Ultra-low Phase Noise RF Signal Generator Market Size Analysis:

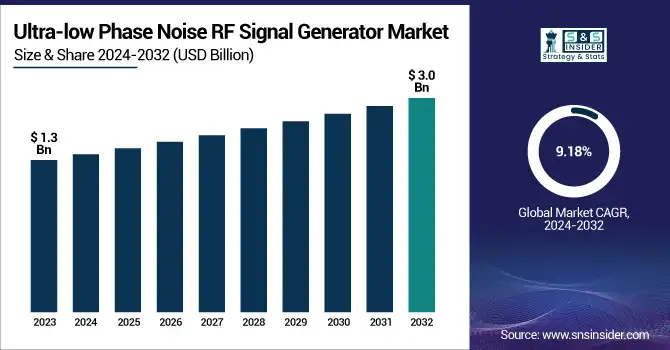

The Ultra-low Phase Noise RF Signal Generator Market was valued at USD 1.3 billion in 2023 and is expected to reach USD 3.0 billion by 2032, growing at a CAGR of 9.18% from 2024-2032.

This report consists of an in-depth analysis of the Ultra-Low Phase Noise RF Signal Generator Market, highlighting key trends and advancements. The global production volume of RF signal generators is witnessing steady growth, with regional variations driven by demand in telecommunications, aerospace, and defense. Improvements in phase noise performance across different frequency bands indicate a shift towards higher precision and stability in signal generation. The increasing adoption by end-use industries reflects the growing need for low-phase noise solutions in quantum computing, radar systems, and satellite communications. Additionally, research and development investments in next-generation RF signal generation technologies are accelerating, with countries focusing on innovation for enhanced signal integrity and performance.

To Get more information on Ultra-low Phase Noise RF Signal Generator Market - Request Free Sample Report

The U.S. Ultra-Low Phase Noise RF Signal Generator Market was valued at USD 0.3 billion in 2023 and is expected to reach USD 0.7 billion by 2032, growing at a CAGR of 8.93% from 2024-2032. driven by rising demand in aerospace, defense, and 5G communications. Increased R&D investments in advanced radar and quantum computing applications are fueling innovation. The market is expected to grow steadily as industries prioritize high-precision signal generation for critical applications.

Ultra-low Phase Noise RF Signal Generator Market Dynamics

Drivers

-

Increasing use in radar, satellite communications, and electronic warfare boosts market demand.

Increasing demand for ultra-low phase noise RF signal generators in aerospace and defence applications is a key factor driving market growth. These generators are vital in radar systems, satellite communications, and electronic warfare, where signal precision and stability are paramount. Due to increasing global defense budgets and the advancement of next-generation radar and surveillance technologies, the demand for high-performance RF signal generators is soaring. Other factors contributing to increased market growth are the deployment of electronic countermeasures and secure communication systems. The need for ultra-low phase noise RF signal generators will be significantly growing as advanced communication systems become a 'priority', at the forefront of governments and various defense organizations.

Restraints

-

Expensive materials and complex manufacturing processes limit widespread adoption.

The production of ultra-low phase noise RF signal generators involves complex manufacturing processes and the use of high-end components, making them expensive. These generators require advanced materials and precision engineering to ensure minimal phase noise, leading to high research and development (R&D) costs. Moreover, the integration of cutting-edge semiconductor technology increases production expenses, limiting adoption, especially among small and medium-sized enterprises (SMEs). The high initial investment and maintenance costs create a barrier for widespread adoption across industries. As a result, affordability remains a key challenge, particularly for commercial applications that demand cost-effective solutions.

Opportunities

-

Growing 5G deployment fuels demand for high-precision RF signal generators.

The rapid deployment of 5G and next-generation wireless networks presents a significant growth opportunity for the ultra-low phase noise RF signal generator market. These generators play a crucial role in testing and optimizing 5G base stations, antennas, and network components. The increasing adoption of millimeter-wave (mmWave) technology and massive multiple-input multiple-output (MIMO) systems further boosts the need for high-precision RF signal sources. With telecommunication companies investing heavily in 5G infrastructure worldwide, the demand for low-phase-noise RF generators will continue to rise. Additionally, emerging technologies such as 6G and advanced satellite communications will create long-term market growth opportunities.

Challenges

-

Engineering difficulties and lack of uniform benchmarks hinder product development.

