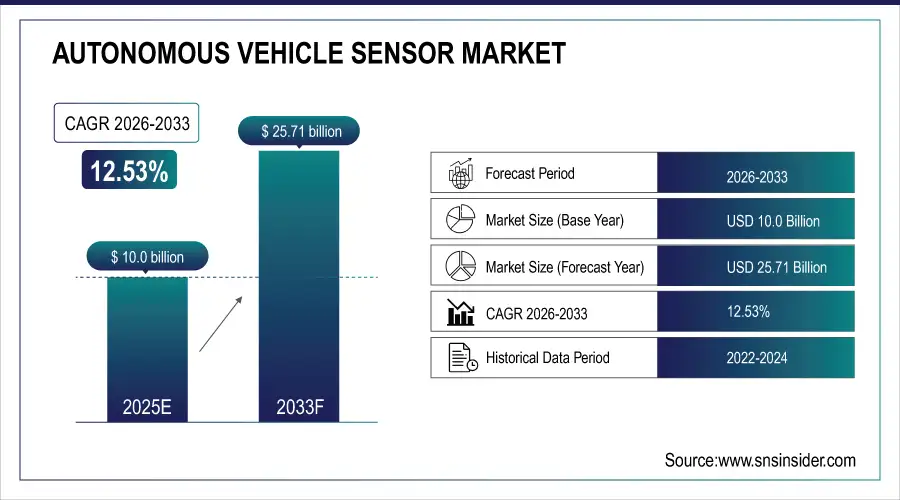

Autonomous Vehicle Sensor Market Size & Growth:

The Autonomous Vehicle Sensor Market size was valued at USD 10.0 Billion in 2025E and is projected to reach USD 25.71 Billion by 2033, growing at a CAGR of 12.53% during 2026-2033.

The Autonomous Vehicle Sensor market is experiencing robust growth, driven by wider deployment of driverless cars as an imperative to provide safer, greener and smarter transport solutions. Central elements such as LiDAR, radar, ultrasonic sensors and AI-enabled cameras allow for accurate environment perception and instant decision-making. Among the many critical Advanced Driver-Assistance System (ADAS) functionalities these types of sensors support, we can refer to collision avoidance, lane-keeping assist, self-parking and adaptive cruise control. Advanced microcontrollers and system-on-chips (SoCs) provide much more than the basic processing functions, including sensor fusion to improve system responsiveness and accuracy. As sensor, integration in every vehicle class is sweeping automotive industry due to the need of compliance with functional safety standards such as ISO 26262 and ASIL classification. The sensor ecosystem is evolving aggressively in an era of high autonomy, providing scale-able and cost competitive solutions to both mainstream and premium autonomous vehicle platforms.

Autonomous Vehicle Sensor Market Size and Forecast:

-

Market Size in 2025: USD 10.00 Billion

-

Market Size by 2033: USD 25.71 Billion

-

CAGR: 12.53% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Autonomous Vehicle Sensor Market - Request Free Sample Report

On June 12, 2025, Texas Instruments highlighted the role of AI-enabled sensor fusion and advanced semiconductors in boosting safety and convenience in autonomous vehicles, reinforcing the importance of ADAS integration.

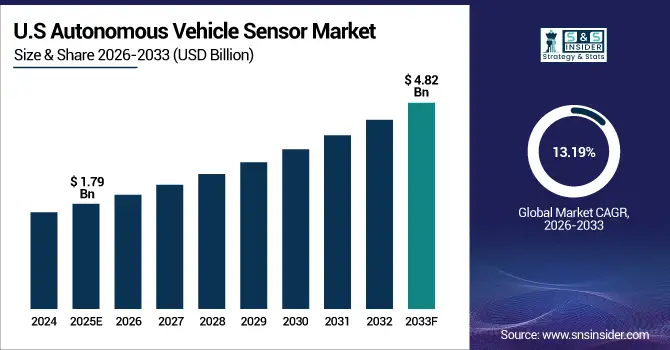

The U.S Autonomous Vehicle Sensor Market size was valued at USD 1.79 Billion in 2024 and is projected to reach USD 4.82 Billion by 2032, growing at a CAGR of 13.19% during 2025-2032. The U.S. Autonomous Vehicle Sensor Market growth is driven by rising adoption of Advanced Driver-Assistance Systems (ADAS), increasing government support for vehicle safety technologies, and growing consumer demand for enhanced driving experiences. Advancements in AI-enabled sensor fusion, LiDAR, radar, and camera systems are further accelerating adoption. Additionally, ongoing investments by automotive OEMs and tech firms are boosting market expansion.

