting sustainability and performance. In the U.S., programs like the National Nanotechnology Initiative and Nano2017 are driving R&D in automotive, energy, and semiconductor sectors.

Key technological advancements, such as the incorporation of graphene and carbon nanotubes for superior strength and conductivity, are revolutionizing the market. Bio-based nanocomposites are emerging as sustainable alternatives to traditional plastics, while innovations in nanocomposite 3D printing are transforming manufacturing processes. Companies like BASF and Evonik are introducing products tailored to sectors like electronics and electric vehicles, emphasizing thermal management and lightweight solutions. As sustainability and government funding drive innovation, the polymer nanocomposites market is poised for rapid expansion, offering versatile solutions for evolving industrial needs.

Polymer Nanocomposites Market Size and Forecast

-

Market Size in 2024: USD 12.22 Billion

-

Market Size by 2032: USD 41.54 Billion

-

CAGR: 16.55% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2019–2023

Get More Information on Polymer Nanocomposites Market - Request Sample Report

Polymer Nanocomposites Market Trends

-

Increasing adoption of lightweight polymer nanocomposites in automotive manufacturing to improve fuel efficiency and reduce emissions

-

Rising use of nanocomposites in electric vehicles for structural components, thermal management, and battery systems

-

Growing demand for high-performance materials in electronics with enhanced thermal conductivity and electrical properties

-

Expanding integration of graphene and carbon nanotubes to improve mechanical strength and conductivity

-

Rapid growth of consumer electronics and semiconductor miniaturization driving nanocomposite adoption

-

Emergence of bio-based and sustainable polymer nanocomposites as alternatives to conventional plastics

-

Advancements in nanocomposite-enabled 3D printing and additive manufacturing technologies

-

Strong government support and funding for nanotechnology research across the U.S., Europe, China, and Japan

Polymer Nanocomposites Market Growth Drivers:

-

Growing Need for Light-Weighting Materials in Automobile Industry.

As fuel efficiency and reduced emissions have moved to the forefront of automobile industry, the need for lightweight material such as polymer nanocomposite has gained importance. Nanocomposites have replaced traditional metal and heavier plastic-based materials in order to make the vehicle light in weight without affecting the strength of the structure. It has been found that nanocomposite contributes to cutting down 30% of vehicle's mass, which automatically translates into enormous fuel efficiency savings. 10% cut in vehicle weight suggests a 6-8% enhancement in fuel economy, according to a study by Department of Energy, USA.

While governments worldwide are reaching for ways to make the emission tap tighter still, focusing in part on targets such as the European Union's aspiration to achieve its objective of reducing carbon emissions by 55% by 2030, car manufacturers are becoming increasingly aggressive with their use of polymer nanocomposites as solutions. These materials are going to find a prominent position in the future course of electric vehicles (EVs), which would accelerate the need as the EV market grows.

-

High-performance material demand in the electronic industry.

The electronic industries are requiring more and more materials that show superior thermal, electrical, and mechanical properties. As such, polymer nanocomposites are becoming a necessity of this industry. As nanocomposite materials filled with graphene or carbon nanotubes, for example, actually improve the electrical conductivity and dissipation of heat in electronic devices like smartphones and laptops. In fact, the application of nanocomposites to electronics may lead to as much as 40% improvement in energy efficiency according to National Nanotechnology Initiative data in the U.S.

The miniaturization trend in the world has also prompted the application of nanocomposite materials for small, robust, and more efficient electronic components. As consumer electronics and high-tech industries, mainly in countries like China and Japan, continue to surge ahead, the demand for these high-performance materials will rise. The rate of consumption of polymer nanocomposites in the electronics sector is expected to be high mainly because of the immense investment made in semiconductor and smart device technology in most regions.

Polymer Nanocomposites Market Restraints:

-

The nanocomposite has relatively high manufacturing costs, which impose limitations on its widespread use.

The production of polymer nanocomposites is normally coupled with complex manufacturing processes and expensive raw materials, which can be graphene or carbon nanotubes. Such nanomaterials exhibit superior mechanical and thermal properties, but at a significantly higher price as compared to traditional polymers. For instance, graphene costs from USD 67,000 to USD 200,000 per ton. This creates a significant challenge for industries that operate with low profit margins, such as in packaging or consumer goods. In addition, a study reveals that nanocomposite production-high quality usually costs 25-30% more for small and medium-sized enterprises compared to conventional polymers.

