Clock Generators Market Size Analysis:

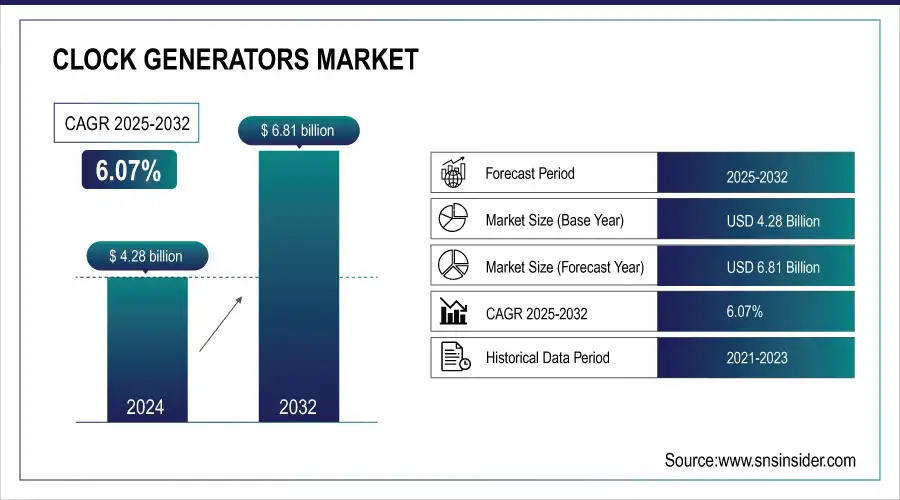

The Clock Generators Market Size was valued at USD 4.28 billion in 2024 and is expected to reach USD 6.81 billion by 2032 and grow at a CAGR of 6.07% over the forecast period 2025-2032.

To Get more information On Clock Generators Market - Request Free Sample Report

The clock generators market is growing rapidly, driven by the increasing demand for precise timing solutions in industries such as AI, telecommunications, automotive, and consumer electronics. Advancements in technologies like 5G, IoT, and AI are accelerating the need for improved performance, accuracy, and synchronization in complex systems. MEMS-based clock generators, offering enhanced reliability, compact designs, and reduced power consumption, are becoming essential in meeting these evolving demands. These innovations help optimize system efficiency, enabling faster data processing and higher throughput across various applications. As industries continue to adopt cutting-edge technologies, the need for high-performance, low-power clock generators is expected to rise, supporting the ongoing evolution of modern electronic systems.

SiTime has launched its Chorus clock-system-on-a-chip for AI data centers, offering 10x higher performance, reduced power consumption, and simplified design. This innovation integrates clock, oscillator, and resonator technologies into a single chip, accelerating design time by up to six weeks.

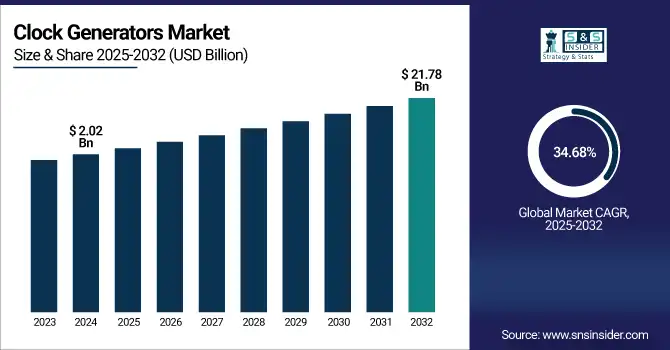

The U.S. clock generators Market size was USD 2.02 billion in 2024 and is expected to reach USD 21.78 billion by 2032, growing at a CAGR of 34.68% over the forecast period of 2025–2032. This expansion is driven by the rising demand for accurate timing solutions in technologies like 5G, IoT, and autonomous systems, essential for synchronizing functions in advanced applications such as telecommunications, automotive, and consumer electronics.

