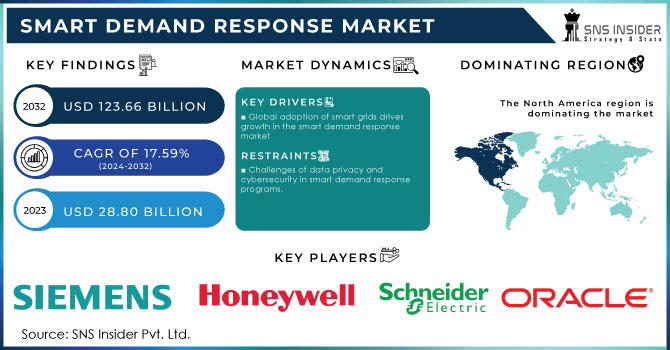

Smart Demand Response Market Size & Overview:

Get More Information on Smart Demand Response Market - Request Sample Report

The Smart Demand Response Market Size was valued at USD 28.80 Billion in 2023 and is expected to reach USD 123.66 Billion by 2032 and grow at a CAGR of 17.59% over the forecast period 2024-2032.

The smart demand response market is quickly developing as energy management systems grow more essential in today's society. As more renewable energy is used and different industries switch to electricity, demand response solutions have become more important for managing loads and maintaining grid stability. In 2024, the U.S. government is making great progress in investing in renewable energy, mainly driven by the Inflation Reduction Act (IRA), which is focused on addressing climate change and promoting economic growth. This important law has resulted in more than USD 115 billion in manufacturing investments for clean energy projects, with a focus on helping low-income communities. The IRA offers attractive tax benefits, such as a bonus through the Production Tax Credit (PTC) and the Investment Tax Credit (ITC), to promote the development of renewable energy projects within the country. In addition, the recently created Low-Income Communities Bonus Credit Program is designed to improve clean energy availability in marginalized areas by providing extra tax credits for solar and wind projects in these communities. Demand response involves adjusting electricity usage based on real-time signals from grid operators or utilities. These signals, whether based on price or incentives, prompt consumers to decrease or change their energy consumption during times of high demand.

The development of smart technologies has changed conventional demand response systems into intelligent demand response solutions. This integration utilizes advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and cloud-based platforms. In the United States, the utilization of cloud-based platforms is rapidly increasing, with nearly 94% of companies using cloud workloads, particularly among larger companies with more than 1,000 employees. 46% of enterprises use public cloud services, while 84% opt for private cloud solutions to secure their data integrity. Real-time data from smart meters, sensors, and connected devices allow for dynamic pricing and automated control of energy usage. These advancements have broadened the reach of demand response from big industrial clients to residential and commercial customers, improving its overall efficiency and impact.

Smart Demand Response Market Dynamics

Drivers

-

Global adoption of smart grids drives growth in the smart demand response market

A primary driver of the Smart Demand Response market is the global shift towards smart grids. With the development of advanced digital technologies, utilities, and consumers can monitor, control, and optimize energy use. Smart grids provide real-time data for utilities, which helps assess energy demand patterns and develop responsive strategies to balance the load. Through SDR programs introducing smart grids, utilities can send a signal to consumers during off-peak hours to reduce consumption or shift use to off-peak hours to prevent grid overloads. This application of a smart grid with an SDR solution is crucial to enhancing grid reliability and energy efficiency. With a traditional energy grid, demand peaks cause outages or require expensive energy production from standby plants, which is not a cost-effective solution. Furthermore, the government and regulatory bodies at the global level are promoting the development of smart grids, to reduce greenhouse gas emissions and promote sustainable use of energy. This beneficial policy environment will help the market to grow, given the prospects of reducing the demand peaks. Overall, the increasing deployment of smart grids across the globe, will in turn raise the demand for the SDR market.

