Automotive Lead-Acid Battery Market Report Scope & Overview:

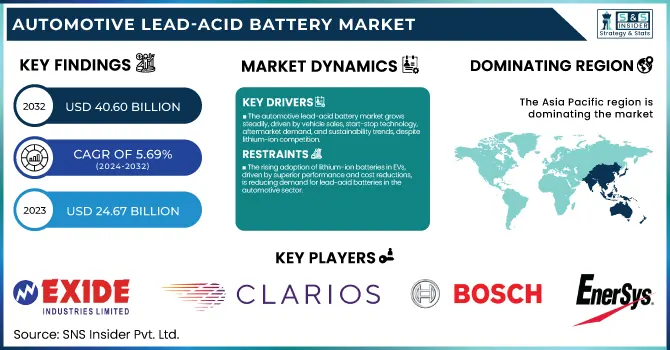

The Automotive Lead-Acid Battery Market Size was estimated at USD 24.67 billion in 2023 and is expected to arrive at USD 40.60 billion by 2032 with a growing CAGR of 5.69% over the forecast period 2024-2032. This report offers a unique perspective on the Automotive Lead-Acid Battery Market by analyzing production volume trends across key regions and capacity utilization rates to assess industry efficiency. It provides insights into manufacturing efficiency and downtime metrics, highlighting operational bottlenecks. The study delves into technological advancements in battery design, such as adopting AGM and EFB technologies across regions. Additionally, it tracks export/import trends, shedding light on shifting trade dynamics. Emerging trends like raw material sourcing challenges, sustainability initiatives in lead recycling, and advancements in battery longevity further enhance this market evaluation.

Automotive Lead-Acid Battery Market Dynamics

Drivers

-

The Automotive Lead-Acid Battery Market is growing steadily due to increasing vehicle sales, rising demand for start-stop technology, strong aftermarket needs, and sustainability trends, despite competition from lithium-ion batteries.

The Automotive Lead-Acid Battery Market is witnessing steady growth, driven by the increasing production and sales of vehicles worldwide. These economies together with India, China, Brazil and Southeast Asian nations, are seeing a boom in ownership of vehicles with growing disposable incomes, better urbanization and upgraded road infrastructure. Particularly in conventional internal combustion engine (ICE) applications, lead-acid batteries continue to be the dominant technology choice because of their low cost, system reliability, and established recycling infrastructure. As the demand for passenger and commercial vehicles increases, so does direct battery consumption, fueling the growth of the market. Moreover, rising adoption of start-stop technology in micro-hybrid vehicles is fuelling demand for superior variants of lead-acid batteries, including Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB). This makes it possible for fast charge acceptance with a long battery lifespan, ideal for new car applications. These are strong factors behind the aftermarket segment, as the growth of the vehicle parc also leads to high demand as well as the influx of battery purchases for replacement. Another important trend is the sustainability approach, as manufacturers are considering recyclable and eco-friendly battery options in order to meet strict environmental laws. Yet the market is challenged by lithium-ion batteries, particularly with the explosive growth of electric vehicles (EVs).

Restraint

-

The rising adoption of lithium-ion batteries in EVs, driven by superior performance and cost reductions, is reducing demand for lead-acid batteries in the automotive sector.

The growing adoption of lithium-ion batteries in the automotive industry is significantly impacting the demand for lead-acid batteries. Lithium-ion technology has been known to provide a higher energy density, longer life, faster charging potential, and reduced weight than its competitor, the lead-acid battery. These benefits have led to lithium-ion batteries becoming the most commonly used energy storage solution within EVs and hybrid vehicles that are seeing fast adoption with stricter emissions and government incentives to boost cleaner energy sources. Ongoing improvements in the production process and the cost of lithium-ion batteries, for instance, make them considerably more available for automotive applications, which has led to a notable decline in lead-acid battery market share. Lead-acid batteries are still employed in conventional internal combustion engine (ICE) vehicles for starter, lighting, and ignition (SLI) purposes; however, the transition towards electrification is progressively reducing their pertinence. The lead-acid battery industry must find innovative solutions to fuel growth in the global transformation of transportation as the markets for electric vehicles grow worldwide, filling niche applications.

Opportunities

-

Innovations in lead-acid battery technology, such as AGM and EFB, are enhancing charge acceptance, cycle life, and overall efficiency, ensuring continued market relevance.