Ultra-low phase noise RF signal generators are challenging to develop due to various technical concerns with stability, power usage, and quality of the signal. If a circuit is to have low phase noise as well as low signal purity, it is a challenging engineering solution. While manufacturers in different streams within a single market segment can share best practices, external best practices are extremely hard to adopt due to the lack of standardized performance metrics and test sets. Developing a single solution becomes challenging as there are various industry requirements in sectors like defence, telecommunications, research laboratories, etc. Extinguishing these technical barriers and standardization will play a vital role in the expansion of the market.

Ultra-low Phase Noise RF Signal Generator Market Segmentation Analysis

By Type

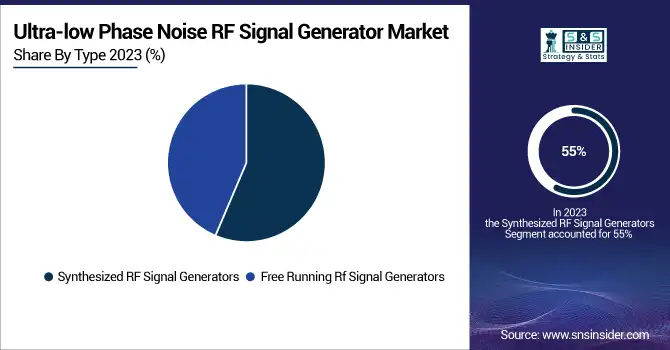

Synthesized RF signal generators segment dominated the market and accounted for the largest share of the overall market in 2023 owing to their better frequency stability, accuracy, and versatility across different applications. These generators are critically important to industries involving aerospace, defense, telecommunications, and research, as they provide highly precise signals used in radar, satellite, and wireless testing. The growing need for high-performance RF test solutions in 5G infrastructure and next-generation communication systems also drives its dominance.

The free-running RF signal generators segment is projected to grow at the fastest CAGR as they are increasingly adopted in cost-sensitive applications, such as industrial and educational research. These generators use simple design, fast frequency tuning, and cost in low-power wireless networks and look like IoT technology compatible generators. The growing demand for compact and energy-efficient signal generation solutions for use in portable and embedded systems is expected to drive the growth of the market.

By Form Factor

The benchtop RF signal generators dominated the market and accounted for the highest market share in 2023, owing to their outstanding performance, improved signal accuracy, and sophisticated testing features. These generators are used in aerospace, defense, telecommunications, and research laboratories, where accurate signal generation is crucial. In addition, their durable construction, simple operation, and capability to cater to high-frequency applications have made them a favorite when it comes to RF testing.

The modular RF signal generators are expected to drive the fastest CAGR due to the growing demand for flexible and scalable testing solutions. Modular generators cut costs over traditional benchtop models and offer seamless integration into automated test systems. Due to its compact size, multi-channel capability, and software-driven configurability, semiconductor testing and other measurement systems targeting wireless communication and IoT development industries are recognizing the value of modular test solutions.

By Application

The radar systems dominated the market and accounted for 49% of revenue share in 2023 because of the high-level applications in the fields of aerospace, defense, and weather monitoring. Radar Performance Requires Ultra Low Phase Noise RF Signal Generators Accurate target detection, tracking, and imaging require proper radar performance, and ultra-low phase noise RF signal generators are critical to this performance. As a result, the growing defense budgets around the world and the increasing development of the next generation radar system increase the demand for the high-precision-RF signal generator.

The communication systems segment is projected to witness the fastest CAGR during the forecast period, primarily due to the rapid expansion of 5G, satellite communications, and wireless networking. Ultra-low PNC RF signal generators are critical components used to deliver high signal fidelity with minimal interference for enhanced network performance. The demand for high-speed data transmission is growing, which entails fast RF signal generators for telecommunication infrastructure testing.

By End-Use

The aerospace and defense segment dominated the market and accounted for the largest share of the market in 2023, because ultra-low phase noise RF signal generators find extensive applications in radar, electronic warfare, and satellite communications. These signal generators provide ultra-precise frequency generation for defense mission-critical applications. This segment still dominates the market, owing to the rising defense budgets globally, technological advancements in military radar systems, and an increasing need for secure satellite-based communication.

