Coating Equipment Market Report Scope & Overview:

Get More Information on Coating Equipment Market - Request Sample Report

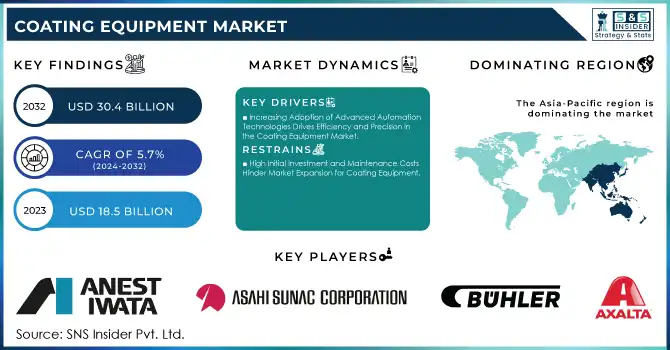

The Coating Equipment Market Size was valued at USD 18.5 billion in 2023 and is expected to reach USD 30.4 billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

The Coating Equipment Market is growing rapidly due to increased demand in automobile, construction, and aerospace industries. Technological advancements in coating systems, stricter environmental regulations, and increased adoption of automation are the core dynamic factors shaping the market. Companies are innovating to specifically meet the need for durable coatings in automotive applications and also eco-friendly systems with less environmental impact. For instance, Nordson and Durr automated coating systems, are a necessity in precision applications since they boost the efficiency of production and reduce labor costs. Other companies such as OC Oerlikon Corporation AG are contributing to growth through high-performance PVD coating systems used in thin-film applications that serve the increasingly needed corrosion-resistant coatings. Such systems now incorporate shifts in favor of powder and electrostatic spray equipment that improve efficiency and reduce material waste on application. The mass manufacturers seek to work with such sustainable and high-quality coating solutions, thus making it a priority for them.

The latest market trends and developments reflect the industry's sense of encouragement to expand globally and diversify its product base. This is seen by the plans announced by JSW Paints in May 2024, regarding entering the auto-coating market, which will be a step toward diversifying its specialty coatings with offerings for specialized automotive applications. This is one way companies are extending their portfolios by entering high-growth fields. In September 2024, for instance, Qemtex launched a powder coating plant in the UAE to get the global markets moving which is another strategic move by the company to strengthen its manufacturing base. This expansion also points toward a trend of companies setting up regional production facilities to better their supply chain with the speed of response to global demands. Such changes indicate that geographic expansion and focused innovation will continue to be at the heart of the agenda for coating equipment companies looking for new markets and better delivery. These trends show that globalization and technological advancement will propel the market forward with key players positioning themselves in the market for efficiency, precision, and environmental stewardship.

Coating Equipment Market Dynamics:

Drivers:

-

Increasing Adoption of Advanced Automation Technologies Drives Efficiency and Precision in the Coating Equipment Market

The demand for automation in coating applications is rapidly rising as manufacturers seek to improve productivity, quality, and consistency in their operations. Automated coating equipment significantly reduces the need for manual intervention, leading to greater accuracy, less material wastage, and faster production rates. This adoption is particularly prominent in sectors such as automotive, electronics, and aerospace, where precision is essential. For instance, automated systems by companies like Nordson and Durr facilitate precise control over coating thickness and coverage, resulting in consistent product quality and reduced defects. Additionally, automation minimizes labor costs and can handle complex coating requirements that would be challenging to achieve manually. As industries continue to modernize production facilities, the demand for advanced automated coating equipment is expected to further strengthen.

-

Rising Demand for Eco-Friendly Coating Solutions Pushes Growth in the Coating Equipment Market

Environmental regulations are increasingly pressuring companies to adopt eco-friendly practices, propelling the demand for sustainable coating equipment. Traditional coatings often contain volatile organic compounds (VOCs), which contribute to environmental pollution and health hazards. In response, the market is witnessing a shift toward equipment capable of applying water-based, powder, or low-VOC coatings, reducing the environmental impact of coating processes. For example, powder coating equipment from ITW Gema AG enables high-efficiency applications without releasing harmful VOCs, making it a popular choice across industries prioritizing sustainable practices. This trend is particularly strong in developed regions with strict environmental regulations, as industries are under more pressure to comply with eco-friendly standards. The shift toward sustainable coating solutions is expected to continue driving innovation and growth in the coating equipment market.

Restraint:

-

High Initial Investment and Maintenance Costs Hinder Market Expansion for Coating Equipment

Despite the numerous advantages of advanced coating equipment, the high initial costs associated with purchasing and setting up this machinery remain a significant restraint. Sophisticated coating equipment, especially those with automation capabilities, require substantial capital investment, which can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, these systems often involve complex technologies that demand regular maintenance and occasional updates, further adding to the operational costs. For instance, automated electrostatic coating systems may require specialized technicians for servicing and calibration, which can lead to increased expenses over time. This high cost factor can discourage potential adopters, particularly those with limited budgets, and may slow down the widespread adoption of advanced coating equipment across various industries.

