RF-Over-Fiber Market Size & Trends:

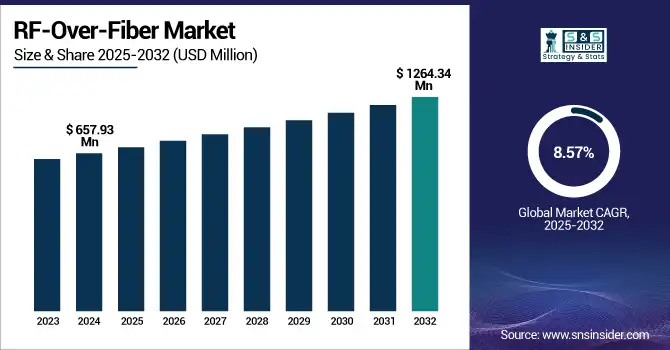

The RF-Over-Fiber Market Size was valued at USD 657.93 million in 2024 and is expected to reach USD 1264.34 million by 2032 and grow at a CAGR of 8.57% over the forecast period of 2025-2032.

To Get more information on RF-Over-Fiber Market - Request Free Sample Report

The global RF Over Fiber market is experiencing strong growth owing to the growing demand for high-speed data transmission, growth in fiber optic technology, and the rollout of 5G networks. The telecommunications, broadcasting, defense, and healthcare sectors are embracing RFoF solutions for their high-performance, low-latency, and cost-saving communication requirements, fueling the market's growth across different geographies.

In 2024, RFOptic launched its RFoF Ultra series supporting frequencies up to 18 GHz for electronic warfare and 5G testing, alongside expansion into the U.S., India, and EMEA highlighting growing global demand and industry-wide adoption.

The U.S. RF Over Fiber Market size was USD 160.47 million in 2024 and is expected to reach USD 265.23 million by 2032, growing at a CAGR of 6.54% over the forecast period of 2025–2032.

The U.S. RF Over Fiber market is on the cusp of growth as industries look to enhance data transmission efficiency and minimize latency. The use of RFoF technologies is gaining momentum in sectors, such as telecommunications, military, and healthcare, propelled by the demand for reliable, high-speed communication systems. Furthermore, the growth of 5G infrastructure also contributes to the growing demand for RF over fiber solutions.

In March 2024, the U.S.-based Broadcom launched Bailly, the industry’s first 51.2 Tbps co-packaged optics Ethernet switch, delivering 70% power savings and supporting scalable AI and data center applications across global markets.

RF-Over-Fiber Market Dynamics:

Key Drivers:

-

Adoption of 5G Networks and Demand for High-Speed Data Transmission Drive Market Growth

As telecom service providers deploy 5G networks, they require high-speed, low-latency data transmission technology that RFoF technology delivers. This need is heightened in metropolitan areas and crowded areas, where dependable and higher speed communications systems are necessary for consumers and businesses. RFoF systems address the aforementioned requirements by providing transparent and high-capacity transmission, and it can be expected to improve network performance as well as to enable applications such as IoT, augmented reality, and self-driving cars.

Restraints:

-

Regulatory and Compliance Challenges Impeding the Widespread Deployment of RF Over Fiber Technologies

Inconsistent communication technology standards in different locations and regions make it difficult to construct RFoF networks. The airwaves that 5G technologies use require a company to sort through, and comply with, a jungle of regulations concerning spectrum licensing, environmental impact and safety criteria. Such regulatory barriers, in addition to adding significant cost and time to market, also introduce uncertainty for businesses that wish to expand into new areas and regions, slowing down the adoption and growth of RFoF solutions.

Opportunities:

-

Rising Demand for Remote Connectivity Solutions in Rural and Underdeveloped Areas Fuels Market Potential

The RF Over Fiber market opportunities is increasing demand for high-speed, reliable internet connectivity in remote and underdeveloped areas. Governments and private companies are committing more to network buildouts in the digital divide, and RFoF systems are a way to get a high-end solution for a relatively low-end cost. That RFoF technology can transmit high volumes of data over long distances with little loss of signal, makes it the ideal solution for remote areas, offering cost-effective and reliable high-speed data communications where broadband infrastructure is either unavailable or not economically feasible to indoctrinate, particularly in remote regions of Africa and the Asia Pacific.

