HVDC Transmission Market Report Scope & Overview:

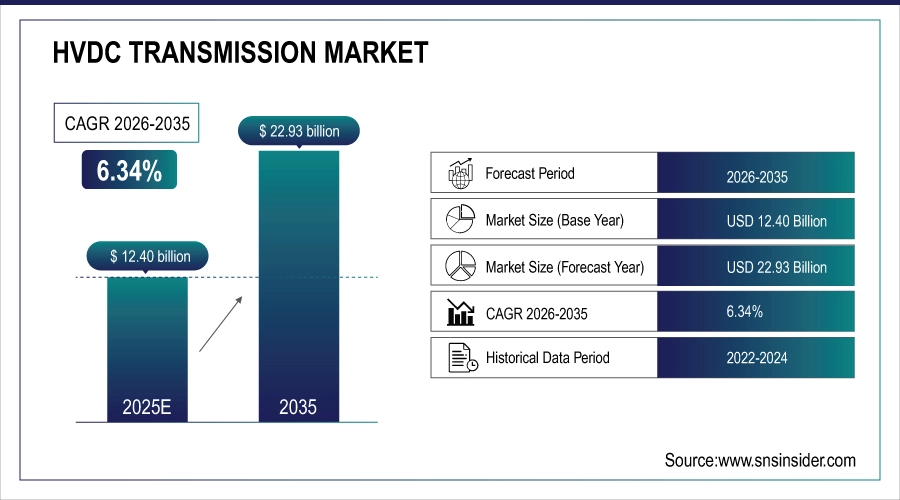

The HVDC Transmission Market size was valued at USD 12.40 Billion in 2025 and is projected to reach USD 22.93 Billion by 2035, growing at a CAGR of 6.34% during 2026-2035.

The HVDC transmission market is poised for significant expansion, driven by the accelerating integration of renewable energy, rising electricity demand, and long distance low loss power transmission is set to drive the HVDC transmission market. Increasingly, HVDC is preferred as an efficient system for stabilizing the grid and transmitting bulk power over long distances. Voltage control, development of modular converter units and power flow in bi-direction are some technological advancements aiding grid integration. Yet, the growth of our markets has always been subject to fluctuations due to regulatory frameworks, financing structures and policy consistency.

July 25, 2025 – U.S. Department of Energy withdraws USD 4.9B loan guarantee for Grain Belt Express HVDC line, putting USD 11B project at risk.Former DOE official calls move illegal as Invenergy warns of impacts on energy savings, jobs, and data center support.

HVDC Transmission Market Size and Forecast:

-

Market Size in 2025: USD 12.40 Billion

-

Market Size by 2033: USD 22.93 Billion

-

CAGR: 6.34% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on HVDC Transmission Market - Request Free Sample Report

Key Trends in the HVDC Transmission Systems Market:

-

Rising demand for long-distance, high-capacity electricity transmission driven by increasing global power consumption and renewable energy integration.

-

Growing adoption of voltage-source converter (VSC) and line-commutated converter (LCC) technologies for efficient and stable high-voltage direct current (HVDC) transmission.

-

Increasing focus on reducing transmission losses and enhancing grid reliability through advanced HVDC solutions.

-

Rapid expansion of interconnection projects and cross-border power transmission to balance regional supply and demand.

-

Integration of smart grid technologies and digital monitoring systems for improved operational control and predictive maintenance.

-

Higher investment by utilities and independent power producers in HVDC systems to support renewable energy integration and decarbonization goals.

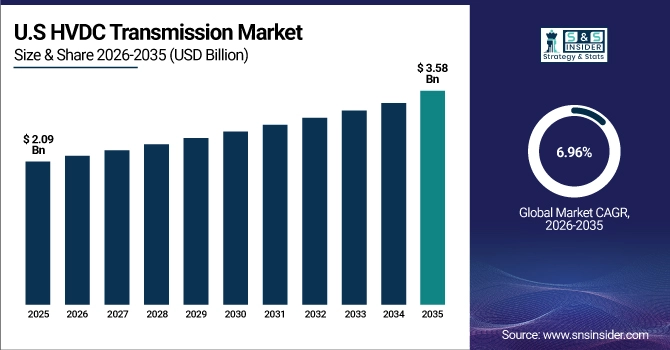

The U.S HVDC Transmission Market size was valued at USD 2.09 Billion in 2025 and is projected to reach USD 3.58 Billion by 2035, growing at a CAGR of 6.96% during 2026-2035. This HVDC Transmission Market growth being propelled by utility efforts towards integration of renewable energy, addition of reliable power capacity, and viable long-distance power links. A growing market expansion is hence dependent on regulatory support, availability of financing and simplified approval processes for projects across states.

