Furfural Derivatives Market Key Insights:

To Get More Information on Furfural Derivatives Market - Request Sample Report

The Furfural Derivatives Market Size was valued at USD 13.2 Billion in 2023 and is expected to reach USD 21.4 Billion by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The furfural derivatives market is expanding due to rising demand for bio-based chemicals in multiple industries. Derived from agricultural waste like corn cobs, bagasse, and rice husks, furfural is transformed into derivatives such as furfuryl alcohol, furoic acid, and tetrahydrofurfuryl alcohol, which are eco-friendly alternatives in various applications. As industries strive to reduce their environmental impact, furfural derivatives have gained traction in the pharmaceutical, automotive, and chemical sectors for their biodegradable properties. These derivatives are crucial in synthesizing resins, solvents, and specialty chemicals, which are increasingly sought after in industrial and automotive applications. The market’s growth is driven by a combination of growing awareness about renewable chemicals and regulatory pressures that encourage a shift from petrochemical-based to bio-based products, especially in the European and North American markets.

Several key dynamic factors are shaping the furfural derivatives market, particularly the increasing focus on sustainable chemicals and cost-effective raw materials. In industries like food packaging and construction, furfuryl alcohol is in high demand due to its ability to enhance product durability. The versatility of furfural derivatives extends to other industrial uses, where they serve as intermediates for manufacturing specialty chemicals that improve product quality and efficiency. Regulatory mandates emphasizing greener production processes in Europe and North America drive companies toward bio-based chemicals, adding momentum to market expansion. The abundant availability of agricultural residues also reduces production costs, as companies can easily source raw materials from local agro-industries, further supporting cost-effective and sustainable operations.

Recent developments reflect ongoing innovation as companies focus on expanding their furfural production capabilities and derivative product lines. For instance, International Furan Chemicals B.V. recently invested in developing advanced technologies to enhance the efficiency of furfuryl alcohol production, positioning itself as a leader in bio-based chemical solutions. Similarly, Lenzing AG, known for its expertise in sustainable raw materials, has expanded its furfural product portfolio to meet the increasing demand for eco-friendly chemicals in the pharmaceutical and food sectors. Penn A Kem LLC, focusing on specialty chemical production, has been upgrading its facilities to include more sustainable practices and increasing furfural derivative output to cater to a broad range of industrial applications. These advancements highlight a shift toward efficient production methods and expanded product applications, strengthening the competitive landscape in the market.

Moreover, collaborations and partnerships among companies are accelerating advancements in the furfural derivatives industry. Arcoy Biorefinery Pvt. Ltd. has collaborated with regional agro-processors to secure consistent raw material supplies, stabilizing its production costs and improving product quality. Zibo Huaao Chemical Co., Ltd. has strategically invested in research and development to diversify its offerings, including furfural acetone, which is finding new applications in the automotive and aerospace industries due to its stability and performance-enhancing properties. Such strategic moves are geared toward establishing a robust supply chain and product innovation pipeline, ensuring sustained market growth in the face of increasing global demand for sustainable chemicals. These developments underscore the commitment of industry players to innovate while reinforcing their position in the rapidly evolving furfural derivatives market.

Market Dynamics

Drivers:

-

Rising Preference for Bio-Based Chemicals Due to Environmental Concerns Drives Demand in the Furfural Derivatives Market

The shift towards bio-based chemicals significantly propels the demand for furfural derivatives. As industries increasingly prioritize environmental sustainability, furfural derivatives derived from renewable biomass sources are gaining traction across various sectors such as agriculture, pharmaceuticals, and chemical manufacturing. Their use minimizes reliance on petrochemicals, aligning with global efforts to reduce carbon emissions and mitigate climate change. Additionally, regulatory policies supporting greener production methods, especially in Europe and North America, further encourage industries to adopt bio-based chemicals. This demand is amplified by consumer awareness regarding the environmental impact of products, leading companies to integrate eco-friendly solutions into their portfolios. The trend supports the expansion of furfural derivatives in multiple applications, underpinned by their biodegradability and minimal ecological footprint.

