Multi Phase Controller for AI Server Market Size & Growth:

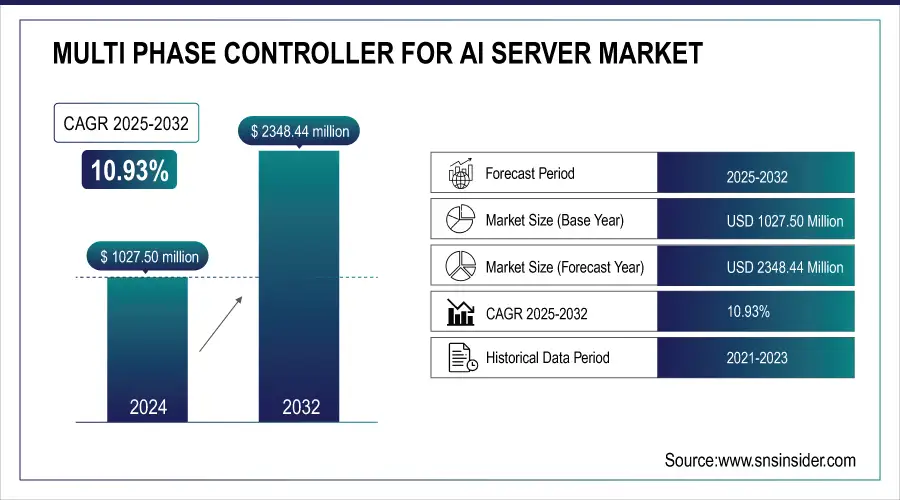

The Multi Phase Controller for AI Server Market size was valued at USD 1027.50 million in 2024 and is expected to reach USD 2348.44 million by 2032, growing at a CAGR of 10.93% over the forecast period of 2025-2032.

Increasing deployment of highly scalable AI servers across global data centers for supporting training as well as inference workloads is expected to bolster the demand for Multi Phase controllers for enhanced power management, thermal performance, and reliability features, owing to the rising demand for energy-efficient and high-performance Multi Phase controllers.

The increasing adoption of AI technologies, which require robust and efficient power management solutions, is driving the Multi Phase Controller for AI Server Market growth. With the rising complexity of AI workloads, servers need fine-grained voltage regulation and higher thermal performance to remain stable and efficient. In addition, the increasing demand for Multi Phase controllers with high current density and better total system reliability due to fast-growing cloud computing, data centers, and edge AI applications drives strong market growth worldwide.

To Get more information on Multi Phase Controller for AI Server Market - Request Free Sample Report

-

Nvidia is pioneering advanced cooling technologies for its upcoming GB200 server racks, which house next-generation Blackwell AI chips. To address the surging energy demands of data centers expected to consume 8% of U.S. power by 2030, Nvidia is shifting from traditional air cooling to liquid cooling methods

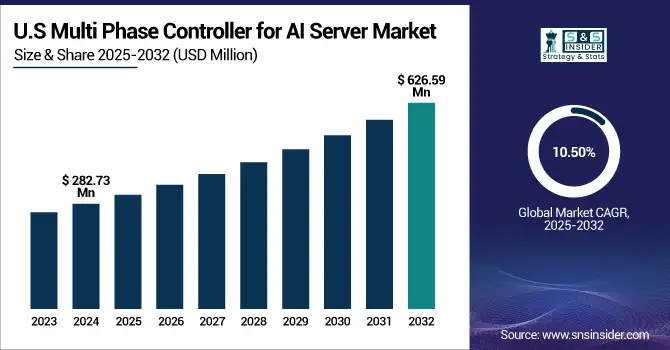

The U.S. Multi Phase Controller for AI Server Market size is estimated to be valued at USD 282.73 million in 2024 and is projected to grow at a CAGR of 10.50%, reaching USD 626.59 million by 2032. Growing AI adoption, augmented need for energy-efficient power administration, expansion of hyperscale information facilities, and developments in high-efficiency computing technologies are some of the driving factors for the U.S. Multi Phase Controller for AI Server Market trends.

Multi Phase Controller for AI Server Market Dynamics:

Key Drivers:

-

AI-Driven Power Management Solutions Propel Multi Phase Controller for AI Server Market to New Heights

The rapid growth of AI technologies, demanding efficient and reliable power management solutions, is the main driver for the Multi Phase Controller for AI Server Market. The increasing complexity of AI workloads makes accurate voltage regulation and improved thermal management essential for the stability and performance of servers. Cloud computing, hyperscale data centers, and edge AI deployments are driving demand for controllers that can deliver high current densities and better energy efficiency. Moreover, increasing investments in AI infrastructure from technology giants and government efforts to enable AI innovation are creating large opportunities in the market.