-

Government policies and incentives drive the adoption of demand response programs for energy efficiency and decarbonization

Global energy crises and the accelerating process of energy decarbonization have catalyzed several governments and regulatory bodies to introduce different policies and incentives to promote the adoption of demand response programs. Such tendencies encourage SDR by stimulating utilities and consumers to adopt certain systems. For instance, a demand response program can be stimulated by rebates. In other words, customers who take part in a demand response program can receive financial incentives in the form of reduced electricity bills or direct payment for the utility. Somewhat simplistically, a part of such an incentive is the savings of the relevant utility that does not have to spend money on fuel or pay third parties to purchase additional electricity to cover the consumption that peaks due to increased market demand or that is reduced by grid limitations or combinations of various factors. Various programs require utilities to meet certain energy efficiency goals or reduce load during peak demand, and SDR represents a straightforward way to accomplish these goals. Many regions also use time-based pricing, which effectively results in higher electricity bills during peak loads, prompting customers to either reduce their use or change the time when they use electricity. Furthermore, regulatory standards for energy efficiency, grid reliability, and carbon emission are likely to become stricter as the energy landscape continues evolving.

Restraints

-

Challenges of data privacy and cybersecurity in smart demand response programs.

Smart demand response relies on advanced communication and data analytics, which has raised concerns about data privacy and cybersecurity. Transfer and transmission of various types of data are produced in SDR, which should be protected by cybersecurity measures. Consumers may not be willing to participate in smart response programs if the process of data exchange and transmission is not protected properly. People usually do not share their real-time usage data due to their preferences or security concerns. Information breach or cyberattack could refute the moral right to participate in any type of smart data. Cybersecurity measures depend largely on the approaches used in the SDG programs. These will be very expensive and technologically difficult actions if it impossible to pass them. This may limit participation and thwart response opportunities.

Smart Demand Response Market Segmentation Overview

By Application

The residential sector dominated the market in 2023 with a 55% market share, fueled by the rising use of smart gadgets and household automation systems. Smart thermostats, home energy management systems (HEMS), and connected intelligent appliances enable homeowners to maximize energy usage by responding to utility signals. Google Nest and Honeywell are offering residential solutions that enable users to manage energy consumption remotely during high-demand periods. While utilities work together with residential customers to control load demand, the industry is still growing thanks to increasing awareness of sustainable energy consumption, backed by government rewards for energy-efficient options.

The industrial sector is considered to be the fastest-growing market during the forecast period 2024-2032, because of its high level of energy consumption and the rising demand for effective energy management. Significant benefits can be experienced by large energy consumers through the use of demand response solutions, leading to decreased operational expenses and reduced grid outage risks. Siemens and Schneider Electric offer sophisticated demand response technologies specifically designed for industrial use, enabling facilities to modify power usage in response to up-to-the-minute signals from grid operators. This increase is fueled by the worldwide move towards industrial sustainability, efficiency, and adherence to strict energy regulations.

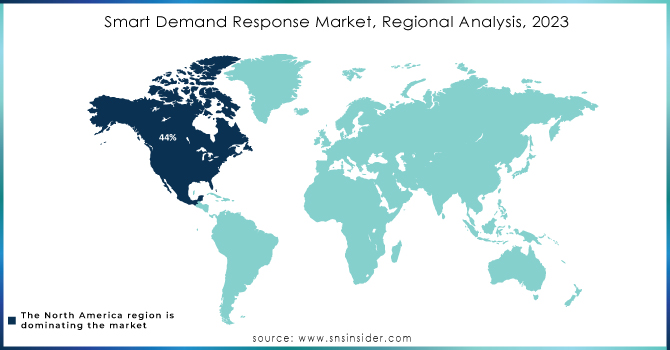

Smart Demand Response Market Regional Analysis

North America led the smart demand response market in 2023 with a 44% market share, powered by the wide acceptance of advanced energy infrastructure and the growing focus on energy efficiency. The growth of the region has been expedited by important companies such as Honeywell International Inc. and Schneider Electric, allowing utilities and businesses to effectively control energy consumption. In North America, there is a high level of popularity for smart grid applications and automated demand response systems, especially in states such as California and Texas, where power demand changes are substantial. AutoGrid Systems and other companies offer AI-based solutions to control real-time energy consumption, solidifying North America's position as a key player in this industry.