The Autonomous Vehicle Sensor Market trends include rapid advancements in AI-enabled sensor fusion, increased integration of LiDAR and radar technologies, and the growing use of solid-state sensors for enhanced durability. A transition towards edge computing in sensor modules, increasing need for high-resolution cameras and the miniaturization of components are also noticeable. Favorable regulation of safety requirements and the trend toward completely autonomous driving also stay at the heart of the market.

Autonomous Vehicle Sensor Market Dynamics:

Drivers:

-

Rising Safety Priorities and AI Integration Fuel Autonomous Vehicle Sensor Market

The growth of the Autonomous Vehicle Sensor Market is driven by increasing emphasis on safety, automation, and operational efficiency across sectors such as defense, logistics, and construction. Increase in Demand for Advanced Sensor Technologies: Increase in the demand for advanced sensor technologies including LiDAR, radar, ultrasonic and artificial intelligence (AI)-enabled vision systems to ensure precise environment perception and real-time decision-making. Additionally, in the noisy environments AVs operate in, high precision sensors integrated within the vehicle can be used for obstacle detection, terrain mapping and even self-navigation. Moreover, the drive to reduce exposure of humans to dangerous environments and increase autonomy is adding further impetus to the deployment of sensor fusion platforms. This growth is being driven in part by improvements in edge computing, AI algorithms and sensor miniaturization.

The U.S. Army evaluated Overland AI’s ULTRA fully autonomous tactical vehicle during Agile Spirit 25 to improve battlefield safety and logistics. The AI-powered vehicle showcased advanced terrain navigation and modular capabilities, supporting missions like resupply, casualty evacuation, and counter-drone operations.

Restraints:

-

High Cost and Reliability Concerns Restrain Autonomous Vehicle Sensor Market Growth

The Autonomous Vehicle Sensor Market faces significant restraints due to high costs of advanced sensor technologies and integration complexity. Advanced systems such as LiDAR, radar and AI-based camera are developed with a lot of R&D spending thereby adding to the vehicle cost and slowing down its adoption in cost-sensitive markets. Moreover, maintaining the consistent performance of sensors regardless of weather, lighting, or terrain conditions is a persistent issue. Widespread deployment could be held back by concerns regarding the accuracy and redundancy of data as well as cyber security, particularly for safety-critical applications. All of these elements taken together effectively slow down commercialization and delay mass adoption across — from civilian transportation to defense systems autonomous platforms, although the need for automation is rising.

Opportunities:

-

Modular Sensor Integration Accelerates AV Market Expansion

The increasing development of scalable and modular autonomous vehicle architectures is creating substantial growth opportunities for the AV sensor market. Flexible platforms that allow automakers to include a variety of advanced driver-assistance and autonomous features depending on the specific vehicle class and automation level. Given the ongoing evolution of regulatory frameworks and the increasing consumer appetite for intelligent mobility solutions, manufacturers can leverage these architectures to minimize expense and complexity in deployment,while substantially shortening time-to-market levels—strengthening sensor uptake across the ecosystem.

In June 2025, NVIDIA’s DRIVE platform offers a modular, safety-certified software stack with real-time sensor fusion, simulation, and AI training tools to accelerate autonomous vehicle development and deployment.

Challenges:

-

System Complexity and Safety Validation Impede Sensor Market Scaling

The Autonomous Vehicle Sensor Market faces significant challenges due to the complexity of sensor fusion, system calibration, and real-time decision-making accuracy. Using various sensor types — LiDAR, radar, cameras and ultrasonic requires integration to be done in a delicate way, increasing the integration load. There is also another big bottleneck that still needs to be resolved: the need to validate safety and reliability in a broad range of real-life scenarios. This is slowing deployment even further, adding months and sometimes years to the process because of regulatory uncertainties and lack of global standardization. Although this is a large step in reducing these barriers, the technical and compliance restrictions still greatly delay innovation and the pace of sensor commercialization, especially for higher-order autonomous systems.