-

Microsoft announced a USD 80 billion investment in AI-driven data centers for fiscal 2025, with over half allocated to U.S.-based projects, underscoring the nation's leadership in AI infrastructure.

Restraints:

-

Complex AI Workloads Challenge Voltage Regulation and Thermal Management Demanding Advanced Multi Phase Controller Solutions

The growing complexity of AI workloads threatens to be a major inhibitor because they require more precise and adaptive voltage regulation. Controllers need to respond dynamically to changes in power demand, but ensuring that a system remains stable while doing this is a major technical challenge. Second, eliminating temperature imbalance is difficult (and even more critical under high-power conditions), and maybe there will be a thermal management issue, requiring advanced integrated (and also compact) cooling solutions with the controller.

Opportunities:

-

Advanced Semiconductors And Integrated AI Servers Drive Multi Phase Controller For AI Server Growth Opportunities

The latest trends such as, the technology adoption of advanced power semiconductor technologies (GaN and SiC) and liquid cooling system present growth opportunities. Additionally, the growing need of compact/combined AI servers with training and inference integrated into a single unit opens a new application window for Multi Phase controllers. The combination of these factors makes the market ripe for substantial growth in the next ten years.

-

Companies like Super Micro Computer have introduced liquid-cooled AI data center systems, reporting 30%-40% energy savings compared to traditional air-cooling methods.

-

The liquid cooling market is expected to more than double to USD 4.8 billion by 2027, reflecting the growing need for efficient cooling solutions in AI infrastructure.

Challenges:

-

AI Server Demands Challenge Multi Phase Controllers With Compatibility EMI and Semiconductor Supply Issues

The nature of rapid AI hardware innovation requires Multi Phase controllers to be flexible enough to accommodate new processor architectures and power requirements, which raises design and compatibility challenges. Moreover, factory production schedules can be delayed by supply chain problems for advanced semiconductor materials like GaN and SiC. Another ongoing engineering challenge involves achieving electromagnetic interference (EMI) compliance when multiple servers are placed in very close quarters. Collectively, these factors demand constant innovation and stringent qualification to sustain performance and reliability in AI server power management.

Multi Phase Controller for AI Server Market Segmentation Outlook:

By Type

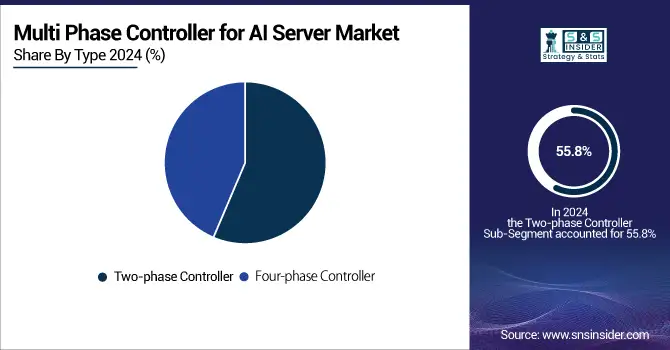

The Multi Phase Controller for AI Server Market was also dominated by the Two-Phase Controller, whose market share was 55.8%. It owes this dominance to the lower cost and ease of implementation, even in AI servers with lower power requirements. Existing architectures in data centers typically implement two-phase controllers, which provide accurate voltage regulation and efficient power delivery, both essential for many AI inference and training workloads.

The Four-Phase Controller segment is projected to be the fastest-growing from 2025 to 2032. As AI workloads become more complex and require more power (and higher current handling), this growth is expected to continue as finer voltage regulation is the only way to go. Four-phase controllers are more efficient than traditional two-phase counterparts, and these benefits translate to higher thermal performance, improved reliability, and better overall efficiency for high-performance AI training servers and integrated AI systems.

By Application

The AI Training Server segment was the leader of the Multi Phase Controller for AI Server Market share for 46.4% in 2024. The reason for this dominance is the scale of power and precision voltage regulation needed to run AI training workloads, which operate on very large datasets and complex neural networks. High Current Density & Heavy Thermal Management of AI training servers leads to Multi Phase controllers to maintain performance & stability. This segment largely dominates the market owing to an increase in the implementation of deep learning and other Machine learning models across multiple industries.

By 2024 to 2032, the AI Inference Training Integrated Server segment will see the fastest CAGR rate. Growth is fueled by the migration of increasingly multi-purpose servers with the ability to run both AI training and inference in a single box. Those integrated servers lower latency and boost efficiency, suitable for edge computing and real-time AI applications. As a result, there will continue to be increasing demand for the adoption of these integrated systems, and Multi Phase controllers designed for these systems will find themselves in greater demand, creating new avenues of growth in power management for AI infrastructures.

