Wire & Cable Compounds Market Report Scope & Overview:

Get More Information on Wire & Cable Compounds Market - Request Sample Report

The Wire & Cable Compounds Market Size was valued at USD 14.84 billion in 2023, and is expected to reach USD 32.50 billion by 2032 and grow at a CAGR of 9.32% over the forecast period 2024-2032.

The rising demand for wire and cable compounds is largely driven by their critical role in the power sector. Extensive use in power transmission applications makes them a vital cog in the infrastructure machine. Wire and cable compounds provide superior insulation, preventing electrical current leakage and ensuring safe, efficient power transmission. They act as a protective sheath, shielding cables from physical damage, harsh chemicals, and corrosion. This translates to longer cable lifespans and more reliable power. These compounds boast impressive mechanical strength, elasticity, and abrasion resistance. This allows cables to withstand the demands of installation and operation in challenging environments. This winning combination has fueled the widespread adoption of wire and cable compounds in the power sector.

In 2021, the IIJA was signed by the U.S. government, which designates USD 65 billion for power infrastructure projects such as grid modernization and the extension of transmission lines. This investment will probably increase the demand for wire and cable compounds that guarantee the dependability and effectiveness of the power transmission system.

Furthermore, the global transition towards renewable energy sources, such as solar and wind, drives significant demand for specialized wire and cable compounds. These renewable energy projects often operate in harsh and challenging environments, where standard cables may not suffice. For instance, solar panels are exposed to intense sunlight, extreme temperatures, and UV radiation, while wind turbines are subjected to constant mechanical stress, fluctuating temperatures, and exposure to moisture and salt in offshore installations.

The rising adoption of electric vehicles is driving demand for specialized wire and cable compounds that can handle high voltage and ensure safety and efficiency in EVs.

Wire & Cable Compounds Market Dynamics

Drivers

Fueled by urbanization and population growth, the global construction boom is propelling the wire & cable compounds market.

Growing construction, driven by rapid urbanization and population growth, is a boon for the wire & cable compounds market. As cities sprawl and populations surge, the need for new infrastructure, homes, and commercial spaces explodes. This translates to a massive demand for wires, cables, and the compounds that make them reliable and cost-effective. While COVID-19 caused a temporary setback, the construction industry is expected to pick up steam, propelling the wire & cable compounds market forward, particularly in Asia Pacific where the use of these compounds in construction is growing rapidly.

China's continued focus on urbanization is resulting in the building of new cities and the growth of already established ones. The government's goal of relocating 250 million people to new urban areas by 2025 has led to significant investments in construction, with the NDRC estimating infrastructure expenditure to exceed USD1000 Billion per year.

Restrain

Government regulations are restricting the use of halogenated polymers in the wire & cable industry.

The widespread use of halogenated polymers in wire & cable compounds is facing a growing challenge: government regulations. A prime example is the European Union's Construction Products Regulation. This legislation acts as a watchdog, ensuring the reliability and safety of building materials sold within the European Economic Area (EEA). The CPR achieves this by setting strict standards and uniform testing methods for various construction materials, including wire & cable compounds. These tests go beyond basic functionality and delve deep into fire safety performance. These stringent regulations have significantly impacted the demand for halogenated compounds in the EU's wire & cable industry. Halogenated materials often perform poorly in some of these fire safety tests. Consequently, the EU construction sector has been directed to prioritize non-halogenated wires and cables. This shift has led to a stagnation in the market for halogenated polymers within the European region.

Wire & Cable Compounds Market Segmentation Analysis

By Type

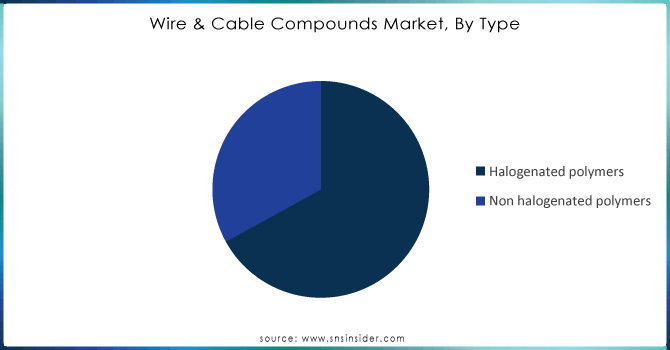

The halogenated polymers, by type segment, are leading the wire and cable compound market and held a share of around 63.45% in 2023. the ever-reliable PVC. PVC's reign isn't solely based on tradition it's a true industry workhorse. This versatile material finds applications across various sectors like footwear, plastics, and packaging, but in the wire & cable world, its dominance is undeniable. PVC holds the prestigious title of the world's third-highest-produced synthetic plastic polymer, trailing only polyethylene and polypropylene. Projections suggest PVC will continue to be king, claiming the lion's share of the wire & cable compounds market. However, PVC isn't without its partner. Chlorinated polyethylene (CPE) enters the scene, offering a helping hand. This unique material is essentially polyethylene with a twist it boasts a chlorine content of around 30-40%. This twist allows CPE to act as a modifier for PVC, fine-tuning its properties for specific applications within the wire & cable industry.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-Use Industry

In the power segment held the largest market share around 38.63% in 2023. The power industry is a critical infrastructure sector that requires a vast and reliable network for electricity generation, transmission, and distribution. With the global push for energy security, grid modernization, and the integration of renewable energy sources, the power sector has seen significant investments in upgrading and expanding its infrastructure. Wire and cable compounds play a vital role in this sector by providing the necessary insulation, durability, and safety features required for high-voltage power transmission.

