Thin Film Battery Market Size & Growth:

The Thin Film Battery Market Size was valued at USD 0.45 Billion in 2023 and is expected to reach USD 2.92 Billion by 2032 and grow at a CAGR of 22.99% over the forecast period 2024-2032.

The Thin Film Battery Market is witnessing enormous growth in 2023 and 2024, most of this growth is seen in the United States. Since the start of September 2024, the United States Department of Energy has allocated more than USD 3 billion to more than 25 battery manufacturing projects across 14 states. This effort is supported under the Bipartisan Infrastructure Law to accelerate domestic production of batteries, including critical mineral processing, battery manufacturing, and recycling endeavours. The selected projects are expected to create jobs primarily in construction, while also enhancing the nation’s ability to manufacturer EV battery and renewable energy storage. This market scenario is majorly determined by government policies.

To get more information on Thin Film Battery Market - Request Free Sample Report

The US administration is looking forward to establishing federal support to balance the prices of U.S. critical minerals by tackling the issue of cheap Chinese materials flooding the market. The Energy Department will set a price floor for several key minerals, and if the market price falls below this threshold, it will be covering that gap. In response to China’s dominance in the market, this plan would subsidize the domestic mineral production necessary to run clean energy technologies, including electric vehicles.

Innovations in thin film battery production, recovery of critical minerals, battery production and recycling have been at the forefront of the growth of the Thin Film Battery Market. The projects include are therefore anticipated to create 12,000 jobs, primarily focused on construction. Some of the key projects that would receive assistance include standards lithium production for electric automotive use under a joint venture standard lithium and Equinor in Lewisville, Arkansas, to which USD 225 million in financing will be provided, and TerraVolta Resources' plans in Texarkana.

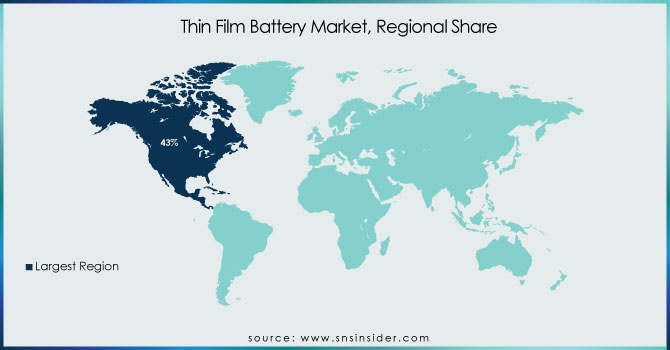

Growing applications for portable electronics, wearables, and IoT devices are leading to the growing requirement for power systems to be smaller and more efficient. Furthermore, market opportunities are supported through regulatory for sustainable energy technologies. In North America, the thin-film battery market accounts for the largest revenue share of the global market, and this is prompting companies to develop enough batteries in compliance with rigid environment and safety standards.

Thin Film Battery Market Dynamics

Key Drivers:

-

The growing acceptance of wearable technology requires thin-film batteries that are compact, efficient, and capable of operating devices optimally.

The high demand for power sources for wearables such as smartwatches, fitness monitors, and health monitoring devices can be attributed to the proliferation of wearable technology. Thin-film batteries are most suitable for this application because of their lightness, flexibility, and compact size, which facilitates easy integration with small devices without adding bulk to them.

The high energy density makes it possible for wearables to work over an extended time, with low rates of frequent recharging to facilitate convenience among the users. Besides, flexible thin film batteries support novel geometries of innovative device designs. Consequently, increased interest in wearables from the consumer market propels the growing dependency on thin film batteries while, in return, pushing up battery technology as demand increases over device evolution.

-

Thin film battery development and integration is especially motivated by government initiatives on renewable energy storage.

Given the normalized, and more actively implemented, policies of central governments across the world focused on support of renewable energy storage, suppliers and efforts to move towards net neutral carbon emissions, thin film batteries are particularly critical due to anticipated utilizations in energy storage systems. For instance, in 2024, the US Department of Energy have budgeted over USD 25 billion into 11 battery projects, underscoring the focus on advancing multiple battery technologies, with thin films among them, to ensure the development and current operation of renewable energy infrastructures. Government programs and project funding are not only important methods of actual financial backing but also create a positive environment for thin film battery technology research and development. The installation of the battery in renewable energy systems further fuel the growth and innovation of the automation in the thin film battery market.

Restrain:

-

The production process of thin-film batteries is highly technical and requires special materials, making it more expensive than traditional batteries.