Advancements in lead-acid battery technology are driving new growth opportunities in the automotive sector. This includes new generations of Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB), which can offer superior charge acceptance, cycle life and efficiency. AGM batteries, for example, have a greater capacity for deep cycling and faster recharge rates, thus, they perform well in modern vehicles, which are running with start-stop systems. Advancements in plate designs, electrolyte formulations, and grid structures also contributed to longer battery life, improved performance, and lower maintenance requirements. These advancements are enabling lead-acid batteries to stay competitive in the face of increasing adoption of lithium-ion alternatives. In addition to this, carbon additives and advanced manufacturing techniques are also showing great promise in increasing energy density and extending the battery life. Lead-acid battery innovations also support sustainability with a well-established recycling ecosystem. These enhancements will be pivotal in maintaining the popularity of lead-acid batteries within the worldwide industry in light of ongoing advancements in automotive technologies.

Challenges

-

Government incentives for EVs and lithium-ion batteries are reducing the demand for lead-acid batteries in the automotive sector.

Governments worldwide are aggressively promoting electric vehicles (EVs) through incentives, subsidies, and policy support to reduce carbon emissions and dependence on fossil fuels. This change presents a major challenge for the lead-acid battery industry, with lithium-ion batteries now emerging as the go-to choice for EVs owing to their superior energy density, increased longevity, and better efficiency. China and Japan are just two countries hoping to fast-track lithium-ion batteries with research funding, tax credits and purchase subsidies, which will hurt lead acid battery demand in the process. On top of that, the growth of the lead-acid batteries market is also constrained due to strict emission policies and ICEs being banned in various parts of the world. This has me worried, considering how much money automakers are pouring into EV tech, and how few manufacturers there still are of lead-acid batteries, which were once the kings of the road. While lead-acid batteries are still popular as auxiliary and backup power sources, the increasing government shift toward electrification presents a major threat to their long-term prospects in the automotive space.

Automotive Lead-Acid Battery Market Segmentation Analysis

By Battery Type

SLI segment dominated with a market share of over 38% in 2023, due to their essential role in conventional internal combustion engine (ICE) vehicles. These batteries provide power to start the engine, run lighting systems and other electrical needs. Their market dominance is due to their extensive usage in passenger cars, trucks, and other commercial vehicles. Furthermore, low cost, high reliability, and ease-of-availability on SLI batteries allowed them to gain preference among automakers and consumers. However, despite the ever-evolving landscape of battery technology, SLI cells continue to dominate, owing to the robust existing infrastructure and economic advantages they possess. Also, high demands for ICE vehicles, especially in under-developed markets, while being the largest market segment, ensure that ICE vehicles hold a strong proposition in the market.

By Vehicle type

Passenger cars region dominated with a market share of over 76% in 2023, due to their large production volume and extensive use of lead-acid batteries for starting, lighting, and ignition (SLI) applications. They are chosen as they are more cost effective, reliable, and recyclable, and as such are the standard for most gasoline and diesel-powered vehicles. This segment dominates the automotive market further propelled by the rising revenue from personal mobility, ownership of vehicles, and the expansion of global automotive production. The growing adoption of stop-start technology in contemporary vehicles has been further supporting the demand for enhanced flooded battery (EFB) and absorbed glass mat (AGM) lead-acid batteries. Passenger cars are the leading revenue source in the automotive lead-acid battery market, thanks to steady sales in emerging and developed markets.

Automotive Lead-Acid Battery Market Regional Outlook

Asia Pacific region dominated with a market share of over 48% in 2023, due to its strong automotive manufacturing base in China, India, Japan, and South Korea. High vehicle production and sales in Asia Pacific recorded in major economies such as China, India and Japan, have boosted the adoption of lead-acid batteries. Lithium-ion batteries may have become prevalent, but lead-acid batteries are still an essential part of auxiliary applications in EVs and hybrid vehicles and the electrics' start-stop systems. The ageing vehicle population fuels demand even further as battery replacements become necessary, along with the emerging automotive aftermarket sector. Lead-acid batteries are relatively inexpensive compared to many other battery technologies, making them an excellent choice for mass production and use, the Essential Guide to lead-acid batteries explains that this also drives their widespread adoption in developing markets, where low-cost solutions are required. Driven by all of these, Asia Pacific would continue to remain the leading region in automotive lead-acid battery market.

