Micro Motor Market Size & Growth Drivers:

The Micro Motor Market Size was valued at USD 43.30 billion in 2023 and is expected to reach USD 81.37 billion by 2032, growing at a CAGR of 7.30% over the forecast period 2024-2032.

Recent advancements in technology and rising demand from diverse industries have led to substantial growth in the micro motor market. These small gadgets transform electrical power into kinetic energy and are used in various industries like automotive, consumer electronics, medical equipment, and robotics. Micro motors are essential for improving the functionality and performance of vehicles in the automotive industry. They are typically utilized in power windows, seat adjustments, and automated mirror movements.

Get More Information on Micro Motor Market - Request Sample Report

In the Asia-Pacific region, the uptake of electric vehicles (EVs) is rapidly expanding, with China at the forefront, responsible for around 65% of worldwide EV sales in 2023. The growth is mainly influenced by the rising emphasis on battery electric vehicles (BEVs), which made up 84.6% of the market share in 2023. 39 out of 49 member states in the APAC region are adopting strong government measures to promote the shift towards electric vehicles and achieve carbon neutrality. With the emergence of electric vehicles and smart technologies, the need for effective micro motors is projected to grow amidst the evolving automotive sector. Electric and hybrid vehicles, specifically need advanced systems to regulate different functions, with micro motors playing a crucial role in ensuring reliability and space-saving solutions.

Micro motors are essential in medical devices for their importance in precision and reliability within this application area. These motors are utilized in surgical instruments, dental tools, and devices for patient care, aiding in complex movements and procedures. In recent years, there has been a notable increase in the use of robotic-assisted surgeries and telemedicine in the United States. In 2024, about 15% of surgical procedures in the country are conducted with the help of robots, a significant rise from previous years when they were mainly used for specialized surgeries. At the same time, telemedicine use has surged significantly, particularly amidst and following the COVID-19 outbreak, with more than 75% of hospitals in the United States now incorporating some type of virtual care. Research suggests that 85% of patients are willing to use telemedicine for healthcare, indicating a change in patient perspectives on remote services. Telemedicine can potentially save over USD 100 billion per year in healthcare costs by decreasing the need for in-person appointments. With the rise of robotic-assisted surgeries and telemedicine in healthcare, there will be an increasing demand for advanced micro motors that can provide high performance in small sizes. Advances in this area, like brushless DC micro motors, provide improved effectiveness and durability, crucial for life-saving medical devices.

Micro Motor Market Dynamics

Drivers

-

The growing demand for micro motors is driven by miniaturization across industries.

The increasing demand for miniaturization in a wide range of industries is one of the key drivers identified for the Micro Motor Market as of 2020. Currently, consumers and various industries aim to employ relatively small, lighter, and more compact devices. Miniaturization leads to a gradual implementation of micro motors and the incorporation of these components into all industries. The convolution is particularly valid for consumer electronics, automotive, and medical devices. Miniaturization of smartphones, wearables, and other gadgets has already led to the creation of their slender design and facilitated the process of development of compact components. Micro motors, consequently, used for camera vibration, and haptic feedback have enabled enhanced usability and efficiency. Thereby, the pressure to create thinner and more powerful miniaturized products has led to an increased demand for better-performing micro motors. Vehicles require lightweight and compact differentiation which may be facilitated by micro motors, as well. The pressure to implement energy-efficient solutions by producing electric cars and vehicles with hybrid motors, requires the creation of miniaturized devices. Micro motors, thus, may be used for electric power steering, window lifts, and other minor car components.

-

The growing demand for micro motors in consumer electronics and IoT devices.

One of the key drivers of the Micro Motor Market is the increasing share of consumer electronics. As technology is advancing, the preferences of the customers are changing, and, currently, demand for high-performing and miniature motors is increasing accordingly. Having a compact and high-performance motor allows technology companies to develop more sophisticated and smaller gadgets that enhance users’ experience. As such, a variety of portable devices such as smartphones, tablets, wearables, and cameras utilize micro motors to include haptic feedback, stabilization, camera zoom, and more. Moreover, as with the rest of technologies, customers are demanding increasingly thinner and lightweight devices that have a limited capability to store and generate power, making a reliable and compact micro motor the best solution to this. As more homes and business become “smart”, such devices as smart locks and thermostats, automatic curtains, and the corresponding machinery are proliferating. Similar to the examples with personal technology, the miniaturization of devices and appliances in one’s home or office is a trend that is supported by the increasing reliance on IoT for automation. As a result, growing numbers of modern devices require a powerful, compact, and efficient motor.

Restraints

-

Obstacles in the micro motor industry resulting from the reliance on raw materials.

