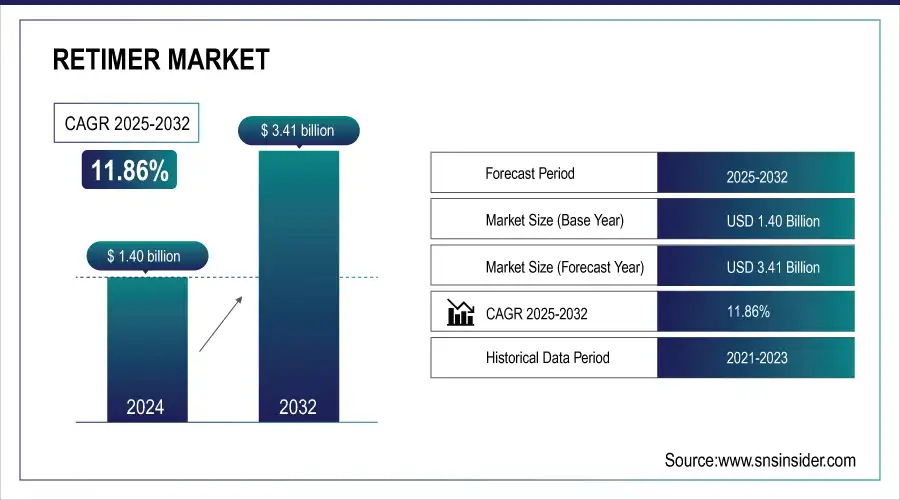

Retimer Market Size & Growth:

The Retimer market size was valued at USD 1.40 billion in 2024 and is expected to reach USD 3.41 billion by 2032 and grow at a CAGR of 11.86% over the forecast period 2025-2032.

To Get more information On Retimer Market - Request Free Sample Report

The global retimer market is experiencing significant growth, propelled by the increasing demand for high-speed data transmission in sectors, such as data centers, consumer electronics, and artificial intelligence workloads. Innovations in interconnect standards, including PCIe, USB, and DisplayPort, are driving this adoption. Furthermore, the ongoing digitalization and expansion of cloud infrastructure are further solidifying the market's importance across various industries globally.

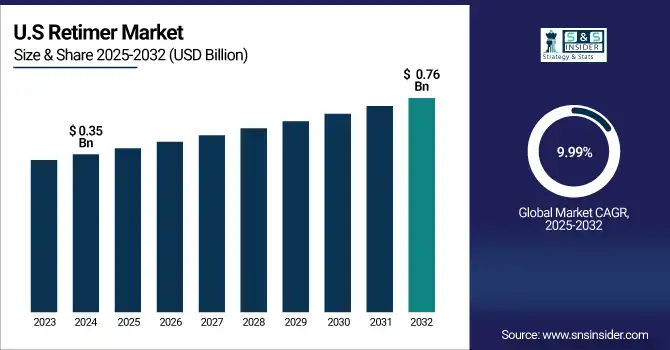

The U.S. retimer market size was USD 0.35 billion in 2024 and is expected to reach USD 0.76 billion by 2032, growing at a CAGR of 9.99% over the forecast period of 2025–2032.

U.S. retimer market is witnessing substantial growth, fueled by the development of data centers, the embrace of next-generation computing standards, and a heightened demand for high-speed connectivity. With considerable investments in artificial intelligence, cloud services, and semiconductor technology, the U.S. continues to be a pivotal center for technological progress, promoting the widespread use of retimers in enterprise, telecommunications, and consumer electronics.

Retimer Market Dynamics:

Key Drivers:

-

Rising Demand for High-Speed Data Transmission Across Cloud, AI, and 5G Applications Boosts the Retimer Market Growth

The growing dependence on data-hungry applications including cloud computing, AI workloads, and 5G infrastructure is fueling the need for high-speed, low-latency data transmission. Retimers are essential for maintaining signal integrity and expanding reach in high-speed interconnects such as PCIe and USB. As businesses and hyperscalers spend on next-generation hardware, retimers are emerging as a key element in delivering peak performance, scalability, and system reliability, thus fueling market growth in all global data infrastructure ecosystems.

Astera Labs demonstrated a PCIe 6.0 SSD reaching 27 GB/s, emphasizing massive storage performance gains for data center workloads.

Restraints:

-

Compatibility Issues with Legacy Systems and Mixed Signal Environments Limit the Adoption of Retimers in Existing Infrastructure

Most organizations work with legacy hardware and mixed signal environments where it is technically complex to incorporate retimers. Systems could either not support newer high-speed protocols or have physical layout issues that make retimer deployment cumbersome. Therefore, retrofitting older systems with retimers tends to involve considerable redesign or replacement of components, adding cost and complexity. This compatibility hurdle deters upgrades in some markets, confining the wider adoption of retimer solutions on mature or cost-conscious infrastructures.

