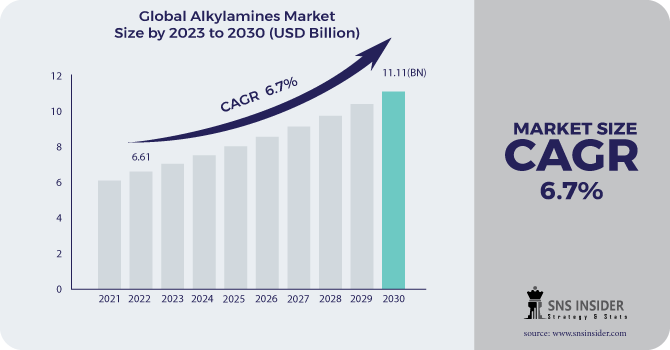

The Alkylamines Market Size was valued at USD 6.24 Billion in 2023. It is estimated to reach USD 10.42 Billion by 2031 and grow at CAGR 6.5% over the Forecast period 2024-2031.

Alkylamines are a versatile group of chemical compounds derived from ammonia (NH₃). They're essentially ammonia molecules with one or more hydrogen atoms replaced by carbon chains (alkyl groups). The number of carbon atoms attached to the nitrogen atom determines the type of alkylamine (primary, secondary, or tertiary). These adaptable compounds are increasingly used in various industries. They act as essential solvents in many processes, help protect crops as pesticides, and even find their way into animal feed formulations. Furthermore, alkylamines play a role in the production of rubber products and water treatment chemicals. The market for alkylamines is expanding due to several factors. The growing demand for diverse solvents utilizing alkylamines is a major driver. Additionally, the use of alkylamine-based pesticides in agriculture and their role in specialized materials like spandex and polyimides contribute to market growth.

Get E-PDF Sample Report on Alkylamines arket - Request Sample Report

Drivers

Growing Demand of Alkylamine market in the Paints and Coatings Industry

Increasing Focus on Environmental Sustainability use of bio biofuels and biodegradable products.

The growth of industries like automotive, machinery, and construction has fueled a surge in demand for high-performance paints and coatings. Alkylamines play a critical role in this by acting as versatile solvents. Their unique properties, including controlled evaporation rates, effective resin and pigment dissolving capabilities, and the ability to enhance other paint characteristics, make them essential ingredients.

Restraint:

Alkylamine production can fluctuate depending on global market conditions.

High cost of maintaining safety and environmental standards in Alkylamines.

Alkylamines can be toxic if inhaled, ingested, or absorbed through the skin. They can cause irritation, respiratory problems, and even neurological effects. Proper safety protocols and equipment are crucial when handling alkylamines. Some alkylamines are volatile organic compounds (VOCs) that contribute to air pollution. Improper disposal of alkylamine waste can also contaminate water sources.

Opportunities

New applications for alkylamines in various industries.

Growig demand of alkylamines in pharmaceutical application

Alkylamines possess a unique combination of properties that make them valuable in various pharmaceutical applications. They effectively dissolve a wide range of drug ingredients, aiding in the formulation of medicines. Compared to some traditional pharmaceutical ingredients, alkylamines can sometimes offer a more cost-effective solution, especially during drug development or large-scale production.

Challenges

New entrants or existing players with expanded capacity in Alkylamines Market.

Impact of Geopolitical Tensions on the Alkylamines Market

Geopolitical instability can disrupt established trade routes and logistics networks. This can make it difficult and expensive to obtain raw materials needed for alkylamine production, especially if they originate in volatile regions. Delays and shortages can create uncertainty for producers and consumers alike. Geopolitical tensions can have a ripple effect on energy prices, a key factor in alkylamine production costs.

Impact of Russia-Ukraine Ukraine has some production capacity for alkylamines and raw materials used in their production. This conflict disrupts these operations and limits overall alkylamine supply. Due to this war has driven up energy prices globally, which can increase alkylamine production costs and lead to price hikes for end products. overall uncertainty created by the war may discourage new investments in alkylamine production capacity.

Due economic downturns, businesses tend to cut costs and postpone non-essential projects. This can lead to decreased demand for alkylamines across various industries that use them, such as pharmaceuticals, personal care products, construction materials, and agriculture. Economic downturns can lead to disruptions in global supply chains, making it more difficult and expensive to obtain raw materials needed for alkylamine production. This can further strain the industry.

