Inspection and Maintenance Robots Market Size & Trends:

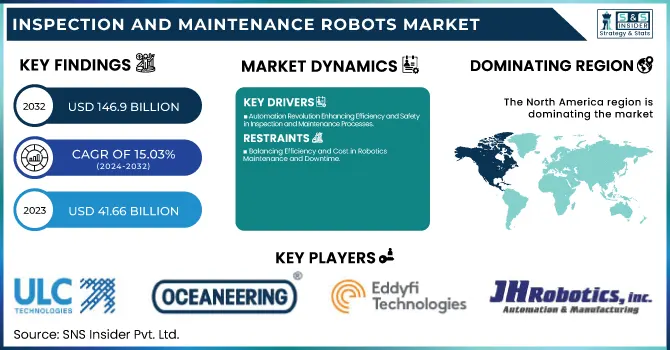

The Inspection and Maintenance Robots Market Size was valued at USD 41.66 billion in 2023 and is expected to reach USD 146.9 billion by 2032, and grow at a CAGR of 15.03% over the forecast period 2024-2032. This growth is driven by the national need for automation in inspection and maintenance tasks as companies look to maximize efficiency and decrease operational expenses. As per this, with the advancement of robotics and AI, industries are increasingly adopting autonomous robots for critical tasks to improve uptime, labor cost, and safety standards dramatically. In addition, robots can be inexpensive, providing high return on investment (ROI) and more regular and precise inspections.

Get more information on Inspection and Maintenance Robots Market - Request Sample Report

Inspection and Maintenance Robots Market Dynamics:

Drivers:

-

Automation Revolution Enhancing Efficiency and Safety in Inspection and Maintenance Processes

Industries are demanding greater automation to boost productivity, minimize human errors and enhance operational efficiency. Inspection and maintenance robots provide automation for companies to do repetitive, hazardous or complex behavior with little or no human involvement. They allow routines of maintenance to be simplified, up time to be maximised and inspections to have greater accuracy. Robotics help enterprises in lowering the costs of labor, enhancing the aspects of safety and equipment reliability. Automation can also be scaled, enabling businesses to achieve greater throughput and scale to larger operations while being compliant with regulatory mandates.

Restraints:

-

Balancing Efficiency and Cost in Robotics Maintenance and Downtime

In an era of increasing global awareness about sustainability, industries face mounting pressure to practice eco-friendly methods and minimize their ecological footprint. Inspection and maintenance robots have a new opportunity to monitor environmental elements like pollution levels, emissions, and energy efficiency. These robots can conduct real-time inspections of air, water, and soil quality, identify troublesome areas, and assist industries in adhering to environmental regulations. And, by doing so, they significantly reduce human exposure to hazardous conditions – all while also advancing their commitment to sustainability, by making sure its resources are managed efficiently, waste is minimized and emissions managed tightly. This emerging trend for autonomous ecosystem surveillance paves the way for the wider application of robotic technologies.

Opportunities:

-

Advancing Sustainability Through Robotics in Environmental Monitoring

With increasing global focus on sustainability, industries are under growing pressure to adopt eco-friendly practices and reduce their environmental impact. Inspection and maintenance robotics also have a unique opportunity to monitor environmental factors, including pollution, gas emissions and energy efficiency levels. These robots turned new employees in the departments of environmental monitoring can do real time inspections of air, water, soil quality, identify areas of concern and help industries comply with environmental regulations. Automating these tasks help companies not just reduce human exposure to hazardous conditions, but also advance their sustainability goals by using resources efficiently, reducing waste, and lowering carbon emissions. This transition towards automated systems for environmental monitoring provides entry points for widespread utilization of robotic solutions.

Challenges:

-

Overcoming Integration Barriers in Robotic Systems for Seamless Operation

Integrating inspection and maintenance robots into existing infrastructure and operational systems presents significant challenges. Many legacy systems in industries such as manufacturing, oil & gas, or utilities may not be compatible with newer robotic technologies, creating integration difficulties. This may require costly modifications to existing systems or, in some cases, a complete overhaul of operational frameworks to ensure seamless functionality. Additionally, synchronization between robots and existing software platforms can be complex, especially when real-time data exchange, autonomous decision-making, and remote control are required. These integration complexities can delay deployment, increase operational costs, and slow the adoption of robotics in critical industries.

Inspection and Maintenance Robot Market Segment Analysis:

By Type

The autonomous segment holds the largest share of the inspection and maintenance robot market, accounting for approximately 78% of the revenue in 2023 The need for more autonomous robots has been on the rise, and this is leading the change. These robots are characterized by being armed with advanced sensors, AI, and machine learning abilities, which enable them to carry out inspections and maintenance operations in complex and hazardous environments with minimal human intervention. Their real-time decision-making and navigation skills increase efficiency and safety, ideal for industries like oil & gas, utilities, and manufacturing, where remote operations are common.

