Carbonyl Iron Powder Market Report Scope & Overview:

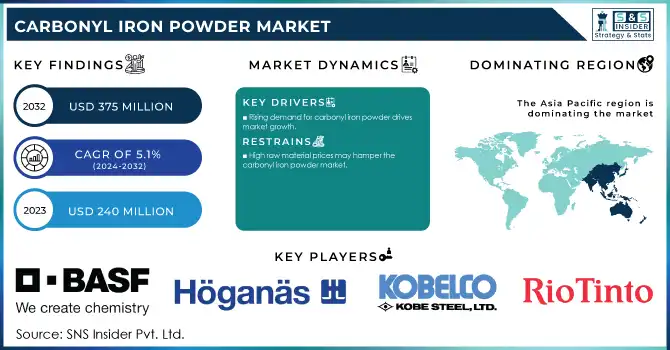

The Carbonyl Iron Powder Market size was USD 240 million in 2023 and is expected to reach USD 375 million by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032. The increasing demand for carbonyl iron powder in the electronics sector is largely driven by its essential role in the production of key components like inductors and transformers. These elements are essential in controlling electrical pulses, distributing energy, and improving the functioning of electronics. With the advent of smartphones, tablets, laptops, and other portable devices, the consumer electronics industry is witnessing a boom in demand for electronic components, wherein quality and reliability have become paramount. The fast expansion of the telecom sector driven by 5G networks and rising infrastructure has also driven the high-performance magnetic materials market. Carbonyl iron powder is best suited for these applications because of its better magnetic strength, small particle size, and utility in the improvement of the performance of electronic devices. The development of technology and the growing market for reduced size and high-power electronics is expected to translate into significantly increased application of carbonyl iron powder in inductors, transformers, and other electronic components, making it an indispensable material in the electronics industry.

Get E-PDF Sample Report on Carbonyl Iron Powder Market - Request Sample Report

In November 2022, in an effort to support the growing sector and wean off of Chinese supply, India will provide incentives worth up to USD 5 billion to businesses that produce parts for devices like laptops and mobile phones domestically, according to two government officials.

Moreover, due to the increased demand for quality and performance in a range of carbonyl iron powder applications, improvements have been made in those manufacturing processes, specifically atomization and reduction, that are advancing the production of this field. To obtain the appropriate magnetic properties of the iron powders, it is necessary to achieve uniform spherical particles of very small sizes, which is accomplished through atomisation a process by which molten metal is pushed through small nozzles in a gas stream and rapidly cooled. In a similar manner, the reduction methods, where iron oxide is reduced to pure iron in very controlled environments, allow for finer control of the powder as well as for higher purities. This leads to carbonyl iron powder possessing an improved particle size distribution, enhanced purity & superior magnetic properties, all of which are beneficial to the end-use applications of carbonyl iron powder, such as in electronics, automotive, and healthcare. These production techniques as they are improved and cost-reduced, allow for greater accessibility for the higher quality carbonyl iron powder through competition with a wider range of industries. Manufacturers are now producing higher quality material in larger quantities this trend is leading to the growth of the carbonyl iron powder market as the demand for carbonyl iron powders is rising across the different industry verticals.

In 2023, Kobe Steel announced advancements in their reduction process, enhancing the purity and magnetic properties of their carbonyl iron powders. The company focused on improving the powder’s performance for use in electronic components like transformers and inductors, which require high magnetic permeability.

Carbonyl Iron Powder Market Dynamics

Drivers

-

Rising demand for carbonyl iron powder drives market growth.

One of the major factors driving the growth of the market is the increasing demand for carbonyl iron powder market from various end-use industries. With more than three years in use, carbonyl iron powder is becoming a preferred type of iron in the production of iron supplements especially its higher bioavailability and lower side effects than other types of iron salts, which makes it a favorable type of iron for healthcare. This is especially called for as iron insufficiency anaemia increasingly exists globally, specifically where populaces are expected to expand while understanding of health grows. The demand for carbonyl iron powder is increasing in the electronics sector attributed to wide usage in making inductors, transformers and other magnetic components. Continued adoption of carbonyl iron powder is also being propelled by the need for high-performance magnetic materials that accompany the rapid proliferation of industries such as telecommunications and consumer electronics. Also, the trend in the automotive industry towards electric vehicles, which need light weight, effective materials, is creating new avenues for carbonyl iron powder in the market for manufacturing electromagnetic parts. The growing application of carbonyl iron powder in these aforementioned industries, combined with progress in the manufacturing technology resulting in better quality and easy availability of carbonyl iron powder is anticipated to bolster its market development. With the healthcare, electronics, and automotive sectors growing, the demand for carbonyl iron powder is anticipated to rise at a healthy pace.