Challenges:

-

Technological Limitations and Complexities in Integration with Existing Legacy Systems Slow RF Over Fiber Adoption

The global market is the technical limitations and complexity associated with integrating RFoF systems with traditional legacy communication networks. Most industries, especially in the established markets, such as defense and telecommunications still use outdated systems that are not compatible with the latest RFoF technologies. Replacing these systems is an enormous time, monetary and labor intensive venture, which in some instances would need construction of new infrastructure. This slow trajectory to seaming can also act as a limitation on market development, with some firms reluctant to embrace new technologies before all of their existing systems are upgraded and compatible.

RF-Over-Fiber Industry Segmentation Analysis:

By Technology

The Digital RF Over Fiber segment dominated with the highest market share of 47.36% in 2024, due to its support for improved data accuracy and noise immunity in high-bandwidth applications. The segment enjoys swift technological developments and increasing demand in broadcasting and defense applications. Interestingly, firms including RFOptic and ViaLite have introduced advanced digital RFoF modules, including automatic gain control and wideband systems, that enhance signal reliability. These advances consolidate the digital segment's status as a prime mover in the overall RF Over Fiber market growth.

The Hybrid RF Over Fiber segment is also expected to grow with the fastest CAGR of 9.67% over 2025-2032, fueled by its ability to support both analog and digital signals over a common infrastructure. Its hybrid nature is becoming increasingly popular in military communication and smart cities networks. Optical Zonu's introduction of modular hybrid RFoF systems and HUBER+SUHNER's incorporation of hybrid fiber solutions into defense-grade networks are prime examples of strategic innovations. Such developments are facilitating wider implementation and augmenting the role of hybrid technology in determining the market's future.

By Application

The telecommunication segment dominated the RF Over Fiber Market with the highest revenue share of about 43.49% in 2024 due to the rising demand for high-bandwidth and long-distance signal transmission across expanding 5G networks and fiber-optic infrastructure. RF over fiber solutions offer superior performance with minimal signal loss and enhanced reliability, making them ideal for supporting dense telecom networks. Increasing investments in telecom infrastructure modernization and growing mobile data traffic further fuel segment dominance, ensuring sustained demand from global telecom operators.

The Broadcasting segment is expected to witness the fastest CAGR of 9.92% between 2025 and 2032 due to its adaptability to combine analog and digital signal transmission. This is driven by recent product advancements. In June 2024, NEC Corporation created an affordable radio-over-fiber system with a 1-bit fiber transmission technique that supports stable millimeter-wave communication networks over 5G/6G. This technique enables high-frequency analog signals to be transmitted through a low-cost electrical-to-optical converter, making it easy to build small and low-cost distributed antenna units. These developments underscore the growing importance of the segment in the changing market scenario.

By End-User

The Service Providers segment dominated the in 2024 with the largest RF Over Fiber market share of 57.98%. This prevalence is attributed to the growing penetration of RFoF systems in cellular backhaul, satellite ground stations, and broadband systems. RF over fibers companies, such as Emcore have even bolstered their RFoF product lines to assist telecos in densifying their optical transmission modules. These advances have enabled vendors to improve the quality of signals transmitted over long spans, enhancing the significance of RF Over Fiber within today's communication systems.

The Healthcare Institutions segment is estimated to the fastest CAGR of 9.77% from 2025 to 2032, due to its capabilities to serve the demands of both traditional and next-gen network requirements in domains such as government, defense, and telecom. For instance, DEV Systemtechnik has created hybrid RFoF systems that can be tailored to operators’ individual needs and are optimized for multi-service integration to enable greater network flexibility at lower CAPEX costs. These are the drivers behind the increased growth of this segment and the increasing importance that it has within the growing RF Over Fiber ecosystem.

By Component

The Transmitter segment dominated as the highest contributor with 42.93% share in 2024, as this component is instrumental for signal modulation and optical conversion in telecom, broadcasting, and defense industry. The segment has experienced substantial advances, such as the introduction of compact high-frequency transmitters tailored to 5G and satcom applications. For instance, APITech recently broadened its line of RF-over-fiber transmitters with low-noise, wideband options for military applications. Such developments bring your attention to the transmitter’s instrumental role in high-performance, long-distance optical communication.