Opportunity:

-

Expansion of Emerging Markets Presents New Growth Opportunities for the Coating Equipment Market

Emerging economies, especially in Asia-Pacific and Latin America, present substantial growth opportunities for the coating equipment market. The rapid industrialization in countries such as India, Brazil, and Vietnam is driving demand for coating equipment across sectors like automotive, consumer goods, and electronics. As manufacturers in these regions seek to enhance production capabilities, many are investing in modernized coating technologies to improve product quality and competitiveness in the global market. For example, India’s growing automotive industry is actively adopting advanced coating systems to meet international standards. Additionally, the cost-effective labor and raw materials available in these regions make them attractive destinations for international companies looking to expand operations. This trend of increased industrial activities and investment in infrastructure creates a favorable environment for coating equipment providers to tap into high-potential markets.

Challenge:

-

Technical Complexity and Skilled Workforce Requirements Create Operational Challenges in the Coating Equipment Market

The technical complexity of modern coating equipment poses a significant challenge, especially in terms of workforce training and operational efficiency. Advanced coating systems often require specialized knowledge to operate, calibrate, and maintain, and this skill gap can hinder effective utilization. Companies face difficulties in finding qualified personnel with the technical expertise to handle automated and high-precision coating equipment, particularly in regions where technical training programs are limited. This shortage of skilled labor can lead to suboptimal equipment performance and higher maintenance costs, impacting productivity and profitability. Furthermore, as coating equipment becomes more sophisticated, companies must continuously invest in employee training to keep pace with technological advancements, which can add to operational costs and reduce adoption rates among smaller enterprises.

Coating Equipment Market Segmentation Overview

By Coating Type

In 2023, the powder coating equipment segment dominated the Coating Equipment Market, with a market share of approximately 40%. The preference for powder coatings over traditional liquid coatings is growing due to their eco-friendly attributes, cost-effectiveness, and superior durability. Powder coating systems, such as those offered by ITW Gema AG, are widely used in industries like automotive and consumer goods, as they provide a more efficient coating process with minimal waste and no solvents. Powder coatings are especially valued for their environmental benefits, such as the absence of volatile organic compounds (VOCs), making them highly attractive to manufacturers striving to meet stringent environmental regulations. This trend is further supported by advancements in electrostatic spray technology, making powder coating systems faster and more efficient.

By Material

In 2023, the polyester segment dominated the Coating Equipment Market, holding a market share of around 30%. Polyester coatings are highly popular due to their exceptional weather resistance and long-lasting durability, making them a preferred choice in both industrial and architectural applications. For example, polyester-based coatings are commonly used in the automotive and building & infrastructure sectors, where performance under harsh weather conditions is crucial. Additionally, the growing demand for energy-efficient and durable coatings in the construction and automotive industries is contributing to the rise in polyester material usage. This dominance is expected to continue as the polyester material is ideal for a range of applications that require robust and versatile coating solutions.

By End-Use Industry

In 2023, the automotive sector dominated the Coating Equipment Market, with a market share of approximately 35%. The automotive industry’s adoption of advanced coating systems is driven by the increasing demand for high-quality, durable, and aesthetically appealing finishes on vehicles. Technologies like electrostatic spray systems, commonly used in automotive coatings, provide superior coverage and uniformity, which are essential for mass production in automotive manufacturing. Companies such as Nordson Corporation have contributed to this growth by offering coating equipment that improves both the appearance and longevity of automotive products. Moreover, automotive coatings are crucial for protecting against corrosion, UV degradation, and wear, making them an essential part of the manufacturing process in the industry.

Coating Equipment Market Regional Analysis

In 2023, the Asia-Pacific region dominated the Coating Equipment Market with a market share of approximately 40%. This dominance can be attributed to the rapid industrialization, urbanization, and significant growth in manufacturing industries across countries such as China, India, Japan, and South Korea. These countries represent major hubs for the automotive, electronics, and construction sectors, all of which are major consumers of coating equipment.

For instance, China is the world’s largest automotive manufacturing country, and the demand for advanced automotive coatings, including powder and liquid coating systems, continues to grow as the automotive industry seeks to improve vehicle aesthetics and durability. China's extensive production of electronics also fuels the demand for high-precision coating equipment used in the electronics industry.