Restraint

-

High raw material prices may hamper the carbonyl iron powder market.

A restraint on the growth of the carbonyl iron powder market is the high price of raw materials. Carbonyl iron powder production is heavily dependent on the supply and price of high-grade iron and other raw materials. Such upstream changes in raw material prices, triggered by factors including supply chain disruptions, geopolitical tensions, and higher energy costs, can lead to increased overall manufacturer production costs. Such price increase can lead to an increased cost of carbonyl iron powder and may be transferred to customers causing a demand decline from end-use industries that prefer economical raw materials. Besides this, costs associated with production are high for small and medium scale manufacturers which impacts their profitability, thus hindering their market competition. However, the carbonyl iron powder market growth in this price-sensitive environment is likely to be hampered by the high prices of raw materials, such as iron oxide, which are likely to increase in price if their economies experience a rapid rate of inflation aiding the carbonyl iron powder market but scaring the growth prospects of the carbonyl iron powder market in industries such as healthcare, electronics, and automotive.

Opportunities

Focus on sustainability for applications in energy-efficient technologies and lightweight materials.

Carbonyl iron powder finds application in the development of soft magnets, a crucial component in electric motors and transformers. They offer high efficiency in converting electrical energy into mechanical energy, leading to significant energy savings. Their use in electric vehicle motors can contribute to increased range and reduced reliance on fossil fuels. Carbonyl iron powder can be used in the production of lightweight components with good mechanical properties. This weight reduction translates to lower fuel consumption and reduced emissions, contributing to a cleaner transportation sector. Used carbonyl iron powder from certain applications might be recyclable, depending on the specific process and contamination levels. Recycling programs for carbonyl iron powder offer a sustainable solution by reducing reliance on virgin raw materials and minimizing environmental impact.

Carbonyl Iron Powder Market Segmentation Analysis

By Type

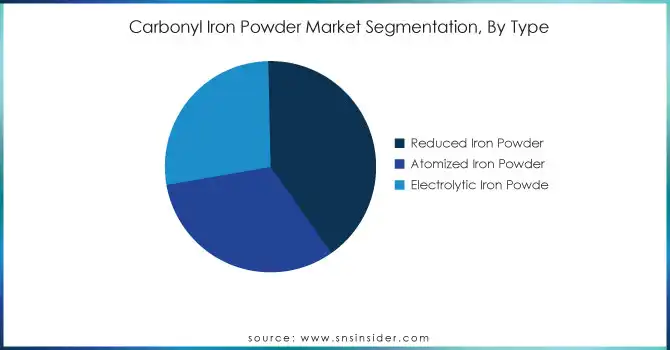

Reduced Iron Powder dominated the type segment of the Carbonyl Iron Powder Market with the highest revenue share of more than 40.6% in 2023 owing to its widespread utilization across various industries such as automotive, electronics, and metallurgy. Its popularity is attributed to its superior properties, including high purity, excellent magnetic characteristics, and cost-effectiveness. Additionally, increased adoption of applications like electromagnetic interference shielding and magnetic recording media further fuels its market demand, sustaining its leading position in the segment.

By End-User

The automotive sub-segment held the highest revenue share in 2023 in the Carbonyl Iron Powder Market due to the escalating demand for lightweight materials to enhance fuel efficiency and reduce emissions in vehicles. Carbonyl iron powder's role in automotive applications, such as in the production of electromagnetic interference shielding components and brake pads, contributed significantly to its adoption within this sector. Moreover, the burgeoning electric vehicle market, which relies on advanced materials for electric motor components, further propelled the demand for carbonyl iron powder in automotive applications.

