Electronic Filtration Market Size Analysis:

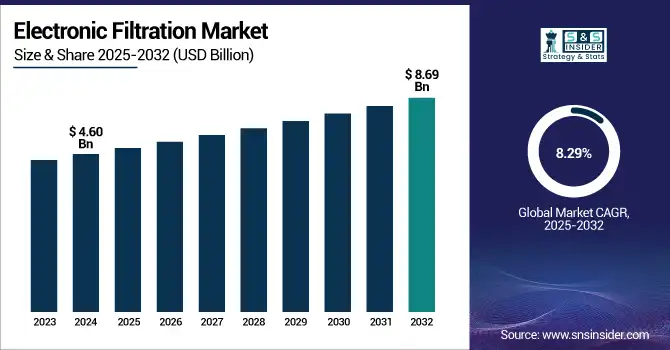

The Electronic Filtration Market size was valued at USD 4.60 billion in 2024 and is expected to reach USD 8.69 billion by 2032, growing at a CAGR of 8.29% over the forecast period of 2025-2032.

The electronic filtration industry is growing rapidly with increased applications in semiconductor manufacturing, consumer electronics, and cleanroom facilities. State-of-the-art filtration products such as Entegris’s Torrento X series, and Vibrant HPM line are essential to address contamination in desiccated wet etch, CVD/PVD, and CMP processes and foster electronic filtration market demand. Focus on indoor air quality regulations and EPA particulate filtration standards are driving demand for HEPA, ULPA and electrostatic filters across residential and commercial sectors, influencing the industry outlook.

To Get more information on Electronic Filtration Market - Request Free Sample Report

Most recently, Entegris sold its electronic chemicals business for USD 700 million to de-leverage and concentrate on filtration solutions and grow its share of the PIC market. Strategic acquisitions, like Entegris’s acquisition of Gore’s microelectronics filtration line for USD 20 million, also demonstrate continued innovation. Ultimately, the electronic filtration market report examines the current status, suppliers and features, ease of implementation, and effect on the electronic filtration business.

Electronic Filtration Market Dynamics:

Drivers:

-

Growing Use of Filtration in Quantum Computing Devices Strengthens Electronic Filtration Market Trends

Ultra-clean environments to support quantum computing, meaning more need for high-efficiency filtration. Such devices quench decoherence due to atmospheric impurities. A company, such as Atlas Copco offers filtration specifically designed for cleanrooms in cryogenic labs. The Quantum Systems Accelerator of the U.S. Department of Energy declares filtration as a key piece of infrastructure. As quantum computing transitions to commercial applications, interest in advanced filtering increases, driving growth in the electronic filtering market and solidifying electronic filtering industry analysis among the nascent computing markets. This progression underscores what is becoming a greater field of opportunity for electronic filter firms.

-

Surge in Electric Vehicle Electronics Production Propel Electronic Filtration Market Growth

The increasing demand for contamination control in electronics and battery components is raising the production of electric vehicles. Companies such as Freudenberg Filtration Technologies can provide cleanroom-compatible filter cassettes suitable for EV manufacturing requirements. EV production increased by 29% between 2022 and 2023, the U.S. Department of Energy reports. This in turn drives the growth of the electronic filtration market especially in automotive electronics. With increasing production capabilities, the electronic filtration market will be expanding over the new industrial applications as well, which in turn will drive the overall volume of electronic filtration market.

Restraints:

-

Complexity in Custom Filtration Design for High-mix Electronic Production Restrains Market Growth

The production of electronics in high-mix environments needs flexible filtration offerings, that add complexity and costs. Clean Rooms International points out problems for standard filters from being integrated into multiple production lines. Adaptive contaminant control is underdeveloped for non-rigid systems, as noted by the US Environmental Protection Agency. This is a limitation to the scalability of companies in the electronic filtration and the electronic filtration market. This complexity of customizability is hindering the electronic filtration market share uptick in multiple applications, such as in aerospace electronics and prototyping, which is a limiting factor to the growth of electronic filtration as a whole.