A crucial restraint for the Micro Motor Market is a dependence on raw materials. The production of micro motors in manufacturing processes is heavily reliant on specific materials essential to the undertaking, such as magnets, copper, and a plethora of alloys. Changes in the availability of said materials, as well as price fluctuations, can have adverse implications for production processes and related costs. Because supply chains can have disruptions that create shortages of required products, geopolitical tensions may lead to changes in the availability of materials, or alterations in demand and their relative percentage of new products in the market, manufacturers face significant uncertainty. Due to these conditions, manufacturing micro motors can present substantial challenges regarding managing costs and production schedules. Should uncertainties regarding the cost of the production of micro motors remain, it will positively affect relations between buyers and suppliers of the aforementioned products. Finally, manufacturers are likely to experience increased pressure on producing micro motors in an environmentally friendly way due to the adverse environmental effects of the extraction and processing of raw materials, a way which is supported by an increasing level of awareness and the adoption of green practices and which is likely to require significant investments.

Micro Motor Market Segmentation Overview

By Type

DC motors held a market share of 65% in 2023 and eventually led the market because of their wide range of uses and effective power control. They provide superior speed regulation and high initial torque, which is perfect for tasks requiring precision. Sectors like automotive, robotics, and medical devices depend greatly on DC micro motors for efficient and dependable functioning. Johnson Electric, for example, utilizes DC motors in automotive parts such as window lifters and seat adjusters. Moreover, Nidec Corporation utilizes DC motors in robotics due to their precise control abilities, underscoring their widespread use in new technologies.

AC motors, renowned for their long-lasting quality and minimal upkeep, are experiencing a surge in CAGR during the forecast period 2024-2032. Demand is boosted by their utilization in household devices, HVAC units, and industrial settings. For instance, ABB uses AC motors in energy-saving industrial machinery, while Siemens incorporates them in HVAC systems to enhance energy efficiency. The increasing emphasis on saving energy and the popularity of smart home technology drive the use of AC micro motors. As industries move towards sustainability and energy efficiency, AC motors are projected to see rapid growth in the future.

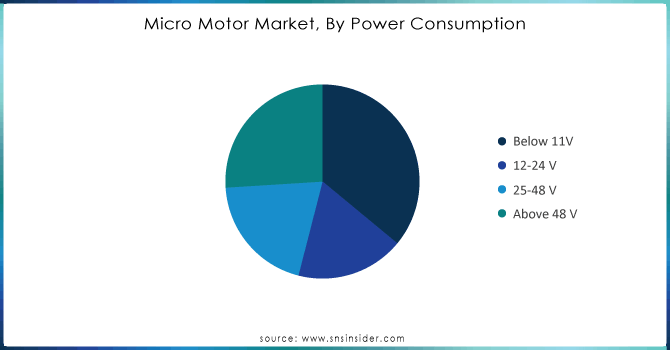

By Power Consumption

The below 11V segment held a major market share of 36% in 2023 and led the market because it is commonly used in low power applications like consumer electronics, small medical devices, and precision equipment. These small motors are popular for being small in size, consuming little energy, and for being cost-effective. Sectors such as healthcare, in which compact yet effective motors are essential for devices like insulin pumps and dental tools, depend greatly on these motors. For instance, Johnson Electric provides micro motors for home appliances and electronic gadgets.

The segment above 48V is experiencing a rapid growth rate during 2024-2032 in the micro motor market, spurred by the rising popularity of electric vehicles (EVs), industrial automation, and heavy machinery. These high-capacity motors provide improved functionality for jobs that demand increased torque and power. They are essential components of electric vehicles' powertrain systems, contributing to improved energy usage and overall performance. For instance, Maxon Motor offers high-voltage micro motors for robotics, while Faulhaber provides motors above 48V for advanced EV applications.

Need any customization research on Micro Motor Market - Enquiry Now

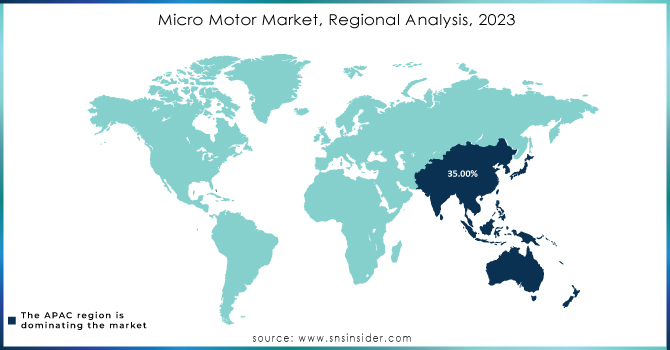

Micro Motor Market Regional Analysis

APAC dominated the market in 2023 with a 35% market share because of its robust industrial foundation and fast urban growth. Nations such as China, Japan, and South Korea have strong manufacturing industries that create a need for micro motors in automation, consumer electronics, and automotive fields. Key sectors like electric vehicle production and robotics are major factors driving growth. For example, businesses such as Nidec Corporation and Mabuchi Motors have large manufacturing plants in the area, serving the automotive, healthcare, and industrial industries. The market in APAC is being further boosted by the rise of smart homes and the growing popularity of electric vehicles.