The HVDC transmission market trends include rising adoption of renewable energy and the need for long-distance, high-efficiency power transmission. With governments increasingly prioritizing grid modernization and focus on cross-border interconnection to boost energy security. From the technological front, approaches like modular multi-level converters (MMC) and bi-directional power flow are making systems increasingly flexible and scalable. Circuited technologies interconnectors are intended to transport big amounts of controlled power across large areas: NRLDC offshore wind integration is another factor propelling demand for HVDC systems. Private investments and public-private partnerships are becoming increasingly more widespread, while regulatory clarity and permitting simplification are crucial to increasing the pace of project deployment.

High Voltage Direct Current (HVDC) Transmission Market Drivers:

-

Rising Localization of HVDC Technology Accelerates Market Expansion

Localization of advanced power transmission technologies is a prevailing trend, which drives development of the HVDC transmission market. Beyond that, governments are expanding investments in infrastructure of their domestic ability to provide high-voltage, long-distance transportation alternatives. This change to energy security reduces reliance on overseas suppliers and allows more rapid HVDC deployment. Furthermore, regional production drives cost-effectiveness and innovation in voltage source converters and transformers. With governments initiatives for decarbonization and reliable grid infrastructure, corresponding domestic capabilities are being strategically embedded into national energy agendas. And this trend is reinforcing the global supply chain, which in turn, increases the pace of technological advancement and HVDC deployment for utility-scale renewable integration and for cross border electricity interconnection projects globally.

July 30, 2025 — HVDC business's Hyosung Heavy Industries will break ground in Changwon on the construction of a plant for a HVDC transformer which is needed for expanded production and R&D with USD 238.7m to make South Korea largest one The investment indicates Hyosung entering into global scale of an area now highlighted by every country as energy infrastructure and overseas demand..

High Voltage Direct Current (HVDC) Transmission Market Restraints:

-

Regulatory and Land Acquisition Challenges Restrain HVDC Market Growth

One of the key restraints in the HVDC transmission market is the complex regulatory landscape and prolonged land acquisition processes. Due to their broad geographic and corporate scale, HVDC projects can be plagued by bureaucratic delays, permitting disputes and local opposition to new rights-of-way. These obstacles extend project timelines and escalate the cost of investment, detracting from its appeal. Disjointed policy frameworks between jurisdictions continue to obstruct the coordinated development and financing efforts. Further, the low return on investment and knowledge-intensive nature of the industry limits market penetration; particularly in developing countries where a huge portion of the demand is originating. Consequently, while the technologies offer value they still face some structural and procedural challenges that impede their deployment and hold global HVDC infrastructure expansion back.

High Voltage Direct Current (HVDC) Transmission Market Opportunities:

-

Strategic Partnerships Open Global Expansion Opportunities for HVDC Market

The HVDC transmission market is gaining momentum through strategic collaborations between engineering and energy firms. These collaborations unite critical infrastructure experience with state-of-the-art HVDC solutions to underpin the development of large-scale, long-distance installations such as submarine and intercontinental systems. While increasingly electrified AI data centers and renewable energy sources increase the stress on electrical grid, these types of partnerships will decrease risk for projects and increase efficiencies while opening new opportunity in burgeoning markets. Consequently, joint HVDC research empowers both countries in grid modernization and energy security making HVDC a building block of the future power

August 5, 2025 – Samsung C&T partners with Hitachi Energy to expand globally in the HVDC sector, enhancing cooperation on advanced transmission projects.The collaboration includes Hitachi’s converter station supply for Samsung’s USD42.4B submarine HVDC project in the UAE.