Autonomous Vehicle Sensor Market Segmentation Analysis:

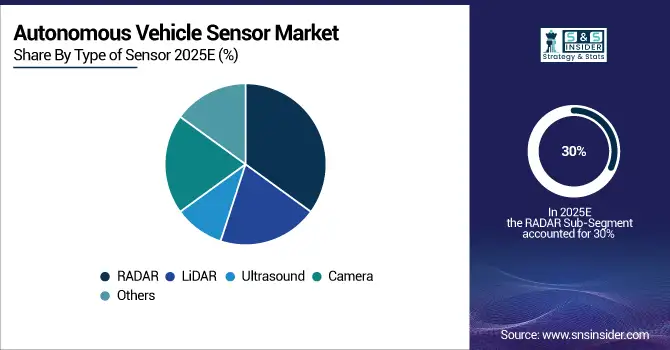

By Type of Sensor

In 2024, the RADAR segment accounted for approximately 30% of the Autonomous Vehicle Sensor market share, driven by its robust performance in adverse weather, affordability, and ability to detect objects at long range. Its critical role in adaptive cruise control, collision avoidance, and blind-spot detection systems continues to support adoption across autonomous and semi-autonomous vehicle platforms, especially in commercial and passenger transport segments.

The LiDAR segment is expected to experience the fastest growth in Autonomous Vehicle Sensor market over 2025-2032 with a CAGR of 18.21%, due to the rise in demand for high-resolution 3D mapping and accurate object detection. It provides unrivaled spatial accuracy for navigating in complex environments, scaling from automotive to logistics and robotics.

By Vehicle Type

In 2024, the Passenger segment accounted for approximately 30% of the Autonomous Vehicle Sensor market share, owing to rising adoptions of Advanced Driver-Assistance Systems (ADAS), and growing consumer demand for safety, convenience, and semi-autonomous features. In passenger vehicles, range imaging sensors are already being integrated into automobiles to assist with hands-free driving; for example automatic parking.

The Commercial segment is expected to experience the fastest growth in Autonomous Vehicle Sensor market over 2025-2032 with a CAGR of 15.67%, backed by rising investments into autonomous bringing fleets, ride hailing services and logistical automations. With this, the requirement for stable sensor systems such as LiDAR, RADAR, and ultrasonic sensors to provide safety, navigation, and operational efficiency is increasing in commercial autonomous applications operating within urban and industrial areas.

By Level of Automation

In 2024, the Level 1 segment accounted for approximately 39% of the Autonomous Vehicle Sensor market share, driven by growing integration of basic driver-assistance systems such as adaptive cruise control and lane-keeping assist. Increasing consumer demand for enhanced safety and convenience features in entry-level vehicles is fueling OEM adoption of cost-effective sensor technologies tailored for Level 1 automation.

The Level 4 segment is expected to experience the fastest growth in Autonomous Vehicle Sensor market over 2025-2032 with a CAGR of 22.07%, driven by advancements in fully autonomous driving technologies and increasing investments in smart city infrastructure. Growing demand for driverless taxis, shuttles, and delivery vehicles is accelerating the adoption of sophisticated sensors required for high-level automation and safety.

By Application

In 2024, the Obstacle Detection segment accounted for approximately 38% of the Autonomous Vehicle Sensor market share, due to increased requirement for superior safety features and collision avoidance in autonomous systems. Need to comply with growing regulatory norms as well as customer interest of accident prevention features has been instrumental in the rise of advanced sensors, that are capable to sense and react towards objects instantaneously for secure passage way.

The Collision Avoidance segment is expected to experience the fastest growth in Autonomous Vehicle Sensor market over 2025-2032 with a CAGR of 14.47%, as a result of increasing safety measurements and stringent government regulations. Growing need for advanced driver-assistance systems (ADAS) and increasing incidents of road accidents will drive the demand for advanced collision avoidance Sensors in autonomous vehicles.

