Fiber Laser Market Size & Growth:

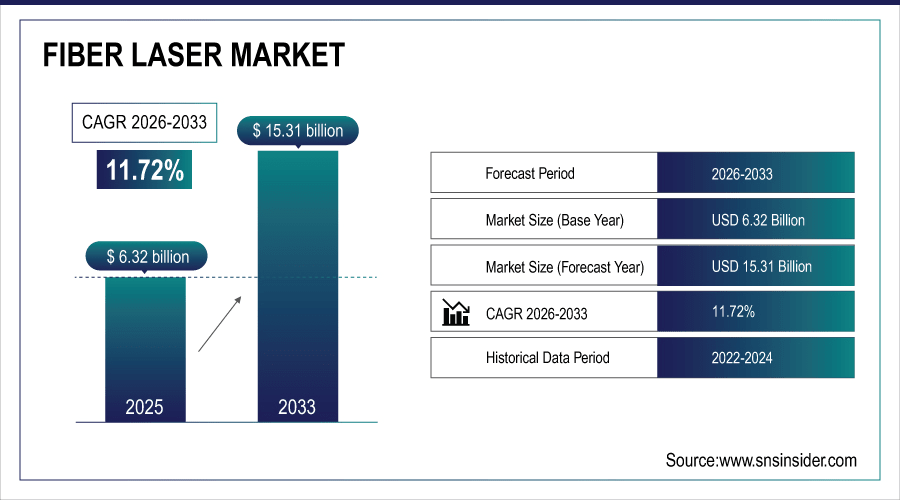

The Fiber Laser Market size was valued at USD 6.32 Billion in 2025E and is projected to reach USD 15.31 Billion by 2033, growing at a CAGR of 11.72% during 2026-2033.

The Fiber Laser Market is expanding due to the rising demand for high-precision, efficient, and cost-effective laser solutions across industries. Increasing adoption in automotive, aerospace, electronics, and medical applications is driving growth. The shift from traditional CO₂ and solid-state lasers toward fiber lasers for cutting, welding, and marking enhances market penetration. Growing use in EV battery welding and additive manufacturing boosts prospects.

Fiber lasers now command >55% market share in industrial laser systems, displacing CO₂ lasers due to 30–50% higher efficiency and 50% lower operating costs.

To Get More Information On Fiber Laser Market - Request Free Sample Report

Fiber Laser Market Trends

-

Increasing replacement of CO₂ and solid-state lasers with fiber lasers, driven by superior efficiency, precision, lower maintenance, and operational flexibility.

-

Rapid adoption of fiber lasers in EV battery welding, aerospace components, and additive manufacturing, enabling high-strength, lightweight, and energy-efficient production.

-

Growing penetration of fiber lasers in medical applications, supporting minimally invasive surgeries, dermatology treatments, and high-precision imaging across advanced healthcare systems.

-

Expanding demand for high-power fiber lasers in heavy-duty metal cutting, drilling, and industrial processing, supporting smart manufacturing and Industry 4.0 adoption.

-

Rising global R&D investments and patent filings in fiber laser innovations, focusing on compact designs, AI-based control, and hybrid laser technologies.

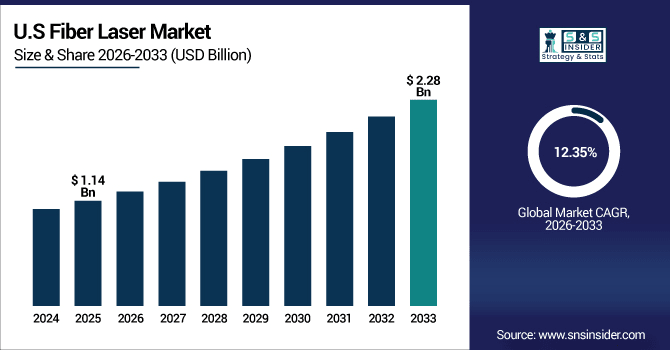

The U.S. Fiber Laser Market size was valued at USD 1.14 Billion in 2025E and is projected to reach USD 2.28 Billion by 2033, growing at a CAGR of 12.35% during 2026-2033. Fiber Laser Market growth is driven by strong demand in automotive, aerospace, and defense manufacturing sectors. Rising adoption in EV battery welding and smart factories boosts penetration. Advanced R&D investments and patent activity from leading players enhance technological competitiveness. Additionally, the country’s emphasis on Industry 4.0 and automation accelerates fiber laser integration across industrial applications.