-

Increasing Utilization of Furfural Derivatives in Pharmaceuticals and Agrochemicals Propels Market Growth

Furfural derivatives have found extensive applications in pharmaceuticals and agrochemicals due to their versatility and eco-friendly properties. In pharmaceuticals, furfural derivatives are used as intermediates in the synthesis of various drugs, especially those with anti-inflammatory and antibacterial properties. Additionally, the agricultural sector benefits from furfural derivatives in the formulation of bio-pesticides and fertilizers, which are less harmful to the environment compared to conventional synthetic chemicals. The demand from these sectors is fueled by the growing need for sustainable and non-toxic products that cater to both health and environmental safety standards. With increased investment in green chemistry, particularly in emerging markets, the demand for furfural derivatives in these high-growth industries is expected to remain strong, creating a favorable landscape for market expansion.

Restraint:

-

High Production Costs Associated with Furfural Derivatives Limit Market Expansion and Affect Pricing Strategies

One of the major challenges impacting the furfural derivatives market is the high cost of production, primarily due to the expensive raw materials and complex extraction processes involved. Unlike petrochemical-based chemicals, which benefit from established, large-scale production facilities and economies of scale, furfural derivatives are derived from agricultural biomass, which requires intensive processing and specialized equipment. This, in turn, raises production costs and results in higher pricing for end-users, limiting adoption rates, especially in cost-sensitive industries. Furthermore, the volatility in raw material availability, due to factors such as seasonal variations and climate change, can lead to inconsistent supply, further influencing costs. This high-cost structure poses a significant restraint, particularly for small and medium enterprises, which may struggle to absorb these expenses or pass them on to consumers, hindering market penetration.

Opportunity:

-

Emerging Applications of Furfural Derivatives in Biofuel Production Present New Growth Avenues for the Market

The increasing exploration of furfural derivatives for biofuel production represents a significant opportunity for market growth. With the global energy sector pushing for renewable fuel alternatives, furfural derivatives offer potential as sustainable biofuel precursors. They can be utilized in producing liquid biofuels that serve as substitutes for conventional fossil fuels, contributing to the reduction of greenhouse gas emissions and fostering energy security. This is especially relevant in regions heavily investing in biofuels, such as North America and Europe, where government policies promote the adoption of cleaner energy sources. As research and development efforts advance, furfural derivatives could become integral to bio-refinery processes, encouraging the production of high-value biofuels. Consequently, this emerging application is anticipated to unlock substantial market potential, attracting investment and fostering innovation within the sector.

Challenge:

-

Limited Awareness and Technical Expertise in Emerging Markets Pose Challenges to the Adoption of Furfural Derivatives

A significant challenge facing the furfural derivatives market is the lack of awareness and technical expertise in emerging markets. Although furfural derivatives offer numerous benefits in terms of sustainability and versatility, many industries in developing regions remain unfamiliar with their applications and advantages over conventional chemicals. Furthermore, the production and application of furfural derivatives require specialized knowledge and infrastructure, which may be lacking in these regions due to limited research and development facilities and a scarcity of trained professionals. This knowledge gap can hinder the adoption of furfural derivatives in key sectors such as agriculture, pharmaceuticals, and biofuels, where they have considerable potential. Addressing these challenges requires concerted efforts from market players and stakeholders to invest in education, technical training, and local partnerships, which could gradually enhance awareness and capabilities in these untapped regions.

Key Segmentation Analysis

By Product Type

Furfuryl Alcohol dominated the Furfural Derivatives Market in 2023 with a market share of around 55%. Furfuryl alcohol's widespread use, particularly in resin production, has solidified its leading position. It serves as a critical component in the manufacturing of furan resins, which are extensively used in the foundry industry for casting applications due to their high mechanical strength and heat resistance. Additionally, furfuryl alcohol is sought after in the production of corrosion-resistant materials, making it a valuable choice for industrial applications. Its versatility across multiple end-use industries, along with growing demand for eco-friendly and bio-based alternatives, has further boosted its prominence. With increasing industrial applications, particularly in emerging markets, furfuryl alcohol’s dominance is expected to continue as manufacturers invest in bio-based chemicals.