Opportunities:

-

Expansion of PCIe 6.0 and USB4 Standard Adoption Creates New Opportunities for Retimer Integration Across Diverse Industry Applications

New interconnect standards such as PCIe 6.0 and USB4 bring much more bandwidth, but also comes with much more signal degradation due to higher frequencies. This makes the retimer to preserve the signal integrity of over long traces and connectors as the critical requirement. With an acceleration of industries deploying these modern standards for AI, gaming, edge computing, and automotive applications, there is expected to be a proliferation of these retimers as the demand for such products rises, granting high growth potential for suppliers specializing in standalone, next-generation signal conditioning solutions.

Micron's PCIe 6.0 SSD achieved 27.14 GB/s read speeds, surpassing expectations and highlighting significant performance gains for AI and HPC workloads.

Challenges:

-

Supply Chain Volatility and Semiconductor Shortages Pose a Significant Challenge to Retimer Market Stability and Timely Delivery

The international semiconductor supply chain is still exposed to geopolitical tensions, natural disasters, and material shortages as sources of disruption. Retimers, as precision ICs, tend to be dependent on advanced packaging and foundry capacity that can be highly concentrated in particular regions, such as East Asia. Any disruption in wafer fabrication, testing, or component sourcing can lead to shipment delays or price instability. Such uncertainty renders it challenging for OEMs to obtain dependable supply, making it hard for market growth and long-term planning.

Retimer Market Segmentation Outlook:

By Function

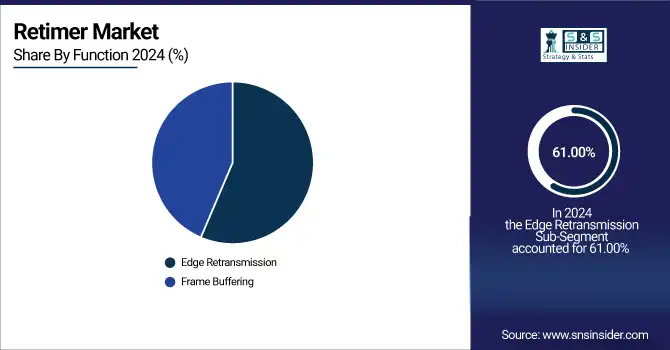

The Edge Retransmission segment is the dominated in retimers market, with a commanding 61.00% revenue share in 2024, fueled by increasing demand for signal integrity within high-speed interconnects, such as PCIe, USB4, and DisplayPort. Industry-leading players, such as Texas Instruments and Renesas have launched sophisticated retimer solutions with edge retransmission optimization to counteract signal degradation. These solutions are finding growing use in servers, laptops, and network equipment, making them indispensable for digital infrastructure today and further solidifying this segment's dominance in the international market.

The Frame Buffering segment will register the fastest CAGR of 12.64% over 2025-2032, driven by the growth in AI inference workloads, real-time video processing, and immersive gaming experiences. Parade Technologies and Analogix have introduced frame buffering-enabled retimers to manage latency-constrained applications in cutting-edge displays and GPUs. With data flow management becoming increasingly important within ultra-low latency environments, frame buffering becomes a cornerstone for ensuring signal reliability, driving the high growth rate in this segment of the market.

By Deployment Mode

The On-premises segment dominated the highest 66.82% market share in 2024, there are high-speed and low-latency requirements for signal processing in data centers and enterprise systems. Industry leaders such as Broadcom and Intel have introduced retimer solutions that preserve signal integrity and enhancing data transmission capabilities within on-premises server infrastructure.

The Cloud segment is growing the fastest, with an estimated CAGR of 12.72% between 2025 and 2032, as cloud service providers increase to support the needs of AI, big data, and IoT applications. Retimers companies, including Microchip Technology and Analog Devices have launched cloud-optimized retimer solutions that improve signal clarity and minimize latency in cloud infrastructures. This increase in cloud deployments is fueling the demand for retimers to provide high-quality, loss data transmission, playing a key role in the growth of the segment.

By Application

The Video Conferencing segment dominated the highest revenue share of 52.81% in 2024 due to the growing global trend towards remote working and virtual communication. Cisco and Logitech have introduced sophisticated video conferencing solutions with retimers, which provide unbroken video streams with negligible signal distortion. Retimers are essential in ensuring signal integrity in the transmission of high-definition video, especially in areas where real-time data exchange is necessary, and thus securing their place in improving performance in the video conferencing industry.

The Live Streaming segment is experiencing the fastest growth, with an estimated CAGR of 12.78% during 2025-2032, driven by increasing demand for high-quality live video broadcasts. AJA Video Systems and Blackmagic Design, among others, have launched retimer products specifically optimized for live streaming to ensure error-free video streaming, cutting latency and signal loss. As live streaming sites grow, retimers are now becoming essential in providing quality experience to users, driving the fast growth of the segment in the retimer industry.

