Grinding Fluids Market Report Scope & Overview:

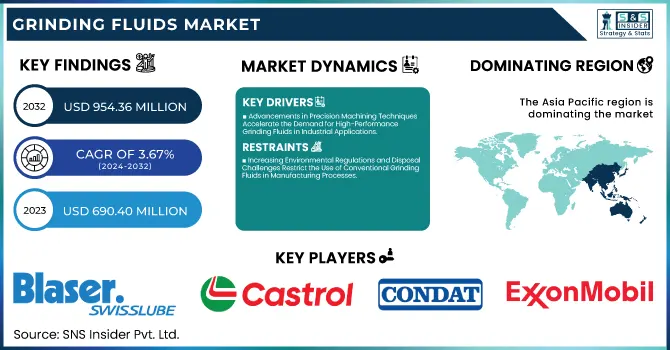

The Grinding Fluids Market Size was valued at USD 690.40 Million in 2023 and is expected to reach USD 954.36 Million by 2032, growing at a CAGR of 3.67% over the forecast period of 2024-2032.

To Get more information on Grinding Fluids Market - Request Free Sample Report

The Grinding Fluids Market is evolving as industries embrace innovation and sustainability. Investment trends reveal a surge in R&D, mergers, and expansions to enhance product performance. A deep raw material analysis in our report uncovers sourcing challenges and price fluctuations affecting manufacturers. As environmental concerns rise, recyclability and waste management of used grinding fluids are shaping regulations and industry practices. The market’s growth is also tied to GDP and industrial expansion, as rising manufacturing activities drive demand. Meanwhile, sustainability and bio-based alternatives are gaining traction, with eco-friendly formulations reshaping competition. Our report provides exclusive insights into these key trends, mapping the future of grinding fluids in an increasingly dynamic industrial landscape.

Grinding Fluids Market Dynamics

Drivers

-

Advancements in Precision Machining Techniques Accelerate the Demand for High-Performance Grinding Fluids in Industrial Applications

The increasing adoption of precision machining techniques across industries such as automotive, aerospace, medical devices, and electronics is driving demand for high-performance Grinding Fluids Market solutions. Modern manufacturing relies on advanced grinding processes that require fluids with superior lubrication, cooling, and anti-wear properties. With the rise of computer numerical control (CNC) machines and automation, manufacturers seek grinding fluids that ensure optimal performance and enhance tool life. Additionally, the growing use of materials like superalloys, composites, and ceramics presents new challenges that demand specialized fluid formulations. High-speed and creep-feed grinding operations require efficient heat dissipation to prevent thermal damage and maintain workpiece integrity. Companies are investing in research and development to create synthetic and semi-synthetic grinding fluids that reduce mist formation, extend service life, and minimize bacterial contamination. Furthermore, sustainability concerns have led to the development of low-VOC and biodegradable grinding fluids. Industries are also adopting smart fluid management systems that monitor contamination levels in real-time, improving operational efficiency. These advancements make high-performance grinding fluids indispensable for modern manufacturing.

Restraints

-

Increasing Environmental Regulations and Disposal Challenges Restrict the Use of Conventional Grinding Fluids in Manufacturing Processes

Stringent environmental regulations on the disposal and recyclability of grinding fluids limit the use of conventional petroleum-based formulations in manufacturing. Used grinding fluids often contain contaminants such as heavy metals, bacteria, and toxic chemicals, requiring costly treatment before disposal. Regulatory agencies worldwide have enforced strict guidelines on fluid waste management, pushing industries to adopt environmentally friendly alternatives. However, transitioning to biodegradable or water-based grinding fluids presents challenges, as some formulations lack the same lubrication and cooling properties as traditional fluids. Industries must also invest in advanced filtration, recycling, and monitoring systems to comply with evolving regulations, increasing operational expenses. The complexity of fluid disposal and treatment adds another layer of regulatory compliance, making it challenging for manufacturers to balance cost and sustainability. Companies that fail to adapt to these regulatory changes may face penalties, limiting their ability to operate in environmentally strict regions. These factors restrain the market’s growth, requiring continuous innovation in sustainable grinding fluid formulations and waste management solutions.