By Application

Resins dominated the Furfural Derivatives Market by application in 2023, capturing 40% of the market share. Resins derived from furfural derivatives, particularly furan resins, are highly valued in the foundry and construction industries due to their durability and chemical resistance. Furan resins are widely used as binders in metal casting, which is essential for automotive and machinery manufacturing. Additionally, the growing demand for bio-based resins in the construction sector, due to their low environmental impact and high performance, has significantly boosted this application. As sustainability concerns drive industries to seek alternatives to petrochemical-based products, furfural-derived resins have seen a rise in adoption, solidifying their market position across multiple sectors.

By End-Use Industry

The Chemicals end-use industry dominated the furfural derivatives market in 2023, accounting for approximately 30% of the market share. In the chemicals sector, furfural derivatives are essential for producing bio-based solvents, resins, and other intermediates, aligning well with the industry's increasing shift toward sustainable chemical solutions. For example, furfuryl alcohol and tetrahydrofurfuryl alcohol are widely used as solvents in the synthesis of other chemicals due to their high solvency and eco-friendly profile. The push for green chemistry, especially in Europe and North America, has heightened the demand within the chemicals sector. This trend is further supported by regulatory frameworks promoting reduced carbon footprints, making furfural derivatives a preferred choice for chemical manufacturers seeking environmentally responsible options.

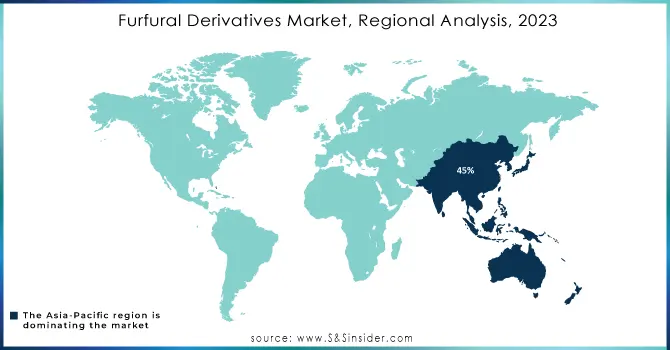

Regional Analysis

Asia-Pacific dominated the Furfural Derivatives Market in 2023, holding a market share of around 45%. This dominance is primarily due to the high availability of agricultural biomass, particularly in countries like China and India, which are major producers of raw materials used in furfural production, such as corn cobs and bagasse. In China, furfural derivatives are extensively used in the chemical and foundry industries for applications like resins and solvents, driven by strong industrial demand and favorable production conditions. Additionally, rising environmental awareness and supportive government policies in Asia-Pacific have spurred the adoption of bio-based chemicals, making the region a key supplier and consumer of furfural derivatives. The robust industrial base and lower production costs have also attracted global manufacturers to invest in this region, reinforcing its leading position in the market.

Moreover, in 2023, North America emerged as the fastest-growing region in the Furfural Derivatives Market, with a CAGR of around 8.5%. The growth in North America is fueled by increasing demand for bio-based chemicals and sustainable materials, driven by strict environmental regulations and a shift towards green chemistry in industries such as agriculture, pharmaceuticals, and automotive. The U.S. and Canada are investing heavily in bio-based product research, encouraging the use of furfural derivatives as eco-friendly alternatives to petrochemicals. Additionally, the rising popularity of biofuels in the region has accelerated demand for furfural derivatives, especially as governments implement policies to promote cleaner energy sources. With increased adoption across multiple sectors, North America’s furfural derivatives market is expected to expand rapidly, driven by a growing emphasis on sustainability and green technologies.

Do You Need any Customization Research on Furfural Derivatives Market - Inquire Now

Recent Developments

-

April 2024: Forto, Europe’s first digital freight forwarder, launched Insetting Light, an affordable, sustainable product utilizing alternative fuels like sustainable aviation fuel, biofuel, and renewable energy to reduce shipment emissions.

-

April 2024: Viking Line advanced its fleet development by introducing a biofuel option for passengers on the Turku route, supporting its goal of a carbon-neutral future.

