Telecom Electronic Manufacturing Services Market Size Report:

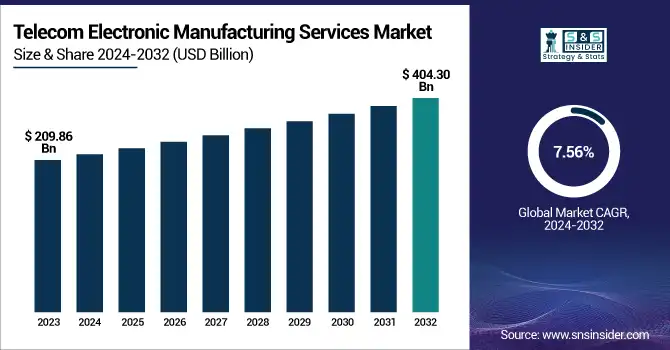

The Telecom Electronic Manufacturing Services Market was valued at 209.86 Billion in 2023 and is projected to reach USD 404.30 Billion by 2032, growing at a CAGR of 7.56% from 2024 to 2032. This growth is primarily driven by the rapid deployment of 5G networks, increasing demand for advanced telecom infrastructure, and the growing trend of outsourcing complex manufacturing tasks to specialized EMS providers.

To Get more information on Telecom Electronic Manufacturing Services Market - Request Free Sample Report

Additionally, the integration of cutting-edge technologies such as AI-driven testing, IoT, and cloud-connected systems into telecom hardware has significantly increased the need for agile and high-precision manufacturing capabilities. In the United States, the market stood at USD 36.95 billion in 2023 and is expected to reach USD 72.62 billion by 2032, registering a CAGR of 7.78% during the forecast period. Key statistical trends reshaping the market include rising technology adoption rates, a growing focus on sustainability and ESG compliance, increasing volatility in the Bill of Materials (BOM) due to global supply chain shifts, and a surge in co-development engagement frequency between EMS providers and telecom OEMs to accelerate innovation, customization, and time-to-market delivery.

Telecom Electronic Manufacturing Services Market Dynamics:

-

The Impact of US Tariffs on the Electronics Manufacturing Services (EMS) Market

US tariffs on electronics have significantly disrupted the global Electronics Manufacturing Services (EMS) sector, offering both challenges and opportunities. The tariffs, including up to 145% on Chinese imports and a global 10% tariff, have raised production costs and altered supply chains. India, benefiting from the government’s "Make in India" initiative, is becoming an attractive manufacturing hub as foreign companies look to relocate production. Despite the imposition of a 26% tariff on Indian goods, India’s electronics sector is seen as more favorable than competitors such as Vietnam, China, and Taiwan, which face higher tariffs. The US remains a crucial market for India’s electronics industry, with mobile phones being a significant export. However, the US's desire to reshore semiconductor and tech manufacturing for national security concerns could impact India’s competitiveness, particularly as countries like Vietnam gain advantages from zero tariffs on smartphones.

Drivers:

-

Rapid expansion of 5G and fiber-optic networks is fueling demand for telecom hardware, driving Telecom EMS market growth.

The rapid deployment of 5G networks and large-scale fiber-optic expansion are accelerating the demand for high-performance telecom hardware, significantly boosting the Telecom Electronic Manufacturing Services (EMS) market. Major telecom players like AT&T are heavily investing in 5G and fiber rollouts, anticipating strong growth in free cash flow. Similarly, Bharti Airtel’s multi-billion-dollar partnership with Ericsson to enhance 4G and 5G coverage highlights a global shift toward advanced telecom infrastructure. The complexity and density of 5G networks require robust, fiber-rich backbones to meet low latency and high-speed data needs, fueling demand for precision-engineered hardware. This trend is further supported by proactive government initiatives and public-private partnerships aimed at improving digital connectivity. As a result, EMS providers are witnessing increased demand for telecom-grade electronic components, positioning them at the core of this next-gen network transformation.

Restraints:

-

Technology obsolescence in the Telecom EMS market drives the need for continuous innovation and substantial R&D investment to stay competitive.

Technology obsolescence is a significant challenge for the Telecom Electronic Manufacturing Services (EMS) market, driven by rapid advancements in telecom technologies. As networks evolve with the emergence of technologies such as 5G, fiber optics, and next-generation telecom hardware, existing products can become obsolete in a short period of time. EMS providers need to keep investing in R&D in order to provide innovative solutions for telecom infrastructure and better respond to more complex customer demands. Because of this demand for innovation, there are higher costs and resources used, and the pressure on companies to keep up with technological changes. Furthermore, not adapting quickly enough risks losing market share to more nimble competitors with cutting-edge and future-proofed offerings. As the telecom landscape evolves at a rapid pace, companies must embrace technological upgrades or risk being left behind in a highly competitive industry.