Opportunities

-

Growing Investments in Smart Manufacturing and Industry 4.0 Technologies Enhance the Demand for Intelligent Grinding Fluid Management Systems

The increasing adoption of Industry 4.0 and smart manufacturing technologies presents significant opportunities for the Grinding Fluids Market. Digitalization and automation have transformed industrial processes, leading to the development of intelligent fluid management systems that optimize grinding fluid performance. IoT-enabled sensors, AI-driven analytics, and real-time monitoring technologies are being integrated into grinding fluid systems to track concentration levels, contamination, and viscosity. These advancements help manufacturers improve efficiency, extend fluid life, and reduce overall consumption. Additionally, automated fluid dispensing systems ensure precise fluid usage, preventing excess waste and lowering costs. With industries prioritizing sustainability and operational efficiency, the demand for smart grinding fluid solutions is expected to grow. Companies investing in digitalized fluid management technologies can gain a competitive edge by offering enhanced performance, cost savings, and sustainability benefits. The integration of Industry 4.0 in grinding processes will drive innovations in fluid formulations, paving the way for a new era of efficiency-driven and environmentally friendly grinding fluid solutions.

Challenge

-

Development of Cost-Effective Bio-Based Grinding Fluids Without Compromising Performance Remains a Significant Industry Challenge

Developing bio-based grinding fluids that offer the same performance as traditional petroleum-based formulations remains a critical challenge for the industry. Many bio-based fluids suffer from lower oxidation stability, reduced lubrication properties, and shorter lifespans, making them less effective in high-speed and heavy-duty grinding applications. Additionally, the high cost of plant-derived raw materials and production processes makes bio-based grinding fluids more expensive than conventional options. To bridge this gap, researchers are exploring advanced additives and synthetic alternatives to enhance the efficiency of bio-based formulations. However, large-scale commercialization remains difficult due to cost constraints and inconsistent raw material availability. Addressing this challenge requires collaboration between manufacturers, researchers, and policymakers to develop economically viable and high-performance bio-based grinding fluid solutions.

Grinding Fluids Market Segmental Analysis

By Type

Synthetic grinding fluids dominated the Grinding Fluids Market in 2023 with a market share of 40.7%. The dominance of synthetic fluids is attributed to their superior performance in high-speed and precision grinding applications across industries such as automotive, aerospace, and electronics. Unlike semi-synthetic and water-soluble alternatives, synthetic grinding fluids offer enhanced lubrication, cooling, and rust protection, leading to increased tool life and surface finish quality. The rising adoption of eco-friendly and low-volatile organic compound (VOC) formulations, driven by regulatory bodies like the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA), has further accelerated their demand. Additionally, companies such as ExxonMobil, Quaker Houghton, and Castrol have been actively developing advanced synthetic formulations with extended service life and reduced environmental impact. In 2023, the International Manufacturing Technology Show (IMTS) highlighted the growing preference for synthetic fluids in CNC machining and metal grinding applications, emphasizing their role in improving efficiency and sustainability. The continued shift toward automation and precision manufacturing further cements synthetic fluids as the preferred choice in the industry.

By Application

Disk drivers dominated the Grinding Fluids Market in 2023 with a market share of 35.6%. The increasing production of hard disk drives (HDDs) and solid-state drives (SSDs) for consumer electronics, data centers, and industrial applications has fueled the demand for grinding fluids in this segment. The precision grinding of disk platters and drive components requires highly stable fluids that provide exceptional cooling, prevent surface defects, and reduce machining downtime. With the surge in global data storage needs, leading technology firms like Western Digital, Seagate, and Toshiba have ramped up manufacturing, directly impacting the demand for high-performance grinding fluids. Government-backed digitalization initiatives, such as China’s “Made in China 2025” and the U.S. CHIPS and Science Act, have further stimulated investment in semiconductor and storage device manufacturing, reinforcing the dominance of the disk driver segment. Additionally, industry reports from SEMI (Semiconductor Equipment and Materials International) indicate a rising demand for ultra-precise grinding fluids in the silicon wafer and HDD manufacturing process, further supporting this segment’s leadership in the market.