Clock Generators Market Dynamics

Key Drivers:

-

Growing Adoption of Advanced Technologies like 5G, IoT, and AI Fuels the Demand for Clock Generators

The growing use of sophisticated technologies, including 5G, the Internet of Things (IoT), and artificial intelligence (AI), is a key driver for the Market. These emerging technologies need synchronization to be extremely precise and have robust clocking solutions to ensure seamless performance and real-time data processing. While all such industries have been increasingly leveraging more networked devices and systems in their applications, the market demand for clock generators that possess high accuracy, stability, as well as high efficiency in clock systems is developing extremely fast.

Restrain:

-

High Power Consumption in High-Performance Clock Generators Limits Market Expansion.

A key limitation of the Market is the high power draw of high-performance clock generators, particularly those applied in telecom and data centers. Such systems tend to be high in power requirements, contributing to higher costs of operation. Power-efficient clocking solutions with necessary performance but not excessive energy needs are becoming increasingly important. This challenge affects the implementation of sophisticated clock generators, especially in sectors aiming to lower operating expenses without compromising system performance.

Opportunities:

-

Opportunities in Emerging Markets with Increasing Investments in 5G and Smart Devices.

Emerging economies in Asia-Pacific and Latin America offer tremendous growth prospects for the Market. As these economies step up investments in 5G infrastructure, smart devices, and industrial automation, the need for sophisticated clock generators that provide guaranteed time synchronization will grow. Those firms that are able to innovate cost-effective and scalable solutions to meet the needs of emerging markets will be at a premium. These markets are also adopting IoT and AI technologies, adding further momentum to the demand for accurate clocking solutions.

Challenges:

-

Technological Complexity and High Development Costs Pose Challenges for Clock Generator Manufacturers.

The major challenges the Market is facing are the technological complexity and the high cost of development that the manufacturers are grappling with. To innovate leading-edge clocking products with excellent performance, such as low jitter, low latency, and good accuracy, significant R&D investments are required. The increasing cost of production and an ongoing demand for innovation needed to cater to industry trends like 5G and AI, also put companies under financial strain. Industry still faces challenges in how to deal with these barriers without sacrificing cost efficiency and market competitiveness.

Clock Generators Market Segment Analysis:

By Product Type

The CMOS Clock Generators segment dominated the Market with 37.68% market share in 2024. CMOS technology is much preferred for low power usage, high efficiency, and low cost, thus suiting applications in consumer electronics, telecommunication, and automotive markets. In recent times, players such as Texas Instruments and Analog Devices have introduced revolutionary CMOS-based clock generators, making market dominance increasingly prominent. As power-efficient and reliable clocking solutions continue to gain traction, CMOS clock generators are fundamental to the growth of the industry.

The Programmable Clock Generators segment is expected to fastest CAGR of 7.07% during 2025-2032. These generators are flexible, enabling users to modify clock frequencies according to particular application requirements. Recent developments by the likes of Maxim Integrated and Silicon Labs, which have brought in sophisticated programmable clocking solutions for 5G networks and IoT, are major contributing factors. With growing demand for flexible clocking systems across various industries, the growth of this segment is well in sync with the overall trends towards precision and efficiency in the Market.

By Technology

The Silicon-Based technology segment dominated the clock generators market with the highest revenue share of 36.79% in 2024. Silicon-based clock generators are the choice due to their scalability, cost advantage, and suitability for high-volume production, and they are thus suitable for consumer electronics, telecommunications, and automotive industries. Silicon clock generators optimized for high-performance computing and 5G networks have been developed by companies such as Intel and Qualcomm, leading to their supremacy. With continued demand for low-cost, efficient solutions, silicon-based clock generators continue to be a staple of market expansion.

The Gallium Arsenide (GaAs)-Based segment is expected to fastest CAGR of 7.16% between 2025 and 2032, mainly because of their high-performance capabilities in high-frequency applications. GaAs clock generators possess higher efficiency and lower signal distortion, which makes them suitable for telecommunications, aerospace, and military applications. Players such as Broadcom and Microchip Technology have introduced new GaAs-based clock generators, specifically designed for 5G and satellite communications. With the increasing requirement for high-performance, low-latency systems, this segment is predicted to fuel drastic clock generators market growth.