Opportunities:

-

Telecom EMS providers can thrive by capitalizing on the growing demand for high-quality hardware driven by the expansion of fiber-optic networks.

The expansion of fiber-optic infrastructure by telecom operators presents a significant opportunity for Telecom Electronic Manufacturing Services (EMS) providers. The demand for high-speed, reliable connectivity continues to skyrocket and as telecom companies build and upgrade their networks, the demand for inherently advanced yet sturdy hardware, components and other infrastructure grows. EMS providers can leverage this trend by providing customized solutions that can ensure reliable data transfer, be scalable, and reliable. As fiber-optic technology also becomes more of a necessity in the delivery of next-generation services including 5G and IoT, EMS companies will be positioned to provide the components needed, including fiber-optic cables, network routers and signal processors. This increasing need for advanced telecom hardware creates an opportunity for EMS providers to innovate and expand their offerings in the dynamic telecom industry, helping to establish a resilient, future-proof communication network.

Challenges:

-

Navigating complex and evolving regulatory compliance across regions presents significant operational challenges for Telecom Electronic Manufacturing Services (EMS) providers.

Regulatory compliance remains a significant challenge for Telecom Electronic Manufacturing Services (EMS) providers due to the ever-changing landscape of regulations across different regions. EMS firms have to deal with a wide array of local, national, and global regulations when it comes to product safety, environmental effects, and data privacy. These regulations often require a significant effort to monitor, adapt, and ensure that all products meet strict requirements. Noncompliance with regulatory guidelines can lead to expensive fines, damage to reputation or product-launch slowdowns. Moreover, the diverse nature of these regulations further complicates global operations, compelling EMS providers to adjust manufacturing processes to meet varying regional needs. The challenge will continue, needing ongoing investment in relevant compliance management and legal resources to prevent disruption and to maintain competitive position.

Telecom Electronic Manufacturing Services Market Segment Analysis:

By Services

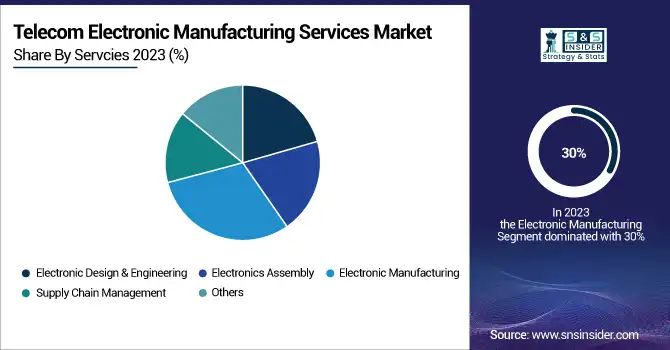

The Electronic Manufacturing Services (EMS) segment holds a dominant position in the market, contributing a significant share of revenue, estimated at approximately 30% in 2023. This dominance is driven by the increasing demand for high-quality, reliable electronic components across various industries, including telecommunications, consumer electronics, and automotive. EMS providers are essential for the efficient production of these components, offering services such as assembly, testing, and logistics. As technology continues to advance, EMS companies play a crucial role in meeting the needs of manufacturers by ensuring timely delivery, cost-efficiency, and adherence to stringent quality standards. The growth of sectors like 5G networks, smart devices, and automotive electronics further strengthens the EMS sector’s leadership in the global market.

The Electronic Design & Engineering segment is expected to experience the fastest growth over the forecast period from 2024 to 2032. This growth is driven by increasing demand for customized, cutting-edge electronic solutions across industries like telecommunications, consumer electronics, and automotive. As companies prioritize innovation and product differentiation, the need for advanced design and engineering services to develop complex, high-performance electronics is rising. Additionally, the integration of emerging technologies such as artificial intelligence, IoT, and 5G networks accelerates the demand for specialized design services. As a result, Electronic Design & Engineering is poised to become a key driver of market expansion, with companies investing heavily in R&D to meet evolving consumer needs.

Telecom Electronic Manufacturing Services Market Regional Outlook:

In 2023, the Asia-Pacific region dominated the Telecom Electronic Manufacturing Services (EMS) market, securing 45% of the global market share, driven by technological advancements and increasing telecom infrastructure demand in countries like China, Japan, India, and South Korea. China, as the key player, significantly contributes to the EMS market due to its advanced manufacturing capabilities and robust telecom industry. The country’s rapid 5G infrastructure expansion, with over 4.19 million 5G base stations by the end of 2024, outpaces the U.S., positioning it as a global leader. Additionally, China's telecom giants, such as China Mobile, China Telecom, and China Unicom, boast hundreds of millions of 5G customers. This growth, fueled by government initiatives like “Made in China 2025,” underpins the demand for telecom hardware and EMS solutions, further driving market growth in the region.

