Sodium Nitrate Market Report Scope & Overview:

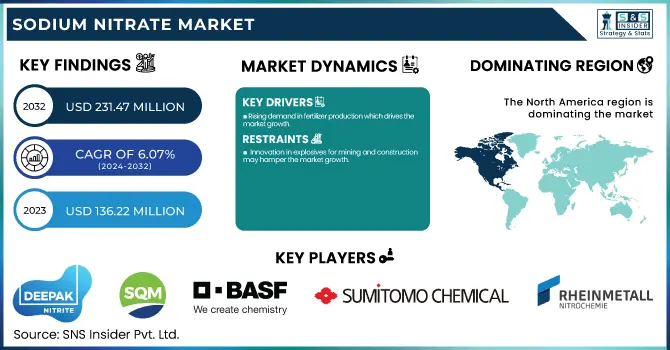

The Sodium Nitrate Market size was USD 136.22 Million in 2023 and is expected to reach USD 231.47 Million by 2032 and grow at a CAGR of 6.07 % over the forecast period of 2024-2032. The sodium nitrate market report provides an in-depth analysis of global production capacity and utilization by country and grade, highlighting key manufacturing hubs. It examines feedstock price fluctuations, their impact on production costs, and regulatory policies and trade restrictions shaping market dynamics. The report also assesses environmental metrics, including emissions, waste management, and sustainability initiatives. Additionally, it explores application demand trends across industries such as fertilizers, explosives, and pharmaceuticals, while tracking innovation and R&D investments in advanced sodium nitrate formulations. This comprehensive study offers valuable data for strategic decision-making.

To Get more information on Sodium Nitrate Market - Request Free Sample Report

Sodium Nitrate Market Dynamics

Drivers

-

Rising demand in fertilizer production which drives the market growth.

One of the most important nitrogen sources in fertilizers is sodium nitrate which is essential to improve soil fertility and crop production. As the world population expands, the need for efficient fertilizers to produce food and guarantee food security has increased dramatically. More, being quick soluble, sodium nitrate is a good source of nitrogen at first, so it is more advantageous for high-value crops such as fruits and vegetables. Its adoption has also been fueled by government initiatives encouraging sustainable agriculture and green fertilizers. The compound also aids in enhancing the metabolism of plants, which guarantees the growth of quicker and healthier crops. In countries with soil depleted of nutrients–which currently includes parts of Africa and Asia–the use of sodium nitrate is rising to help drive productivity from the land. Moreover, controlled-release fertilizer technologies are driving the expansion of sodium nitrate application, allowing for sustainable crop growth and effective nutrient utility without environmental effects.

Restraint

-

Innovation in explosives for mining and construction may hamper the market growth.

Sodium nitrate has been commonly used for a long time for preserved meats and canned foods to save the meat preserve bacteria growth and prolong shelf life. Still, increasing worries about possible associations with several diseases, including cancer and vascular disease, have brought tougher food safety regulations. With regulatory bodies like the U.S. Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) restricting the limits of nitrates in food, food manufacturers have made a necessity of online purchases of organic and natural preservatives. Moreover, changing trends towards clean-label and nitrate-free food products further decrease the market demand for sodium nitrate in food applications. Hence, the decreasing trend for the usage of sodium nitrate in food preservation is likely to affect the overall sodium nitrate market size and the extent its application is used in other many applications.

Opportunity

-

Increasing adoption of carbon capture, utilization & storage creates an opportunity in the market.

The explosives sector has historically been a strong driver of sodium nitrate demand, primarily in mining, quarrying, and construction applications. Nevertheless, explosive technology has developed a lot since then, and much safer and more effective explosives have been developed that rely less on sodium nitrate. Emulsion explosives and new-generation AMFO blends are prime examples of modern explosives with superior stability, higher energy content, and environmentally favorable performance characteristics that provide a more competitive alternative to industry. Moreover, the rise in governmental regulations on the handling of hazardous chemicals and explosive materials is making the usage of conventional sodium nitrate-based explosives more difficult. The use of sodium nitrate in the mining and construction industries has been falling as operators turn to establish safer, more affordable, and less tightly regulated alternatives. This change can create a roadblock to market growth, forcing manufacturers to find new applications and industries to sustain demand.