By Application

The Telecommunications segment dominated the clock generators market share, generating 31.69% of revenue in 2024. The need for accurate timing in high-speed data transfer and network synchronization drives the leadership. Clock generators companies such as Analog Devices and Renesas Electronics are among the firms that have developed sophisticated clock generators for use in 5G base stations and optical networks. Such advancements provide low-jitter, high-accuracy clocking, which is crucial for telecom infrastructure. With the worldwide launch of 5G, the segment continues to record high growth in the market around the clock.

The Consumer Electronics segment will witness the fastest CAGR of 6.80% from 2025 to 2032 due to increased global demand for smartphones, wearables, and smart home appliances. Programmable and ultra-low-power clock generators are being increasingly adopted in small form factor devices that need efficient timing solutions. Firms such as Texas Instruments and Silicon Labs have introduced high-performance, miniaturized clock ICs for electronics designers. With increasingly complex, feature-rich smart devices, demand for dependable, space-constrained clock generators drives market growth.

By Output Frequency Range

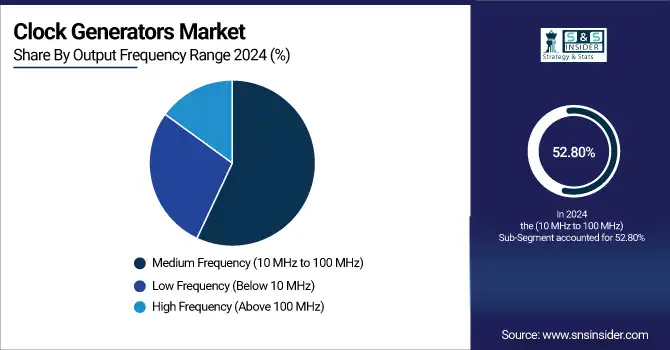

The Medium Frequency (10 MHz to 100 MHz) segment dominated the Market with a revenue share of 52.80% in 2024, as it plays a critical function in managing speed and energy efficiency in various applications. The frequencies are omnipresent in embedded systems, IoT devices, and telecommunications infrastructure. IDT (Integrated Device Technology) and Cypress Semiconductor have come up with strong medium-frequency solutions that provide accurate timing. Their innovations continue to enable market growth by addressing the needs of mid-range performance devices and systems.

The High Frequency (Above 100 MHz) segment is anticipated to fastest CAGR of 7.08% during 2025–2032 due to the demand for ultra-high-speed data processing and low latency in cloud computing and high-end communications. High-frequency generators are increasingly used within AI servers and next-generation networking hardware. Firms like NXP Semiconductors and ON Semiconductor have introduced sophisticated high-frequency clock solutions that serve high-speed digital systems, complementing the speeding up of the pace of innovation in the Market.

By End-User Industry

The Telecommunication Service Providers segment dominated the Market with 40.78% revenue contribution in 2024, due to the significant requirement for high-precision clocking in 5G, broadband, and satellite communication networks. Precise clock synchronization improves data transmission and reduces latency. Abracon LLC and IQD Frequency Products are among the firms that have created telecom-grade clock generators supporting trustworthy, high-speed communications. These solutions continue to support the global telecom infrastructure, reinforcing the segment's leadership in the clock generation market.

The Consumer Electronics Manufacturers segment is expected to fastest CAGR of 7.46% during the period from 2025 to 2032 due to growing demand for sophisticated smart devices, AR/VR headsets, and portable electronics. These applications demand miniature, power-saving, and high-accuracy timing components. Firms like Epson Electronics and TXC Corporation have launched miniaturized clock generator solutions catering to today's electronics. These innovations run parallel with increasing consumer demand and are crucial to the changing dynamics of the Market.