The remotely operated segment is expected to experience the fastest growth in the inspection and maintenance robot market over the forecast period from 2024 to 2032. This growth is driven by the increasing demand for robots that can be controlled and monitored remotely, providing real-time data and feedback from difficult-to-reach or hazardous locations. Remotely operated robots are particularly valuable in industries such as oil & gas, aerospace, and utilities, where direct human access is often limited or dangerous. These robots allow operators to perform critical inspections and maintenance tasks with precision and safety, improving operational efficiency and reducing downtime. As industries continue to prioritize safety and cost-effectiveness, the adoption of remotely operated robots is set to rise.

By Application

The oil & gas segment dominated the inspection and maintenance robot market in 2023, accounting for around 50% of the total revenue. This expansion is driven by an increasing need for cost-effective and efficient solutions for monitoring and maintaining critical infrastructure like power grids, water treatment facilities, and renewable energy systems. Inspection and maintenance robots are especially suited to working in hazardous, at-risk workplaces that humans cannot access. They provide real-time insights into the condition of equipment, helping utilities perform preventative maintenance and reduce downtime and improve safety.

the utility segment is projected to dominate the The utility sector is expected to be the fastest-growing segment in the inspection and maintenance robot market over the forecast period from 2024 to 2032. The increasing demand for efficient and cost-effective solutions to maintain and inspect critical infrastructure, such as power grids, water treatment plants, and renewable energy installations, is driving this growth. IM robotics is ideal for working in hazardous, dangerous surroundings with limited human access. They offer instant data on the health of pieces of equipment, allowing utilities to take preventive action maintenance activity, minimize downtime and improve safety.

By Component

The hardware segment dominated the Inspection and Maintenance Robot Market in 2023, accounting for approximately 69% of the total revenue. The global inspection and maintenance robotics market is segmented based on the type of hardware components by measuring sensor, actuators, camera, and robotic arms functionalities and this demand is fuelling a lot the growth of Inspection and maintain robotics. So while hardware is critical in ensuring robots can work under difficult environmental conditions, execute with precision, and gather important data. The hardware segment is being driven by constant technological advancements in sensor technology and automation, and better reliability and durability of robotic solutions in robotics and automation, oil & gas, utility, and manufacturing end-use industries.

The software segment is expected to be the fastest-growing in the Inspection And Maintenance Robot Market over the forecast period from 2024 to 2032. This growth is driven by the increasing demand for sophisticated software solutions that enable robots to perform complex tasks autonomously and remotely. Software advancements, including AI, machine learning, and data analytics, allow robots to make real-time decisions, optimize performance, and improve operational efficiency. In addition, the integration of cloud computing and remote monitoring capabilities is enhancing the functionality of inspection and maintenance robots, enabling seamless data collection, analysis, and management.

Inspection and Maintenance Robots Market Regional Outlook:

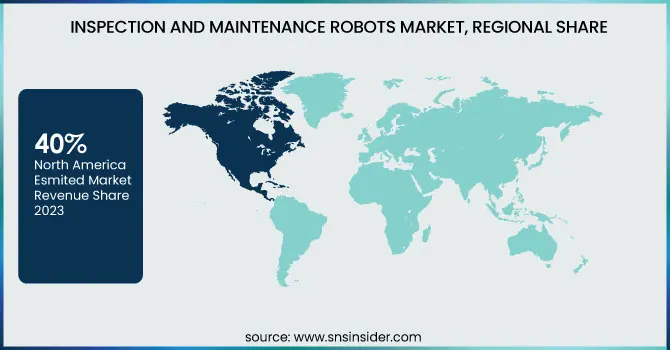

North America dominated the Inspection and Maintenance Robot Market in 2023, capturing around 40% of the total revenue. This lead is due to the region's technical assets, high adoption rates for automation technology, and massive investments spanning over key industries (oil & gas, manufacturing, utilities, and aerospace). This is coupled with the region's solid regulatory frameworks around safety, efficiency, and environmental sustainability, which have promoted a much stronger demand for robotic solutions in inspection and maintenance functions. Additionally, North America is witnessing major organizations and innovators in robotics technology, leading to continual advancements in autonomous and remotely operated systems. The region's focus on minimizing operational downtime, enhancing safety, and reducing maintenance costs strongly encourages the inspection and maintenance robot market from developing rapidly.