High Voltage Direct Current (HVDC) Transmission Market Challenges:

-

High Costs and Technical Complexity Limit HVDC Market Scalability

A major challenge facing the HVDC transmission market is the high initial cost and technical complexity associated with deployment. HVDC is capital-intensive compared to conventional AC systems as HVDC systems require converter stations, specialized transformers, and complex control system which increases upfront investment. Incrementally, there is also a talent bottleneck as the world has an abundance of transmission lines and electrical engineers but few with the experience needed to design, build or repair HVDC LEDs. FranceIt is financial inhibiting factor, especially in developing territories. There are also integration risks, due to the absence of standardized global regulations and lack of interoperability among the different HVDC technologies; As a result, these financial, technical and regulatory barriers are hampering the deployment of HVDC systems on a larger scale across the world.

HVDC Transmission Systems Market Segmentation Analysis:

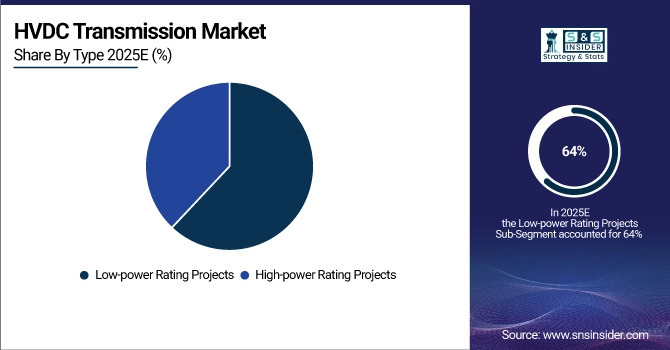

By Type, Low-Power Rating Projects Segment Dominates HVDC Market with 64% Share in 2025, High-Power Rating Projects Segment to Record Fastest Growth with 7.67% CAGR

The Low-Power Rating Projects segment held a dominant HVDC market share of approximately 64% in 2025. These systems are widely adopted in medium-scale renewable energy projects, regional grids, offshore wind connections, and industrial power applications due to their cost-effectiveness, flexible deployment, and ease of integration with existing AC networks. Lower installation costs and operational simplicity continue to drive the adoption of low-power HVDC solutions in emerging economies.

The High-Power Rating Projects segment is expected to witness the fastest growth over 2026–2035 with a CAGR of 7.67%. Rising demand for transmitting bulk power over long distances, strengthening cross-border interconnections, and supporting gigawatt-scale renewable energy projects are fueling investments in large-scale HVDC infrastructure. Utilities and governments are increasingly prioritizing high-power HVDC systems to improve grid reliability and reduce transmission losses.

By Technology, LCC Segment Dominates HVDC Market with 67% Share in 2025, VSC Segment to Record Fastest Growth with 7.81% CAGR

The Line Commutated Converter (LCC) segment accounted for approximately 67% of the HVDC market share in 2025. LCC technology remains dominant due to its proven reliability, cost-effectiveness, and suitability for high-capacity, long-distance power transmission, including bulk power transfers and undersea links.

The Voltage Source Converter (VSC) segment is expected to experience the fastest growth over 2026–2035 with a CAGR of 7.81%. Its excellent controllability, compact footprint, and capability to integrate offshore wind farms, urban power grids, and asynchronous networks are driving adoption across emerging and developed markets.

By Transmission, Overhead HVDC Segment Dominates with 55% Share in 2025, Submarine HVDC Segment to Record Fastest Growth with 10.48% CAGR

The HVDC Overhead Transmission System segment held a dominant 55% share in 2025 due to its cost-effectiveness and ability to transmit large amounts of electricity over long distances efficiently. Overhead systems are widely used in countries like China, India, and parts of North America because of lower installation and maintenance costs.

The Submarine HVDC Transmission System segment is expected to grow at the fastest CAGR of 10.48% from 2026 to 2035. Increasing deployment of offshore renewable energy projects, intercontinental power links, and undersea grid connections in Europe, Asia-Pacific, and the Middle East is driving demand. Submarine systems are critical for enabling cross-border power trade, integrating remote energy sources, and enhancing energy security.

