Specialty Oilfield Chemicals Market Report Scope & Overview:

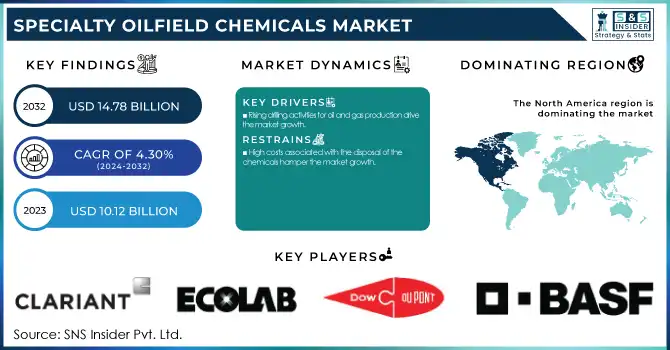

The Specialty Oilfield Chemicals Market Size was valued at USD 10.12 billion in 2023 and is expected to reach USD 14.78 billion by 2032 and grow at a CAGR of 4.30% over the forecast period 2024-2032.

Get more information on Specialty Oilfield Chemicals Market - Request Sample Report

Increased oil recovery plays a vital role in the specialty oilfield chemicals sector, with a growing emphasis on optimizing production from current oil reserves. Due to decreasing traditional oil reserves, oil companies are now utilizing EOR methods to prolong the lifespan of mature fields and obtain additional oil from reservoirs that were once deemed not financially viable. Advanced chemicals are needed for EOR techniques like chemical flooding, gas injection, and thermal recovery to enhance oil viscosity, decrease surface tension, and improve oil displacement from reservoir rock. These specific chemicals, such as polymers, surfactants, and alkalis, are vital in increasing recovery rates by changing the oil and reservoir's physical and chemical characteristics.

For instance, according to the U.S. EIA, there has been a significant increase in Enhanced Oil Recovery (EOR) projects in North America, particularly in the Permian Basin, as companies seek to maximize output from mature fields. This has driven up the demand for specialty chemicals such as polymers and surfactants.

Moreover, technological advancements in chemical formulations are a significant driver of growth in the specialty oilfield chemicals market. Innovations in this field have led to the development of advanced chemicals that enhance performance and efficiency in oil and gas extraction processes. For instance, the introduction of new polymer blends and surfactants has improved the effectiveness of hydraulic fracturing and enhanced oil recovery (EOR) techniques by optimizing fluid dynamics and reducing friction.

Furthermore, operational efficiency is a critical factor driving the specialty oilfield chemicals market, particularly as the oil and gas industry navigates increasingly complex drilling environments such as shale and deepwater wells. In these challenging conditions, the demand for specialty chemicals that enhance drilling performance and reduce downtime is paramount. Specialty chemicals, including advanced drilling fluids and corrosion inhibitors, play a vital role in optimizing the drilling process by ensuring wellbore stability, reducing friction, and preventing equipment failure.

Drivers

Increasing shale gas exploration drives the market growth.

Rising drilling activities for oil and gas production drive the market growth.

The rising drilling activities for oil and gas production are a major driver of growth in the specialty oilfield chemicals market. As global energy demand continues to increase, there is a corresponding surge in exploration and drilling operations, particularly in regions rich in unconventional resources like shale oil and gas. The specialty oilfield chemicals market is experiencing significant growth due to the increase in drilling activities for oil and gas production. For instance, by the end of November 2022, a total of 178 discoveries had been made globally from new-field wildcat drilling, equating to just over 18.7 billion barrels of oil equivalent recoverable. These activities require a wide range of specialty chemicals, such as friction reducers, biocides, and surfactants, to enhance drilling efficiency, ensure well integrity, and improve oil recovery rates. The expansion of drilling activities, especially in North America, the Middle East, and parts of Asia, has led to a higher demand for these chemicals, fueling market growth. The need for more effective and environmentally friendly solutions in increasingly complex drilling environments further propels the adoption of specialty oilfield chemicals, solidifying their critical role in modern oil and gas production.

Restrain

Increasing adoption of renewable energy sources.

High costs associated with the disposal of the chemicals hamper the market growth.

