Tilt Sensor Market Key Insights:

Get More Information on Tilt Sensor Market - Request Sample Report

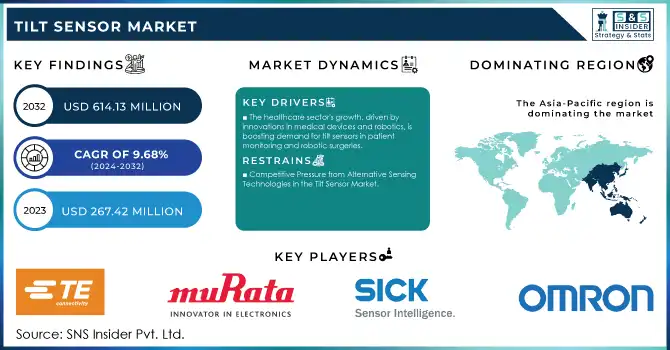

The Tilt Sensor Market Size was valued at USD 267.42 Million in 2023 and is expected to reach USD 614.13 Million by 2032 and grow at a CAGR of 9.68% over the forecast period 2024-2032.

The tilt sensor market is advancing rapidly, driven by its pivotal role in smart cities and infrastructure development initiatives. These sensors are crucial for structural health monitoring (SHM), enabling real-time tracking of inclinations and movements in bridges, dams, and buildings, ensuring safety and maintenance. Smart cities increasingly rely on IoT-powered sensors, such as tilt sensors, for diverse applications including smart grids, transportation systems, and healthcare. For instance, Japan's smart city projects use tilt sensors for disaster monitoring and intelligent transportation, underscoring their growing relevance. The Internet of Things integrates billions of devices into smart city ecosystems, facilitating cost-efficient, real-time data collection and management. Cities like Singapore leverage IoT for waste management and environmental sustainability, while Helsinki’s smart grid achieved a 15% reduction in energy consumption. IoT also enhances disaster preparedness, with 23 UN countries using early warning systems that protected 93.63% of at-risk populations.

The combination of IoT and Artificial Intelligence amplifies the utility of tilt sensors, enabling predictive analytics, efficient resource management, and anomaly detection. AI-powered insights derived from tilt sensor data ensure better urban planning and risk mitigation. Integration with IoT networks supports comprehensive urban analytics, as seen in Berlin's mobility services fostering sustainable transportation. Smart city projects align with global sustainability goals, contributing to the UN Sustainable Development Goals like SDG 11 for sustainable communities. Tilt sensors, supported by advancements in IoT and AI, are integral to this transformation, reinforcing their role in creating adaptive, resilient urban environments. These trends highlight the tilt sensor market's promising trajectory in diverse and innovative applications.

Tilt Sensor Market Dynamics

Drivers

-

The healthcare sector's growth, driven by innovations in medical devices and robotics, is boosting demand for tilt sensors in patient monitoring and robotic surgeries.

The rapid expansion of the healthcare sector is a major driver for the tilt sensor market. Tilt sensors are becoming increasingly integral in medical devices, including patient monitoring systems, robotic surgical instruments, and prosthetics, where they enhance precision and functionality. These sensors are particularly important for movement detection and alignment, such as in robotic surgeries, where they monitor slight movements to improve surgical accuracy and reduce risks. Tilt sensors also play a crucial role in monitoring patient posture, ensuring timely interventions in critical care settings. The growth of smart healthcare systems, advancements in medical robotics, and the focus on patient-centered care are expected to significantly drive the demand for these sensors. Additionally, ongoing technological innovations and the increasing complexity of medical devices, such as the development of specialty pharmacy solutions and robotics, further fuel the need for highly accurate tilt sensors. As the healthcare industry grows, particularly with a focus on improving patient outcomes and operational efficiencies, the market for tilt sensors is projected to expand across various healthcare applications.

Restraints

-

Competitive Pressure from Alternative Sensing Technologies in the Tilt Sensor Market

The tilt sensor market faces significant challenges from competition with alternative sensing technologies, such as MEMS sensors, accelerometers, and gyroscopes, which offer similar motion-sensing capabilities at lower costs. These technologies are increasingly adopted across industries like automotive, robotics, and industrial automation due to their compactness and affordability. For instance, MEMS tilt sensors are being integrated into applications like Tilt Tray Sorters, where traditional tilt sensors once dominated. Additionally, hybrid sensing solutions that combine tilt detection with other functionalities like acceleration and orientation are gaining popularity, offering a more cost-effective and versatile option in fields like mobile devices and robotics. The rise of electrolytic tilt sensors with thin-film technology also contributes to cost reductions and improved accuracy, intensifying the competition for traditional tilt sensors. These factors pressure manufacturers to innovate, focusing on increasing precision, durability, and lowering production costs to stay competitive in the market.