The APAC region is accounted to experience a rapid growth rate during 2024-2032 in the smart demand response market, fueled by fast urbanization and industrialization in countries such as China, India, and Japan. The growing energy usage, coupled with higher funding for smart grid infrastructure, sets APAC up for significant expansion. Efforts by the government to encourage energy efficiency, such as China's emphasis on managing peak loads, have increased demand. In Japan, organizations like Toshiba Corporation are introducing automated demand response systems to balance power supply in residential and industrial settings, promoting the growth of the area.

Need Any Customization Research On Smart Demand Response Market - Inquiry Now

Key Players in Smart Demand Response Market

The major key players in the market are:

-

Siemens (Siemens Demand Response Management, Siemens Spectrum Power)

-

Honeywell (Honeywell Energy Manager, Honeywell Building Management Solutions)

-

Schneider Electric (EcoStruxure Demand Response, Schneider Electric Smart Energy)

-

General Electric (GE) (GE Grid Solutions, GE Demand Response Solutions)

-

Itron (Itron Demand Response, Itron Analytics)

-

ABB (ABB Ability Demand Response, ABB Grid Edge Solutions)

-

Enel X (Enel X Demand Response, Enel X JuiceBox)

-

Deloitte (Deloitte Energy & Sustainability Services, Deloitte Smart Energy Solutions)

-

Oracle (Oracle Utilities Demand Response Management, Oracle Utilities Analytics)

-

Lutron Electronics (Lutron Quantum, Lutron Vive)

-

EnergyHub (EnergyHub Smart Thermostat, EnergyHub Demand Response Platform)

-

AutoGrid (AutoGrid Flex, AutoGrid Insights)

-

EnerNOC (part of Enel X) (EnerNOC Demand Response, EnerNOC Energy Intelligence Software)

-

GridPoint (GridPoint Energy Management System, GridPoint Demand Response)

-

C3.ai (C3 Demand Response, C3 Energy Management)

-

EcoEnergy Insights (EcoEnergy Demand Response, EcoEnergy Energy Analytics)

-

Tendril (Tendril Connect, Tendril Energy Management Platform)

-

Rooftop Solar (Rooftop Solar Demand Response, Rooftop Solar Energy Storage)

-

Uplight (Uplight Demand Management, Uplight Utility Solutions)

-

Simple Energy (Simple Energy Marketplace, Simple Energy Demand Response Platform)

Recent Development

-

In February 2024, Honeywell announced an updated version of its energy management system that is based on artificial intelligence and machine learning. The new system allows monitoring and controlling energy consumption in commercial buildings in real-time.

-

In November 2023, Siemens announced an updated version of its demand response program, adopting smart grid technologies with several utility companies. The joint experimental implementation of the updated technologies will empower customers to adjust their energy consumption to market signals, therefore improving energy efficiency.

-

In September 2023, Schneider Electric launched an updated version of its successful EcoStruxure platform. Compared to the previous version, the new features of the platform allow better performance in terms of demand response. In particular, it is now easier to integrate renewable energy resources into the platform’s capacities. Other improvements include additional analytics and monitoring tools aimed to help businesses participate in demand response.

-

In June 2023, the General Electric company developed and released a new line of smart meters for residential and industrial applications. The new smart meters will now provide users with more detailed information about their energy consumption to enable better decisions and participation in demand response.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.80 Billion |

| Market Size by 2032 | USD 123.66 Billion |

| CAGR | CAGR of 17.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Honeywell, Schneider Electric, General Electric (GE), Itron, ABB, Enel X, Deloitte, Oracle, Lutron Electronics, EnergyHub, AutoGrid, EnerNOC, GridPoint, C3.ai, EcoEnergy Insights, Tendril, Rooftop Solar, Uplight, Simple Energy |

| Key Drivers | • Global adoption of smart grids drives growth in the smart demand response market • Government policies and incentives drive the adoption of demand response programs for energy efficiency and decarbonization |

| RESTRAINTS | • Challenges of data privacy and cybersecurity in smart demand response programs. |