These chemicals, frequently utilized in significant amounts for drilling and production activities, must be handled and disposed of with caution due to the environmental risks they pose. Oil and gas companies face higher operational costs due to regulatory compliance, specialized treatment facilities, and advanced waste management systems involved in the disposal process. With stricter environmental regulations, companies will likely face higher costs in managing waste, posing a greater challenge in avoiding significant expenses. The high costs associated with disposing of certain chemicals may discourage investment, hinder the acceptance of new products, and ultimately affect the overall expansion of the specialty oilfield chemicals market.

Market segmentation

By Type

Friction Reducers held the largest market share market around 37.45% in 2023. Their superior position is attributed to their crucial involvement in hydraulic fracturing processes, particularly in the retrieval of shale oil and gas. Friction-reducing agents are crucial for decreasing the friction between the fluid and the wellbore, enabling increased pump rates and enhanced efficiency during fracturing processes. The rise in unconventional resource demand, mainly in North America, has led to a notable uptick in the utilization of friction reducers, solidifying their importance in the oilfield chemicals industry. Furthermore, continued improvements in friction reducer formulations, including the creation of more efficient and eco-friendly versions, have also strengthened their position in the market. Friction reducers have become the top type in the specialty oilfield chemicals market due to their wide usage in major oil-producing areas and their role in improving operational efficiency.

By Application

In the application segment production segment held the largest market share around 35.23% in 2023. This is explained by the fact that these compounds are used throughout the production process, from well stimulation and maintenance to drilling. Additives to drilling fluid are crucial for optimizing drilling operations because they reduce friction, offer stability, and guard against formation damage. Acidizing agents and fracturing fluids are examples of well stimulation chemicals that increase well productivity by dissolving deposits and causing fractures in the reservoir rock. Scale and corrosion inhibitors guard against deterioration and mineral deposits to prolong the life of production facilities. Oil-water emulsions are separated by demulsifiers and emulsion breakers, and further hydrocarbon extraction is facilitated by improved oil recovery chemicals.

Regional Analysis

North America held the largest market share in the specialty oilfield chemicals market around 41.33% in 2023. The United States and Canada are the leading producers of commercially viable natural gas extracted from shale formations worldwide. According to the U.S. Energy Information Administration (EIA), in 2022, the U.S. produced approximately 28.5 trillion cubic feet (Tcf) of dry natural gas from shale formations, accounting for approximately 80% of the country's total dry natural gas production in the same year. The abundance of shale gas reserves in North America has created a favorable environment for the growth of the specialty chemical market. The increasing demand for specialty oilfield chemicals, such as drilling fluids, corrosion inhibitors, and biocides, has been driven by the need to enhance the efficiency and productivity of shale gas exploration activities. The use of these chemicals helps to reduce operational costs and improve the overall performance of the drilling process. Moreover, the North American region has a well-established infrastructure for the production and distribution of specialty chemicals. The presence of leading specialty chemical manufacturers in this region has further boosted the growth of the market. These manufacturers are investing heavily in research and development activities to develop innovative and sustainable products that meet the evolving needs of the industry.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The Key Players are BASF, Clariant, Ecolab, DowDuPont, Schlumberger, Solvay, AkzoNobel, Halliburton, Baker Hughes, Kemira.& Other Players.

Recent Development:

-

In 2023, Clariant expanded its production capacity in the Middle East by opening a new manufacturing facility dedicated to specialty oilfield chemicals.

-

In 2023, Halliburton introduced a new line of environmentally friendly oilfield chemicals designed to reduce the environmental impact of drilling operations

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.12 Bn |

| Market Size by 2032 | US$ 14.78 Bn |

| CAGR | CAGR of 4.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Friction Reducers, Inhibitors, Biocides, Demulsifiers, Surfactants, and Other) • By Application (Cementing, Drilling fluids, Oil Recovery, Well Stimulation, And Production) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF, Clariant, Ecolab, DowDuPont, Schlumberger, Solvay, AkzoNobel, Halliburton, Baker Hughes, Kemira. |

| Key Drivers | • Increasing crude oil production activities • Increasing oil demand across the globe • Rising drilling activities for oil and gas production |

| Restrain | •High costs associated with the disposal of the chemicals hamper the market growth |