Tilt Sensor Market Segment Outlook

by Housing Material Type

In 2023, the metal housing segment captured the largest share of the tilt sensor market, accounting for around 63% of the revenue. This significant market share is driven by the superior durability, strength, and ability of metal materials to endure extreme conditions. Metal tilt sensors are highly valued in sectors such as automotive, aerospace, industrial automation, and geophysical monitoring due to their resilience to mechanical stress, vibrations, and temperature variations. The metal casing ensures long-term operational reliability in harsh environments, which is essential for precise measurements in critical applications like surveying equipment and machine tool leveling. Moreover, metals are easily machinable, allowing for customized shapes and sizes, ensuring that these sensors maintain high performance in demanding conditions, making them ideal for complex industrial applications.

by Technology

In 2023, the MEMS segment dominated the tilt sensor market, capturing around 59% of the revenue. This dominance is driven by the compact size, low power consumption, and high precision of MEMS-based tilt sensors. MEMS sensors combine accelerometers and gyroscopes to offer reliable motion detection and are widely used in automotive, robotics, and consumer electronics applications. Their small form factor and affordability make them ideal for applications requiring integration into space-constrained devices such as smartphones, wearables, and drones. Furthermore, MEMS technology is integral in providing high-performance solutions for industries like geophysics, industrial automation, and medical devices. With the increasing demand for miniaturized and cost-effective sensing solutions, MEMS tilt sensors continue to lead the market, ensuring their strong growth trajectory in the coming years.

Tilt Sensor Market Regional Outlook

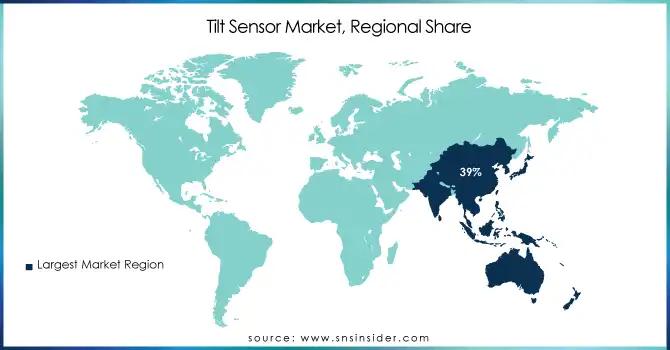

In 2023, Asia-Pacific dominated the tilt sensor market, capturing around 39% of global revenue. Driven by rapid industrialization, technological advancements, and increasing demand in sectors like automotive, robotics, and consumer electronics. Countries like China, Japan, and India have witnessed substantial growth, particularly in automotive applications, where MEMS-based tilt sensors are widely used for vehicle stability and navigation systems. The region's strong manufacturing capabilities in MEMS sensors further contribute to the market's expansion. Additionally, government initiatives to build smart cities, along with rising investments in robotics and automation, have fueled market growth. With advancements in IoT and industrial automation, the demand for precision and reliable tilt sensors is expected to continue growing across the region.

North America is the fastest-growing region in the tilt sensor market, expected to maintain strong growth through 2032. The United States leads in this development, driven by advancements in MEMS technology and increasing demand across sectors such as automotive, aerospace, and construction. Tilt sensors play a key role in automotive safety systems, industrial automation, and smart city infrastructure. The growing adoption of Internet of Things (IoT)-enabled sensors and wireless technologies in various applications, including robotics and autonomous vehicles, is also fueling market growth. As key players in the region innovate with high-precision tilt sensors, North America continues to dominate due to its technological advancements, with significant investments supporting the market's expansion.

Need any customization research on Tilt Sensor Market - Enquiry Now

Key Players

Some of the major players in Tilt Sensor with their product:

-

TE Connectivity (MEMS and Fluid-Filled Tilt Sensors)

-

Murata Manufacturing Co., Ltd. (MEMS Tilt Sensors)

-

SICK AG (Inclination Sensors)

-

Omron Corporation (MEMS Tilt Sensors)

-

Bosch Sensortec GmbH (MEMS Inertial Sensors)

-

Analog Devices, Inc. (Force Balance Tilt Sensors)

-

Jewell Instruments (Electrolytic Tilt Sensors)

-

Fredericks Company (Electrolytic Tilt Sensors)

-

Honeywell International Inc. (Industrial Tilt Sensors)

-

Balluff GmbH (Industrial MEMS Tilt Sensors)

-

Pepperl+Fuchs (Inclination Sensors for Industrial Applications)

-

Kübler Group (Tilt Measurement Systems)

-

Level Developments Ltd. (Precision Tilt Sensors)

-

Rieker Inc. (Mechanical Tilt Indicators)

-

Parallax Inc. (Digital MEMS Tilt Sensors)

-

Elmos Semiconductor SE (Automotive Tilt Sensors)

-

STMicroelectronics (3-Axis MEMS Tilt Sensors)

-

MEMSIC Inc. (Accelerometer-Based Tilt Sensors)

-

Leuze electronic GmbH (Inclination Sensors)

-

POSITAL FRABA (Tiltix Inclinometers)

-

Infineon Technologies (XENSIV TLE49SR)

Key Raw Materials and Suppliers

1. Silicon Wafers (for MEMS Tilt Sensors)

Used for fabricating MEMS sensors.

Suppliers:

-

Siltronic AG

-

GlobalWafers Co., Ltd.

-

SUMCO Corporation

-

Shin-Etsu Chemical Co., Ltd.

2. Glass (for Electrolytic Tilt Sensors)

Used for making precision components in electrolytic sensors.

Suppliers:

-

Corning Inc.

-

Nippon Electric Glass Co., Ltd.

-

SCHOTT AG

3. Metal Alloys (for Housings and Force Balance Sensors)

Includes aluminum, stainless steel, or titanium for durable housings.

Suppliers:

-

ArcelorMittal

-

Nippon Steel Corporation

-

Thyssenkrupp AG

VSMPO-AVISMA Corporation (for titanium)

4. Plastic and Polymers (for Nonmetal Housings)

Materials such as ABS, polycarbonate, or PEEK.

Suppliers:

-

SABIC

-

BASF SE

-

Covestro AG

5. Electrolyte Solutions (for Electrolytic Sensors)

Specialized electrolytes used in high-precision tilt sensors.

Suppliers:

-

Sigma-Aldrich (Merck Group)

-

Thermo Fisher Scientific

6. Piezoelectric Materials (for Force Balance Sensors)

Quartz or ceramic-based materials.

Suppliers:

-

CTS Corporation

-

PI Ceramic GmbH

-

Kyocera Corporation

7. Electronic Components (for Sensor Circuitry)

Resistors, capacitors, and integrated circuits.

Suppliers:

-

Murata Manufacturing Co., Ltd.

-

TDK Corporation

-

AVX Corporation

8. Adhesives and Sealants

Used for assembling and sealing sensor components.

Suppliers:

-

Henkel AG & Co. KGaA

-

3M Company

-

Sika AG

9. Fluid (for Fluid-Filled Sensors)

Specialty oils or liquids for damping or sensing mechanisms.

Suppliers:

-

Dow Chemical Company

-

ExxonMobil Chemical

-

Shell Chemicals

10. Conductive Coatings and Materials

For enhancing electrical connections and performance.

Suppliers:

-

Heraeus Group

-

Mitsubishi Materials Corporation

Recent Development

-

June 20, 2024 – TDK Corporation has launched the TAS8240, a new redundant analog TMR angle sensor designed for safety-relevant applications. This compact sensor provides precise rotor position measurements for BLDC motors in automotive systems like power steering and brake boosters, with high accuracy of ±1.0° and stability across a wide temperature range from -40 °C to +150 °C. The sensor’s four redundant outputs offer enhanced safety, supporting system safety levels up to ASIL D.

-

May 20, 2024 – Infineon launched the XENSIV TLE49SR, a differential Hall-based angle sensor designed for automotive applications. It offers high accuracy with less than 1-degree angle error and excellent stray field immunity, tolerating up to 8 mT. The sensor features three digital output interfaces: PWM, SENT, and SPC, and is ideal for precise measurements in chassis height, pedal position, and steering angle systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 267.42 Million |

| Market Size by 2032 | USD 614.13 Million |

| CAGR | CAGR of 9.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity, Murata Manufacturing Co., Ltd., SICK AG, Omron Corporation, Bosch Sensortec GmbH, Analog Devices, Inc., Jewell Instruments, Fredericks Company, Honeywell International Inc., Balluff GmbH, Pepperl+Fuchs, Kübler Group, Level Developments Ltd., Rieker Inc., Parallax Inc., Elmos Semiconductor SE, STMicroelectronics, MEMSIC Inc., Leuze electronic GmbH, and POSITAL FRABA |

| Key Drivers | • The healthcare sector's growth, driven by innovations in medical devices and robotics, is boosting demand for tilt sensors in patient monitoring and robotic surgeries. |

| Restraints | • Competitive Pressure from Alternative Sensing Technologies in the Tilt Sensor Market. |