Multi Phase Controller for AI Server Market Regional Analysis:

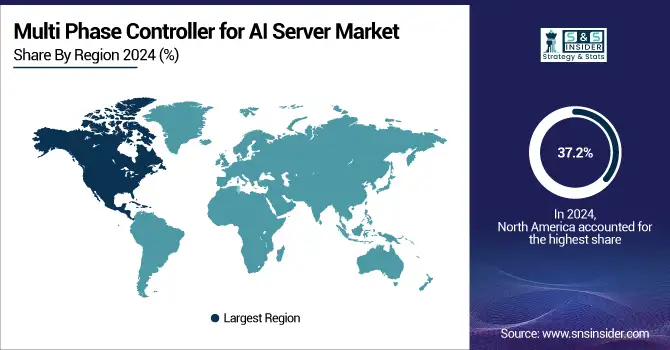

North America held the highest share of 37.2% in 2024. Such leadership is fueled by the region's developed technology ecosystem, the high number of global AI and cloud service providers such as Microsoft, Google, or Amazon, and the large investments in AI infrastructure. Currently, the U.S. is leading the way in the field of AI, and rapid growth in data centers and AI servers is driving demand for power management solutions. Furthermore, the further development of semiconductor technologies such as GaN and SiC is also accelerating the growth of the market. Also, North America is the leader in edge AI, due to the solid and widespread data center base, and this helps it consolidate its data center position. All these factors together drive the region to become a crucial market for Multi Phase controller adoption and technology advancement in AI server power management.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North American market was ruled by the U.S. due to a well-built AI ecosystem, the presence of major tech giants, ample data center infrastructure, and ongoing investments in advanced computing and power management technologies.

The Multi Phase Controller for AI Server Market in Asia Pacific is expected to expand at a CAGR of 11.6% from 2025 to 2032. The rapid growth is attributed to the growing adoption of AI technologies across end-use industries, including manufacturing, finance, and healthcare, in addition to increasing deployment of high-performance computing infrastructure. Cloud services, edge computing, and data center expansions to house increased AI workloads are expanding rapidly in the region. Also, continuous growth in government activities favoring digital transformation and investments in AI research are increasing demand for effective power management technologies, thus further promoting the requirement for Multi Phase controllers for future-ready server systems in the region.

Massive investments in AI infrastructure, data center expansion, strong semiconductor manufacturing capabilities, and government support for AI-based technological innovation enabled China to dominate the Asia Pacific market.

Europe is experiencing consistent growth owing to the accelerated adoption of AI technologies across the automotive, industrial, and healthcare sectors. This region advocates energy efficiency and sustainability, which leads to the implementation of advanced power management solutions. Market growth is facilitated by several factors, such as the proliferation of cloud infrastructure, increasing spending on artificial intelligence innovations, as well as the high demand for edge AI applications.

With its industrial prowess and early AI-manufacturing adoption, Germany dominated the European market, paving the way with large investments in data centers and leadership in advanced electronics and power management technologies.

Latin America and the Middle East & Africa will grow gradually owing to the increasing digital transformation and rising adoption of AI across numerous sectors, including finance, telecommunications, Government, and others. Demand is being bolstered by expanding cloud infrastructure, better internet penetration, and increasing interest in smart technologies. The market remains nascent, but rising investments in data centers and technological capabilities around the regions have set the ground for future market growth opportunities.

Key Players:

Some of the major Multi Phase Controller for AI Servers companies are Texas Instruments, Infineon Technologies, Renesas Electronics, Analog Devices, Alpha and Omega Semiconductor (AOS), Monolithic Power Systems (MPS), ON Semiconductor, STMicroelectronics, Richtek Technology, and Linear Technology.

Recent Developments:

-

In February 2024, Infineon launches TDM2254xD dual-phase power modules delivering over 2000A for AI data centers. The modules boost energy efficiency by 2% and cut operating temperatures by 5°C to support high-power GPU servers.

-

In January 2025, Alpha and Omega Semiconductor launched the AOZ73016QI, a 16-phase controller designed to boost power efficiency and performance in AI servers and graphics cards. The controller supports NVIDIA’s latest OpenVReg16 specs, offering advanced power management and flexible programmability.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1027.50 Million |

| Market Size by 2032 | USD 2384.44 Million |

| CAGR | CAGR of 10.93% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Two-phase Controller and Four-phase Controller) • By Application (AI Training Server, AI Inference Server, AI Inference Training Integrated Server) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, Infineon Technologies, Renesas Electronics, Analog Devices, Alpha and Omega Semiconductor (AOS), Monolithic Power Systems (MPS), ON Semiconductor, STMicroelectronics, Richtek Technology, and Linear Technology. |