North America is expected to witness significant growth in the Telecom Electronic Manufacturing Services (EMS) market from 2024 to 2032, driven by the ongoing expansion of 5G networks and increased telecom infrastructure investments. The U.S., as a major player, continues to enhance its telecom capabilities through large-scale deployments of 5G technologies, creating substantial demand for advanced telecom hardware. The region benefits from the high adoption rate of cutting-edge technologies and significant investments from telecom giants like AT&T, Verizon, and T-Mobile. Additionally, North American government initiatives, such as the Infrastructure Investment and Jobs Act, are driving infrastructure development, further boosting the demand for EMS. As the region progresses towards full 5G deployment, the market for telecom hardware and services is set to experience robust growth, positioning North America as a key contributor to the global EMS landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Telecom Electronic Manufacturing Services Market along with their Products:

-

FLEX LTD. (Singapore) – Telecom infrastructure components, 5G network devices, and communications equipment.

-

Jabil Inc. (USA) – Telecom hardware, network equipment, and communication devices.

-

Plexus Corp. (USA) – Telecom network equipment, base stations, and signal processing components.

-

Benchmark Electronics, Inc. (USA) – Telecom equipment, signal processors, and communication network components.

-

Celestica Inc. (Canada) – Telecom network infrastructure, 5G base stations, and communication components.

-

COMPAL Inc. (Taiwan) – Communication devices, base stations, and telecom equipment.

-

Creation Technologies LP (Canada) – Telecom equipment, signal processing devices, and communication infrastructure.

-

Fabrinet (Thailand) – Optical communication devices, fiber-optic components, and telecom network hardware.

-

Foxconn Technology (Taiwan) – Telecom components, 5G infrastructure devices, and communication electronics.

-

Sanmina Corporation (USA) – Telecom base stations, communication modules, and network components.

-

Venture Corporation Limited (Singapore) – Telecom network hardware, communication devices, and 5G infrastructure solutions.

-

Kimball Electronics, Inc. (USA) – Telecom devices, network infrastructure, and communication hardware.

-

Wistron Corporation (Taiwan) – Telecom network components, base stations, and communication devices.

-

Universal Scientific Industrial Co., Ltd. (USI) (Taiwan) – Telecom infrastructure hardware, 5G equipment, and communication components.

-

Zollner Elektronik AG (Germany) – Telecom infrastructure devices, signal processing equipment, and communication hardware.

-

SIIX Corporation (Japan) – Telecom infrastructure, communication devices, and network equipment.

-

Elcoteq SE (Finland) – Telecom network devices, communication components, and infrastructure equipment.

-

SMTC Corporation (Canada) – Telecom communication equipment, base stations, and network components.

List of key suppliers for raw materials and components in the Telecom Electronic Manufacturing Services (EMS) market:

-

Dow Inc.

-

3M Company

-

DuPont

-

LG Chem

-

Samsung SDI

-

Mitsubishi Materials Corporation

-

Nitto Denko Corporation

-

Henkel AG & Co.

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

TE Connectivity

-

Sumitomo Electric Industries

-

Corning Incorporated

-

Kyocera Corporation

-

Avago Technologies

-

Panasonic Corporation

Recent News:

-

April 9, 2025, India’s USD 2.7 billion PLI scheme for electronic components, announced in March 2025, aims to reduce import reliance and boost local manufacturing. With investments of USD 7 billion, it targets creating 92,000 jobs and driving innovation in key sectors like PCBs, displays, and semiconductors.

-

Apr 9, 2025, Dixon Technologies has announced the establishment of a Rs 1,000-crore facility in Oragadam, near Chennai, creating 5,000 jobs. The new factory will produce laptops, all-in-one PCs, and offer EMS services, marking a significant investment in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 209.86 Billion |

| Market Size by 2032 | USD 404.30 Billion |

| CAGR | CAGR of 7.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Electronic Design & Engineering, Electronics Assembly, Electronic Manufacturing, Supply Chain Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLEX LTD. (Singapore), Jabil Inc. (USA), Plexus Corp. (USA), Benchmark Electronics, Inc. (USA), Celestica Inc. (Canada), COMPAL Inc. (Taiwan), Creation Technologies LP (Canada), Fabrinet (Thailand), Foxconn Technology (Taiwan), Sanmina Corporation (USA), Venture Corporation Limited (Singapore), Kimball Electronics, Inc. (USA), Wistron Corporation (Taiwan), Universal Scientific Industrial Co., Ltd. (USI) (Taiwan), Zollner Elektronik AG (Germany), SIIX Corporation (Japan), Elcoteq SE (Finland), SMTC Corporation (Canada). |