Moreover, as countries worldwide focus on reducing energy losses and enhancing grid efficiency, the demand for advanced wire and cable compounds has surged. These materials are essential for ensuring the long-term reliability and safety of power systems, especially as the industry shifts towards more sustainable energy sources such as solar and wind.

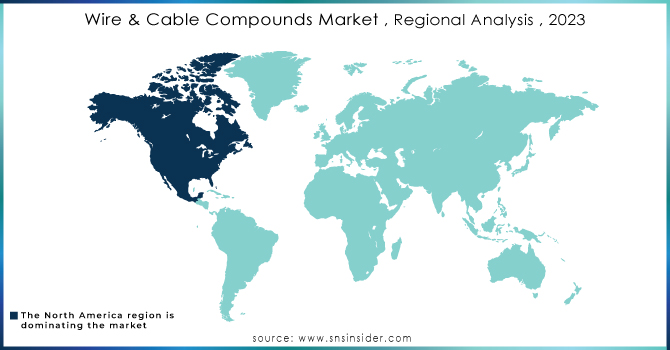

Wire & Cable Compounds Market Regional Overview

North America region dominates in the wire & cable compounds market, holding the largest market share in 2023. This dominance can be attributed to the well-developed industrial base, and the market for wire & cable compounds thrives alongside domestic industrial growth. Specific sectors within North America are experiencing particularly explosive growth. The communication industry is a prime example. Fueled by continuous technological advancements and significant investments in communication infrastructure, this sector is driving a surge in demand for wire & cable compounds. Governments are actively investing in renewable energy solutions like solar and wind power plants. This focus on clean energy translates to a growing need for wires and cables, and consequently, an increased demand for the compounds used in their production. As these clean energy initiatives gain momentum, the market for wire & cable compounds in the power sector is poised to follow suit.

Key Players

-

Avient Corporation (ColorMatrix, Compounding Solutions)

-

Borouge (Borlink, Borstar)

-

DuPont de Nemours, Inc. (Zytel, Teflon)

-

Eastman Chemical Company (Eastman Tritan, Eastman Chemical Coatings)

-

Evonik Industries AG (VESTAMID, VESTOSINT)

-

Exxon Mobil Corporation (Exxtral, Exxalon)

-

Hanwha Solutions Corporation (HIVOL, HDFLEX)

-

Mitsubishi Chemical Corporation (Duracon, Tarflon)

-

PolyOne Corporation (OnCap, Geon)

-

SABIC (LEXAN, NORYL)

-

Royal DSM (Arnite, EcoPaXX)

-

Solvay S.A. (Ryton, Solef)

-

Siam Cement Public Company Limited (SCG Polyolefin, SCG PVC)

-

Trelleborg AB (Trelleborg Rubber Compounds, Trelleborg Non-metallic Solutions)

-

Trelleborg (Trelleborg Elastomers, Trelleborg Cable Solutions)

-

The Dow Chemical Company (DOWLEX, ELVAX)

-

Thermo Fisher Scientific (Nalgene, Teflon)

-

Huntsman Corporation (VITON, DYNEEMA)

-

LG Chem Ltd. (LG Chem Cable Materials, LG Flex)

-

BASF SE (Ultramid, Ultradur)

RECENT DEVELOPMENTS

-

In May 2024: DuPont announced plans to split into three independent publicly traded companies. This move separates its Electronics and Water businesses, allowing them more focus and agility, while New DuPont will remain a diversified industrial leader. All three companies are expected to boast strong financials and promising growth prospects.

-

In June 2024: TEGO® Guard 9000, a revolutionary technology for exterior wall paints, has bagged the prestigious Ringier Technology Innovation Award in the Coating Industry category. This award, established in 2006, recognizes groundbreaking advancements in the coatings industry, and TEGO® Guard 9000's impressive quick-set property clearly impressed the judges.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.84 Billion |

| Market Size by 2032 | US$ 32.50 Billion |

| CAGR | CAGR of 9.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Halogenated Polymers, Non- Halogenated Polymers) • By end-use industry (Construction Wind Energy, Power, Communication, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hanwha Solutions Corporation (South Korea), DuPont de Nemours Inc. (US), Evonik Industries AG (Germany), Siam Cement Public Company Limited (Thailand), Borouge (UAE) Avient Corporation (US), Eastman Chemical Company (US), Solvay S.A. (Belgium), Mitsubishi Chemical Corporation (Japan), Trelleborg AB (Sweden), Exxon Mobil Corporation (US) |

| DRIVERS | • Fueled by urbanization and population growth, the global construction boom is propelling the wire& cable comapunds market. |

| Restraints | • Government rules are restricting the use of halogenated polymers in the wire & cable industry. |