By Application

Solvents

Rubber Processing

Water Treatment

Feed Additives

Pharmaceuticals

Others

The solvent sub-segment dominates the global alkylamines market by application, boasting a share of over 40%. This dominance stems from their extensive use in creating various versatile solvents. Some key examples include dimethyl acetamide, dimethyl formamide, and hexamethyl formamide. These solvents find application across diverse industries, including acrylic fiber production, pharmaceuticals, and beyond.

By Type

Methylamines

Ethylamines

Propylamines

Butylamines

Cyclohexylamines

The Methylamine, the simplest primary amine, and dominating segment, it is a key player in the world of organic compounds. Methylamine serves as a building block for various herbicides, insecticides, and fungicides, contributing to improved crop protection and yield. It is also popular in the paint & Coating industry, contributing to the creation of vibrant paints and coatings.

.png)

Get Customized Report as Per Your Business Requirement - Request For Customized Report

The Asia-Pacific region is dominating the alkylamine market, boasting the largest market share and demonstrating the most promising growth trajectory. The region's thriving export sector is driving up demand for alkylamines used in various industries. Growing demand on water treatment activities and the production of surfactants is creating a significant market for alkylamines in Asia-Pacific.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major playes listed in the Alkylamines Market are Feicheng Acid Chemicals Co. Ltd., Alkylamines Chemicals Ltd., Koei Chemical Company, Luxi Chemical Group Co., Ltd., Arkema, Mitsubishi Gas Chemical Company, Eastman Chemical Co., BASF SE, Dow Inc., Balaji Amines, and others.

In March 2022, BASF made plans to construct a brand new, large-scale production facility for alkyl ethanolamines at their Verbund site in Antwerp, Belgium. This expansion project is expected to be completed in 2024.

In February 2022, Eastman's care additives business announced the successful completion of a major expansion project at their manufacturing sites in Ghent, Belgium and Pace, Florida. This project significantly increased their production capacity for tertiary amines, specifically DIMLA 1214.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.24 Billion |

| Market Size by 2031 | US$ 10.42 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Solvents, Agrochemicals, Rubber Processing, Water Treatment, Feed Additives, Pharmaceuticals, Others) • By Type (Methylamines, Ethylamines, Propylamines, Butylamines, Cyclohexylamines) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Luxi Chemical Group Co., Ltd., BASF SE, Arkema, Dow Inc., Alkylamines Chemicals Ltd., Feicheng Acid Chemicals Co. Ltd., Koei Chemical Company, Eastman Chemical Co., Balaji Amines, Mitsubishi Gas Chemical Company |

| Key Drivers | • Expanding wastewater treatment facilities worldwide. • Alkylamines are in high demand for solvent applications. |

| RESTRAINTS | • Alkylamine's negative consequences and the high cost of maintenance • Varying costs for raw materials |

Ans: Primary or secondary type of research done by this reports.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Luxi Chemical Group Co., Ltd., BASF SE, Arkema, Dow Inc., Alkylamines Chemicals Ltd., Feicheng Acid Chemicals Co. Ltd., Koei Chemical Company, Eastman Chemical Co., Balaji Amines, Mitsubishi Gas Chemical Company are the major key players of Alkylamines Market.

Ans: Alkylamine's negative consequences and the high cost of maintenance and Varying costs for raw materials are the restraints for Alkylamines Market.

Ans. The projected market size for the Alkylamines Market is USD 10.42 Billion by 2031.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact Of Russia Ukraine War

5.2 Impact of Economic Slowdown

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Average Selling Price

9.1 North America

9.2 Europe

9.3 Asia Pacific

9.4 Latin America

9.5 Middle East & Africa

10. Alkylamines Market Segmentation, By Type

10.1 Introduction

10.2 Trend Analysis

10.3 Methylamines

10.4 Ethylamines

10.5 Propylamines

10.6 Butylamines

10.7 Cyclohexylamines

11. Alkylamines Market Segmentation, By Application

11.1 Introduction

11.2 Trend Analysis

11.3 Solvents

11.4 Agrochemicals

11.5 Rubber Processing

11.6 Water Treatment

11.7 Feed Additives

11.8 Pharmaceuticals

11. 9 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Alkylamines Market by Country