Grinding Fluids Market Regional Outlook

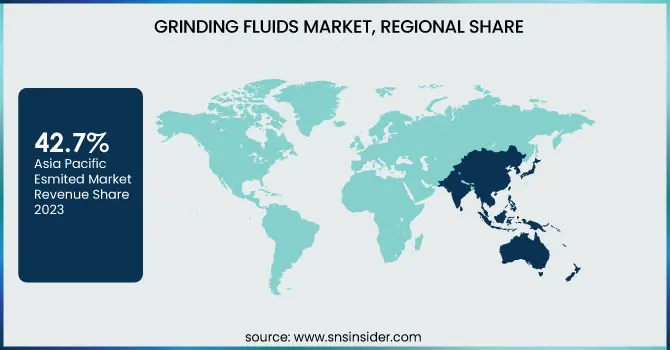

Asia Pacific dominated the Grinding Fluids Market in 2023 with a market share of 42.7%. The region’s leadership is driven by the strong presence of manufacturing hubs in China, India, Japan, and South Korea, where metalworking and automotive industries heavily rely on grinding fluids for precision machining. China, as the world’s largest automotive producer, accounted for over 26 million vehicle productions in 2023 (China Association of Automobile Manufacturers - CAAM), significantly driving demand for grinding fluids. Furthermore, China’s booming electronics sector, particularly in semiconductor manufacturing, has propelled the usage of high-performance synthetic grinding fluids for silicon wafer processing. Japan, home to leading machine tool manufacturers like Mazak and Okuma, has contributed significantly to the market with its advanced manufacturing capabilities. Meanwhile, India's rise as a global manufacturing hub has led to substantial investments in infrastructure, boosting the production of heavy machinery and precision engineering components. Additionally, South Korea’s dominance in semiconductor manufacturing, with companies like Samsung and SK Hynix investing in cutting-edge chip fabrication plants, has fueled demand for specialized grinding fluids used in wafer polishing and fabrication processes. The expansion of industrial activities, along with increased government support for domestic manufacturing, continues to reinforce Asia Pacific’s dominance in the market.

Europe emerged as the fastest-growing region in the Grinding Fluids Market with a significant CAGR during the forecast period. The growth is fueled by stringent environmental regulations promoting the adoption of bio-based and low-VOC grinding fluids, along with a rising focus on precision engineering in the aerospace, automotive, and medical device industries. Germany, the region’s leading market, accounted for over a major share of Europe's total metalworking fluid consumption in 2023 (VDMA - German Engineering Federation), owing to its dominance in automotive and industrial machinery production. The presence of major automakers like Volkswagen, BMW, and Daimler has spurred demand for advanced grinding fluids to enhance machining efficiency. France and Italy, both strongholds of aerospace and high-precision manufacturing, have also seen increased demand for high-performance grinding fluids. Additionally, the European Union's push toward sustainable manufacturing practices is accelerating the adoption of water-soluble and bio-based fluids, further driving market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Benz Oil, Inc. (AMSOIL INC.) – (Benz Met-Grind, Benz Tech-Grind)

-

Blaser Swisslube AG – (Blasogrind, B-Cool)

-

Castrol Ltd. (BP P.L.C.) – (Castrol Syntilo, Castrol Hysol)

-

CGF, Inc. (Cutting & Grinding Fluids, Inc.) – (CGF Aqua-Grind, CGF Super-Grind)

-

Cimcool Industrial Products LLC – (Cimperial, Cimtech)

-

Condat Group – (Mecagreen, Condagreen)

-

EnviroServe Chemicals, Inc. – (ES-Grind, EnviroCut)

-

ETNA Products, Inc. – (ETNA Grindway, ETNA Cutcool)

-

ExxonMobil Corporation – (Mobilgrind, Mobilcut)

-

FUCHS Petrolub SE – (Ecocool, Ecocut)

-

Houghton International Inc. (Quaker Houghton) – (Hocut, Houghto-Grind)

-

Idemitsu Kosan Co., Ltd. – (Daphne Alphacool, Daphne Cut)

-

Indian Oil Corporation Ltd. (Servo Lubricants) – (Servo Kool, Servo Cut)

-

Lincoln Chemical Corporation – (LinCool, LinTech Grind)

-

Master Fluid Solutions – (Trim Microsol, Trim E206)

-

oelheld GmbH – (SintoGrind, DiaGrind)

-

Quaker Houghton – (Quakercool, QuakerCut)

-

TotalEnergies SE – (Valona, Lactuca)

-

Yushiro Chemical Industry Co., Ltd. – (Yushiroken, Yushirocut)

Recent Developments

-

May 2024: FUCHS launched ECOCOOL GLOBAL 1000, a cutting and grinding fluid for aerospace, improving tool life by 150% and cutting speeds by 16%. It also introduced FLUIDS LIVE for real-time lubricant monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 690.40 Million |

| Market Size by 2032 | USD 954.36 Million |

| CAGR | CAGR of 3.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Semi-synthetic, Synthetic, Water-soluble, Others) •By Application (Disk Drivers, Lubricate Machine Tools, Metal Substrates, Silicon Wafer, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, TotalEnergies SE, FUCHS Petrolub SE, Castrol Ltd. (BP P.L.C.), oelheld GmbH, ETNA Products, Inc., Benz Oil, Inc. (AMSOIL INC.), Lincoln Chemical Corporation, EnviroServe Chemicals, Inc., CGF, Inc. (Cutting & Grinding Fluids, Inc.) and other key players |