North America has emerged as the fastest-growing region in the automotive lead-acid battery market, driven by a strong automotive industry and rising demand for replacement batteries. A well-established vehicle fleet in the region and frequent replacement of batteries due to extreme weather conditions is driving the growth of the market. Moreover, increased adoption of electric vehicles (EVs) and hybrid vehicles drives the functionality of lead-acid batteries, used extensively for auxiliary and start-stop systems. The supply chain is fortified by the presence of major automotive manufacturers and battery suppliers, enabling swift expansion. The market is also being boosted by government initiatives focused on sustainable transportation, as well as battery recycling programs. The automotive landscape and technological developments in North America are a key growth engine.

Some of the major key players in the Automotive Lead-Acid Battery Market

-

Exide Industries Ltd. (Automotive Batteries, Motorcycle Batteries)

-

Tai Mao Battery Co., Ltd. (Lead-Acid Starter Batteries, Industrial Batteries)

-

PT. Century Batteries Indonesia (Automotive Lead-Acid Batteries, Motorcycle Batteries)

-

Clarios (VARTA, OPTIMA, Heliar Lead-Acid Batteries)

-

Robert Bosch GmbH (S5, S4, S3 Lead-Acid Car Batteries)

-

CSB Energy Technology Co., Ltd. (VRLA Batteries, Automotive Lead-Acid Batteries)

-

Reem Batteries (Automotive Lead-Acid Batteries, Deep Cycle Batteries)

-

GS Yuasa Corporation (ECO.R, VARTA, Lithium & Lead-Acid Hybrid Batteries)

-

EnerSys (ODYSSEY, PowerSafe, Genesis Automotive Batteries)

-

Ritar International Group (VRLA Automotive Batteries, AGM Batteries)

-

East Penn Manufacturing Company (Deka, Duracell Automotive Batteries)

-

Stryten Energy (Enhanced Flooded Batteries, AGM Batteries)

-

Camel Group Co., Ltd. (Lead-Acid Starter Batteries, Stop-Start Batteries)

-

Mebco (Passenger Car Batteries, Heavy-Duty Lead-Acid Batteries)

-

Leoch International Technology Limited (AGM, Gel, Flooded Lead-Acid Batteries)

-

Koyo Battery Co., Ltd. (Sealed Lead-Acid Batteries, Automotive Batteries)

-

C&D Technologies, Inc. (VRLA Batteries, Lead-Acid Industrial Batteries)

-

Tianneng (Start-Stop Batteries, Motive Power Lead-Acid Batteries)

-

Johnson Controls (Hella, Optima, VARTA Lead-Acid Batteries)

-

FIAMM Energy Technology (Ecoforce AGM, FIAMM Titanium PRO Batteries)

Suppliers for (Known for high-performance lead-acid and lithium-ion batteries, widely used in automobiles and industrial applications) on Automotive Lead-Acid Battery Market

-

Clarios (USA)

-

GS Yuasa Corporation (Japan)

-

Exide Industries Limited (India)

-

EnerSys (USA)

-

East Penn Manufacturing Company (USA)

-

FIAMM Energy Technology (Italy)

-

Leoch International Technology Limited (Hong Kong)

-

Amara Raja Batteries Ltd. (India)

-

Furukawa Electric Co., Ltd. (Japan)

-

C&D Technologies, Inc. (USA)

Recent Development

-

In July 2024: Exide Industries Ltd. introduced a new Absorbent Glass Mat (AGM) battery for automotive starting, lighting, and ignition (SLI) applications.

-

In August 2023: Clarios acquired Paragon GmbH & Co. KGaA’s power business, strengthening its expertise in batteries and battery management systems. This move enhances Clarios' engineering capabilities and supports its low-voltage and lithium-ion projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.67 Billion |

| Market Size by 2032 | USD 40.60 Billion |

| CAGR | CAGR of 5.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type (Flooded, SLI, Absorbent Glass Mat (AGM), Enhanced Flooded Battery (EFB)) • By Vehicle Type (Passenger Cars, Light and Heavy Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Exide Industries Ltd., Tai Mao Battery Co., Ltd., PT. Century Batteries Indonesia, Clarios, Robert Bosch GmbH, CSB Energy Technology Co., Ltd., Reem Batteries, GS Yuasa Corporation, EnerSys, Ritar International Group, East Penn Manufacturing Company, Stryten Energy, Camel Group Co., Ltd., Mebco, Leoch International Technology Limited, Koyo Battery Co., Ltd., C&D Technologies, Inc., Tianneng, Johnson Controls, FIAMM Energy Technology. |