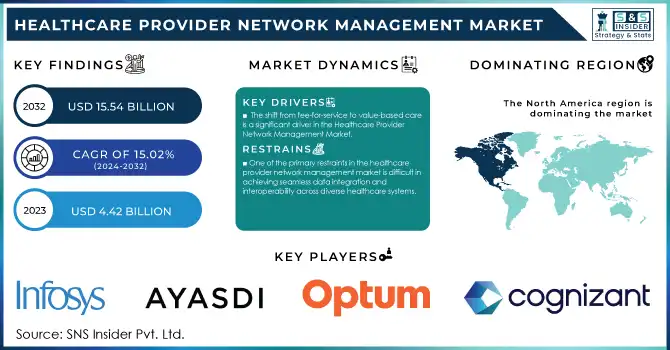

Healthcare Provider Network Management Market Size & Overview:

The Healthcare Provider Network Management Market size was estimated at USD 4.42 billion in 2023 and is expected to reach USD 15.54 billion by 2032 at a CAGR of 15.02% during the forecast period of 2024-2032. The healthcare provider network management market is rapidly evolving as healthcare organizations adopt advanced solutions to manage complex operations efficiently. These systems are vital in streamlining provider credentialing, claims processing, and regulatory compliance, addressing the growing administrative burden in value-based care models. With over 90% of healthcare executives prioritizing operational efficiency, adopting these solutions has become a strategic imperative for payers and providers.

The rise of Artificial Intelligence and Machine Learning in network management systems has revolutionized capabilities such as fraud detection, real-time data integration, and predictive analytics. For example, AI-driven tools can identify anomalies in claims, saving healthcare payers millions of dollars annually in fraud-related losses. Similarly, cloud-based platforms have enabled seamless scalability and improved collaboration across stakeholders, with some solutions reducing claim processing times by as much as 50%.

Get more information on Healthcare Provider Network Management Market - Request Sample Report

Telehealth integration has further expanded the functionality of provider network management systems, with virtual care visits increasing by over 1,000% in 2020 alone. Systems that support telehealth are essential in aligning virtual care providers with traditional healthcare networks, ensuring better patient access and continuity of care. For instance, healthcare organizations leveraging hybrid models for telehealth and in-person visits reported a 20-30% improvement in patient satisfaction scores.

Compliance with regulatory frameworks, such as the Affordable Care Act and the Health Insurance Portability and Accountability Act, is a key factor driving the market. Failing to adhere to these regulations can result in severe penalties, prompting organizations to invest heavily in advanced network management solutions. In 2022, U.S. healthcare entities faced fines totaling over USD 28 million due to compliance violations, underlining the critical importance of robust systems.

Healthcare Provider Network Management Market Dynamics

Drivers

-

The shift from fee-for-service to value-based care is a significant driver in the Healthcare Provider Network Management Market.

Value-based care models emphasize improved patient outcomes and cost efficiency, requiring enhanced coordination across diverse healthcare providers. Network management systems enable seamless integration of services, ensuring efficient patient referrals and accurate performance tracking. These solutions are crucial for optimizing resource allocation and achieving quality care benchmarks. For instance, they assist in monitoring key performance indicators such as hospital readmission rates and treatment success rates, which are vital for reimbursement under value-based contracts.

-

Focus on Cost Containment and Operational Efficiency

Healthcare systems face mounting pressure to reduce administrative costs, which account for up to 30% of total healthcare spending in some regions. Advanced network management tools help streamline processes such as credentialing, claims adjudication, and compliance reporting, significantly reducing manual errors and delays. Automation in these areas has proven to save healthcare providers millions of dollars annually while improving patient satisfaction. For example, automated claims management can reduce processing times by 40%, enabling quicker reimbursements and lessened administrative burden.

-

Technological advancements such as artificial intelligence, machine learning, and blockchain are transforming provider network management.