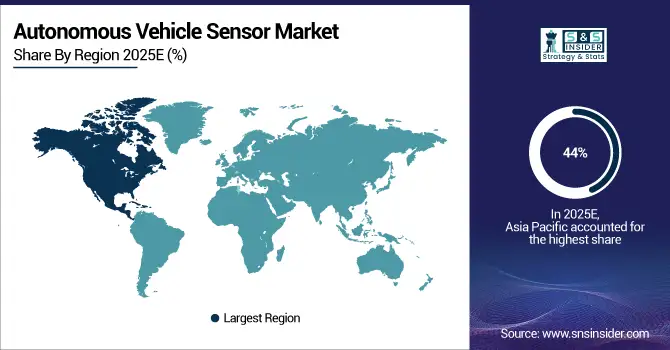

Autonomous Vehicle Sensor Market Regional Outlook:

In 2024 Asia Pacific dominated the Autonomous Vehicle Sensor market and accounted for 44% of revenue share, attributable to rapid urbanization and higher government support by promoting smart mobility joined with huge investments done for autonomous driving technologies. This will establish the region as a leader in autonomous transportation solutions and promote sensor manufacturing and testing of autonomous vehicles by companies like China, Japan, South Korea and others.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is expected to witness the fastest growth in the Autonomous Vehicle Sensor Market over 2025-2032, with a projected CAGR of 14.29%, due to the high adoption of ADAS & self driving vehicles, and presence of key autonomous technology giants such as Tesla, NVIDIA among others. The market in Asia Pacific is estimated to witness the rapid growth owing to continued R&D investment and infrastructure readiness that propel demand further across the region.

In 2024, Europe emerged as a promising region in the Autonomous Vehicle Sensor Market, due to increasing investments in smart mobility and strong government support to implement sustainable transport initiatives along with major automotive OEM presence. Subsequently, increase in sensor technologies and demand for autonomous features in premium vehicles has accelerated the market across top European Economies as well.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Autonomous Vehicle Sensor market, supported by slow infrastructure development, growing adoption of ADAS features, and increasing investment for smart city and intelligent transport projects. Increased sales of such sensors in emerging economies can also be attributed to government initiatives for modernizing mobility and advancing automotive manufacturing activities.

Autonomous Vehicle Sensor Companies are:

The Key Players in Autonomous Vehicle Sensor Market are Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, DENSO, NXP Semiconductors, BorgWarner Inc., Fujitsu, Asahi Kasei Corporation, Lumentum Operations LLC, Valeo, Brigade Electronics, Navtech Radar, Teledyne Geospatial, Aptiv PLC, Infineon Technologies AG, Velodyne Lidar, Inc., Ouster, Inc., Ambarella, Inc., Luminar Technologies, Inc., ON Semiconductor Corporation. and Others.

Recent Developments:

-

In May 2025, Continental has produced 200 million radar sensors, underscoring its leadership in ADAS and autonomous driving technologies. With €1.5 billion in new orders, its advanced, compact radar systems enable critical safety features and 360° vehicle awareness.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 10.00 Billion |

| Market Size by 2033 | USD 25.71 Billion |

| CAGR | CAGR of 12.53% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Sensor(RADAR, LiDAR, Ultrasound, Camera and Others) • By Vehicle Type(Passenger and Commercial) • By Level of Automation(Level 1, Level 2, Level 3, Level 4 and Level 5) • By Application(Obstacle Detection, Navigation, Collision Avoidance and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Autonomous Vehicle Sensor market Companies are Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, DENSO, NXP Semiconductors, BorgWarner Inc., Fujitsu, Asahi Kasei Corporation, Lumentum Operations LLC, Valeo, Brigade Electronics, Navtech Radar, Teledyne Geospatial, Aptiv PLC, Infineon Technologies AG, Velodyne Lidar, Inc., Ouster, Inc., Ambarella, Inc., Luminar Technologies, Inc., ON Semiconductor Corporation. and Others. |