Challenges

-

Raw material price volatility may create a challenge for the market.

Sodium nitrate is a product of key raw materials namely Sodium carbonate (soda ash) & nitric acid, prices of which are consistently fluctuating with the global supply chain balancing challenges, energy prices spike along with the geopolitical challenges. Manufacturing costs for sodium nitrate are significantly affected by rapidly increasing energy prices, especially in places that are heavily reliant on fossil fuels. Moreover, ongoing supply chain issues such as bottlenecks in transportation & bans on trading raw materials may lead to sporadic availability of raw materials, and house pricing for raw materials again. Regulatory policies restricting environmental outcomes in raw material extraction and processing similarly affect chemical production inputs. The uncertainties regarding pricing make it challenging for manufacturers to stick with competitive price points and in turn profit margins and stability in the market. In such cases, the players in sodium nitrate market will have to adopt raw material price volatility mitigation mechanisms like supply chain diversification and low-cost production strategies for their profitability.

Sodium Nitrate Market Segmentation Analysis

By Grade

The industrial segment held the largest market share around 55% in 2023. Industrial-grade sodium nitrate is used as a nitrogen source in the fertilizer industry, and the agricultural sector is a prominent driver of the industrial-grade sodium nitrate market. Also, its use as an oxidizing agent in explosives, makes it an in-demand product in mining, quarrying and construction applications, which is another factor driving its dominance in the market. Industrial-grade sodium nitrate is also used in the glass industry for decolorizing and refining during the production of high-quality glass, such as optical and solar glass. In addition, the focus on sewage treatment and industrial effluent management has increased the usage of sodium nitrate in biological treatment processes for its purposes. These factors, coupled with its cost-effectiveness and versatility, have made industrial-grade sodium nitrate the largest segment in the market.

By Application

Fertilizer held the largest market share around 32% in 2023. It is owing to the important functioning of sodium nitrate as a Nitrogen-rich soil nutrient used in agricultural applications. Sodium nitrate is primarily used as a fast-acting nitrogen fertilizer. Sodium nitrate is one of the most commonly used fast-acting nitrogen fertilizers used on crops like fruit, vegetables, and other leafy greens because it provides a readily available source of nitrogen for plant growth. The increasing global need for high-yield crops to meet food security and population growth demands blueprints the requirement for sodium nitrate-based fertilizers. Moreover, growing government initiatives in sustainable agriculture and nitrogen-based fertilizers across the regions including Asia-Pacific and Latin America is also projected to drive the market scenario.

Sodium Nitrate Market Regional Outlook

North America held the largest market share around 42% in 2023. Nitrogen-based fertilizers are essential to big agriculture commercial farming in the U.S. and Canada leading to high demand in the region propelling the market. Furthermore, the well-established mining sediment and construction industry increases sodium nitrate consumption in explosives and blasting agents. North American sodium nitrate market also finds its rise in the pharmaceutical sector as it is used in the manufacturing of many medical as well as chemical applications. In addition, stringent environmental regulations have also encouraged increased usage of sodium nitrate in wastewater treatment and industrial effluent management which is further supporting the growth of the market. Due to the support of strong infrastructural development, developed chemical manufacturing facilities, and continued R&D investments, the region accounts for a leading market for sodium nitrate.