Electronic Filtration Market Segmentation Analysis:

By Type

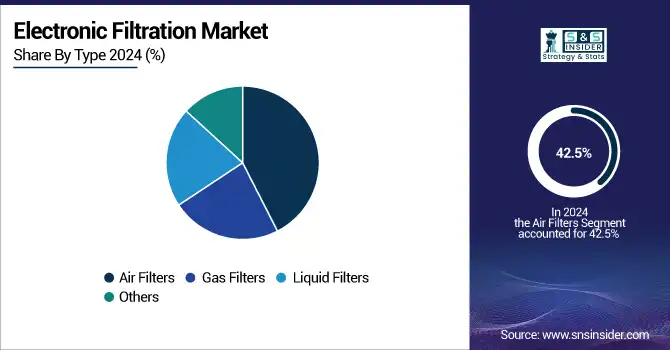

Air filters dominated the electronic filtration market in 2024 with a market share of 42.5%, driven by increasing cleanroom adoption in semiconductor and electronics manufacturing. Increasingly stringent indoor air quality standards, more stringent EPA regulations and increasing use of high efficiency particulate air filters has meant tremendous growth in the number of air filter installations. Firms, such as Camfil or Mann + Hummel are utilizing air filtration technologies, in the electronics cleanrooms to surge the electronic filtration market size and augment the electronic filtration market share at the developed regional perspectives.

Liquid filters are projected to be the fastest-growing segment in the electronic filtration market over 2025-2032, with a CAGR of 8.92%. Growth is driven by their extensive use in chemical processes, wet etching, and cooling systems, requiring high-purity control. The National Institute of Standards and Technology says that it is imperative that ultra-clean fluids be kept in our electronics processing, and consistently clean fluids is what makes liquid filters such a big part of the future electronic filtration market trends and in the overall electronic filtration market size growth.

By Filter Materials

Glass fiber dominated the electronic filtration market in 2024 with a market share of 26.4%, owing to its superior thermal resistance and fine particulate retention capabilities. Glass fiber filters are commonly used in clean room environments for electronic and semiconductor manufacturing that require uniform air flow and high accuracy in filtration. It will enhance contamination control, boost U.S. Department of Energy (DOE) market share for electronic filtration, and advance the electronic filtration market across key manufacturing sectors as well as the broader marketplace.

Polyethersulfone (PES) is the fastest-growing filter material in the electronic filtration market from 2025 to 2032, registering a CAGR of 9.78%. The growing preference for PES filters in strip application & aggressive chemical environment such as in photolithography is one of the key trends, which is influencing the PES market. Filtering electronic companies are increasingly focusing on PES products for their chemical resistance and mechanical strength, driving electronic filtering market trends and electronic filtering market growth across high-performance electronics segments.

By Filtration Technologies

Membrane filtration dominated the electronic filtration market in 2024 with a market share of 29.8%, due to its exceptional efficiency in removing micro- and nano-particles from gases and liquids. It is widely adopted in semiconductor processing, where precision filtration is required to maintain ultra-clean environments. The National Institute of Standards and Technology has recognized membrane filtration as vital in advanced chip fabrication, reinforcing electronic filtration market trends and supporting electronic filtration market growth across highly controlled manufacturing facilities.

Electrostatic filtration is the fastest-growing technology in the electronic filtration market over 2025-2032, with a projected CAGR of 9.42%. This growth is driven by its increasing use in energy-efficient HVAC systems in cleanrooms. The U.S. Environmental Protection Agency supports electrostatic filtration for enhanced air quality, helping reduce particulate load while maintaining sustainability. These trends significantly expand the electronic filtration market size and shape the future direction of electronic filtration market analysis in facility design.

By Application

Cleanroom environments dominated the electronic filtration market in 2024 with a market share of 35.9%, driven by their essential role in high-precision electronics and semiconductor manufacturing. Cleanroom filtration systems are critical in maintaining Class 1 to Class 100 air quality, minimizing contamination during sensitive processes. The Semiconductor Industry Association emphasizes investments in cleanroom infrastructure to reduce yield losses, reinforcing the dominance of this segment in electronic filtration market analysis and boosting electronic filtration market share among key electronic filtration companies.

Chemical vapor deposition (CVD) and physical vapor deposition (PVD) applications are the fastest growing in the electronic filtration market over 2025-2032, with a CAGR of 9.27%. These applications demand ultra-pure environments for thin film processing and advanced semiconductor layering. The U.S. Department of Energy highlights advanced filtration materials as critical to successful vapor deposition, significantly contributing to electronic filtration market trends and driving electronic filtration market growth in microelectronics and advanced packaging sectors.

By End-Use Industry

Consumer electronics dominated the electronic filtration market in 2024 with a market share of 38.2%, driven by high-volume production of smartphones, laptops, and wearables requiring precise contamination control. Clean air and fluid systems are essential in assembling miniature, sensitive components. According to the U.S. International Trade Administration, the growing export and production of consumer electronics is pushing demand for high-efficiency filtration, strengthening electronic filtration market share and reinforcing electronic filtration market size across global assembly lines.