North America is accounted to have a rapid growth rate of 7.82% during 2024-2032, due to progress in aerospace, healthcare, and electric vehicles. The area is experiencing substantial investments in automation and defense, resulting in a strong need for precision micro motors. Maxon Motor and Johnson Electric are providing micro motors for use in medical tools, drones, and robotics. North America's market expansion is being sped up by the fast technological progress and the use of smart devices in fields such as healthcare and automotive.

Key Players in Micro Motor Market

The major key players in the market are:

-

Nidec Corporation (DC Brushless Motors, Stepping Motors)

-

Mabuchi Motor Co., Ltd. (Coreless Motors, Brushed DC Motors)

-

Johnson Electric Holdings Limited (Brushless DC Motors, Actuators)

-

Maxon Group (ECX Speed Motors, A-Max DC Motors)

-

Faulhaber Group (BX4 Series Brushless Motors, SR Flat DC Micromotors)

-

ABB Ltd. (AC Servo Motors, NEMA Frame Motors)

-

Allied Motion Technologies, Inc. (Brushless Motors, Gimbal Motors)

-

Denso Corporation (Electric Power Steering Motors, HVAC Motors)

-

Portescap (Disc Magnet Motors, Ultra EC Brushless Motors)

-

Moog Inc. (Fractional Horsepower Motors, Torque Motors)

-

Siemens AG (SIMOTICS Micro Drives, Synchronous Motors)

-

MinebeaMitsumi Inc. (Vibration Motors, Precision Brushless Motors)

-

Yaskawa Electric Corporation (Sigma Series Servo Motors, Rotary Servo Motors)

-

Shinano Kenshi Co., Ltd. (Hybrid Stepping Motors, Coreless DC Motors)

-

Oriental Motor Co., Ltd. (Stepper Motors, Brushless DC Motors)

-

Asmo Co., Ltd. (Window Lift Motors, Wiper Motors)

-

Mitsuba Corporation (Starter Motors, Blower Motors)

-

AMETEK, Inc. (Pittman Brush DC Motors, Haydon Kerk Linear Actuators)

-

Parvalux Electric Motors Ltd. (PMDC Motors, Planetary Gear Motors)

-

Koford Engineering LLC (High-Speed Brushless Motors, Slotless Motors)

Recent Development

-

March 2024 – Faulhaber introduced a new line of micro motors with a metal planetary gearhead. The product is specifically designed for a broad range of compact industrial applications. The gearheads can improve the torque capacity and rigidity, making the motors suitable for highly precise medical and industrial tasks requiring stable and durable components.

-

January 2024 – Maxon developed a flat DC micro motor series improved for ultra-compact applications, such as wearable technology and medical devices. The design of the new series allowed for high power efficiency in minimal space.

-

September 2023 – A new brushless DC micro motor with an integrated encoder was developed by Portescap. The product was integrated into robotics and medical applications with innovative performance requirements. Similarly, the unique component design allowed for more precise control and a longer product lifespan.. In this way, the absence of brushes at high speeds created less friction and generated less heat.

-

February 2023 – Nidec developed a micro motor solution with high comparative torque for the needs of the electric vehicle market. The increased capacity was achieved through a unique and lightweight design, allowing electric vehicles to fulfill the requirements of additional power and efficiency, maintaining a lower total weight.

-

June 2023 – Johnson Electric created a new generation of high-efficiency micro motors, intended for high-power household appliances, such as industrial vacuum cleaners and coffee machines. The product decreased the overall noise generated by the appliances and improved energy efficiency with the geometry of the components.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.30 Billion |

| Market Size by 2032 | USD 81.37 Billion |

| CAGR | CAGR of 7.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (AC Motor, DC Motor) • By Power Consumption (Below 11V, 12-24V, 24-48V, Above 48V) • By Application (Automotive, Industrial Automation, Electronic Appliances, Healthcare, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nidec Corporation, Mabuchi Motor Co., Ltd., Johnson Electric Holdings Limited, Maxon Group, Faulhaber Group, ABB Ltd., Allied Motion Technologies, Inc., Denso Corporation, Portescap, Moog Inc., Siemens AG, MinebeaMitsumi Inc., Yaskawa Electric Corporation, Shinano Kenshi Co., Ltd., Oriental Motor Co., Ltd., Asmo Co., Ltd., Mitsuba Corporation, AMETEK, Inc., Parvalux Electric Motors Ltd., Koford Engineering LLC |

| Key Drivers | • The growing demand for micro motors is driven by miniaturization across industries. • The growing demand for micro motors in consumer electronics and IoT devices. |

| RESTRAINTS | • Obstacles in the micro motor industry resulting from the reliance on raw materials. |