AI and ML enable predictive analytics to optimize network performance and identify potential issues before they escalate, such as claim denials or provider shortages. Blockchain enhances security in credentialing processes, ensuring provider data integrity and reducing fraud risks. Cloud-based solutions offer scalability and facilitate real-time collaboration, especially valuable for telehealth and hybrid care models. These innovations drive the demand for advanced network management systems globally.

Restraints

-

One of the primary restraints in the healthcare provider network management market is difficult in achieving seamless data integration and interoperability across diverse healthcare systems.

Healthcare organizations often utilize multiple legacy systems that lack compatibility, creating silos that hinder data sharing and coordination among providers. This challenge becomes even more pronounced with the growing complexity of networks that include various specialists, telehealth services, and ancillary care providers. The lack of standardized data formats and communication protocols exacerbates these issues, increasing operational inefficiencies and limiting the full potential of network management solutions. Additionally, transitioning from outdated systems to advanced platforms involves significant costs and time investments, which can deter small and mid-sized organizations. As a result, the industry faces delays in fully leveraging modern technologies to streamline operations and enhance care delivery. Addressing these barriers is essential for maximizing the impact of provider network management solutions.

Healthcare Provider Network Management Segmentation Analysis

By Component

In 2023, the services segment dominated the healthcare provider network management market, accounting for 60% of the market share. This dominance stems from the critical role of services in ensuring the effective deployment and utilization of network management solutions. Healthcare organizations increasingly rely on implementation, integration, and support services to optimize their workflows and meet compliance requirements. Consulting services also play a vital role, helping organizations navigate the complexities of regulatory landscapes and tailor solutions to their unique operational needs. The demand for ongoing maintenance and upgrades further reinforces the prominence of this segment, as healthcare systems continuously evolve to adapt to new challenges and technological advancements.

The software/platforms segment is projected to grow at the fastest rate due to its integral role in automating and streamlining provider network management processes. Advanced platforms offering features such as credentialing, claims processing, and real-time analytics are increasingly adopted to reduce administrative inefficiencies and improve operational outcomes. The shift toward value-based care models and the need for enhanced interoperability further drive the demand for robust software solutions, making this segment a significant growth area.

By Delivery Mode

In 2023, the on-premise delivery mode segment accounted for the largest share of the healthcare provider network management market. This segment's dominance, estimated at over 60% of the market share, is attributed to organizations that prioritize control over their IT infrastructure and data security. Many healthcare providers, especially large hospitals and healthcare institutions with strict data governance policies, prefer on-premise solutions. These systems provide enhanced control over sensitive patient data, ensuring compliance with local regulations and mitigating concerns around data breaches and external cyber threats. On-premise delivery also allows for complete customization of the network management software to meet the specific needs of healthcare organizations, further strengthening its appeal.

The cloud-based delivery segment is expected to grow at the fastest rate in the coming years. Cloud solutions are increasingly favored for their flexibility, scalability, and lower total cost of ownership. Healthcare organizations are shifting towards cloud platforms to streamline operations, enable remote collaboration, and improve data interoperability. With cloud platforms offering improved security features, cost-effectiveness, and ease of integration with other healthcare systems, they are becoming the preferred choice for many organizations, driving substantial growth in this segment.

Healthcare Provider Network Management Market Regional Outlook

In 2023, North America, particularly the United States, held a dominant position in the healthcare provider network management market. The region’s leadership was driven by its advanced healthcare infrastructure, high adoption rates of digital health technologies, and stringent regulatory standards. North America's focus on enhancing operational efficiency, ensuring data security, and facilitating collaboration among healthcare providers contributed to the widespread use of network management solutions. Additionally, the rise in chronic disease prevalence and the shift toward value-based care models further fueled demand for these technologies.

Europe ranked as the second-largest market, with countries such as the UK, Germany, and France leading the way. The region's focus on improving healthcare delivery, alongside the increasing need for interoperable solutions and compliance with regulations like GDPR, played a significant role in its market growth. European healthcare organizations were increasingly investing in solutions that enabled efficient management of provider networks and ensured compliance with evolving regulations.