This difference in cost can be a limiting factor for the widespread adoption of thin-film batteries, particularly in price-sensitive markets. Besides that, scalability of production is a challenge so far, as economies of scale are hard to obtain because of the highly complicated processes of manufacturing involved. These factors give rise to a more substantial cost structure for thin-film batteries, making them less competitive in the wider market of batteries. Such factors require a solution if the affordability and accessibility of thin-film batteries are to be improved across different applications.

Thin Film Battery Market Segment Analysis

By Battery Type

The Thin Film Battery Market was dominated, in 2023, by the rechargeable segment, with a share of 65%. The reason behind this predominant position is the heavy adoption of rechargeable thin-film batteries in consumer electronics, medical devices, and wearable technologies, where compactness, low weight, and prolonged energy access are major concerns. These batteries can be recharged to meet the increasing consumer needs for an energy source that is both environmentally friendly and economical. In addition to this, improvements in battery technology have also resulted in higher energy densities and longer lifecycles, making the rechargeable thin film battery even more attractive.

On the other hand, the disposable segment, though smaller in terms of market share at present, is expected to grow the fastest during the forecast period from 2024 to 2032, with a CAGR of 23.61%. This is due to the increasing use of disposable thin film batteries in single-use medical devices, smart packaging, and environmental sensors.

Disposable batteries are most suited for applications where battery replacement is difficult or the devices are designed to be operated with limited service life. As thin film batteries continue gaining in scale and new applications have just begun to emerge across various industries, the scope of growth for both the rechargeable and disposable segments is most likely going to come into play.

By Battery Voltage

In 2023, the below 1.5 V segment accounted for 45% of the total market share. This is because the segment has wide applications in low-power devices such as medical implants, RFID tags, and some wearable technologies where minimum voltage is adequate for proper functionality. Below 1.5 V thin film batteries are best suited for such applications due to their compact size and flexibility.

Moving forward the above 3 V segment will be expected to grow with a fastest CAGR of 23.54% during the fore-term period from 2024 to 2032. This is because there is an increasing number of high voltage battery applications that have these high voltage output powers. Such cases include energy harvesting devices, wireless sensors, and advanced medical equipment.

The development of high-voltage thin film batteries enables the expansion of their use into more energy-intensive applications, broadening the scope of the market. As technologies continue to evolve, the growth of voltage-specific applications is anticipated to drive growth across all the voltage segments of the Thin Film Battery Market.

Thin Film Battery Market Regional Overview

North America held the majority of the market share in 2023 at 43%. The region is supported by its advanced technological infrastructure, substantial investment in research and development, and an early adaptation of advanced technologies across industries like healthcare, consumer electronics, and renewable energy. Major market players along with the high emphasis on innovation support the position of North America in the market.

On the other hand, the Asia Pacific region is expected to grow at the fastest rate, with a CAGR of 23.75% during the forecast period from 2024 to 2032. This rapid growth is attributed to the rapidly growing electronics manufacturing sector, increasing adoption of electric vehicles, and supportive government initiatives promoting renewable energy solutions in countries like China, Japan, and India.

The Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cells (ACC) was unveiled by the government of India in 2023, with ₹18,100 crore allocated to the scheme for five years with an aim of increasing domestic manufacturing, reducing reliance on imports, and supporting advancement in battery technology. Along with this, the Viability Gap Funding under the Union Budget 2023-24 has provided ₹3,760 crore for setting up 4,000 MWh of battery energy storage systems. It has prompted the manufacturers to undertake large-scale projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the Major Players in the Thin Film Battery Market Are

-

Cymbet Corporation (EnerChip rechargeable batteries, EnerChip RTC)

-

STMicroelectronics (Thin-Film Battery Solutions, Energy Harvesting Modules)

-

Excellatron Solid State, LLC (Thin Film Rechargeable Batteries, Solid State Battery Technology)

-

Blue Spark Technologies (Thin Film Batteries, Printed Electronics)

-

BrightVolt (Flexion Flexible Batteries, Custom Battery Solutions)

-

Enfucell Oy (SoftBattery, Printed Power Solutions)

-

Imprint Energy (ZincPoly Batteries, Flexible Printed Batteries)

-

Ilika plc (Stereax Solid State Batteries, Battery Technology Licensing)

-

ProLogium Technology Co., Ltd. (Solid-State Lithium Ceramic Batteries, Automotive Battery Solutions)