-

April 2024: Japan Airlines (JAL) introduced the JAL Corporate SAF Programme, a new business initiative certified for its environmental impact, showcasing CO₂ reduction through the use of Sustainable Aviation Fuel (SAF).

Key Players

-

Arcoy Biorefinery Pvt. Ltd. (Furfuryl Alcohol, Furfural, Furoic Acid)

-

Aurora Fine Chemicals LLC (2-Methylfuran, Furfurylamine, 5-Methylfurfural)

-

Beijing Lys Chemicals Co., Ltd. (Furfuryl Alcohol, Tetrahydrofurfuryl Alcohol, Furoic Acid)

-

Central Romana Corporation, Ltd. (Furfural, Furfuraldehyde, Furfural Alcohol)

-

Furfural Español S.A. (Furfural, Furoic Acid, Methylfuran)

-

Gaoping Chemical Co., Ltd. (Furfural, Furfuryl Alcohol, Tetrahydrofurfuryl Alcohol)

-

Hebei Xingtai Chunlei Furfuryl Alcohol Co., Ltd. (Furfuryl Alcohol, Tetrahydrofurfuryl Alcohol, Furoic Acid)

-

Hongye Chemical Co., Ltd. (Furfuryl Alcohol, Tetrahydrofurfuryl Alcohol, Methylfuran)

-

International Furan Chemicals B.V. (Furfuryl Alcohol, Furoic Acid, Tetrahydrofurfuryl Alcohol)

-

Koei Chemical Co., Ltd. (2,5-Dimethylfuran, Furfuryl Alcohol, 5-Methylfurfural)

-

Lenzing AG (Furfuryl Alcohol, Furfural, Furoic Acid)

-

Linzi Organic Chemicals Inc. Ltd. (Furfuryl Alcohol, Furfural, Furoic Acid)

-

Penn A Kem LLC (Tetrahydrofurfuryl Alcohol, 2-Methylfuran, Furfural Alcohol)

-

Robinson Brothers Ltd. (Furfurylamine, 2-Methylfuran, Furfuraldehyde)

-

Shanxi Province Gaoping Chemical Co., Ltd. (Furfural, Furoic Acid, Furfuryl Alcohol)

-

Silvateam S.p.A. (Furfural, Furfuryl Alcohol, Furfural Acetone)

-

SolvChem, Inc. (Furfuryl Alcohol, Furfural, Tetrahydrofurfuryl Alcohol)

-

TransFurans Chemicals bvba (Furfuryl Alcohol, Furfural, Tetrahydrofurfuryl Alcohol)

-

Xian Welldon Trading Co., Ltd. (Furfuryl Alcohol, 2,5-Dimethylfuran, Furfural)

-

Zibo Huaao Chemical Co., Ltd. (Furfuryl Alcohol, Furoic Acid, Tetrahydrofurfuryl Alcohol)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.2 Billion |

| Market Size by 2032 | US$ 21.4 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Furfuryl Alcohol, Furoic Acid, Furfural Acetone, Methylfuran, Tetrahydrofurfuryl Alcohol (THFA), Others) •By Application (Solvents, Resins, Pharmaceutical Intermediates, Agricultural Chemicals, Flavor and Fragrance, Fuel Additives, Others) •By End-Use Industry (Pharmaceuticals, Chemicals, Agriculture, Food and Beverage, Automotive, Textiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | International Furan Chemicals B.V., Arcoy Biorefinery Pvt. Ltd., Central Romana Corporation, Ltd., Harbin Chunhai Biotech Co., Ltd., Lenzing AG, Penn A Kem LLC, Silvateam S.p.A., Shanxi Province Gaoping Chemical Co., Ltd., Zibo Huaao Chemical Co., Ltd., Hebei Xingtai Chunlei Furfuryl Alcohol Co., Ltd. and other key players |

| Key Drivers | • Rising Preference for Bio-Based Chemicals Due to Environmental Concerns Drives Demand in the Furfural Derivatives Market • Increasing Utilization of Furfural Derivatives in Pharmaceuticals and Agrochemicals Propels Market Growth |

| RESTRAINTS | • High Production Costs Associated with Furfural Derivatives Limit Market Expansion and Affect Pricing Strategies |