12.2.3 North America Alkylamines Market By Type

12.2.4 North America Alkylamines Market By Application

12.2.5 USA

12.2.5.1 USA Alkylamines Market By Type

12.2.5.2 USA Alkylamines Market By Application

12.2.6 Canada

12.2.6.1 Canada Alkylamines Market By Type

12.2.6.2 Canada Alkylamines Market By Application

12.2.7 Mexico

12.2.7.1 Mexico Alkylamines Market By Type

12.2.7.2 Mexico Alkylamines Market By Application

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Alkylamines Market by Country

12.3.2.2 Eastern Europe Alkylamines Market By Type

12.3.2.3 Eastern Europe Alkylamines Market By Application

12.3.2.4 Poland

12.3.2.4.1 Poland Alkylamines Market By Type

12.3.2.4.2 Poland Alkylamines Market By Application

12.3.2.5 Romania

12.3.2.5.1 Romania Alkylamines Market By Type

12.3.2.5.2 Romania Alkylamines Market By Application

12.3.2.6 Hungary

12.3.2.6.1 Hungary Alkylamines Market By Type

12.3.2.6.2 Hungary Alkylamines Market By Application

12.3.2.7 Turkey

12.3.2.7.1 Turkey Alkylamines Market By Type

12.3.2.7.2 Turkey Alkylamines Market By Application

12.3.2.8 Rest of Eastern Europe

12.3.2.8.1 Rest of Eastern Europe Alkylamines Market By Type

12.3.2.8.2 Rest of Eastern Europe Alkylamines Market By Application

12.3.3 Western Europe

12.3.3.1 Western Europe Alkylamines Market by Country

12.3.3.2 Western Europe Alkylamines Market By Type

12.3.3.3 Western Europe Alkylamines Market By Application

12.3.3.4 Germany

12.3.3.4.1 Germany Alkylamines Market By Type

12.3.3.4.2 Germany Alkylamines Market By Application

12.3.3.5 France

12.3.3.5.1 France Alkylamines Market By Type

12.3.3.5.2 France Alkylamines Market By Application

12.3.3.6 UK

12.3.3.6.1 UK Alkylamines Market By Type

12.3.3.6.2 UK Alkylamines Market By Application

12.3.3.7 Italy

12.3.3.7.1 Italy Alkylamines Market By Type

12.3.3.7.2 Italy Alkylamines Market By Application

12.3.3.8 Spain

12.3.3.8.1 Spain Alkylamines Market By Type

12.3.3.8.2 Spain Alkylamines Market By Application

12.3.3.9 Netherlands

12.3.3.9.1 Netherlands Alkylamines Market By Type

12.3.3.9.2 Netherlands Alkylamines Market By Application

12.3.3.10 Switzerland

12.3.3.10.1 Switzerland Alkylamines Market By Type

12.3.3.10.2 Switzerland Alkylamines Market By Application

12.3.3.11 Austria

12.3.3.11.1 Austria Alkylamines Market By Type

12.3.3.11.2 Austria Alkylamines Market By Application

12.3.3.12 Rest of Western Europe

12.3.3.12.1 Rest of Western Europe Alkylamines Market By Type

12.3.2.12.2 Rest of Western Europe Alkylamines Market By Application

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia Pacific Alkylamines Market by Country

12.4.3 Asia Pacific Alkylamines Market By Type

12.4.4 Asia Pacific Alkylamines Market By Application

12.4.5 China

12.4.5.1 China Alkylamines Market By Type

12.4.5.2 China Alkylamines Market By Application

12.4.6 India

12.4.6.1 India Alkylamines Market By Type

12.4.6.2 India Alkylamines Market By Application

12.4.7 Japan

12.4.7.1 Japan Alkylamines Market By Type

12.4.7.2 Japan Alkylamines Market By Application

12.4.8 South Korea

12.4.8.1 South Korea Alkylamines Market By Type

12.4.8.2 South Korea Alkylamines Market By Application

12.4.9 Vietnam

12.4.9.1 Vietnam Alkylamines Market By Type

12.4.9.2 Vietnam Alkylamines Market By Application

12.4.10 Singapore

12.4.10.1 Singapore Alkylamines Market By Type

12.4.10.2 Singapore Alkylamines Market By Application

12.4.11 Australia

12.4.11.1 Australia Alkylamines Market By Type

12.4.11.2 Australia Alkylamines Market By Application

12.4.12 Rest of Asia-Pacific

12.4.12.1 Rest of Asia-Pacific Alkylamines Market By Type

12.4.12.2 Rest of Asia-Pacific Alkylamines Market By Application

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Alkylamines Market by Country