Uniform dispersion of nanoparticles within the polymer matrix is technically challenging and requires sophisticated equipment and expertise involved in some fabrication processes. This further diminishes scalability, thus taking more time in production, amplifying costs even further. Moreover, the availability of raw materials is scarce in some regions, particularly outside the main manufacturing centers like China and the United States. This makes the price of the nanocomposites all the more volatile and challenging to estimate for the costs quoted by the manufacturers. Improvement in production technology and materials will be required only if this can reduce the cost and continue maintaining the superior properties of the nanocomposites.

Polymer Nanocomposites Market Segment Analysis:

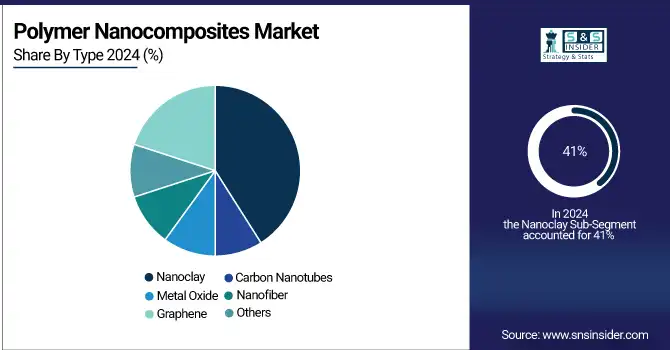

By Type

Nanoclay segment dominated the market in 2024 holding 41% market share. Primarily, nanoclay's excellent mechanical, thermal, and barrier properties make the polymers reliable for several applications in packaging, automotive, and more. Its stiffness, fire resistance, and low gas permeability made it a versatile material to be used with different industrial applications. Besides that, the relative ease of its availability and cost-effectiveness when compared with other nanomaterials make it even more dominant in terms of market presence.

By Application

The Automotive sector has the highest market share of 30% in the polymer nanocomposites market in the year 2024. Automobile industries have been one of the major consumers of polymer nanocomposites, especially when the material needs to be lightweight and stronger.

Nanocomposites stand out as an exceedingly promising solution as the world's automakers make efforts to reduce the weight of vehicles to improve fuel efficiency and decrease emissions. Materials such as carbon nanotubes and nanoclays are added to polymers to enhance performance characteristics that include tensile strength, thermal stability, and durability.

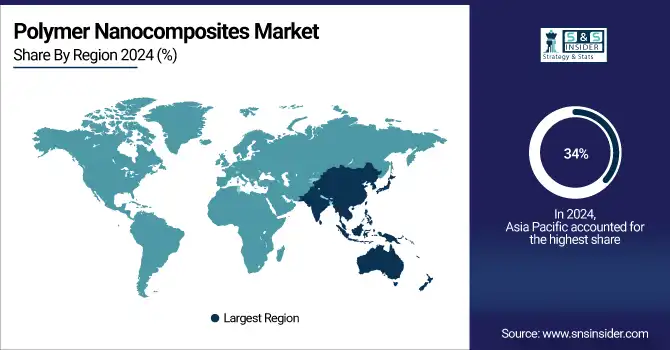

Polymer Nanocomposites Market Regional Analysis:

Asia Pacific Polymer Nanocomposites Market Insights

The Asia Pacific is expected to lead the polymer nanocomposites market with around 34% of overall market share in 2024. The reason for this domination is due to the huge presence of manufacturing facilities in countries like China, Japan, and South Korea. These countries hold large production systems for both automotive and electronics as well as packaging materials that represent high consumers of polymer nanocomposites. Demand is induced by government initiatives towards the promotion of advanced materials usage in such sectors.

Need Any Customization Research On Polymer Nanocomposites Market - Inquiry Now

Europe Polymer Nanocomposites Market Insights

Europe, however, is expected to expand at a fast growth rate during the review period. EU's strict environmental regulations drive adoption by substituting lightweight and recyclable materials with that of an older kind mainly in the automotive and packaging industries. Most such countries cut carbon footprints through sustainable material innovation, thus placing Europe as a growth market for polymer nanocomposites in the coming years.

North America Polymer Nanocomposites Market Insights

North America leads the polymer nanocomposites market due to strong automotive and electronics sectors, increased adoption of lightweight materials, and significant R&D investments. High demand for fuel-efficient vehicles, advanced electronics, and regulatory support for emission reduction drive the use of polymer nanocomposites across the U.S. and Canada.

Latin America (LATAM) and Middle East & Africa (MEA) Polymer Nanocomposites Market Insights

The LATAM and MEA regions are witnessing growing adoption of polymer nanocomposites in automotive, electronics, and industrial applications. Emerging manufacturing hubs, urbanization, and government initiatives to support sustainable and energy-efficient technologies contribute to market growth, with Brazil, Mexico, UAE, and Saudi Arabia leading regional demand.

Polymer Nanocomposites Market Key Players:

-

Arkema (Nanostrength, Graphistrength)

-

BASF SE (Ultramid, Ultradur)

-

Cabot Corporation (Graphene Nanoplatelets, Fumed Silica)

-

Dow Chemical (INFUSE, ENGAGE)

-

Dupont (Kevlar, Tyvek)

-

Evonik Industries (AEROSIL, AERODISP)

-

InMat Inc. (InMat X-Nano, InMat Elastomer)

-

Nanocyl S.A. (PLASTICYL, EPOCYL)

-

Nanoshel LLC (Nanoclay, Nanotubes)

-

Nanophase Technologies Corporation (NanoUltra, NanoMetalox)

-

RTP Company (RTP 300 Series, PermaStat)

-

Showa Denko (Nanodiamond, Graphene Oxide)

-

Sigma-Aldrich (Graphene, CNTs)

-

Sumitomo Chemical (Nanocomposite Sheets, Polymer Additives)

-

Zyvex Technologies (Epovex, Zyvex Carbon NanoFiber)

-

PolyOne Corporation (Polymax, LubriOne)

-

Sabic (ULTEM, LNP)

-

Nanotech Industrial Solutions (NanoLub, Nanodiamonds)

-

Celanese Corporation (Celstran, Hostaform)

-

Honeywell International (Spectra, Shield)

Competitive Landscape for Polymer Nanocomposites Market:

BASF SE is a global chemical leader headquartered in Ludwigshafen, Germany, specializing in advanced polymer nanocomposites for automotive, electronics, and construction sectors. Their portfolio includes Ultramid® polyamide and Ultradur® polybutylene terephthalate, enhancing material strength, thermal stability, and flame retardancy. BASF’s innovations support lightweighting, energy efficiency, and regulatory compliance in various applications

-

In October 2024, BASF's Petrochemicals division completed upgrades for Superabsorbent Polymers (SAP) at its Freeport, Texas site, enhancing production rates and process optimization.

Cabot Corporation, headquartered in Boston, Massachusetts, is a global leader in specialty chemicals and performance materials. The company specializes in advanced nanomaterials, including carbon nanotubes (CNTs), carbon nanostructures (CNS), and conductive additives, which enhance the mechanical, thermal, and electrical properties of polymers. These innovations support applications across automotive, electronics, packaging, and energy sectors. Cabot's commitment to sustainability is evident through its eco-friendly solutions and ongoing investments in nanotechnology research and development

-

In May 2024, Cabot Corporation introduced REPLASBLAK® universal circular black masterbatches, utilizing certified sustainable materials to enhance the circularity of their products.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.22 Billion |

| Market Size by 2032 | USD 41.54 Billion |

| CAGR | CAGR of 16.55% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Carbon Nanotubes, Metal Oxide, Nanofiber, Nanoclay, Graphene, and Others), • By Application (Packaging, Automotive, Electronics & Semiconductor, Aerospace & Defense, Construction, Coatings, Energy, and Others) • By Polymer (Polypropylene, Polyamide, Epoxy Resin, Polyethylene) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Arkema, BASF SE, Cabot Corporation, Dow Chemical, Dupont, Evonik Industries, InMat Inc., Nanocyl S.A., Nanoshel LLC, Nanophase Technologies Corporation, RTP Company, Showa Denko, Sigma-Aldrich, Sumitomo Chemical, Zyvex Technologies, PolyOne Corporation, Sabic, Nanotech Industrial Solutions, Celanese Corporation, Honeywell International. |