Asia Pacific held a significant market share. Growing industrialization, demand from the agriculture sector, and chemical industries industry bounds the Asia Pacific sodium nitrate market significant share. China, India, and Indonesia are some of the largest consumers of sodium nitrate, primarily due to its use in fertilizers, as the large crop production levels and government measures for promoting nitrogen-based fertilizers, tend to compel the demand for sodium nitrate. The sodium nitrate market is also driven by the significant demands in the booming mining and construction industries in the region especially where the global leaders in the mining sector China and Australia are driving the demand for sodium nitrate for use in explosives. Furthermore, the rising specialty glass, pharmaceuticals, and wastewater treatment chemicals are also contributing to the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Deepak Nitrite Limited: (Sodium Nitrite, Nitro Toluenes)

-

SQM S.A.: (Potassium Nitrate, Iodine)

-

BASF SE: (Ammonium Nitrate, Nitric Acid)

-

Weifang Haiye Chemistry and Industry Co.: (Sodium Nitrite, Calcium Ammonium Nitrate)

-

Acf Nitratos S.A.: (Sodium Nitrite, Potassium Nitrate)

-

Quality Chemicals S.L.: (Sodium Nitrite, Potassium Nitrate)

-

Shijiazhuang Fengshan Chemical Co. Ltd.: (Sodium Nitrite, Sodium Metabisulfite)

-

Uralchem JSC: (Ammonium Nitrate, Urea)

-

Alfa Aesar: (Sodium Nitrite, Silver Nitrate)

-

American Elements: (Sodium Nitrite, Barium Nitrate)

-

Huaqiang Chemical Group Co. Ltd.: (Sodium Nitrite, Ammonium Chloride)

-

Liuzhou Chemical Industry Co. Ltd.: (Sodium Nitrite, Sodium Sulfate)

-

Rashtriya Chemicals and Fertilizers Ltd.: (Ammonium Nitrate, Urea)

-

Seth Nandram Daulatram Biyani (SNDB): (Sodium Nitrite, Potassium Nitrate)

-

Sinkiang Nitrate Minerals Co. Ltd.: (Sodium Nitrite, Potassium Nitrate)

-

Sumitomo Chemical Co. Ltd.: (Sodium Nitrite, Methionine)

-

Sumitomo Corporation: (Sodium Nitrite, Fertilizers)

-

Nitrochemie: (Sodium Nitrite, Nitrocellulose)

-

Shandong Haihua Group Co., Ltd.: (Sodium Nitrite, Soda Ash)

-

Liuzhou Chemical Industry Co., Ltd.: (Sodium Nitrite, Ammonium Bicarbonate)

Recent Development:

-

In October 2023, SQM proposed a bid of approximately USD 900 million to acquire all remaining shares of Azure Minerals Limited, aiming to strengthen its presence in the lithium industry.

-

In July 2023, NovaAir Technologies unveiled plans to establish a medical and Sodium Nitrate plant in Karnataka, India. The initiative aims to address the rising demand for medical gases in the healthcare sector. This expansion reinforces the company's commitment to enhancing gas supply infrastructure.

-

In 2023, BASF SE increased its sodium nitrite production capacity in Germany to address the rising demand for high-purity applications in the pharmaceutical and food sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 136.22 Million |

| Market Size by 2032 | USD 231.47 Million |

| CAGR | CAGR of 6.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Industrial, Pharmaceutical, Food) • By Application Chemicals, Fertilizers, Explosives, Glass, Pharmaceuticals, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Deepak Nitrite Limited, SQM S.A., BASF SE, Weifang Haiye Chemistry and Industry Co., Acf Nitratos S.A., Quality Chemicals S.L., Shijiazhuang Fengshan Chemical Co. Ltd., Uralchem JSC, Alfa Aesar, American Elements, Huaqiang Chemical Group Co. Ltd., Liuzhou Chemical Industry Co. Ltd., Rashtriya Chemicals and Fertilizers Ltd., Seth Nandram Daulatram Biyani (SNDB), Sinkiang Nitrate Minerals Co. Ltd., Sumitomo Chemical Co. Ltd., Sumitomo Corporation, Nitrochemie, Shandong Haihua Group Co., Ltd., Liuzhou Chemical Industry Co., Ltd. |