Japan, another key player in the region, has long been a leader in technological innovations and is home to major automotive manufacturers like Toyota and Honda, who are actively investing in state-of-the-art coating equipment to meet both domestic and international standards for vehicle finishes. Additionally, India’s burgeoning automotive and construction industries are driving demand for coatings that are both cost-effective and durable, further bolstering the demand for coating equipment. The Asia-Pacific region’s cost-effective production capabilities, combined with a large consumer base and significant investments in infrastructure, have positioned it as the dominant player in the global coating equipment market.

Get Customized Report as per your Business Requirement - Request Sample Report

Recent Developments

October 2024: PPM Technologies launched the FlavorWRIGHT SmartSpray food coating system, offering precise, consistent spray applications for improved quality, efficiency, and reduced waste in food coating processes.

July 2023: Austria-based Miba AG invested USD 17.6 million in opening a new manufacturing facility in South-Eastern Styria. The expansion aimed to double the production area from 3,000 square meters to 6,300 square meters. The facility was built to improve the production of coating systems and related equipment.

May 2023: Sames Kremlin launched a new electrostatic spray gun named Nanogun Airmix Xcite for automotive and wood coating applications. It was designed to deliver excellent performance during operation and was available in 3 pressure ranges: 120, 200, and 400 bar.

Key Players in Coating Equipment Market

-

Anest Iwata Corporation (Spray Guns, Air Compressors)

-

Asahi Sunac Corporation (Spray Equipment, Automatic Painting Systems)

-

Axalta Coating Systems Ltd. (Liquid Coating Systems, Powder Coating Systems)

-

Buhler AG (PVD Coating Systems, Thin Film Coating Equipment)

-

Carlisle Companies Inc. (Spray Guns, Fluid Handling Equipment)

-

Durr AG (Paint Booths, Atomizers)

-

Exel Industries (Spray Guns, Electrostatic Applicators)

-

Graco Inc. (Airless Sprayers, Electrostatic Sprayers)

-

IHI Ionbond AG (PVD Coating Systems, CVD Coating Systems)

-

ITW Gema AG (Powder Coating Guns, Automatic Coating Equipment)

-

J. Wagner GmbH (Powder Coating Systems, Spray Guns)

-

Larius Srl (Airless Sprayers, Pneumatic Pumps)

-

Nordson Corporation (Powder Coating Systems, Liquid Coating Systems)

-

OC Oerlikon Corporation AG (Thermal Spray Equipment, PVD Coating Systems)

-

Plasmatreat GmbH (Plasma Systems, Surface Treatment Equipment)

-

SATA GmbH & Co. KG (Spray Guns, Air Filtration Systems)

-

SAMES KREMLIN (Electrostatic Spray Guns, Airless Pumps)

-

Sulzer Ltd (Mixing and Dispensing Equipment, Spray Nozzles)

-

Taikisha Ltd (Automated Coating Systems, Paint Circulation Systems)

-

Therma-Tron-X, Inc. (Electrocoating Equipment, Powder Coating Ovens)

Key Raw Materials and Leading Suppliers in the Coating Equipment Market:

-

-

Resins and Polymers

-

Epoxy Resins

-

Huntsman Corporation

-

BASF SE

-

Dow Chemical Company

-

-

Polyester Resins

-

BASF SE

-

Royal DSM

-

SABIC

-

-

Acrylic Resins

-

Arkema S.A.

-

Evonik Industries

-

Dow Chemical Company

-

-

Polyurethane Resins

-

Covestro AG

-

BASF SE

-

Huntsman Corporation

-

-

-

Pigments and Dyes

-

Titanium Dioxide

-

DuPont

-

Chemours Company

-

Tronox Limited

-

-

Iron Oxide

-

LANXESS AG

-

BASF SE

-

Kronos Worldwide Inc.

-

-

Organic Pigments

-

Clariant International Ltd.

-

BASF SE

-

Cabot Corporation

-

-

-

Other Raw Materials

-

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.5 Billion |

| Market Size by 2032 | US$ 30.4 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coating Type (Powder coating equipment, Liquid coating equipment, Specialty coating equipment) • By Material (Polyester, Acrylic, PVC, Epoxy, Silicon) • By End-Use Industry (Automotive, Aerospace, Industrial, Building & Infrastructure, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nordson Corporation, IHI Ionbond AG, OC Oerlikon Corporation AG, SATA GmbH & Co. KG, Anest Iwata Corporation, Graco Inc., Axalta Coating Systems Ltd., Carlisle Companies Inc., Wagner Systems Inc., Asahi Sunac Corporation and other key players |

| Key Drivers | • Increasing Adoption of Advanced Automation Technologies Drives Efficiency and Precision in the Coating Equipment Market •Rising Demand for Eco-Friendly Coating Solutions Pushes Growth in the Coating Equipment Market |

| RESTRAINTS | • High Initial Investment and Maintenance Costs Hinder Market Expansion for Coating Equipment |