-

Front Edge Technology, Inc. (NanoEnergy Thin Film Batteries, Custom Energy Storage Solutions)

-

Jenax Inc. (J.Flex Flexible Batteries, Wearable Power Solutions)

-

NEC Corporation (Organic Radical Battery, Energy Storage Systems)

-

Panasonic Corporation (Rechargeable Batteries, Energy Storage Solutions)

-

Samsung SDI Co., Ltd. (Thin-Film Battery Modules, Energy Storage Products)

-

LG Energy Solution (Battery Solutions for IoT, Thin Film Flexible Batteries)

-

Solid Power, Inc. (Solid-State Batteries, Energy-Dense Storage Solutions)

-

QuantumScape Corporation (Next-Gen Thin Film Batteries, Solid-State Battery Systems)

-

Murata Manufacturing Co., Ltd. (Micro Batteries, Flexible Power Solutions)

-

Seiko Instruments Inc. (Thin Film Rechargeable Batteries, Energy Solutions)

-

Toshiba Corporation (Energy Storage Systems, Compact Battery Modules)

Major Suppliers (Components, Technologies)

-

BASF (Battery Electrolytes, Specialty Chemicals)

-

Asahi Kasei Corporation (Separator Materials, Battery Components)

-

Umicore (Active Cathode Materials, Battery Raw Materials)

-

Toray Industries (Battery Separator Films, Composite Materials)

-

3M (Conductive Tapes, Bonding Solutions)

-

Hitachi Chemicals (Electrolytes, Battery Solutions)

-

DuPont (Protective Films, Battery-Grade Polymers)

-

Sumitomo Chemical (High-Performance Battery Chemicals)

-

Mitsubishi Chemical (Battery Binders, Conductive Additives)

-

SK Innovation (High-Performance Electrolytes, Battery Materials)

Major Clients

-

Apple Inc.

-

Samsung Electronics

-

Tesla, Inc.

-

Medtronic

-

Fitbit (Google)

-

Sony Corporation

-

Hewlett-Packard (HP)

-

Intel Corporation

-

Garmin Ltd.

-

Siemens AG

Recent Trends

-

July 2024: UK-based solid-state battery developer Ilika has already shipped its initial batch of Goliath battery prototypes to Tier 1 automobile company customers, which will take the prototype battery for testing at their facilities. The company test the P1 Goliath prototype batteries here in-house in a customer sponsored program since last May. Unlike liquid electrolytes, Goliath batteries utilise a ceramic type and are backed by a silicon anode combined with an oxide solid electrolyte. This, according to Ilika, could mean lighter vehicles, faster charging, and longer range, going along with the batteries' higher cell-to-pack ratio.

-

May 2024: Arkema has been chosen by ProLogium, a Taiwanese technology leader in advanced batteries, as a key development and supply partner ahead of the launch of its gigafactory in France. The collaboration begun in 2010, by Arkema and ProLogium, reached its new peak at an LOI (letter of intent) exchange ceremony held in Paris, marking the intent by ProLogium to build a state-of-the-art R&D laboratory in France, host of Arkema's flagship Battery Center of Excellence. This one further demonstrates one time again how capable Arkema is of working with the leaders of the batteries of tomorrow to develop more efficient, safer, and more sustainable ones, utilizing their large suite of technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.45 Billion |

| Market Size by 2032 | USD 2.92 Billion |

| CAGR | CAGR of 22.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Voltage (Below 1.5V, 1.5 V to 3V, Above 3V), • By Battery Type (Disposable, Rechargeable), • By Application (Consumer Electronics, Medical Devices, Wearable Technology, Smart Cards, RFID, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cymbet Corporation, STMicroelectronics, Excellatron Solid State LLC, Blue Spark Technologies, BrightVolt, Enfucell Oy, Imprint Energy, Ilika plc, ProLogium Technology Co., Ltd., Front Edge Technology Inc., Jenax Inc., NEC Corporation, Panasonic Corporation, Samsung SDI Co., Ltd., LG Energy Solution, Solid Power Inc., QuantumScape Corporation, Murata Manufacturing Co., Ltd., Seiko Instruments Inc., Toshiba Corporation. |

| Key Drivers | • The growing acceptance of wearable technology requires thin-film batteries that are compact, efficient, and capable of operating devices optimally. • Thin film battery development and integration is especially motivated by government initiatives on renewable energy storage. |

| Restraints | • The production process of thin-film batteries is highly technical and requires special materials, making it more expensive than traditional batteries. |