Clock Generators Market Regional Overview:

The North America market dominated the Market with a 37.98% revenue in 2024 due to robust demand from telecommunication providers, data centers, and defence industries. The region's technological progress and early adoption of 5G infrastructure boost clock generator installations. Maxim Integrated and Semtech Corporation have released high-precision clocking solutions designed for next-generation networking and military applications. These advancements point to North America's strong innovation landscape and reinforce its leadership status in the global clock generator industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. leads the North American Market through its highly developed semiconductor industry, high concentration of top manufacturers, aggressive 5G infrastructure rollout, and high demand from defence and data center industries, fuelling sustained innovation and technology uptake.

The Asia Pacific is estimated to fastest CAGR of 7.44% during 2025-2032, driven by increasing demand from consumer electronics, automotive, and telecommunication sectors in countries such as China, Japan, and South Korea. Growth driven by the growth of semiconductor fabrication clusters and the deployment of 5G boosts regional expansion. Organizations like Asahi Kasei Microdevices (AKM) and Seiko Instruments have introduced budget-friendly, smaller clock generator products targeted towards the APAC market. Such continual growth puts Asia Pacific on high-growth, future-driven prospects.

-

China dominated the Asia Pacific Market as it hosts a large base of OEMs and semiconductor fabs, has aggressive tech expansion policies, and has high demand for consumer electronics and telecom infrastructure and is the region's leading growth driver.

Europe is a major contributor to the Market, due to increasing usage in automotive electronics, industrial automation, and communications. Germany, France, and the UK are fuelling investments in semiconductor technology and smart infrastructure. Strong R&D capabilities and emphasis on high-reliability applications within the region offer support for consistent adoption of advanced clock generation technologies.

-

Germany leads the Market in Europe with its robust manufacturing base, leadership in automotive production, and technology innovation. The nation's high-end semiconductor industry and increasing demand for telecom and automation propel the use of clock generation solutions.

In the Middle East & Africa, the UAE and Saudi Arabia rule the Clock Generators Market due to technological progress in 5G networks, telecom infrastructure, and defense technologies. In Latin America, Brazil is the market leader, backed by expanding industrial automation and telecommunication, with Argentina also playing a notable role.

Clock Generators Companies are:

Major Key Players in Clock Generators Market are Texas Instruments, Analog Devices, Inc., Renesas Electronics Corporation, Microchip Technology Inc., ON Semiconductor Corporation, Silicon Laboratories Inc., Maxim Integrated Products, Inc., NXP Semiconductors N.V., STMicroelectronics N.V., SiTime Corporation.

Recent Development:

-

In April 2024, Microchip announced the industry's smallest MEMS clock generator, integrating a MEMS resonator and PLLs into a 6-pin DFN package. This device replaces up to three crystals and oscillators, reducing board space by up to 80% and supporting a range of frequencies for smart devices.

-

In February 2024, SiTime introduced 23 new clock products, including jitter cleaners, network synchronizers, clock generators, and buffers, to enhance its portfolio for data center, AI, and networking applications. These products aim to provide precision timing solutions to meet the growing demands of these sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.28 Billion |

| Market Size by 2032 | USD 6.81 Billion |

| CAGR | CAGR of 6.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (CMOS Clock Generators, TTL Clock Generators, Embedded Clock Generators, Programmable Clock Generators) • By Technology (Silicon Based, Gallium Arsenide Based, MEMS (Micro-Electro-Mechanical Systems), Hybrid) • By Application (Consumer Electronics, Telecommunications, Automotive, Industrial Automation, Healthcare Devices) • By Output Frequency Range (Low Frequency (Below 10 MHz), Medium Frequency (10 MHz to 100 MHz), High Frequency (Above 100 MHz)) • By End-User Industry (Consumer Electronics Manufacturers, Automobile Manufacturers, Telecommunication Service Providers, Healthcare Equipment Manufacturers, Industrial Control System Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, Analog Devices, Inc., Renesas Electronics Corporation, Microchip Technology Inc., ON Semiconductor Corporation, Silicon Laboratories Inc., Maxim Integrated Products, Inc., NXP Semiconductors N.V., STMicroelectronics N.V., SiTime Corporation. |