Carbonyl Iron Powder Market Regional Outlook

Asia Pacific held the largest market share around 48.50% in 2023. Asia-Pacific region is impacted by a combination of multiple factors responsible for this development like rapid industrialization, technical advantage over manufacturing and enhanced demand from the significant end-user industries. Being the hub of a few of the most massive electronics and automobile production factories, in nations which include China, Japan, and South Korea wherein carbonyl iron powder is commonly used in the manufacturing of components of inductors, transformers and electromagnetic materials. Furthermore, healthy sector expansions in Asia-Pacific nations are also projected to leverage the usage of iron supplements created from carbonyl iron powder, especially in India, as iron deficiency anemia is a common concern there. Low cost of manufacturing due to the presence of many players in the region and high growth of technology are some of the factors which are adding to the growth of the market. In addition, the rising government efforts on promoting local manufacturing, along with substantial investments in the electronics & automotive sectors are driving the carbonyl iron powder market in the region, thereby making Asia-Pacific the top contributor to the global carbonyl iron powder market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (BASF Carbonyl Iron Powder, Iron Powders for Magnetic Applications)

-

Hoganas AB (Hoganas Carbonyl Iron Powder, Hoganas Pre-alloyed Powders)

-

INDUSTRIAL METAL POWDERS (INDIA) PVT. LTD. (Carbonyl Iron Powder, Iron Powder for Electronics)

-

KOBE STEEL LTD. (Iron Powder for Sintered Components, Fine Iron Powder for Electronics)

-

Rio Tinto Metal Powders (Carbonyl Iron Powder, Atomized Iron Powder)

-

JFE Steel Corporation (High Purity Carbonyl Iron Powder, Sintered Iron Powders)

-

SkySpring Nanomaterials (Iron Nanopowder, Carbonyl Iron Powder)

-

International Specialty Products (Carbonyl Iron Powder, High Purity Iron Powder)

-

Parshwamani Metals (Iron Powder, Carbonyl Iron Powder)

-

Yuelong Superfine Metal Co. (Carbonyl Iron Powder, Metal Powders for Electronics)

-

Jilin ZC New Materials Co., Ltd. (Carbonyl Iron Powder, Fine Iron Powder)

-

Stanford Advanced Materials (Carbonyl Iron Powder, Iron Nanopowder)

-

Reade International Corp. (Iron Powder, Carbonyl Iron Powder)

-

Sintez-CIP (Carbonyl Iron Powder, Iron Powder for Automotive Industry)

-

JIANGXI YUEAN ADVANCED (Carbonyl Iron Powder, Iron Powders for Electrical Applications)

-

Henan Zhongtai Industrial Co., Ltd. (Carbonyl Iron Powder, Powder Metallurgy Materials)

-

Korea Metal Powders Co., Ltd. (Carbonyl Iron Powder, Fine Iron Powder)

-

Molycorp Inc. (Carbonyl Iron Powder, Metal Powders for Electronics)

-

GGP Metal Powders Ltd. (Carbonyl Iron Powder, Sintering Iron Powder)

-

Sumitomo Metal Mining Co., Ltd. (Carbonyl Iron Powder, Powdered Iron Products)

Recent Development

-

In February 2024, BASF is making waves in the carbonyl iron powder market! They've expanded capacity for high-performance grades, launched their finest-ever ultra-fine powder (CIP SF) with coated versions, and are collaborating with customers to explore new applications in areas like EMI shielding and even nutrition supplements. This focus on innovation positions BASF as a leader in the versatile world of carbonyl iron powder.

-

In 2023, SkySpring Nanomaterials company has introduced its gray or black powder composed of iron particles ranging from 20 to 100 nm, iron nanopowder has seen extensive usage in manufacturing and research of its potential in recent years. A versatile magnetically active material with applications in electronics, medicine, imaging, environmental management, and data storage, This can be obtained as a power or a suspension in a solvent such as ethanol.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 240 Million |

| Market Size by 2032 | US$ 375 Million |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Reduced Iron Powder, Atomized Iron Powder, and Electrolytic Iron Powder) • By End-User (Automotive, Chemical, General Industrial, Food, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Hoganas AB, INDUSTRIAL METAL POWDERS (INDIA) PVT.LTD., KOBE STEEL LTD., Rio Tinto Metal Powders, JFE Steel Corporation. |

| Key Drivers | • Rising demand for carbonyl iron powder drives market growth. |

| Restraints | • High raw material prices may hamper the carbonyl iron powder market. |