AIRBORNE RADARS MARKET KEY INSIGHTS:

Get More Information on Airborne Radars Market - Request Sample Report

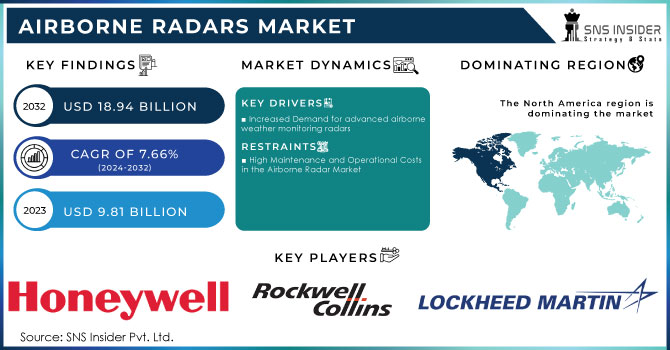

The Airborne Radars Market Size was valued at USD 9.81 Billion in 2023 and is expected to reach USD 18.94 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.

The use of UAVs with integrated radar systems has been reliant on surveillance, reconnaissance, border patrol, and other applications. The global market innovates to meet requirements in unmanned aerial systems for military, civil, and commercial sectors, compelling innovation towards compact and lightweight solutions for efficient UAV radars.

Global growth in the market is expected through increasing investments in modernization programs related to defence and aerospace. Governments and defence organizations continuously allocate budgets to upgrade their airborne platforms with the latest radar systems to stay at the technological cutting edge and safeguard their nation. The development and procurement of newer manned and unmanned aircraft encourage the procurement of state-of-the-art airborne radars, thereby expanding the market. For Instance, The Defence Acquisition Council cleared acquisitions worth USD 10.18 billion to strengthen India's defence capabilities and infrastructure. In this regard, the acquisitions sanctioned include a range of essentials, such as weaponry, armoured vehicles, advanced communication systems, and surveillance equipment. The DAC has also acquired the Air Defence Tactical Control Radar under the Buy (Indian-IDDM). A strategic step entails the enhancement of air defence systems, particularly for the detection of slow, small, and low-flying targets. The radar is likely to be incorporated into surveillance, detection, and tracking of different target patrols as a means of enhancing the security device.

Higher-level surveillance and reconnaissance demand are high in the market. Modern airborne radar systems have emerged as an important component in extending real-time situational awareness, detecting various targets, tracking them, and conducting ISR missions. This rising demand for effective monitoring over various terrains-land, air, and maritime domains-creates an urgency for having airborne radar systems that can provide enhanced levels of detection, imaging, and target identification capabilities.

MARKET DYNAMICS

KEY DRIVERS:

-

Increased Demand for advanced airborne weather monitoring radars

Extreme weather conditions pose giant disturbances in the aviation sector. Advanced weather monitoring radars offer more detailed resolutions of real-time weather conditions, hence better-informed decisions and avoidance of turbulence by pilots, ensuring safe travels. Airborne radar data are also vital to Governments and Disaster Management Agencies in monitoring and predicting weather-related disasters such as floods and storms. For Instance, Under Allied Air Command's operational control, the NATO Airborne Early Warning and Control Force (NAEW&C Force), the biggest multinational collaborative endeavour of the Alliance, has its HQ located at NATO Air Base (NAB) Geilenkirchen in Germany. It was here, in 1982, that the very first NATO Boeing E-3A Sentry Airborne Warning and Control System aircraft arrived to become the key 'eye-in-the-sky' component of the Alliance, providing airspace surveillance, battlespace management, as well as command, control, and communications (C3) capabilities to NATO.

The advanced weather monitoring radars are inextricably linked with the issuance of early warnings and evacuation procedures. Agriculture has come to depend more and more on the accuracy of weather data for the optimization of crop management. Advanced airborne radars have proved to be very useful in understanding rainfall patterns, soil moisture, and forecasts, thus helping the farmer make informed decisions based on quality data. This increased demand for advanced weather monitoring radars will boost the market for airborne radars.

RESTRAIN:

-

High Maintenance and Operational Costs in the Airborne Radar Market

High maintenance and operational costs are some of the major restraint factors for the airborne radar market. Airborne radar systems are highly technical tools built to detect and track several targets in real-time usually under tough environmental and operational conditions. Their maintenance requires highly skilled personnel, specialized infrastructure, and frequent updates, and therefore large financial burdens from operators, especially in the military sector.

The budget of DoD, U.S. Department of Défense, reflects the rising costs of maintaining advanced airborne radar systems. Among the big-ticket items in the Air Force's $169.5 billion for FY 2023 is an increase of $5.5 billion in O&M fund appropriations. These cover such increases as a 4.6% civilian pay raise and $576 million in benefits. But more seriously, there is funding in the billions to maintain all these weapons systems at 85% operational readiness, where radar maintenance costs are included. Such money shows investment in high-performance radar systems, especially because new technologies such as stealth aircraft and hypersonic weapons, always touted as the next big thing, constantly will force the radar systems to keep up to be effective.