By Application, Overhead Segment Dominates HVDC Market with 44% Share in 2025, Subsea Segment to Record Fastest Growth with 11.56% CAGR

The Overhead application segment accounted for approximately 44% of the HVDC market share in 2025, primarily due to suitability for long-distance inland power transmission. Countries like China and India continue to adopt overhead HVDC systems for large-scale infrastructure projects due to cost-efficiency and ease of maintenance.

The Subsea application segment is expected to witness the fastest growth over 2026–2035 with a CAGR of 11.56%. Growth is fueled by offshore renewable energy investments and intercontinental HVDC projects in Europe, the Middle East, and Asia-Pacific. Advances in insulation materials, installation techniques, and deep-sea technology are improving the viability and efficiency of subsea HVDC systems.

HVDC Transmission Market Regional Insights:

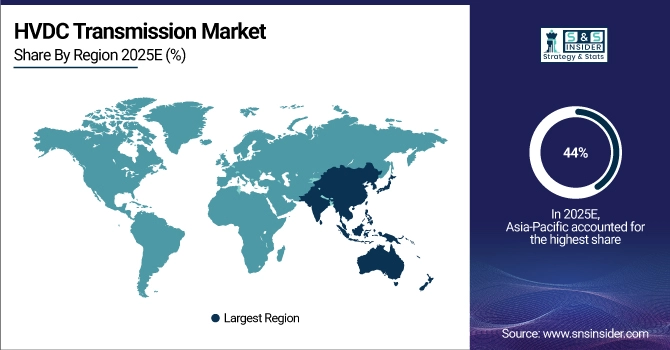

Asia-Pacific Dominates HVDC Market in 2025

In 2025, Asia-Pacific accounted for an estimated 44% share of the HVDC Market, driven by large-scale grid modernization, interconnection projects, and rising demand for long-distance power transmission. Major investments in HVDC infrastructure are being made by China, India, and South Korea to support industrial growth, urbanization, and renewable energy integration. Government policies, public-private partnerships, and accelerated project approvals across key economies further strengthen the region’s leadership in HVDC deployment.

China, India, and South Korea are the dominant countries in Asia-Pacific, leading initiatives in large-scale renewable energy transmission, cross-border interconnections, and smart grid implementation. Together, these nations drive regional growth through policy support, infrastructure investments, and technological advancements in high-voltage direct current systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is the Fastest-Growing Region in HVDC Market

North America is projected to grow at a CAGR of 8.00% from 2026 to 2035, fueled by increasing investments in cross-border interconnections, renewable energy penetration, and grid modernization initiatives. High-voltage transmission for remote wind and solar projects is a major focus area in both the U.S. and Canada. Supportive regulatory frameworks and active private sector participation are accelerating adoption of HVDC solutions across the region.

The United States dominates North America’s HVDC Market, driven by early adoption of large-scale transmission projects, robust renewable energy development, and infrastructure modernization. U.S. utilities and project developers are increasingly deploying HVDC systems to improve efficiency, reliability, and interconnectivity of the national grid.

Europe HVDC Market Insights, 2025

Europe held a significant portion of the HVDC Market in 2025, supported by aggressive renewable energy targets and investments in inter-country grid infrastructure. Countries such as Germany, the UK, and the Nordic nations are advancing HVDC deployments to enhance grid stability, reduce transmission losses, and enable efficient long-distance power transfer.

Germany leads Europe’s HVDC market due to its strong industrial base, renewable energy expansion, and government-backed grid modernization projects. Advanced engineering expertise and policy incentives further strengthen Europe’s position as a key HVDC market.

Middle East & Africa and Latin America HVDC Market Insights, 2025

In 2025, the Middle East & Africa and Latin America regions showed steady growth in the HVDC Market, driven by increasing demand for reliable electricity transmission across large and remote territories. Brazil, Chile, Saudi Arabia, and the UAE are investing in HVDC projects to support renewable energy integration, interregional connectivity, and grid modernization. Both regions represent emerging markets for HVDC systems, focusing on cross-border energy trade, renewable project support, and development of resilient power networks. Strategic infrastructure investments and government-led energy initiatives are expected to create long-term market opportunities.

HVDC Transmission Market Key Players:

-

Hitachi Energy

-

Siemens Energy AG

-

General Electric Company (GE Grid Solutions)

-

Mitsubishi Electric Corporation

-

Toshiba Corporation

-

Nexans S.A.