12.5.2.2 Middle East Alkylamines Market By Type

12.5.2.3 Middle East Alkylamines Market By Application

12.5.2.4 UAE

12.5.2.4.1 UAE Alkylamines Market By Type

12.5.2.4.2 UAE Alkylamines Market By Application

12.5.2.5 Egypt

12.5.2.5.1 Egypt Alkylamines Market By Type

12.5.2.5.2 Egypt Alkylamines Market By Application

12.5.2.5 South Africa

12.5.2.5.1 South Africa Alkylamines Market By Type

12.5.2.5.2 South Africa Alkylamines Market By Application

12.5.2.6 Rest of Africa

12.5.2.6.1 Rest of Africa Alkylamines Market By Type

12.5.2.6.2 Rest of Africa Alkylamines Market By Application

12.5.2.6 Saudi Arabia

12.5.2.6.1 Saudi Arabia Alkylamines Market By Type

12.5.2.6.2 Saudi Arabia Alkylamines Market By Application

12.5.2.7 Qatar

12.5.2.7.1 Qatar Alkylamines Market By Type

12.5.2.7.2 Qatar Alkylamines Market By Application

12.5.2.8 Rest of Middle East

12.5.2.8.1 Rest of Middle East Alkylamines Market By Type

12.5.2.8.2 Rest of Middle East Alkylamines Market By Application

12.5.3 Africa

12.5.3.1 Africa Alkylamines Market by Country

12.5.3.2 Africa Alkylamines Market By Type

12.5.3.3 Africa Alkylamines Market By Application

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Alkylamines Market by Country

12.6.3 Latin America Alkylamines Market By Type

12.6.4 Latin America Alkylamines Market By Application

12.6.5 Brazil

12.6.5.1 Brazil Alkylamines Market By Type

12.6.5.2 Brazil Alkylamines Market By Application

12.6.6 Argentina

12.6.6.1 Argentina Alkylamines Market By Type

12.6.6.2 Argentina Alkylamines Market By Application

12.6.7 Colombia

12.6.7.1 Colombia Alkylamines Market By Type

12.6.7.2 Colombia Alkylamines Market By Application

12.6.8 Rest of Latin America

12.6.8.1 Rest of Latin America Alkylamines Market By Type

12.6.8.2 Rest of Latin America Alkylamines Market By Application

13. Company Profiles

13.1 Feicheng Acid Chemicals Co. Ltd.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Alkylamines Chemicals Ltd.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Koei Chemical Company

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Luxi Chemical Group Co., Ltd.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Arkema

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Mitsubishi Gas Chemical Company

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Eastman Chemical Co.

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 BASF SE

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Dow Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Balaji Amines

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases And Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Biofuel Additives Market size was valued at USD 16.54 billion in 2022, and is expected to reach USD 49.40 billion by 2030, and grow at a CAGR of 14.8% over the forecast period 2023-2030.

The Polyurethane Foams Market is expected to increase at a CAGR of 7.4%, from USD 46.28 billion in 2022 to USD 81.94 billion in 2030.

The Electronic Materials and Chemicals Market size was valued at USD 64.2 billion in 2022. It is estimated to hit USD 105.46 billion by 2030 and grow at a CAGR of 6.4% over the forecast period of 2023-2030.

The Micro Flute Paper Market size was USD 69.9 billion in 2022 and is expected to Reach USD 108.9 billion by 2030 and grow at a CAGR of 5.7% over the forecast period of 2023-2030.

The Unsaturated Polyester Resins Market Size was valued at USD 10.31 billion in 2022, and is expected to reach USD 16.81 billion by 2030, and grow at a CAGR of 6.3% over the forecast period 2023-2030.

The Tight Gas Market Size was valued at USD 12763.79 billion cubic feet in 2023 and is expected to reach USD 19002.09 billion cubic feet by 2031 and grow at a CAGR of 5.1% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone