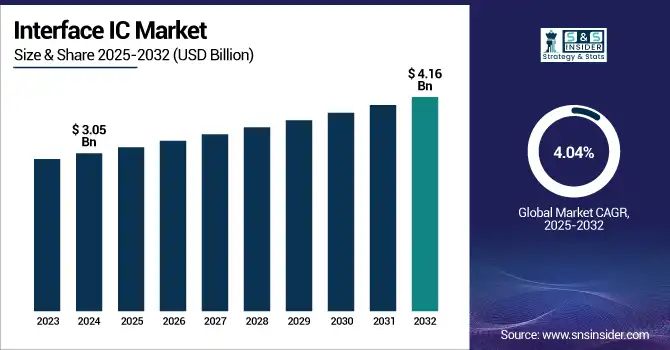

Interface IC Market Size Analysis:

The Interface IC Market Size was valued at USD 3.05 billion in 2024 and is expected to reach USD 4.16 billion by 2032 and grow at a CAGR of 4.04 % over the forecast period 2025-2032.

To Get more information on Interface IC Market - Request Free Sample Report

The global Interface IC market is registering a high growth, spurred by the technology advancements and the rising requirement for faster, safer and more reliable data communication. This momentum is being driven by growth in consumer electronics and industrial automation applications. Moreover, the steady advancement of interface technologies is offering improved speed and performance, making it easier to use in different areas. Local momentum and increasing connectivity demands also help drive the growing market environment globally.

According to research, PCIe 5.0 and PCIe 6.0 are being adopted in hyperscale data centers, supporting 32–64 Gbps/lane, placing new performance demands on interface ICs.

The U.S. Interface IC Market size was USD 0.66 billion in 2024 and is expected to reach USD 0.79 billion by 2032, growing at a CAGR of 2.23 % over the forecast period of 2025–2032.

The US interface ic market growth due to the presence of the multiple electronics manufacturers and integration of IoT and smart solutions. Substantial investments in automotive sector particularly in electric and autonomous vehicles and increase in industrial automation act as drivers of the market. The nation also enjoys a high ecosystem of semiconductor innovators that are continuously innovating advanced interface IC solutions to sustain market expansion and competitive advantages among the world’s marketplace.

According to research, 5G base stations and edge data centers in US now require ICs supporting latency <1ms and ultra-low jitter performance.

Interface IC Market Dynamics

Key Drivers:

-

Increasing demand for high-speed data transfer in consumer electronics fuels market expansion globally

Increasing consumer need of enhanced speed and efficiency of transferring data in smartphones, laptops and other smart devices is a major factor for market growth. Interfacing ICs facilitate the transfer of data between two or more devices such as by providing enhanced device performance and user experience. The increase of applications multimedial, streaming and consumption of high definition contents has increased the demand of efficient interface, leading companies to propose and use sophisticated ICs, capable to support higher data rates and lower power consumptions.

According to research, New interface ICs with adaptive voltage scaling can reduce power consumption by up to 55% compared to older designs.

Restrain:

-

Rapid technological changes lead to short product lifecycles, impacting market stability

Semiconductor and interface technology are rapidly changing, which leads to a higher rate of product loss. Companies are under tremendous pressures to stay profitable while constantly iterating their products to keep pace with evolving standards and dynamic consumer expectations. This short-life-cycle situation puts strong pressure on manufacturers for cost reduction and operational efficiency improvements, and could also cause inventory problems, supply chain disruption, demand volatility, and finally impact the steady and sustainable growth of the market in the long-term run.

Opportunities:

-

Adoption of 5G technology opens new avenues for high-performance Interface IC development

The deployment of 5G networks calls for high-performance interface ICs to enable extremely high-speed data and low latency. This transition demands that high-speed, energy-efficient ICs for telecommunications infrastructure and mobile devices, as well as new applications in the form of IoT, autonomous systems, etc. should be designed and implemented. The growth of the 5G ecosystem provides Interface IC manufacturers with a large opportunity to differentiate their products and profit from a burgeoning market which addresses new network requirements, but also imposes power consumption and Signal Integrity constraints in a wide range of complex system environments.

According to research, Modern high-performance interfaces (PCIe 5.0/6.0, USB 4, CXL) now support data rates between 32–64 Gbps, creating challenges for signal integrity at 5G backhaul & fronthaul layers.

Challenges:

-

Stringent regulatory compliance and certification complexities hinder market expansion and slow innovation pace

The manufacturers are forced to comply with strict rules concerning the product safety, electromagnetic compatibility and environmental sustainability with significant testing activities and documentation. These procedures add to the cost of development and prolong the time required to launch the product. And then, multipe standards across numerous countries compound the complexity, sending providers wading through a sea of regulation. The current barrier to entry in the Interface IC industry often stunts competition and slows technological innovation to the detriment of smaller companies.

Interface IC Market Segment Analysis:

By Type of Interface

The analog segment dominated the Interface IC Market with the highest revenue share of about 45.83% in 2024. Its dominance is attributed to its critical role in bridging real-world analog signals with digital systems across diverse applications. In the middle of this landscape, Texas Instruments features a wide set of analog ICs and it can easily be argued that they are intrinsic to providing power management, audio processing, and sensor interfacing. Their products allow performance, reliability and ease of use in consumer electronics, industry and car industry.

The digital segment is expected to grow at the fastest CAGR of about 5.05% from 2025 to 2032. This growth is fueled by the market's need for high-speed data handling in sophisticated digital systems. At the centre of this shift, STMicroelectronics remains committed to pushing the boundaries in the design of next-generation digital interface ICs for IoT applications, AI and 5G infrastructure. Their advanced technology solutions provide superior system performance while covering the evolving digital interface innovation applications in several markets.

By Interface Standard

The serial segment dominated the Interface IC Market with the highest revenue share of about 43.79% in 2024. This comes mainly from widespread serial communication protocol I2C, SPI and UART. Analog Devices is synonymous with high performance among engineers, and has a long history of inventing breakthrough technology for customers. These are some of the smallest, most highly-integrated connector family in the market, providing many benefits, including compact design, robustness, and high performance for consumer, industrial and automotive applications.

The high-speed segment is expected to grow at the fastest CAGR of about 4.91% from 2025 to 2032. It is in demand for multimedia devices and data centers due to the fast data-rate transfer applications. At the core of this revolution, Renesas Electronics is delivering advanced high-speed interface ICs that support USB 3. x, HDMI and display port specifications. These solutions cater to increasing requirements for high-speed, high-bandwidth and always-on internet connection in consumer electronics, corporate computing and communication.

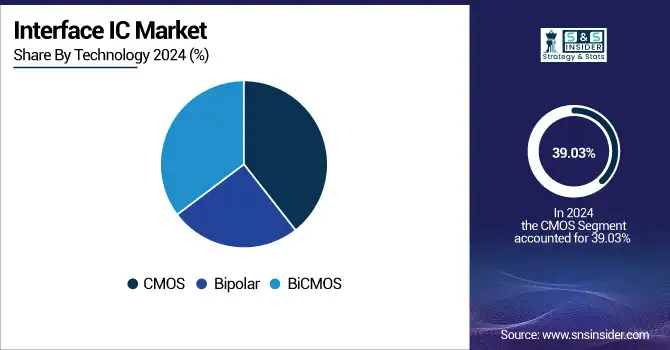

By Technology

The CMOS segment dominated the Interface IC Market with the highest revenue share of about 39.03% in 2024. Its dominance is linked to low power, cost, and adaptability. In addition to CMOS process technologies and provided by Interface ICs Companies such as Infineon Technologies, ultralow power, highly-integrated interface ICs are developed. Their products are widely used in smartphones, in-vehicle electronics, smart appliances, IoT devices, and other areas where small size and low power consumption are requirements.

The BiCMOS segment is expected to grow at the fastest CAGR of about 4.78% from 2025 to 2032, is driven by a need for ICs that can achieve a CMOS power dissipation while matching the performance of a bipolar transistor. Significant in this area, ON Semiconductor is leading development of BiCMOS-based interface ICs for high-performance requirements. Their offerings meet performance demands in automotive safety systems, communications infrastructure, and mixed-signal applications that require high speed, low signal cross talk, and low noise.

By End Use

The consumer electronics segment dominated the Interface IC Market with the highest revenue share of about 34.29% in 2024. This is due to the incredible demand for smartphones, tablets, wearables, and smart home products. Centrally- Many IC’s Qualcomm includes highend interface IC’s in consumer IC’s chips in the middle of the segment which boost the performance and the connectivity of the devices. The strong market momentum in this segment is being propelled by accelerated innovation cycles and consumer’s insatiable appetite for more features.

The automotive segment is expected to grow at the fastest CAGR of about 5.43% from 2025 to 2032. This growth is driven by electric vehicle (EV) deployment, advanced driver-assistance systems (ADAS) and connected car applications. At the core of this expansion, NXP Semiconductors is providing automotive-grade interface ICs that also comply with strict safety and performance requirements. Their products facilitate higher communication and sensor integration, including for vehicle autonomy, electrification and the next generation of automotive electronics.

Interface IC Market Regional Analysis:

North America dominated the Interface IC Market share of about 33.35% in 2024. This dominance is driven by strong presence of mature semiconductor manufacturers, high technology R&D capabilities, and aggressive technology push in consumer electronics, automotive, aviation and industrial applications. The region has well-established infrastructure and is open to innovations led in the IoT, AI, and 5G market as well and Northern America also enjoys a secure regulatory framework and consistent investments in new product development, enabling it to lead the overall wearable computing devices market.

-

The U.S. dominates the North American Interface IC Market due to the presence of large number of leading semiconductor companies in the region along with well-established R&D infrastructure and remarkable demand from end use applications including consumer electronics, automotive, aerospace and industrial automation in the country, which continue to drive innovation and large scale production capacities.

Asia Pacific is expected to grow at the fastest CAGR of about 5.12% from 2025 to 2032. This expansion is driven by fast industrialization, growing electronics production and surging use of smartphones, wearable devices and electric vehicles. Cost-competitive manufacturing environment in the region and increasing government focus on semiconductor manufacturing contribute to the expansion of the market. Moreover, increasing adoption of IoT devices, smart appliances, and automation in the automotive sector in countries including China, India, South Korea, and Taiwan is fueling the demand for Interface ICs.

-

China leads the Asia Pacific Interface IC Market with a large electronics manufacturing industry presence, favorable government backing for semiconductors development, growing consumer electronics and automotive industry, and establishment of local processing centres that are aiming at decreasing the market’s dependence on foreign technologies.

Europe holds substantial of the Interface IC Market owing to the robust industrial automation, and automotive, and aerospace industries. The area enjoys state-of-the-art manufacturing and a regulatory environment that fosters high-quality semiconductor manufacturing. Rising investment in electric vehicles and smart infrastructure are also spurring demand. Leading the innovative market is none-other than Germany, France and the UK, while the rest of Europe is along for the ride with consistent growth.

-

Germany dominates Europe’s Interface IC Market, backed by its powerful automotive and industry sectors, its advanced manufacturing strengths and solid R&D landscape. A focus in country at innovation, semiconductor supply chain and steady growth to lead the region.

The Middle East & Africa market is dominated by UAE which has been making heavy investments in the smart cities, telecom, and energy sectors among others while Saudi Arabia and Qatar continue to expand the industrial base. In Latin America, Brazil leads the way with growing electronics, automotive, automation and connected device markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Interface IC Companies are:

Major Key Players in Interface IC Market are Texas Instruments, Analog Devices, NXP Semiconductors, Maxim Integrated, ON Semiconductor, STMicroelectronics, Renesas Electronics, Infineon Technologies, Microchip Technology, Broadcom and others.

Recent Development:

-

In March 2023, Broadcom announced the production launch of its Tomahawk 5 Ethernet switch/router chips, delivering 51.2 terabits/second of switching capacity. This advancement enables single-hop connectivity between 256 high-performance AI/ML accelerators, each with 200 Gbps of network bandwidth, significantly enhancing AI training and inference tasks.

-

January 2023, Synaptics introduced the SmartBridge SB7900 local dimming IC, enabling high-resolution automotive displays up to 6K while reducing power consumption and system complexity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.05 Billion |

| Market Size by 2032 | USD 4.16 Billion |

| CAGR | CAGR of 4.04% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Interface (Analog, Digital, Mixed-Signal) • By Interface Standard (Serial, Parallel, High-Speed) • By Technology (CMOS, Bipolar, BiCMOS) • By End Use (Consumer electronics, Automotive, Industrial automation, Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, Analog Devices, NXP Semiconductors, Maxim Integrated, ON Semiconductor, STMicroelectronics, Renesas Electronics, Infineon Technologies, Microchip Technology, Broadcom |