-

Prysmian Group

-

NKT A/S

-

Schneider Electric SE

-

NR Electric Co., Ltd.

-

C-EPRI Electric Power Engineering Co., Ltd.

-

Sumitomo Electric Industries, Ltd.

-

LS Cable & System Ltd.

-

China XD Group

-

TBEA Co., Ltd.

-

Hyosung Heavy Industries

-

Alstom Grid (part of GE Grid Solutions)

-

American Superconductor Corporation (AMSC)

-

State Grid Corporation of China

-

Xian XD Power System Co., Ltd.

Competitive Landscape of HVDC Transmission Systems Market:

Hitachi Energy

Hitachi Energy is a global leader in power and automation technologies, specializing in high-voltage direct current (HVDC) transmission systems, grid solutions, and renewable integration. The company provides turnkey HVDC projects, converter stations, and advanced power electronics to enable long-distance, efficient, and reliable power transmission. Its role in the HVDC Market is pivotal, supporting the deployment of large-scale renewable energy, cross-border interconnections, and grid modernization.

-

In 2025, Hitachi Energy is expected to advance multi-terminal HVDC solutions and voltage-source converter (VSC) technology to enhance efficiency and controllability in offshore wind and intercontinental power transmission projects.

Siemens Energy AG

Siemens Energy is a Germany-based multinational focused on energy technology, delivering HVDC transmission systems, grid stabilization solutions, and converter technologies. The company supports high-capacity, long-distance, and flexible transmission infrastructure, integrating both line-commutated converter (LCC) and voltage-source converter (VSC) technologies. Siemens Energy plays a critical role in the HVDC market by enabling cross-border power transfer, renewable energy integration, and enhanced grid reliability.

-

In 2025, Siemens Energy plans to expand its HVDC portfolio with advanced modular converter stations and smart grid-ready HVDC solutions for Asia-Pacific and European markets.

General Electric Company (GE Grid Solutions)

GE Grid Solutions, a division of General Electric, offers comprehensive HVDC systems, power transmission equipment, and grid automation solutions. The company provides high-capacity HVDC lines, advanced control systems, and turnkey projects, catering to both onshore and offshore applications. Its role in the HVDC Market is significant, driving long-distance power transmission, renewable energy integration, and modernization of aging grids.

-

In 2025, GE Grid Solutions aims to deploy next-generation HVDC technology, including high-power VSC systems for offshore wind projects and improved energy efficiency across interconnection networks.

Mitsubishi Electric Corporation

Mitsubishi Electric is a Japan-based multinational delivering HVDC transmission systems, power electronics, and energy infrastructure solutions. The company specializes in both LCC and VSC technologies for high-capacity and long-distance transmission, with a strong focus on renewable energy integration, grid stability, and energy efficiency. Its role in the HVDC Market is vital, particularly in Asia-Pacific and global interconnection projects.

-

In 2025, Mitsubishi Electric is expected to enhance its HVDC product line with advanced multi-terminal systems and compact, high-efficiency converters for offshore and urban transmission projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 12.40 Billion |

| Market Size by 2035 | USD 22.93 Billion |

| CAGR | CAGR of 6.34% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(High-power Rating Projects, Low-power Rating Projects) • By Technology(Line Commutated Converter (LCC) and Voltage Source Converter (VSC)) • By Transmission (Submarine HVDC Transmission System, HVDC Overhead Transmission System and HVDC Underground Transmission System) • By Application(Subsea, Underground, Overhead and Mixed) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The HVDC Market companies are Hitachi Energy Ltd., Siemens Energy AG, NEXANS S.A., Toshiba Energy Systems & Solutions Corporation, CHINA XD GROUP, Mitsubishi Electric Corporation, General Electric Company (GE), Xu Ji Group Co. Ltd., NR Electric Co. Ltd., Prysmian Group, TBEA Co., Ltd., NKT A/S, ABB Ltd., Schneider Electric SE, Sterlite Power Transmission Ltd., Rongxin Power Electronic Co., Ltd. (RXPE), Sumitomo Electric Industries, Ltd., Hyundai Electric & Energy Systems Co., Ltd., Pinggao Group Co., Ltd., LS Cable & System Ltd., and Others. |