Fiber Laser Market Growth Drivers:

-

Rising Demand for High-Precision and Energy-Efficient Laser Solutions Across Automotive, Aerospace, Electronics, and Healthcare Industries.

The Fiber Laser Market is experiencing robust growth driven by demand for high-precision, energy-efficient, and cost-effective laser solutions. Automotive, aerospace, and electronics sectors increasingly rely on fiber lasers for cutting, welding, and marking applications. Their superior beam quality, efficiency, and lower maintenance requirements make them a preferred choice over CO₂ and solid-state lasers. The shift toward smart factories and Industry 4.0 further enhances adoption across U.S. and global industries.

Fiber lasers capturing over 60% of industrial laser sales due to 30–50% greater energy efficiency and 40% lower lifetime costs vs. CO₂ lasers — accelerated by Industry 4.0 adoption in 75% of U.S. smart factories for precision automation.

Fiber Laser Market Restraints:

-

High Initial Capital Costs and Dependence on Rare-Earth Materials for Fiber Laser Production Limit Expansion

Despite growing popularity, the Fiber Laser Market faces challenges due to high initial capital costs and reliance on rare-earth materials like ytterbium and erbium. These materials are crucial for fiber laser production but subject to price volatility and supply chain risks, often concentrated in specific regions. For smaller businesses, the high setup and operational expenses limit accessibility, creating barriers to large-scale adoption, particularly in cost-sensitive markets.

Fiber Laser Market Opportunities:

-

Expanding Adoption of Fiber Lasers in EV Battery Welding, Additive Manufacturing, and Advanced Medical Applications Globally

Significant opportunities exist in the Fiber Laser Market as adoption grows in EV battery welding, additive manufacturing, and medical applications. Their efficiency and precision make them vital for energy transition, aerospace innovation, and minimally invasive surgeries. Governments and private investors are increasing R&D funding to enhance performance and develop compact, AI-driven fiber laser systems. These advancements, coupled with rising industrial automation and digitalization, create immense opportunities for global market expansion.

Fiber lasers now power over 80% of EV battery welding lines globally (up from 35% in 2020) and are used in 90% of new metal additive manufacturing systems.

Fiber Laser Market Segment Analysis

-

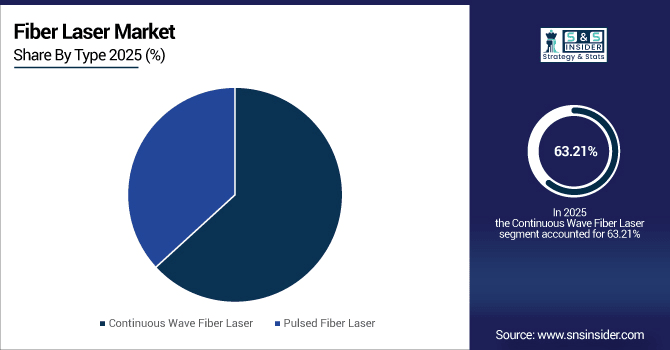

By Type, continuous wave fiber lasers are estimated to lead the market with a 63.21% share in 2025E, while pulsed fiber lasers are projected to be the fastest growing at a CAGR of 11.97%.

-

By Power Output, low-power fiber lasers are projected to lead the market with a 49.23% share in 2025E, while medium-power fiber lasers are expected to be the fastest growing segment with a CAGR of 12.04%.

-

By Application, material processing is anticipated to dominate the market with a 37.22% share in 2025E, whereas the medical segment is forecasted to record the fastest growth at a CAGR of 12.20%.

-

By End-User, the automotive industry is expected to hold the largest share at 40.23% in 2025E, while the electronics sector is predicted to register the fastest growth with a CAGR of 12.49%.

By Type, Continuous Wave Fiber Laser Lead While Pulsed Fiber Laser Registers Fastest Growth

In 2025E, Continuous wave (CW) fiber lasers dominate the market owing to their superior efficiency and suitability for applications requiring uninterrupted high power. They are extensively used in metal cutting, welding, and heavy-duty industrial processes. Their reliability and longer operational lifespan make them highly preferred in manufacturing. Pulsed fiber lasers, however, are growing rapidly due to rising adoption in marking, engraving, and micromachining. Their ability to deliver short, precise bursts of energy makes them ideal for intricate applications.