By Industry

The media and entertainment segment dominated the largest market share of 59.62% demand for high-speed, high-resolution video workflows is increasing. For example, Avid Technology and Evertz Microsystems have started offering high-end broadcast equipment utilizing retimers to facilitate 4K/8K editing and live production. Retimers are crucial to reduce latency and maintain signal integrity in video interfaces, which is critical for smooth, high-quality video in vibrant entertainment settings.

The Healthcare segment is projected to expand at the fastest CAGR of 13.65% during 2025-2032 due to the digitalization of medical imaging, robotic surgeries, and real-time diagnostics. GE Healthcare and Philips have included sophisticated data transfer technology using retimers in their medical equipment to ensure high-resolution imaging and data integrity. Retimers guarantee efficient, quick transmission of signals accurately in life-critical applications with improved performance and safety and more crucial with every passing day as the face of digital healthcare evolves.

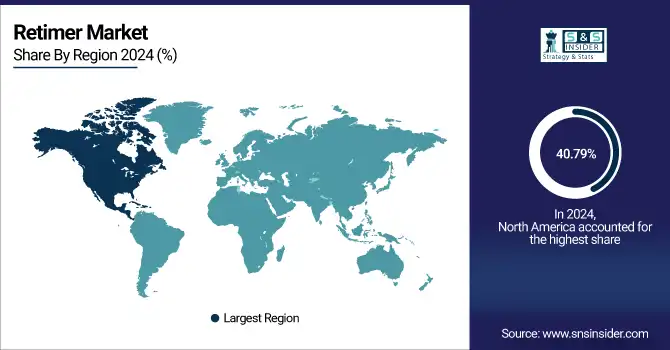

Retimer Market Regional Analysis:

North America dominated the retimer market share of 40.79% in 2024 attributed to the high technological advancement, well-established cloud infrastructure and evolved data center build. Firms such as Broadcom and Astera Labs as well have introduced higher speed retimer solutions for PCIe and CXL standards to serve the increasing need for high-speed interconnect in the region. The region’s expertise in AI, enterprise computing and 5G innovation underscores the importance of retimers in ensuring signal integrity and system performance in a variety of applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. holds the largest share in the North American market, which can be attributed to the development of the semiconductor industry and presence of data centers, increasing demand for high-speed computing technology, and development of leading market players including Intel, Broadcom, and Texas Instruments.

The Asia Pacific market is expected to expand at the fastest CAGR of 13.29% during the period 2032, driven by strong growth in consumer electronics, automotive technology, and hyperscale data centers. Renesas Electronics and Montage Technology have designed region-specific retimer products that are compatible with both PCIe and CXL standards. As nations such as China, Japan, and South Korea move faster with digital infrastructure and 5G deployment, high-speed signal integrity solutions drive the APAC dominance of retimer market growth.

-

The China holds the largest share in the Asia Pacific market, is influenced by its huge electronics manufacturing industry, expanding 5G & data center businesses and government led technology initiatives. Local businesses and global alliances also help bolster China’s role as the engine of regional growth.

The Europe market is projected to grow at a stable rate, considering, the increasing demand for high-speed data transmission and expanding data center investments, and automotive and industrial sectors. With the proliferation of AI, IoT, and automation, along with adoption of AI, IoT and automation, retimers are essential to maintain signal integrity and improve performance across a broad range of high-speed communication applications.

-

Germany leads the European market based on its cutting-edge electronics, automotive, and industrial automation industries, as well as robust investments in data centers and high-speed computing infrastructure enabling signal integrity solutions.

Middle East & Africa restrimer market is led by UAE and Saudi Arabia due to increasing technological advancements, data center investment and extensive telecom networks. Within Latin America, Brazil leads the way, driven by digital transformation, tech investments and demand for high-speed communications solutions.

Retimer Companies are:

Major Key Players in Retimer Market are Montage Technology, Parade Technologies, Rambus, Ranesas Electronics, Rohde Schwarz, Silicon Labs, Synopsys, Texas Instruments, VIAVI, Xilinx.

Recent Development:

-

November 2023, Renesas launched its USB 3.1 Gen 2 retimer, aiming to improve data transfer speeds and reduce latency for USB applications in consumer electronics and computing devices.

-

March 2024, Broadcom introduced the industry's first 5nm PCIe Gen 5.0/CXL 2.0 and PCIe Gen 6.0/CXL 3.1 retimers, offering low power solutions and enhanced efficiency for AI infrastructure. These retimers, in combination with Broadcom's PEX series switches, constitute the industry's first end-to-end PCIe portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.40 Billion |

| Market Size by 2032 | USD 3.41 Billion |

| CAGR | CAGR of 11.86% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Function (Edge Retransmission, Frame Buffering) •By Deployment Mode (Cloud, On-premises) •By Application (Video Conferencing, Live Streaming, Video Surveillance) •By Industry (Media and Entertainment, Education, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Montage Technology, Parade Technologies, Rambus, Ranesas Electronics, Rohde Schwarz, Silicon Labs, Synopsys, Texas Instruments, VIAVI, Xilinx. |