The Optical Amplifier segment is expected to expand with the fastest CAGR of 9.43% during the period of 2025-2032, driven by the increasing need to preserve signal strength over long fiber links, particularly in large-scale infrastructure and aerospace applications. Firms, such as II-VI Incorporated have upgraded their EDFA product line to enable coherent optical systems, which has led to greater adoption in high-capacity RFoF links. These developments are driving the segment's growth and solidifying its pivotal position in enhancing signal integrity in the RF Over Fiber ecosystem.

RF-Over-Fiber Market Regional Outlook:

North America dominated the radio frequency over fiber market with a 38.91% market share, due to the rising demand for high-performance communication solutions among telecom, defense, and broadcasting industries. Firms, such as Optelian introduced next-generation RFoF systems optimized for high-capacity transport and edge networks. Moreover, Corning's new fiber optic cables optimized for high-speed data transmission have played a key role in growing North America's fiber infrastructure. Such developments strengthen the region's leadership in the RF Over Fiber market.

The U.S. dominated the North American market due to its superior infrastructure, massive-scale 5G and telecom initiatives, high defense and aerospace investments, and the large presence of big industry players catalyzing innovations and fiber-optic technology uptake.

Asia Pacific is expected to grow at the fastest CAGR of 10.00% over 2025-2032 with huge urbanization drives and high-density 5G deployments. The likes of Huawei have built disruptive RF Over Fiber solutions for high-performance 5G networking, while Japan-based Fujikura launched leading-edge fiber optic amplifiers for supporting next-gen communication. These advances, combined with investments in smart cities and broadband infrastructure, make Asia Pacific a rapidly expanding market for RF Over Fiber technology.

China dominated in the Asia Pacific market due to its swift technological advances, huge government investment on 5G and smart city projects, and the existence of major telecom players. This has led to extensive use of RF over fiber products in different industries.

The market in Europe is expanding, as it is concentrating on improving communication infrastructures for 5G and defense. Countries like Germany, France, and the U.K. are building out fiber optic to meet the increased demand for high-speed data delivery. Evolution (Gain) With rising application in telecommunication, broadcasting military etc., Europe is going to offer a great traction to RF Over Fiber market over the forecast period.

Germany dominated the market in Europe due to its robust industrial ecosystem, high-speed fiber network build-out, and government-supported digital initiatives. Its dominance in automobile and defense technology further drives RF over fiber growth in key communication and sensing applications.

The Middle East & Africa market is dominated by the UAE and Saudi Arabia, with the latter being spurred by investment in defense and smart infrastructure. In Latin America, Brazil is the leader fueled by increased telecom demand and digital transformation initiatives, complemented by rising adoption of fiber-optic communication technologies in major industries.'

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Major players in RF-Over-Fiber Market are Coherent Corp., HUBER+SUHNER AG, EMCORE Corporation, G&H Group, SEIKOH GIKEN CO., LTD, Broadcom Inc., DEV Systemtechnik GmbH, Global Foxcom, RF Optic Ltd., and Syntonics LLC.

Recent Developments:

-

February 2024, RFOptic launched its new Automatic Level Control (ALC) feature, enhancing its RF over fiber systems to support frequencies up to 6 GHz. This advancement allows for improved signal integrity by automatically adjusting the output levels of RF signals, ensuring optimal performance even in varying conditions.

-

December 2024, HUBER+SUHNER launched the RF-over-Fiber 2300 series, featuring ultra-low latency and an extended frequency range up to 40 GHz. This series supports applications in 5G, satellite communications, and radar systems, providing enhanced performance for high-frequency signal transmission.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 657.93 Million |

| Market Size by 2032 | USD 1264.34 Million |

| CAGR | CAGR of 8.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Analog RF Over Fiber, Digital RF Over Fiber, Hybrid RF Over Fiber) • By Application (Telecommunication, Broadcasting, Military and Aerospace, Medical, Industrial) • By End User (Service Providers, Telecom Operators, Government and Defense, Healthcare Institutions) • By Component (Transmitter, Receiver, Optical Amplifier, Fiber Optic Cable) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Coherent Corp., HUBER+SUHNER AG, EMCORE Corporation, G&H Group, SEIKOH GIKEN CO., LTD, Broadcom Inc., DEV Systemtechnik GmbH, Global Foxcom, RF Optic Ltd., Syntonics LLC. |