Electronic Filtration Market Regional Analysis:

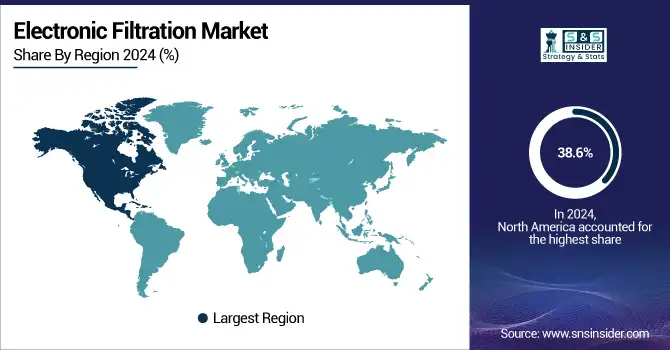

Asia Pacific dominated the electronic filtration market in 2024 with a 38.6% market share, driven by its role as the global hub for electronics and semiconductor manufacturing. Major investment in cleanroom and smart manufacturing infrastructure in China, Japan, South Korea and Taiwan continue to boost air and liquid filtration technology demand. China takes center stage in the region with the Ministry of Industry and Information Technology’s clean room upgrades and air filtration orders for major electronics zones. Such companies, such as Hangzhou Cobetter continue to contribute to liquid filtration systems, thereby strengthening the development and trends of electronic filtration market on regional front.

North America is the fastest-growing region with the highest CAGR of 8.79% and the second-largest region in the electronic filtration market, supported by strong technological innovation and large-scale semiconductor manufacturing. The region benefits from government incentives intended to increase domestic production of chips, including clean rooms, which are crucial to keeping contamination in check. The U.S. Environmental Protection Agency (EPA) encourages energy-efficient filtration technologies on basis of the sustainability targets of the region that boost electronic filtration market trends in the manufacturing industries.

The U.S. is the dominant country in North America’s electronic filtration market, with a market size of USD 871.06 million in 2024 and is projected to reach a value of USD 1703.38 million by 2032, with a market share of about 72%. The dominance is driven by the CHIPS and Science Act, which allocates USD 52 billion to semiconductor manufacturing and research. The U.S. Department of Commerce actively supports infrastructure improvements, including advanced filtration systems to reduce particle contamination in fabs. Major companies, such as Intel and Texas Instruments are upgrading cleanrooms to maintain product quality, strengthening the electronic filtration market share, and encouraging innovation in electronic filtration companies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Electronic Filtration Market Key Players:

The major electronic filtration market competitors include Entegris, Inc., Mott Corporation, Porvair Filtration Group, Cobetter Filtration, Graver Technologies, Pall Corporation, Donaldson Company, Inc., Parker Hannifin Corporation, Clean Rooms International, and CHANGSUNG Corporation.

Recent Developments in the Electronic Filtration Market:

-

In February 2025, Pall Corporation partnered with MTR Carbon Capture, integrating Pall’s advanced filtration with MTR’s Polaris membrane system for flue‑gas carbon capture.

-

In October 2024, MANN+HUMMEL presented sustainability‑focused innovations at FILTECH 2024, including carbon‑footprint‑reduced air filters using recycled and bio‑based materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.60 billion |

| Market Size by 2032 | USD 8.69 billion |

| CAGR | CAGR of 8.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Air Filters, Gas Filters, Liquid Filters, Others) •By Filtration Rating (Merv 1-4, Merv 5-8, Merv 9-12, Merv 13-16, Hepa Filters) •By Filter Materials (Polypropylene, Polytetrafluoroethylene (Ptfe), Nylon, Polyethersulfone (Pes), Cellulose, Glass Fiber, Ceramic, Stainless Steel/Metals, Others) •By Filtration Technologies (Mechanical Filtration, Adsorption Filtration, Depth Filtration, Membrane Filtration, Electrostatic Filtration, Others) •By Application (Cleanroom Environments, Photolithography, Wet Etching And Cleaning Processes, Chemical Vapor Deposition (Cvd) And Physical Vapor Deposition (Pvd), Gas Delivery Systems, Water Purification Processes, Others) •By End-Use Industry (Consumer Electronics, Semiconductor Industry, Telecommunications Equipment, Industrial Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Entegris, Inc., Mott Corporation, Porvair Filtration Group, Cobetter Filtration, Graver Technologies, Pall Corporation, Donaldson Company, Inc., Parker Hannifin Corporation, Clean Rooms International, CHANGSUNG Corporation |