Asia-Pacific is to be the fastest-growing region in the Inspection And Maintenance Robot Market over the forecast period from 2024 to 2032. The need for industrial robots is seeing rapid growth with the introduction of industrial automation which is further propelled by the rise in infrastructure development and the demand in key sectors like oil & gas, manufacturing, utilities, and others. Strong investments are being made in robotic technologies by countries such as China, Japan, and India to enhance operational efficiency and safety in unsafe areas at lower costs. Also, the development of smart cities, renewable energy initiatives, and the use of Industry 4.0 technologies are driving the demand for next-generation inspection and maintenance robots even higher. With its growing industrial base and technological development, the region is a powerhouse in the world economy.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

Some of the Major Key Players in Inspection and Maintenance Robot Market along with their product:

-

ULC Robotics (USA) – Pipeline inspection robots, robotic solutions for infrastructure maintenance

-

Eddyfi (Canada) – Eddy current array (ECA) inspection systems, NDT (non-destructive testing) robots

-

JH Robotics, Inc. (USA) – Robotic inspection systems, automated robotic devices for pipeline maintenance

-

Oceaneering (USA) – Remote-operated vehicles (ROVs), robotic systems for subsea inspection and maintenance

-

Robotnik (Spain) – Autonomous mobile robots (AMRs), robotic solutions for industrial environments

-

LEO Robotics (USA) – Inspection robots for industrial and hazardous environments

-

Superdroid Robots, Inc. (USA) – Custom robotic platforms, inspection robots for various industrial sectors

-

FARO Technologies, Inc. (USA) – 3D measurement and inspection equipment, laser scanning robots

-

Cognex Group (USA) – Vision sensors, machine vision systems for robotic inspection

-

Shell (Netherlands) – Robotic systems for maintenance and inspection of energy and oil assets

-

Aetos Group (USA) – UAVs and robotic platforms for inspections and maintenance in high-risk areas

-

Ensign Bickford Industries (USA) – Robotics solutions for hazardous material detection and maintenance

-

GE Inspection Robotics (USA) – Robotics for industrial inspections, including tank and vessel inspection robots

-

Gecko Robotics (USA) – Wall-climbing robots, industrial inspection and maintenance robots

-

Genesis Systems Group (USA) – Robotics automation systems for industrial inspection, welding, and maintenance

Some potential customers (companies) in the Inspection And Maintenance Robot Market:

-

ExxonMobil (Oil & Gas)

-

BP (Oil & Gas)

-

Shell (Oil & Gas)

-

National Grid (Utilities)

-

Duke Energy (Utilities)

-

General Electric (Manufacturing)

-

Siemens (Manufacturing)

-

Toyota (Automotive)

-

Lockheed Martin (Aerospace & Defense)

-

Boeing (Aerospace & Defense)

-

Rio Tinto (Mining)

-

BHP (Mining)

-

Bechtel (Infrastructure & Construction)

-

Vinci (Infrastructure & Construction)

-

NextEra Energy (Renewable Energy)

-

Ørsted (Renewable Energy)

-

AT&T (Telecommunications)

-

Verizon (Telecommunications)

-

Maersk (Shipping & Ports)

-

Royal Dutch Shell (Shipping & Ports)

-

John Deere (Agriculture)

-

Bayer Crop Science (Agriculture)

Recent Development:

-

On August 27, 2024, GE Aerospace announced the launch of AI-led "white light robot" inspection at its Services Technology Acceleration Center. This technology will transform maintenance, repair, and overhaul (MRO) processes by accelerating the speed, efficiency, and consistency of inspections, and generating a digital record of every part's condition and history throughout its lifecycle.O

-

On September 19, 2024, Siemens, in collaboration with ANYbotics and Roboverse Reply, introduced the ANYmal robot, an autonomous mobile robot (AMR) designed to enhance industrial maintenance. Equipped with advanced AI and LiDAR technology, the robot performs autonomous inspections in complex environments, collecting high-quality data, detecting gas leaks, and improving sustainability by minimizing energy loss from leaks.

| Report Attributes | Details |

| Market Size in 2023 | USD 41.66 Billion |

| Market Size by 2032 | USD 146.9 Billion |

| CAGR | CAGR of 15.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Autonomous, Remotely Operated) • By Application (Oil & Gas, Food & Beverage, Utility, Others) • By Component (Hardware, Software) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ULC Robotics (USA), Eddyfi (Canada), JH Robotics, Inc. (USA), Oceaneering (USA), Robotnik (Spain), LEO Robotics (USA), Superdroid Robots, Inc. (USA), FARO Technologies, Inc. (USA), Cognex Group (USA), Shell (Netherlands), Aetos Group (USA), Ensign Bickford Industries (USA), GE Inspection Robotics (USA), Gecko Robotics (USA), Genesis Systems Group (USA). |