The information and communication technology segment are projected to record the fastest CAGR, owing to the proliferating abstract of 5G networks, IoT, and future communication technologies. However, for high-quality RF equipment, the ultralow phase noise RF signal generators are used to test such telecommunication equipment with signal integrity, such as making sure reducing or avoid the effect of interference signal.

Ultra-low Phase Noise RF Signal Generator Market Regional Landscape

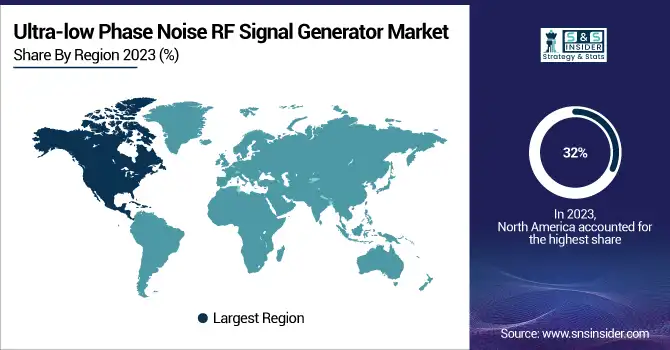

North America dominated the market and accounted for 32% of the revenue share in 2023, driven by robust investments in the aerospace, defense, telecommunications, and semiconductor industries. Also, the research and development capabilities, a strong local support, and the presence of key players of the market in the region are likely to drive continued innovations in the RF signal generation technologies. Countries are constantly investing in 5G networks, satellite communications, and defense modernization programs to accelerate the growth of this market.

The Asia-Pacific region is projected to grow at the fastest CAGR because of rapid industrialization, increasing 5G infrastructure, and enhanced defense expenditure. Nations such as China, Japan, South Korea, and India are investing heavily in wireless communication technologies, semiconductor fabrication, and electronic warfare systems. Market growth is further powered by the growing use of advanced RF signal generators for telecom testing, automotive radar applications, and research labs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Ultra-low Phase Noise RF Signal Generator Market are:

-

Rohde & Schwarz – SMA100B RF and Microwave Signal Generator

-

Keysight Technologies – N5183B MXG X-Series Microwave Signal Generator

-

Anritsu Corporation – MG3690C RF/Microwave Signal Generator

-

Berkeley Nucleonics Corporation – Model 845 Microwave Signal Generator

-

Tektronix – TSG4100A Vector Signal Generator

-

Vaunix Technology Corporation – Lab Brick LMS-802DX Signal Generator

-

Holzworth Instrumentation – HSX Series RF Synthesizers

-

Signal Hound – SM200C RF Spectrum Analyzer and Signal Generator

-

Windfreak Technologies – SynthHD Dual Channel RF Signal Generator

-

Boonton Electronics – SGX1000 RF Signal Generator

-

RF-Lambda – RLSDG Series Signal Generator

-

Synergy Microwave Corporation – SYNX-2600 Ultra-Low Phase Noise Signal Generator

-

Morion, Inc. – MV317 Ultra-Low Phase Noise OCXO-based Generator

-

Wenzel Associates, Inc. – Blue Tops Ultra-Low Phase Noise Signal Generator

Recent Developments

-

January 2024: Keysight Technologies expanded its SSA-X Signal Source Analyzer portfolio by introducing higher frequency models, including 26.5 GHz, 44 GHz, and 54 GHz versions. These models offer integrated, one-box solutions for phase noise and signal source analysis, catering to advanced wireless communications, radar, and high-speed digital applications.

-

May 2024: Keysight Technologies addressed the trade-offs between low phase noise, fast switching, and high signal purity in signal generators. They introduced the G3 Analog Signal Generator series, covering frequencies from 9 kHz to 54 GHz, designed to meet the demanding specifications of high-precision test and measurement application.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 1.3 Billion |

|

Market Size by 2032 |

USD 3.0 Billion |

|

CAGR |

CAGR of 9.18 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Synthesized RF Signal Generators, Free Running RF Signal Generators) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Rohde & Schwarz, Keysight Technologies, Anritsu Corporation, Berkeley Nucleonics Corporation, Tektronix, Vaunix Technology Corporation, Holzworth Instrumentation, Signal Hound, Windfreak Technologies, Boonton Electronics, RF-Lambda, Synergy Microwave Corporation, Morion, Inc., Wenzel Associates, Inc. |