The Asia-Pacific region is expected to experience the highest growth, driven by rapid urbanization, growing healthcare demands, and significant investments in healthcare infrastructure. Countries such as China, India, and Japan are adopting digital solutions to streamline provider network management, reduce costs, and improve healthcare delivery. The increasing uptake of telemedicine and government reforms in the healthcare sector are key factors propelling growth in this region.

Need any customization research on Healthcare Provider Network Management Market - Enquiry Now

Key Players

-

Cognizant - Cognizant Digital Health Platform, Cognizant Provider Network Management Solutions

-

Optum, Inc. - Optum Network Management, Optum360, Optum Analytics

-

Ayasdi, Inc. - Ayasdi Health AI Platform

-

Change Healthcare - Change Healthcare Provider Network Management, Change Healthcare Analytics Solutions

-

Genpact Limited - Genpact Intelligent Network Management Solutions, Genpact Healthcare Analytics

-

Infosys Limited - Infosys Healthcare AI & Analytics, Infosys Provider Network Management Services

-

McKesson Corporation - McKesson Network Management Solutions, McKesson Provider Solutions

-

Mphasis Limited - Mphasis Cloud-Based Healthcare Solutions, Mphasis Healthcare Network Optimization Services

-

Cerner Corporation - Cerner Health Network Management, Cerner Provider Data Management

-

Athenahealth - athenaNet, athenaProvider Network

-

EPIC Systems - Epic Provider Network Management, Epic Care Everywhere

-

Medtronic - Medtronic Care Management Solutions, Medtronic Provider Network Solutions

-

Allscripts Healthcare Solutions - Allscripts CareInMotion, Allscripts Provider Network Management

-

Dell Technologies - Dell Healthcare Cloud Solutions, Dell Healthcare Data Management

-

IBM Watson Health - IBM Watson Health Provider Network Management, IBM Watson Health Analytics

-

Oracle Corporation - Oracle Healthcare Cloud Solutions, Oracle Provider Data Management

-

Verisk Health - Verisk Provider Network Solutions, Verisk Health Analytics

-

UnitedHealth Group - UnitedHealth Provider Network Solutions, Optum Provider Management

Recent Developments

In Oct 2024, Andros introduced Andros Arc, an AI-driven platform aimed at enhancing provider network management for health plans. This innovative solution is designed to optimize the efficiency and effectiveness of managing healthcare provider networks.

In March 2024, Provider Network Solutions (PNS) partnered with Provider Network Solutions of Puerto Rico (PNS PR) to launch Provider Network Solutions Texas (PNS Texas). This new entity aims to significantly impact primary care providers in Fort Bend, Harris, and Montgomery Counties, with plans for gradual expansion across the entire state of Texas.

In June 2023, Quest Analytics introduced Provider Claims Insights, an enhancement within its Quest Enterprise Services (QES) platform. This new tool provides analytics on provider performance, helping health plans optimize provider selection and improve network performance while reducing administrative costs.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.42 Billion |

| Market Size by 2032 | USD 15.54 Billion |

| CAGR | CAGR of 15.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Software/Platforms, Services] • By Delivery Mode [On-premise Delivery, Cloud-based Delivery] • By End User [Payers, Private Health Insurance, Public Health Insurance] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cognizant, Optum, Inc., Ayasdi, Inc., Change Healthcare, Genpact Limited, Infosys Limited, McKesson Corporation, Mphasis Limited, Cerner Corporation, Athenahealth, EPIC Systems, Medtronic, Allscripts Healthcare Solutions, Dell Technologies, IBM Watson Health, Oracle Corporation, Verisk Health, UnitedHealth Group |

| Key Drivers | • The shift from fee-for-service to value-based care is a significant driver in the Healthcare Provider Network Management Market. • Focus on Cost Containment and Operational Efficiency • Technological advancements such as artificial intelligence, machine learning, and blockchain are transforming provider network management. |

| Restraints | • One of the primary restraints in the Healthcare Provider Network Management Market is the difficulty in achieving seamless data integration and interoperability across diverse healthcare systems. |