By Power Output, Low Power Leads Market While Medium Power Registers Fastest Growth

The Fiber Laser Market is led by low-power fiber lasers due to their widespread use in marking, engraving, and small-scale cutting. Their cost-effectiveness and flexibility make them suitable for SMEs and light manufacturing. Growing adoption in electronics miniaturization and packaging also supports their dominance. Meanwhile, medium-power fiber lasers are witnessing rapid adoption in welding and thin-sheet cutting. Their higher efficiency, precision, and expanding industrial applications contribute to making them the fastest-growing segment in the forecast period.

By Application, Material Processing Dominate While Medical Shows Rapid Growth

By Application, Material processing remains the largest application for fiber lasers, driven by demand in cutting, welding, drilling, and additive manufacturing. Their ability to deliver precision and high-quality finishes makes them a preferred choice in automotive and aerospace sectors. Electronics manufacturing also heavily relies on them for micro-processing. On the other hand, the medical segment is growing quickly, with fiber lasers being increasingly used in minimally invasive surgeries, dermatology, and imaging, highlighting their strong potential in healthcare advancements.

By Deployment, Automotive Lead While Electronics Grow Fastest

In 2025E, the automotive sector leads the fiber laser market, benefiting from their use in cutting, welding, and component fabrication. With the rising focus on EV production, fiber lasers are critical for battery welding and lightweight material processing. They also enhance productivity and reduce costs in large-scale automotive manufacturing. Meanwhile, the electronics sector is emerging as the fastest-growing end-user, driven by the need for miniaturization, micro-cutting, and precise engraving in consumer electronics and semiconductor applications, accelerating adoption significantly.

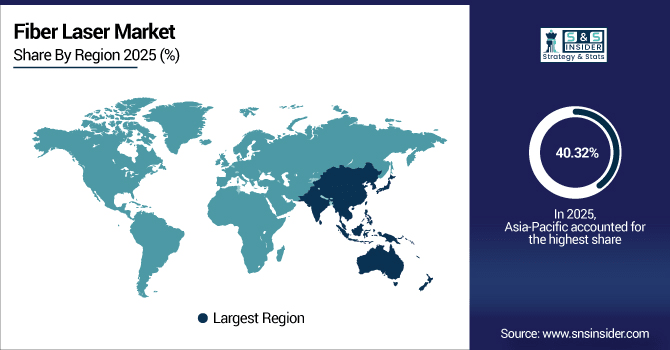

Asia-pacific Fiber Laser Market Insights

In 2025E Asia-Pacific dominated the Fiber Laser Market and accounted for 40.32% of revenue share, this leadership is due to the rapid industrialization and strong manufacturing bases in China, Japan, and South Korea. High demand from automotive, electronics, and metal processing sectors fuels growth. Expanding EV production and government-backed smart manufacturing initiatives support adoption. Increasing investments in R&D further strengthen regional competitiveness.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Fiber Laser Market Insights

China dominates the fiber laser industry due to its strong manufacturing ecosystem and global leadership in laser production. Widespread adoption in automotive, electronics, and materials processing boosts market share. Growing EV demand drives welding applications.

North America Fiber Laser Market Insights

North America is expected to witness the fastest growth in the Fiber Laser Market over 2026-2033, with a projected CAGR of 12.62 due strong adoption in aerospace, automotive, and defense industries. U.S.-based players drive innovation with advanced R&D investments and patents. Rising demand for EV battery welding and smart manufacturing supports expansion. Fiber lasers increasingly replace CO₂ lasers, delivering higher efficiency and cost savings.

U.S. Fiber Laser Market Insights

The U.S. fiber laser market benefits from advanced industrial infrastructure, strong innovation, and high-tech adoption. Leading players focus on aerospace, defense, and EV applications. Government support for advanced manufacturing accelerates growth.

Europe Fiber Laser Market Insights

In 2025E, Europe shows strong growth in fiber lasers due to advanced automotive, aerospace, and electronics industries. Germany, Italy, and France lead adoption. Fiber lasers are increasingly replacing traditional CO₂ lasers in precision manufacturing. EU sustainability policies encourage efficient laser technologies. Expanding EV adoption and smart industry initiatives further accelerate market penetration.

Germany Fiber Laser Market Insights

Germany dominates Europe’s fiber laser market, supported by its advanced automotive and industrial machinery sectors. Strong use in welding, cutting, and additive manufacturing drives growth. Adoption in EV battery production enhances demand. German firms emphasize high-power, precision fiber lasers.