Other than the above direct costs, the high long-term operating costs are also a significant restraint. Keeping radars for aircraft like the F-35A and F-15EX requires perennial funding for upgradation in terms of infrastructure improvement and technological advancements. For instance, the $2.3 billion set aside for military construction in FY 2023 funds much-needed infrastructure meant to underpin high-tech radars like airborne systems.

The increasing costs of operation challenge the airborne radar market to such an extent that it poses a limitation on new entrants and discourages investments. Only governments and big defence contractors can afford to have developed, operate, and maintain such systems. This is quite limiting in terms of expansion and diversification in technology.

MARKET SEGMENTS ANALYSIS

BY COMPONENT TYPE

The Antennas Segment holds the largest share with 23.2% in 2023 and is expected to remain the market leader throughout the forecast period. Phased-array antennas and electronically scanned arrays (ESAs) have been critical for the superior performance delivered by airborne radar systems. A phased-array antenna enables high-frequency and ultra-wideband scanning of electronic beams with rapid precision, thus supporting fast target acquisition and tracking.

The Graphical User Interfaces segment would record the highest growth rate of 10.48% CAGR during the forecast period. The segment growth is owed to the increasing demand for higher situational awareness. Modern airborne radar systems generate high datasets that include information on air and ground targets, environmental conditions, and electronic warfare threats.

BY MODE TYPE

By Mode type, the Air-To-Ground Segment held the largest market share at 46.2% in 2023. High demand for multi-role aircraft is further bolstering the market for air-to-ground segments. Most modern military aircraft are fitted with multi-functional radar systems with capabilities in multiple roles, including performing air-to-ground missions. With these roles, military forces can maximize their aerial assets to be agile and responsive in mission scenarios. Another significant factor that makes defence organizations procure high-versatility air-to-ground radar systems is the need for the latter.

The Air-To-Air Segment is forecasted to lead in the race for growth in CAGR of 9.30% during the forecast period. More attention to fifth-generation fighter aircraft further advances the air-to-air segment. Newer-generation fighter aircraft, including fifth-generation platforms, are configured with advanced radar systems that have superior range and stealth detection capabilities and can engage airborne targets.

BY INSTALLATION TYPE

The New Installation Segment has the highest growth rate of 9.79% CAGR in the forecasted period. and introduces cutting-edge technology or innovative features, which have huge outperformance over currently available airborne radar systems it will attract more customers to gain a competitive advantage. This new installation segment comes along with a cost advantage, due to retrofitting the existing system or compared to buying traditional airborne radar systems makes it more appealing to the customers, making it a market leader.

The Retrofit Segment dominated the market in 2023 with the largest revenue share of 67.2%. Cybersecurity updates are crucial to the retrofit segment. With modern radar systems now digital and connected, with data-sharing capabilities embedded, retrofitting allows robust cybersecurity features to be added. Advanced cybersecurity measures can be enhanced in upgraded systems to defend against cyber threats while maintaining critical mission data integrity and confidentiality.

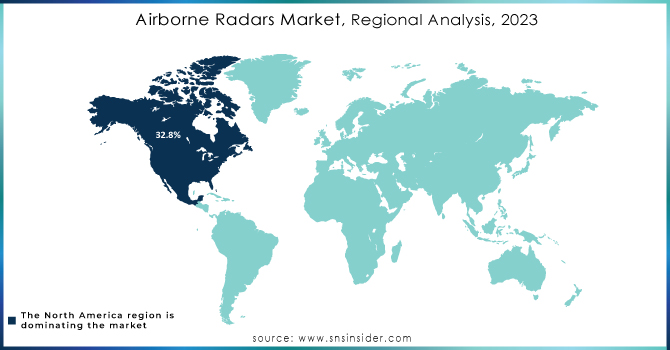

REGIONAL ANALYSIS

North America held the largest share of 32.8% in the airborne radars market in 2023 and is also expected to grow at the highest CAGR during the forecast period. Growing ISR and border surveillance capabilities have significantly driven the growth momentum of the market in North America. For example, the U.S. Defence has increased spending tremendously in the ISR programs. The FY 2023 budget proposal for the United States Air Force had hefty investments in ISR platforms mainly dependent on various radar technologies as mentioned above, like the E-3 Sentry Airborne Warning and Control System and the E-8C Joint Surveillance Target Attack Radar System. Such systems use radar to detect, identify, and track enemy assets across vast areas; they offer real-time operational intelligence.

Asia-Pacific is expected to hold the highest CAGR of 10.32% in the forecasted period. In this region, market growth is expected to continue its upward trend due to increasing demands for airborne surveillance, scientific research, commercial aircraft and business jets' weather monitoring, perimeter surveillance, and battlefield surveillance. The Australian government is placing importance on airborne surveillance radar modernization for the Royal Australian Navy and Air Force. The budget share of South Korea for defence is increasing, and therefore the airborne radars market will grow.