Latin America (LATAM) and Middle East & Africa (MEA) Fiber Laser Market Insights

The Fiber Laser Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to demand in automotive, electronics, construction, defense, and telecom sectors. Brazil, Mexico, and Gulf countries lead adoption, while Africa’s smartphone market supports growth. Despite limited manufacturing capacity and import dependence, rising industrial automation, international partnerships, and government digital initiatives present significant opportunities.

Fiber Laser Market Competitive Landscape:

IPG Photonics Corporation is the global leader in fiber laser technology, offering high-power lasers for cutting, welding, and marking. Its strong R&D investments drive innovation in advanced applications, including EV battery welding, aerospace, and medical devices. IPG’s broad product portfolio supports global industries with efficient, reliable, and energy-saving solutions.

-

In June 2025, IPG unveiled high-power lasers built on a rack-integrated (RI) platform offering 60% floor space savings, simplified integration, and enhanced reliability, showcased at Laser World of Photonics in Munich

Trumpf Group is a major industrial technology provider, specializing in fiber lasers for automotive, aerospace, and electronics industries. The company offers high-power continuous wave and pulsed lasers, enabling precision cutting and welding. Strong global manufacturing presence and technological leadership help Trumpf maintain a competitive edge in smart manufacturing and Industry 4.0 applications.

-

In June 2025, at the LASER trade fair, Trumpf introduced its new TruFiber laser series (500 W to 50 kW) tailored for highly productive industrial welding, including EV battery manufacturing.

Coherent Inc. delivers a wide range of photonics solutions, including fiber lasers for industrial, medical, and scientific applications. Known for high-performance lasers in materials processing, Coherent supports semiconductor, electronics, and defense markets. The company’s focus on innovation and partnerships enables expansion into advanced manufacturing technologies and next-generation industrial applications.

-

In March 2025, Coherent launched its AIM FL series—multi-kilowatt single-mode fiber lasers (500 W to 3 kW) designed for precision welding in automotive, medical devices, and consumer goods industries

nLIGHT Inc. specializes in high-power semiconductor and fiber lasers used in aerospace, defense, automotive, and industrial manufacturing. Its lasers are designed for precision, durability, and scalability. With increasing adoption in EV welding, aerospace components, and additive manufacturing, nLIGHT continues to strengthen its market presence through innovation and cost-effective solutions.

-

In February 2025, nLIGHT reported its full-year 2024 results, highlighting revenue of $198.5 million and significant growth in its defense business, which represented 55% of total sales.

Fiber Laser Companies are:

-

Trumpf Group

-

Coherent Inc.

-

nLIGHT Inc.

-

Lumentum Holdings Inc.

-

Jenoptik AG

-

Laser Quantum Ltd.

-

Keopsys Group

-

Toptica Photonics AG

-

Raycus Fiber Laser Technologies Co., Ltd.

-

Maxphotonics Co., Ltd.

-

Wuhan Ruike Fiber Laser Technology Co., Ltd.

-

EKSPLA

-

Huaray Precision Laser Co., Ltd.

-

JPT Opto-electronics Co., Ltd.

-

Amonics Ltd.

-

Calmar Laser Inc.

-

AdValue Photonics Inc.

-

SPI Lasers (a subsidiary of TRUMPF)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.32 Billion |

| Market Size by 2033 | USD 15.31 Billion |

| CAGR | CAGR of 11.72% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Output ((Low Power, Medium Power, High Power), • By Application (Material Processing, Medical, Telecommunications, Aerospace & Defense, and Others) • By Type (Continuous Wave Fiber Laser, Pulsed Fiber Laser) • By End-User (Automotive, Electronics, Aerospace, Medical, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IPG Photonics Corporation, Trumpf Group, Coherent Inc., nLIGHT Inc., Fujikura Ltd., Lumentum Holdings Inc., Jenoptik AG, Laser Quantum Ltd., Keopsys Group, Toptica Photonics AG, Raycus Fiber Laser Technologies Co., Ltd., Maxphotonics Co., Ltd., Wuhan Ruike Fiber Laser Technology Co., Ltd., EKSPLA, Huaray Precision Laser Co., Ltd., JPT Opto-electronics Co., Ltd., Amonics Ltd., Calmar Laser Inc., AdValue Photonics Inc., SPI Lasers (a subsidiary of TRUMPF) |