Need Any Customization Research On Airborne Radars Market - Inquiry Now

Key Players

Some of the major players in the Airborne Radars Market are:

-

Lockheed Martin Corporation (AN/APG-81 AESA Radar, AN/APS-147 Multi-Function Radar)

-

Rockwell Collins Inc. (APG-70 AESA Radar, APG-67 Radar)

-

Saab AB (Gripen E Radar, ERIEYE AEW&C Radar)

-

Honeywell International Inc. (AN/APG-79 AESA Radar, AN/APS-125 Radar)

-

General Dynamics Corporation (AN/APG-63 Radar, AN/APG-66 Radar)

-

Rheinmetall AG (Fire Control Radar, Ground Surveillance Radar)

-

BAE Systems (ASTA Radar, SEA SPY Radar)

-

Northrop Grumman Corporation (AN/APG-77 AESA Radar, AN/SPY-6 AESA Radar)

-

Raytheon Technologies (AN/APG-83 AESA Radar, AN/SPY-1 Radar)

-

Thales Group (Ground Master 400 Radar, Sea Fire Radar)

-

Leonardo S.p.A. (Grifo AESA Radar, Seaspray Radar)

-

Hensoldt (Twister AESA Radar, Multi-Mission Radar)

-

L3Harris Technologies, Inc. (AN/APG-67 Radar, AN/APS-153 Radar)

-

Elbit Systems Ltd. (EL/M-2080 Radar, EL/M-2075 Radar)

-

Israel Aerospace Industries (EL/M-2075 Radar, EL/M-2080 Radar)

-

Indra (IRIS-M Radar, Radar Systems for UAVs)

-

Telephonics Corporation (AN/APS-154 Radar, AN/APS-137 Radar)

-

OPTIMARE Systems GmbH (OPTIMARE Radar, OPTIMARE Maritime Radar)

-

Echodyne Corp. (EchoGuard Radar, EchoMapper Radar)

-

Saab Group (Gripen E Radar, ERIEYE AEW&C Radar)

RECENT TRENDS

-

In January 2024, Lockheed Martin Corporation and Northrop Grumman will be delivering the 75th APY-9 radar to the U.S. Navy's E-2D Advanced Hawkeye. The new APY-9 radar system by Lockheed Martin is integrated into the new variant of Advanced Hawkeye. The E-2, Northrop Grumman's aircraft, is famous for its excellent capabilities to track air, land, and sea at the same time.

-

In January 2024, the Ministry of National Defence Republic of Lithuania announced an order to the Dutch Command Materiel and IT agency COMMIT for Thales Ground Master 200 Multi-Mission Compact radars. Thales will support the project in collaboration with partner ELSIS from Lithuania, focusing on the integration of the radar system into vehicles. Simultaneous detection, tracking, and classification of current and emerging threats with high precision is offered by compact radars.

-

In June 2023, Hanwha Systems Co. Signed an Agreement with Leonardo SpA to Collaborate with AESA Radar for the Light Fighter Jets, this collaboration marks the company's strategic step to start collaborating on developing AESA radar systems on the fighter aircraft with Leonardo. The AESA radar is one of the critical components, related to next-generation combat aircraft, detection, and tracking mechanisms toward airborne and ground targets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.81 Billion |

| Market Size by 2032 | US$ 18.94 Billion |

| CAGR | CAGR of 7.66 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Antennas, Receivers, Processors, Transmitters, Graphical User Interfaces, Stabilization Systems, Others) • By Mode Type (Air-to-Ground, Air-to-Air, Air-to-Sea) • By Range Type (Long Range, Medium Range, Short Range, Very Short Range) • By Dimension type (2D, 3D, 4D) • By Frequency Type (X-band, C-band, KU-band, S-band, HF/VHF/UHF, KA-band, Multi-band, L-band) • By Installation Type (New Installation, Retrofit) • By Technology Type (Active Electronically Scanned Array, Software-Defined Radar. Synthetic Aperture Radar, Digital Beamforming, Multistatic Radar Systems, Low Probability of Intercept) • By Application Type (Defence and Military, Commercial and Business) • By Waveform type (Frequency Modulated Continuous Wave (FMCW), Doppler, Ultra-wideband Impulse) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, Rockwell Collins Inc., Saab AB, Honeywell International Inc, General Dynamics Corporation, Rheinmetall AG, BAE Systems, Northrop Grumman Corporation, Raytheon Technologies, Thales Group, Leonardo S.p.A., Hensoldt, L3Harris Technologies, Inc., Elbit Systems Ltd., Israel Aerospace Industries, Indra, Telephonics Corporation, OPTIMARE Systems GmbH, Echodyne Corp., Saab Group |

| Key Drivers | • Increased Demand for advanced airborne weather monitoring radars |

| Restraints | • High Maintenance and Operational Costs in the Airborne Radar Market |